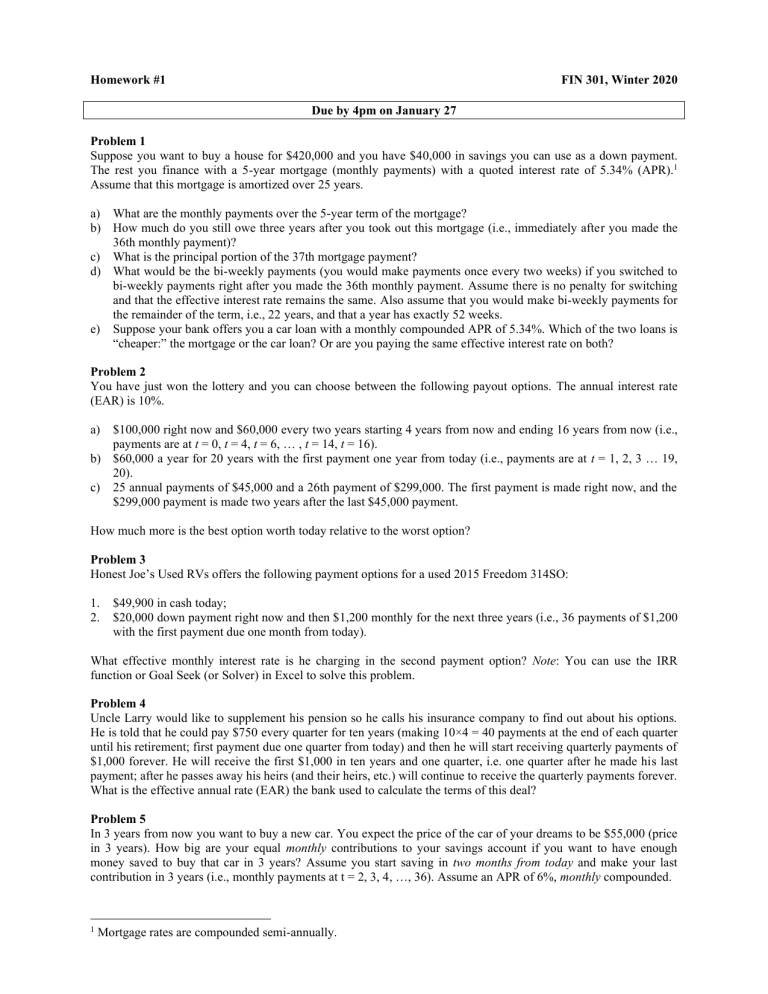

Homework #1 FIN 301, Winter 2020 Due by 4pm on January 27 Problem 1 Suppose you want to buy a house for $420,000 and you have $40,000 in savings you can use as a down payment. The rest you finance with a 5-year mortgage (monthly payments) with a quoted interest rate of 5.34% (APR).1 Assume that this mortgage is amortized over 25 years. a) What are the monthly payments over the 5-year term of the mortgage? b) How much do you still owe three years after you took out this mortgage (i.e., immediately after you made the 36th monthly payment)? c) What is the principal portion of the 37th mortgage payment? d) What would be the bi-weekly payments (you would make payments once every two weeks) if you switched to bi-weekly payments right after you made the 36th monthly payment. Assume there is no penalty for switching and that the effective interest rate remains the same. Also assume that you would make bi-weekly payments for the remainder of the term, i.e., 22 years, and that a year has exactly 52 weeks. e) Suppose your bank offers you a car loan with a monthly compounded APR of 5.34%. Which of the two loans is “cheaper:” the mortgage or the car loan? Or are you paying the same effective interest rate on both? Problem 2 You have just won the lottery and you can choose between the following payout options. The annual interest rate (EAR) is 10%. a) $100,000 right now and $60,000 every two years starting 4 years from now and ending 16 years from now (i.e., payments are at t = 0, t = 4, t = 6, … , t = 14, t = 16). b) $60,000 a year for 20 years with the first payment one year from today (i.e., payments are at t = 1, 2, 3 … 19, 20). c) 25 annual payments of $45,000 and a 26th payment of $299,000. The first payment is made right now, and the $299,000 payment is made two years after the last $45,000 payment. How much more is the best option worth today relative to the worst option? Problem 3 Honest Joe’s Used RVs offers the following payment options for a used 2015 Freedom 314SO: 1. 2. $49,900 in cash today; $20,000 down payment right now and then $1,200 monthly for the next three years (i.e., 36 payments of $1,200 with the first payment due one month from today). What effective monthly interest rate is he charging in the second payment option? Note: You can use the IRR function or Goal Seek (or Solver) in Excel to solve this problem. Problem 4 Uncle Larry would like to supplement his pension so he calls his insurance company to find out about his options. He is told that he could pay $750 every quarter for ten years (making 10×4 = 40 payments at the end of each quarter until his retirement; first payment due one quarter from today) and then he will start receiving quarterly payments of $1,000 forever. He will receive the first $1,000 in ten years and one quarter, i.e. one quarter after he made his last payment; after he passes away his heirs (and their heirs, etc.) will continue to receive the quarterly payments forever. What is the effective annual rate (EAR) the bank used to calculate the terms of this deal? Problem 5 In 3 years from now you want to buy a new car. You expect the price of the car of your dreams to be $55,000 (price in 3 years). How big are your equal monthly contributions to your savings account if you want to have enough money saved to buy that car in 3 years? Assume you start saving in two months from today and make your last contribution in 3 years (i.e., monthly payments at t = 2, 3, 4, …, 36). Assume an APR of 6%, monthly compounded. 1 Mortgage rates are compounded semi-annually. Problem 6 What is the annual equal amount of money you have to set aside to guarantee yourself an annual income to perpetuity of $15,000 starting in 41 years from now? You make the first payment in three years from now and the last payment in 40 years. Assume an interest rate of 7% (EAR). Problem 7 The annual percentage rate (APR) on your credit card is 24% and your bank uses monthly compounding. During the first week of school, you racked up $1,000 in credit card debt. You do not have access to a cheaper source of financing, and you definitely do not want to tell your parents, so you decided that you will pay it all back in $100 equal monthly installments. Your first payment is due one month from today. How long will it take you to bring your credit card balance to zero? Problem 8 His recently departed Uncle Jimmy, may he rest in peace, has left John a 25-year annuity (25 annual payments). He will receive the first payment of $5,000 in 4 years from today, and payments will grow at a constant rate of 5% per year thereafter. What is the present value of his inheritance if he is discounting at a) 3% (EAR); b) 5% (EAR); and c) 10% (EAR)? 2