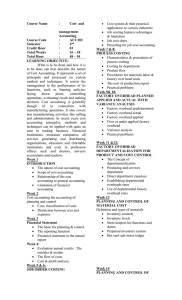

Class note for CMA Professional Level –I 102:COA (Cost Accounting) CMA Professional Level –I 102: Cost Accounting Class No. 11 102.08 Cost Accumulation System Cost accumulation – a collection of cost data in an organized manner. -Objective of Cost Accumulation; -Cost Cost Accumulation Periodic vs. Perpetual; -Cost Accumulation-Actual Actual vs. Standard; -Periodic Periodic an Perpetual Cost Accounting System; -The Factory Ledger. Objective of Cost Accumulation Cost accumulation refers to the recognition and recording of costs. Source documents can be designed to supply information that can be used for multiple purposes. Collection of costs in an organized fashion by means of a cost accounting system. There are two primary approaches to cost accumulation: job order and process costing . Under a job order system, the three basic elements of manufacturing costs-direct materials, direct labor, and factory overhead-are accumulated according to assigned job numbers. Cost Accumulation-As the partially finished goods move through the factory, the total value of these goods continues to increase, because more work and overhead are being used on them. Relationship of Cost Accumulation, Cost Measurement, and Cost Assignment Under a process cost system, manufacturing costs are accumulated according to processing department or cost center. Cost Accumulation Methods Cost accumulation refers to the manner in which costs are collected and identified with specific customers, omers, jobs, batches, orders, departments and processes. The center of attention for cost accumulation can be individual customers, batches of products that may involve several customers, the products produced within individual segments during a period, or the products Page -149 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) produced by the entire plant during a period. The company’s cost accumulation method, or methods are influenced by the type of production operation and the extent to which detailed cost accounting information is needed by management. Methods- Direct Costing Concepts - Job - Process - Activity - Absorption - Direct There are 4 accumulation methods as discussed below: Actual Costs Knowledge of actual costs, after the fact, may not be useful for planning and decision making. Estimated Costs Managers use estimated costs to make decisions about the future. Backflush accounting is a cost accounting system which focuses on the output of an organization and then works backwards to attributed costs to stock and cost of sales. Type Type of ofCost CostUsed UsedFor: For: Costing CostingSystem System Direct DirectMaterials Materials Direct DirectLabor Labor Factory FactoryOverhead Overhead Actual Actual Costing Costing Actual Actual Cost Cost Actual Actual Cost Cost Actual Actual Cost Cost Normal Normal Costing Costing Actual Actual Cost Cost Actual Actual Cost Cost Applied AppliedOverhead OverheadCost Cost Standard StandardCosting Costing Standard StandardCost Cost Standard StandardCost Cost Standard StandardCost Cost Relevant, Timely Normal costing is used to value manufactured products with the actual materials costs, the actual direct labor costs, and manufacturing overhead based on a predetermined manufacturing overhead rate. These three costs are referred to as product costs and are Page -150 used for the cost of goods sold and for inventory valuation. Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Job Order :In job order costing, costs are accumulated by jobs, orders, contracts, or lots. The key is that the work is done to the customer's specifications. As a result, each job tends to be different. For example, job order costing is used for construction projects, government contracts, shipbuilding, automobile repair, job printing, textbooks, toys, wood furniture, office machines, caskets, machine tools, and luggage. Accumulating the cost of professional services (e.g., lawyers, doctors and CA's) also fall into this category. Process :In process costing, costs are accumulated by departments, operations, or processes. The work performed on each unit is standardized, or uniform where a continuous mass production or assembly operation is involved. For example, process costing is used by companies that produce appliances, alcoholic beverages, tires, sugar, breakfast cereals, leather, paint, coal, textiles, lumber, candy, coke, plastics, rubber, cigarettes, shoes, typewriters, cement, gasoline, steel, baby foods, flour, glass, men's suits, pharmaceuticals and automobiles. Process costing is also used in meat packing and for public utility services such as water, gas and electricity. Back Flush :Back flush costing is a simplified cost accumulation method that is sometimes used by companies that adopt just-in-time (JIT) production systems. However, JIT is not just a technique, or collection of techniques. Just-in-time is a very broad philosophy, that emphasizes simplification and continuously reducing waste in all areas of business activity. JIT systems were developed in Japan and depend on the communitarian concepts of teamwork and continuous improvement. In fact, many of the assumptions, attitudes and practices of communitarian capitalism are included in the JIT philosophy. Hybrid, or Mixed Methods: Hybrid or mixed systems are used in situations where more than one cost accumulation method is required. For example, in some cases process costing is used for direct materials and job order costing is used for conversion costs, (i.e., direct labor and factory overhead). In other cases, job order costing might be used for direct materials, and process costing for conversion costs. The different departments or operations within a company might require different cost accumulation methods. For this reason, hybrid or mixed cost accumulation methods are sometime referred to as operational costing methods. Page -151 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Cost Accumulation Periodic vs. Perpetual Periodic Cost Accumulation Systems: Systems The first step in comprehending a periodic cost accumulation system is to understand the flow of costs as goods pass through the various stages of production. The flow of costs in a manufacturing company, under a periodic cost accumulation system, is shown in Figure. The cost of goods put into production (direct materials + direct labor + factory overhead) plus the cost of work-inwork process inventory at the beginning of the period equals the cost of goods in process during the period. In order to determine the cost of goods manufactured, the cost of ending work-in-process inventory ventory is subtracted from the cost of goods in process during the period. The cost of goods manufactured plus beginning finished goods inventory equals the cost of goods available for sale. When the ending finished goods inventory is deducted from this figure, gure, the cost of goods sold results. The total operating costs can now be computed by adding selling, general, and administrative expenses to the cost of goods sold. Page -152 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) 5 types of special journals •Sales Journal •Cash Receipts Journal •Purchases Journal •Cash Payments Journal •Payroll Journal 5 types of subsidiary ledgers •Accounts receivable subledger •Accounts payable sub-ledger •Fixed assets sub-ledger •Project cost sub-ledger (to track cost on a project by project basis) •Factory overhead sub-ledger (to track individual factory overheads like factory rent and factory insurance) Example: Materials cost: Direct …………………………………………………………………………….. Tk. 60,000 Indirect …………………………………………………………………………….. 20,000 Labor cost: Direct ……………………………………………………………………….. Tk.18,000 Indirect …………………………………………………………………….. 17,000 Other indirect manufacturing costs: Power and heat ………………………………………………………… 30,000 Power and heat …………………….……………………………………………. 10,000 Inventories (in taka): * Beginning Work-in-process ………………………………………………………. 2,000 Finished goods ……………..…………………………………………. 15,000 Ending Work-in-process.………………………………………………………. 8,000 Finished goods …………………………..……………………………. 20,000 Tk. 80,000 35,000 *Assume no beginning or ending raw materials inventory Page -153 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Solution under Periodic Cost Accumulation Systems: Cost Assignment Approaches are showing bellow: Actual Costing System Normal Costing System Standard Costing System Direct Materials Actual Actual Standard Manufacturing Costs Direct Labor Actual Actual Standard Overhead Actual Budgeted Standard Page -154 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Perpetual Cost Accumulation System Perpetual cost accumulation systems are designed to provide relevant information to management on a timely basis to aid in planning and control decisions. The major objective in such systems, as was the case with periodic cost accumulation systems, is the accumulation of total costs and the computation of unit costs. In a perpetual cost accumulation system, the cost of direct materials, direct labor, and factory overhead must first flow through work-in-process inventory in order to reach finished goods inventory. The total costs transferred from work-in-process inventory to finished goods inventory during the period equal to cost of goods manufactured. The ending work-in-process inventory is the balance of un-finished production at the end of the period. As goods are sold, the cost of the goods sold is transferred from the asset account Finished Goods Inventory to the expense account Cost of Goods Sold. The ending finished inventory is the balance of unsold production at the end of the period. The total expenses equal the cost of goods sold plus selling, general, and administrative expenses. Solution under Perpetual Cost Accumulation Systems: Cost Accumulation-Actual vs. Standard Collection of actual costs in an organized way by means of actual cost accounting system. There are two primary approaches to cost accumulation: Job Order and Process Costing. Under Page -155 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) a job order system, the three basic elements of manufacturing costs costs-direct direct materials, direct labor, and factory overhead-are are accumulated according to assigned job numbers. Under a process cost system, manufacturing costs a are re accumulated according to processing department or cost center. Standard Cost accumulation represent methods used to accrue costs as predetermined. There are two types: job costing and process costing. These methods depend on the type of production. Standard costing is a product costing system when a company measures all costs – direct materials, direct labor, and factory overhead – using standard quantities and costs. It is often used to measure performance, determine target costs, and improve production productio process. rpetual Cost Accounting System Periodic and Perpetual System It is the Periodic (yearly) verification is otherwise known as Periodic Cost Accounting System. system of records maintained by the controlling department which not reflects the physical movement off stocks and their current balance. Perpetual (regularly)verification verification is otherwise known as Perpetual Cost Accounting System. S It is the system of records maintained by the controlling department which reflects the physical movement of stocks and their cur current balance. Periodic system relies upon an occasional physical count of the inventory to determine the ending inventory balance and the cost of goods sold. Perpetual erpetual system keeps continual track of inventory balances. Page -156 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) FIFO is a contraction of the term "first in, first out," and means that the goods first added to inventory are assumed to be the first goods remov removed from inventory for sale. Income tax payment LIFO is a contraction of the term "last in, first out," and mea means ns that the goods last added to inventory are assumed to be the first goods removed from inventory for sale. The Factory Ledger Group of accounts used to record factory factory-related related transactions and to keep track of various manufacturing costs such as direct materials, direct labor, and factory overhead costs. It is a record kept by a factory. It is often practical for a manufacturing concern to include a factory ledger in its accounting system. Generally, this procedure is followed when manufacturing operations are far-flung flung from the main office, or when the nature of such operations rrequires a large number of accounts. Some accounts relating to manufacturing are kept in factory office books while other are kept in general office books. What accounts and other records be kept in the factory journal and ledger and what accounts and recor records be maintained in the general journal and ledger would depend on various factors and the nature of manufacturing concerns. However, there are certain accounts which are usually kept on the factory books. These are accounts concerned with manufacturing costs sts and include stores or materials accounts, labor or payroll accounts, factory overhead accounts, general ledger, is also included on the factory books. Inventory Materials WIP Finished Goods Accounts maintained at Factory: Only 5 accounts are maintained in the Factory ledger and alll other account are kept in General Ledger. 1. Material 2. Factory Payroll 3. Factory Overhead Applied and Control 4. Work –In-Progress (WIP) 5. Finished Goods. Most organizations maintain cash and other factory assets on the general office records. Thuss the general ledger includes such Page -157 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) accounts as sales, cost of goods sold, factory plant and machinery, accumulated depreciation and liabilities etc. It also includes the control account, factory ledger. The need for segregating factory accounts from other accounting data also arises due to the following factors: When the general or administrative offices and the factory offices are not located at the same place or in the same premises or under the same roof. When the decentralization policy is to be followed in numerous production plants each having its own management and administration. When the above conditions are present, it is advisable and advantageous to keep some books at the factory offices and some at the general offices. The general offices usually maintains: All vouchers payable or account payable accounts, cash and accounts receivable accounts, selling and administrative accounts etc. The manufacturing accounts relating with materials or stores, work in process, finished goods, labor and factory overhead are kept at factory offices. When both the offices are involved, the reciprocal entry is passed in the books. Partly Journal Entry for Factory Ledger Purchase of Materials Materials Return to Supplier The Materials Issued for Production Materials Return from Factory Recording of Payroll Payment Distribution of Payroll Employer’s Contributions Factory Overhead Applied to Production Basic Entry Dr. Materials Cr. Accounts Payable Dr. Accounts Payable Cr. Materials Dr. Factory Overhead Control A/C Dr. WIP Cr. Materials Dr. Materials Cr. Factory Overhead Control A/C Cr. WIP Dr. Payroll (Selling & Admin) Dr. Payroll (Direct & Indirect) Cr. Deduction Cr. Accrued Payroll Dr. Accrued Payroll Cr. Cash Dr. W-I-P Dr. Factory Control A/C Dr. Selling Expenses Dr. Admin Expenses Cr. Payroll Dr. Factory Control A/C Dr. Selling Expenses Dr. Admin Expenses Cr. Fund A/C Dr. W-I-P Cr. Factory Overhead Applied Factory Ledger Dr. Materials Cr. General Ledger Dr. General Ledger Cr. Materials Dr. Factory Overhead Control A/C Dr. WIP Cr. Materials General Ledger Dr. Factory Ledger Cr. Accounts Payable Dr. Accounts Payable Cr. Factory Ledger ---- Dr. Materials Cr. Factory Overhead Control A/C Cr. WIP Dr. Factory Payroll (Direct & Indirect) Cr. General Ledger -------Dr. W-I-P Dr. Factory Control A/C Cr. Factory Payroll Dr. Factory Control A/C Cr. General Ledger Dr. W-I-P Cr. Factory Overhead Applied ---- Dr. Payroll (Selling & Admin) Dr. Factory Ledger Cr. Deduction Cr. Accrued Payroll Dr. Accrued Payroll Cr. Cash Dr. Selling Expenses Dr. Admin Expenses Cr. Payroll Dr. Factory Ledger Dr. Selling Expenses Dr. Admin Expenses Cr. Fund A/C ---- Page -158 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Problem -61 For Cost Accumulation FARHANA Manufacturing Company uses a job order cost accounting system and keeps perpetual inventory records. Prepare journal entries to record the following transactions during the month of October. Oct 1 8 Purchased raw materials for Tk.25,000 on account. Raw materials requisitioned by production: Direct materials Tk.6,000 Indirect materials 1,000 15 25 Paid factory utilities, Tk.2,100 and repairs for factory equipment, Tk.3,000. Incurred Tk.72,000 of factory labor. 25 Time tickets indicated the following: Direct Labor (4,000 hrs × Tk.12 per hr) = Tk.48,000 Indirect Labor (3,000 hrs × Tk.8 per hr) = 24,000 Tk.72,000 Applied manufacturing overhead to production based on a predetermined overhead rate of Tk.9 per direct labor hour worked. Goods costing Tk.18,000 were completed in the factory and were transferred to finished goods. Goods costing Tk.15,000 were sold for Tk.25,000 on account. 25 28 30 Solution of problem no-61 Oct 1 8 15 25 25 25 Raw Materials Inventory ........................................................ Accounts Payable ........................................................ (Purchase of raw materials on account) 25,000 Work In Process Inventory ..................................................... Manufacturing Overhead .................................................... Raw Materials Inventory .............................................. (To record materials used) 6,000 1,000 Manufacturing Overhead .................................................... Cash ............................................................................... (To record payment of factory utilities and repairs) 5,100 Factory Labor ......................................................................... Factory Wages Payable .............................................. (To record factory labor costs) 72,000 Work In Process Inventory ..................................................... Manufacturing Overhead .................................................... Factory Labor ................................................................ (To assign factory labor to production) 48,000 24,000 Work In Process Inventory ..................................................... Manufacturing Overhead ........................................... (To apply manufacturing overhead to production) 36,000 25,000 7,000 5,100 72,000 72,000 36,000 Page -159 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) 28 30 Finished Goods Inventory ...................................................... Work In Process Inventory ............................................ (To record completion of production) 18,000 Accounts Receivable ............................................................ Cost of Goods Sold ................................................................ Sales ................................................................................ Finished Goods Inventory ............................................ (To record sales of finished goods and its cost) 25,000 15,000 18,000 25,000 15,000 Problem -62 The gross earnings of factory workers for MUTTAKEEN Company during the month of January are Tk.100,000. The employer's payroll taxes for the factory payroll are Tk.12,000. Of the total accumulated cost of factory labor, 75% is related to direct labor and 25% is attributable to indirect labor. Required: (a) Prepare the entry to record the factory labor costs for the month of January. (b) Prepare the entry to assign factory labor to production. (c) Prepare the entry to assign manufacturing overhead to production, assuming the predetermined overhead rate is 125% of direct labor cost. Solution of problem no. 62 (a) (b) Factory Labor ................................................................................... Factory Wages Payable ........................................................ Payroll Taxes Payable ............................................................ 112,000 Work in Process Inventory ............................................................... Manufacturing Overhead .............................................................. Factory Labor ......................................................................... (Tk.112,000 × 75% = Tk.84,000) 84,000 28,000 100,000 12,000 112,000 (c) Work in Process Inventory ............................................................... 105,000 Manufacturing Overhead .................................................... 105,000 (Tk.84,000 × 125% = Tk.105,000) Problem -63 YEASMINE Company begins operations on July 1, 2014. Information from job cost sheets shows the following: Manufacturing Costs Assigned Job No. July August September 100 Tk.12,000 Tk.8,800 101 7,800 9,700 Tk.12,000 102 5,000 103 11,800 6,000 104 5,800 7,000 Job 102 was completed in July. Job 100 was completed in August, and Jobs 101 and 103 were completed in September. Each job was sold for 60% above its cost in the month following completion. Page -160 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Required: (a) (b) (c) Compute the balance in Work in Process Inventory at the end of July. Compute the balance in Finished Goods Inventory at the end of September. Compute the gross profit for August. Solution of problem no. 63 (a) (c) Work in Process Inventory July Job 100 Job 101 Balance, July 31 Gross Profit Month Job Number August 102 (b) Tk.12,0000 7,8000 Tk.19,8000 Sales Tk.8,000 Finished Goods Inventory Job 101 Job 103 Balance, Sept. 30 COGS Tk.5,000 Tk.29,5000 17,8000 Tk.47,3000 Gross Profit Tk.3,000 Problem - 64 MONYEM Manufacturing uses a job order cost accounting system for cost accumulation. On April 1, the company has Work in Process Inventory of Tk.7,600 and two jobs in process: Job No. 221, Tk.3,600, and Job No. 222, Tk.4,000. During April, a summary of source documents reveals the following: For Materials Requisition Slips Job No. 221 Tk.1,200 222 1,700 223 2,400 224 2,100 General use 600 Totals Tk.8,000 Labor Time Tickets Tk.2,600 1,200 2,900 2,800 400 Tk.9,900 MONYEM applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost. Job No. 221 is completed during the month. Required: (a) Prepare summary journal entries to record the raw materials requisitioned, factory labor used, the assignment of manufacturing overhead to jobs, and the completion of Job No. 221. (b) Calculate the balance of the Work in Process Inventory account at April 30. Solution of problem no. 64 (a) April 30 Work in Process Inventory ............................................... Manufacturing Overhead .............................................. Raw Materials Inventory ........................................ Work in Process Inventory ............................................... Manufacturing Overhead .............................................. Factory Labor .......................................................... Work in Process Inventory ................................................................ Manufacturing Overhead ..................................... (Tk.9,500 × 60% = Tk.5,700) 7,400 600 8,000 9,500 400 9,900 5,700 5,700 Page -161 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Finished Goods Inventory ............................................... Work in Process Inventory ...................................... (Tk.3,600 + Tk.1,200 + Tk.2,600 + Tk.1,560 = Tk.8,960) 8,960 8,960 (b) Work in Process Inventory, April 30 = Tk.21,240 Job No. 222 Tk. 7,620 Job No. 223 7,040 Job No. 224 6,580 Tk.21,240 (Tk.4,000 + Tk.1,700 + Tk.1,200 + Tk.720) (Tk.2,400 + Tk.2,900 + Tk.1,740) (Tk.2,100 + Tk.2,800 + Tk.1,680) Problem No. 65 :( Materials, Overhead, Cost of Goods Sold) MUTTAKEEN LTD. applies manufacturing overhead to jobs using a predetermined overhead rate based on direct labor cost. The information below has been taken from the cost records of the Company for the last year: Direct materials used in production ..................................................... Tk.1,250 Total manufacturing costs charged to production during the year (includes direct materials, direct labor, and applied factory O/H .....Tk.6,050 Manufacturing overhead applied.......................................................... Tk.2,800 Selling and administrative expenses .................................................... Tk.1,000 Inventories: Direct materials, January 1............................................................... Tk.130 Direct materials, December 31.......................................................... Tk.80 Work in process, January 1 ............................................................... Tk.250 Work in process, December 31 ......................................................... Tk.400 Finished goods, January 1................................................................. Tk.300 Finished goods, December 31........................................................... Tk.200 Required: i. Compute the cost of direct materials purchased during the year. ii. Compute the predetermined overhead rate that was used during the past year. iii. Compute the Cost of Goods Manufactured for the last year. iv. Compute the Cost of Goods Sold for the last year. Solution of problem no. 65: Materials, Overhead, Cost of Goods Sold) i. Cost of raw materials used in production........................................ Tk.1,250 Less: decrease in the raw materials inventory during the year (Tk.130 - Tk.80) …………........................................................ 50 Cost of raw materials purchased during the year ................ Tk.1,200 ii. Total manufacturing costs ............................................................... Tk.6,050 Less: Direct materials used in production ..................................... 1,250 Less: Manufacturing overhead applied ....................................... 2,800 Direct labor cost incurred................................................................ Tk.2,000 Page -162 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Predetermined overhead rate = Manufacturing overhead cost ÷ Direct labor cost = Tk.2,800 ÷ Tk.2,000 = 140% of direct labor cost iii. Total manufacturing costs ............................................................... Tk.6,050 Add: Work in process inventory, January 1 ................................ 250 6,300 Deduct: Work in process inventory, December 31 ..................... 400 Cost of goods manufactured.......................................................... Tk.5,900 iv. Finished goods inventory, January 1 .................................................. Tk. 300 Add: Cost of goods manufactured................................................... 5,900 Cost of goods available for sale ...................................................... 6,200 Deduct: Finished goods inventory, December 31 .......................... 200 Cost of goods sold ........................................................................... Tk.6,000 Problem No. 66 :( Costing and Control of Manufacturing Overhead) FARHANA LTD. has developed a costing system where the following manufacturing overhead is applied to production on the basis of standard machine-hours: Machine Hours______ 21,600 24,000 26,400 Production units …………………………............. 18,000 20,000 22,000 Variable overhead cost ……………………………. Tk.127,440 Tk.141,600 Tk.155,760 Fixed overhead cost ......................................... Tk.171,072 Tk.171,072 Tk.171,072 The company was expecting to produce 22,000 unit last year. The actual results for the year were as follows: Number of unit produced .............................. Machine-hours incurred ................................. Variable overhead cost ................................... Fixed overhead cost ....................................... 21,500 24,940 Tk.145,899 Tk.170,540 Required: Compute all four manufacturing overhead under or over applied for the company. Solution of problem no. 66 :( Costing and Control of Manufacturing Overhead) Variable Overhead Spending Variance = (AH × AR) - (AH × SR) = Tk.145,899 - [(Tk.155,760/26,400) × 24,940] = Tk.1,247 F Variable Overhead Efficiency Variance = (AH × SR) - (SH × SR) = [24,940 × (Tk.155,760/26,400)] - [21,500 × (26,400/22,000) × (Tk.155,760/26,400)] = Tk.5,074 F Fixed Overhead Budget Variance = Actual fixed overhead cost - Budgeted fixed overhead cost = Tk.170,540 - Tk.171,072 = Tk.532F Fixed Overhead Volume Variance = Fixed portion of the predetermined overhead rate × (Denominator hours – Standard hours allowed) = Tk.171,072 - [(Tk.171,072/26,400) × 21,500 × (26,400/22,000)] = Tk.3,888 U Page -163 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com Class note for CMA Professional Level –I 102:COA (Cost Accounting) Problem No. 67 :( cost per unit under both absorption and variable costing) Max Marks : 12 MUTTAKEEN Company sells a special putter for $20 each. In March, it sold 28,000 putters while manufacturing 30,000. There was no beginning inventory on March . Production information for March was: Direct manufacturing labor per unit 15 minutes Fixed selling and administrative costs $ 40,000 Fixed manufacturing overhead 132,000 Direct materials cost per unit 2 Direct manufacturing labor per hour 24 Variable manufacturing overhead per unit 4 Variable selling expenses per unit 2 Required: a. Compute the cost per unit under both absorption and variable costing . b. Compute the ending inventories under both absorption and variable costing. c. Compute operating income under both absorption and variable costing. Solution of problem mo. 67 :( cost per unit under both absorption and variable costing} a. Compute the cost per unit under both absorption and variable costing # 1 2 3 4 ITEM Direct manufacturing labor ($24/4) Direct materials Variable manufacturing overhead Fixed manufacturing overhead ($132,000/30,000) TOTAL ABSORPTION 6.00 2.00 4.00 4.40 16.40 VARIABLE 6.00 2.00 4.00 0 12.00 b. Compute the ending inventories under both absorption and variable costing. # 1 2 3 4 5 6 7 ITEM Beginning inventory Cost of goods manufactured: 30,000 × $16.40 ,,30,000 × $12.00 Cost of goods available for sale Cost of goods sold: 28,000 × $16.40,,28,000 × $12.00 Total of Ending inventory ABSORPTION 0 VARIABLE 0 $492,000 $492,000 $360,000 $360,000 $459,200 $ 32,800 $336,000 $ 24,000 ABSORPTION $560,000 459,200 0 100,800 VARIABLE $560,000 $336,000 56,000 168,000 $56,000 40,000 $ 4,800 $132,000 40,000 $ (4,000) c. Compute operating income under both absorption and variable costing. # 1 2 3 4 5 6 7 ITEM Sales (28,000 × $20) Cost of goods sold (28,000 × $16.40),,(28,000 × $12) Variable selling expenses (28,000 × $2) Gross margin ,, Contribution margin Less : Variable selling and administrative ,, Manufacturing Fixed selling and administrative,, Selling and administrative TOTAL Page -164 Friday, April 17, 2015 Md.Monowar Hossain FCMA,CPA,FCS, ACA GM & Head of ICC, Agarani Bank Limited. eMail: md.monowar@gmail.com