Masan Consumer Corporation Analysis and Recommendation for Wake-Up 247 Energy Drink in Vietnam

advertisement

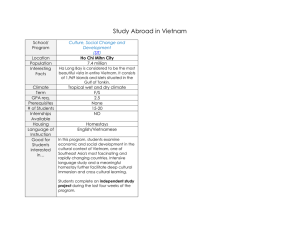

University of Bedfordshire Masan Consumer Corporation Analysis and Recommendation for Wake-Up 247 Energy Drink in Vietnam Hà DIệp Bách 1815126 FTU007-3 1 1. Introduction The purpose of this report is to provide an in-depth strategy analysis of Masan Group Corp and evaluate their strategy in the light of Masan’s energy drink Wake-up 247 development in Vietnam. Masan Group Corp’s strategic position is analyzed through an internal and external analysis of the company using business model such as: SWOT, Porter’s 5 Forces, Canvas Business Model, etc. Masan Consumer is one of Vietnam’s largest local diversified FMCG companies. Recently, Masan has become the main sponsor of the 2019 V-League football tournament, the highest rank soccer tournament in Vietnam. Under a five-year sponsorship deal, the tournament will be named the Wake-up 247 V-League. This is a huge opportunity for Masan Consumer to improve its image and gain more attractions from customers, especially expanding market share for their first and only coffee-based energy drink Wake-up 247 in Vietnam. 2 2. Overview - Masan Consumer Corporation In June 1996, Viet Tien Industry – Technology – Trading JSC was established, specializing in food processing and food seasoning. Four years later, Minh Viet Industry Import – Export JSC was established, specializing in trading food products. In August 2003, Viet Tien Industry – Technology – Trading JSC merged with Minh Viet Industry Import – Export JSC and changed its name to Masan Trading Corporation. In 2011, Masan Food Corporation changed its name to Masan Consumer Corporation as part of a corporate restructuring aimed at entering other consumer product categories. Masan Consumer Corporation produces sauces, spices, instant noodles, seasoning seeds and other packaged goods. To increase market share, Masan focuses on managing brands by segmenting the target market with corresponding individual products. Each line of sauces, instant noodles and seasoning seeds have both premium brands and intermediate brands. It can be mentioned such as Omachi instant noodle brand towards high-end market segment, while Tien Vua brand serves the middle market segment. The company vision is to become a powerful corporation in the local private sector in terms of size, profit, and income for shareholders, and become a potential growth partner and preferred employers in Vietnam. Masan’s management team consists of experts with international expertise in risk management and capital allocation, Vietnamese managers with local implementation experience and senior professional managers with practical experience from multinational corporations. - Wake-up 247 Energy Drink Although it was launched in early 2014, the name Wake-up 247 did not attract attention in the market until the last 3 years. Unlike Red Bull and other brands when being positioned to be a product of energy boost, Wake-up 247 has chosen a niche market directing towards gamers with continuous funding for League of Legends Championship in Vietnam, one of the most popular online games available nowadays. The image of Wake-up 247 energy drink frequently 3 appeared on the hands of famous professional e-sport athletes has increased this brand identity at cyber games or gaming houses among the teenagers. Whether regular distribution channels through grocery stores or supermarkets are overwhelmed by Red Bull or Sting, Wake-up 247 has chosen to approach the niche market where few units exploited, the business results of this energy drink have increased in recent years and is becoming one of the market leaders. With strong growth, Wake-up 247 is being invested strongly by Masan Consumer Corporation. After the early years only associated with e-sports, this brand recently sponsored many football events and the latest is the main sponsor for V-League 2019, the most famous football championship in Vietnam. 4 3. SWOT Analysis (See Appendix A) - Strength o Masan Consumer is a big brand in the market, accounting for 75% of the market share nationwide. They aimed to build different brands for different market segments. From the success of current product brands, Masan can expand its market share by capturing the unbranded product segment, which has a lot of potential with many small manufacturers. o Masan produce a wide variety of products: soy sauce, fish sauce, seasoning spices, instant noodles with a certificate for each type of product. o Masan has the advantage of being a domestic company, understand the situation and have the necessary knowledge to handle the problem comparing to foreign investors. o The distribution network of the corporation, especially Chinsu is very strong, including 5 distribution centers throughout Vietnam, a strong sales force with 162 exclusive distributors and 1,628 salespeople, helping Masan to deliver products to more that 164,000 retailers nationwide. o Masan Consumer Corporation has an experienced and high qualified management team who has worked at multinational companies such as Unilever, P&G or Nestle. At the same time, there is a thorough understanding of the domestic market. - Weakness o Most materials are not imported directly but through distributors. If Masan cannot find a supply of raw and suitable materials for production needs or inconsistent contract conditions, it will definitely affect businesses. o With lots of information including using 3MCPD in soy sauce, Omachi premium noodles with only 5% pure potatoes or Tien Vua instant noodles containing Transfat has been considered unethical by a few experts, creating skeptical and bad images for the business. 5 o With the complaint of one of the main competitor to the Competition Management Department, Acecook has accused the promotion of “Tien Vua sour cabbage with beef” of Masan violated the competition regulations. In particular, the advertisement has taken two pictures of two noodle bowls, one pale yellow from Tien Vua, another is dark yellow from another business. Then add water to the bowl to compare and deliver a message that when you put water into the noodles, if “the water turns yellow, it indicates that the noodles are dyed with chemicals”. The first part of the ad mentioned the phrase “toxic colored chemicals”, making a bad impression on consumers. - Opportunity o The fact that Vietnam joined WTO brings access to foreign markets for Masan Consumer Corporation. Vietnam is Masan Consumer’s main focus area and also South East Asia fastest growing economy. From 2004 to 2011, the real gross domestic product (GDP) grew at a compound annual rate of 7.1%. Although Vietnam’s growth is based on low labor costs and increased productivity after “Đổi Mới” – a homegrown, political and economic renewal campaign that marked the beginning of its transition from a centrally planned economy to a socialist – oriented market economy, Vietnam is truly in the potential of unexploited domestic and natural resources. o All products of Masan Consumer are essential consumer goods, so there are many groups of potential customers and more opportunities to expand their market share. o Government policy encourages business activities. - Threat o High competition with many big brands in the market: Vina Acecook, Nestle, etc. o The risk of talent bleeding due to the appearance of many competitors. 6 o Vietnam has recently experienced macroeconomic challenges, including high inflation and devalued currencies in exchange of GDP growth. In addition, although the private economic sector is growing strongly, it is still fragmented, reflecting in the revenue structure and market share. Private – sector companies continue to be challenged by the limitation of long – term capital, lack of expertise and less competitiveness than multinational companies. 7 4. PEST Analysis (See Appendix B) - Political Factors These are factors that influence to all businesses in a territorial region, the policy related in institutional markets and laws can affect the viability and growth of any industry. The business must follow this rule of institutional elements of an area they want to enter. Stabilization: this factor is really important. If the government do not have the policy with factors of transparent and sufficient, this is quite hard to attract the investor to enter a national economy. The stability of the elements of political conflict creates good conditions for operating a business without the instability and conflict in government policy. The outlook for Vietnamese consumers is positive, as the government targets economic growth through public spending and promoting investment and exports. Tax policy: Consumption tax, income tax etc. will affect the revenue and profit of the business. Clear tax policy and transparency is a favorable investment for enterprises. Moreover, the assistance from the government in tax policy will be a good condition for business to participate in Vietnam market. - Economic Factors Business need to consider whole factors in short term, long term and the interference from government in an environmental economy. Hence, business must analyze the economic environment to identify the change of environment, trend and adapt strategies into business. Four main factors can affect the economy is the growth rate of the economy, interest rate, exchange rate and inflation. Consumer confidence in Vietnam increased to 141.10 in October from 135.30 in September of 2015. Consumer confidence in Vietnam averaged at 135.68 from 2014 until 2015, reaching an all-time high of 143.10 in June of 2015 and a record low of 123.30 in May of 2014. Consumer confidence in Vietnam is reported by ANZ/Roy Morgan. 8 Economic growth leads to the emergence of consumption from the customer. Therefore, this can provide the industry with more comfortable and reduce competitive pressure. In contrast, economic decline can lead to reduce consumption and boost the competition in the industry. Interest rate might influence the demand on the product of customer and firm. This is a factor for customers to decide what product they will pay for if the interest rate goes up or down. The benchmark interest rate in Vietnam was last recorded at 6.50 percent. Interest rate in Vietnam averaged at 7.44 percent from 2000 until 2015, reaching an all-time high of 15 percent in June, 2008 and a record low of 4.80 percent in August of 2000. Interest rate in Vietnam is reported by The State Bank of Vietnam. The exchange rate specifies the value for money in a nation with other nations, the shift of exchange rate impact directly on the competition of a 9 company with the global market. The USD/VND traded at 22,477 VND on Friday, November 20th, according to Interbank Exchange Market. The Vietnamese Dong averaged at 18359.43 from 2003 until 2015, reaching an alltime high of 22546.59 in August of 2015 and a record low of 15,002 in December, 2003. Inflation can reduce the stability in a market, this is a cause for economy’s slow-growth trend. The inflation rate in Vietnam was recorded at 0 percent in October, 2015. Inflation rate in Vietnam averaged 6.89 percent from 1996 until 2015, reaching an all-time high of 28.64 percent in August, 2008 and a record low of -2.60 percent in July, 2000. Inflation rate in Vietnam is reported by the General Statistics Office of Vietnam. 10 - Social Factors Each country or territory has cultural values and social factors characteristics, and these factors are characteristics of consumers in those areas. With an estimated population of more than 86 million, Vietnam is the 13 th most populous country in the world. Due to a significant improvement in living standards, Vietnam’s population has grown steadily since the 1990s and is expected to increase by one million every year. The country has a young population with about a quarter (25.8%) under 14 years old and more than two thirds (67.9%) between 14 and 65 years old (Euromonitor, 2010). - Technological Factors This is one of the factors that are very significant with a business if they want to survive in a competitive market. These effects are mainly through technological development trends, the pace of development of new technologies new products, the ability of technology transfer, technology support policies of the government. The encouragement for developing technology is a long-term orientation from government, remarkably in food industry, this a top priority in a company or an organization. 11 5. Porter 5 Forces (See Appendix C) - The threat of new entrants Masan Consumer Corporation will be faced with high threat of new entrants because the food and beverages industry always has a high growth and it attracts many investors in this industry. Although there are high competitive in this area, a lot of company still join because the demand of consumers is high, so the profitability will be high. - The threat from substitute products There is a high threat from other substitute, for example, if consumers do not want to buy Wake-up 247 energy drink, they can buy fruit juice instead. The price of these two products is quite the same. - The bargaining power of customers There is high power of customers because customers have many choices in choosing products from different brands, not only from Masan. The number of customers is large, so Masan should focus on customer’s needs and also increase the quality of products to compete with other companies. - The bargaining power of suppliers Masan is one of the biggest corporation in Vietnam. The power of suppliers can be low because there are many suppliers in this sector. Masan has more power in choosing their suppliers. In contrast, suppliers do not cooperate with Masan will lose benefit to sell big quantity products. - The rivalry among current competitors in the industry Masan is a multidisciplinary company, so they have to face with many competitors with high competitive strengths. In energy drink sector, Masan’s rivals including Suntory PepsiCo and Redbull Vietnam. In instant noodle sector, 12 Masan will compete with Ace Cook, Asia Food and Vifon. In coffee sector, there are some competitors such as Nestle and Trung Nguyen. 13 6. BCG Matrix (See Appendix D) BCG Matrix based on research that classifies a company’s products in terms of potential cash generation and cash expenditure requirements. It characterized into four strategies categories which is a star, question mark, cash cow, and dog. - The star shows that products are high market share and market growth. This is the position of a strong corporation, leading the market share in a potential market. Masan’s star is Nam Ngư fish sauce, they need to continue to invest in improving product quality to maintain the superiority of products. Masan can also take advantage of large production scale to lower production costs in order to maintain the advantage in terms of price. They need to combine resources to defeat their rivals. - The cash cow is business which is low in market growth but high in market share. It means that the firm spends less, the business is stable. So, they should be profitable in order to help fund investment in question mark and star. Chinsu fish sauce and soy sauce are the cash cow of Masan Consumer Corporation. The product has the highest market share in a market that is no longer growing strongly. - The question mark shows low market share but high in market growth. To develop a question mark to a star, the firm should invest heavily money. With Masan’s soy sauce “Tam Thái Tử”, products have a small market share in an attractive and skyrocketing market. Business strategy is maybe to find ways to increase market share. It means moving towards the "star" position by improving products and services. Masan should also focus on investment to increase competitiveness for products in that market. - The Dog is business which is low in both market share and market growth. The products in this stage cannot generate profit and must be divested. The dog of Masan Consumer Corporation can be Omachi Premium Instant Noodles. Masan has low market share in instant noodles products category when competing with Vina Acecook. However, it is also an essential product to contribute to the development of other products of Masan. So, corporation need to maintain by 14 improving products and implement new strategies to increase market share, accept no profit. 15 7. Benefit for Masan Consumer and Wake-up 247 Energy Drink On February 20, the signing ceremony and the announcement of the sponsorship contract for V-League 2019 took place in Hanoi. The main sponsor of the tournament will now be Masan Consumer Goods Joint Stock Company (MSC) with their new energy drink brand Wake-up 247. MSC’s sponsorship contract for V-league has a 5year term with a value of up to hundreds of billions of VND. The value of the sponsorship in the 2019 season alone is over 40 billion VND and will continue to go up in the following years. This has affirmed the company ambition in developing their unique energy drink Wake-up 247. The new sponsorship will guarantee the increasing brand recognition as for the next 5 years, the most famous national football championship will show up under the name Wake-up 247 V-League. This could be considered as a very reckless move from MSC’s board of director with the fact that the energy drink market in Vietnam is huge and there are more and more new products coming in to the market. It will not only bring huge opportunities for Wake-up 247 to expand its market share and become a market leader in coffee-flavored energy drink sector, but it is also a great chance for MSC to improve its brand image among the consumers after an amount of rumors related to the company’s products’ ingredients problems. Launched in 2014 with the first year revenue of less than 300 billion VND, after 4 years of average growth of over 50% per year, energy drinks has surpassed instant coffee, bringing to MSC 1,950 billion VND in revenue. This revenue level of Wake-up 247 may even exceed that of Red Bull Vietnam, its main competitor on the energy drink market. Masan can take advantages of their resources to focus more on improving the product quality to maximize customer satisfaction when choosing Wake-up 247. Nowadays, consumers are more and more interested in healthy energy drink. MSC should advertise Wake-up 247 with its unique flavor and most importantly, its healthy ingredients and environment-friendly packaging. Vietnam football industry are skyrocketing due to the national team’s success at an international level. People are coming to the stadium to watch the match more than ever. This could be a good opportunity for Wake-up 247 to gain more brand recognition with marketing campaign before, during and after the football match. 16 8. Recommendation From all the analysis above, several recommendations have been made for MSC to consider in order to develop Wake-up 247 energy drink. The first step for MSC is creating new images for packaging. They can design an eye-catching Wake-up 247 products to impress consumers. A picture of a famous Vietnamese football player like Nguyễn Quang Hải will definitely help attract the young consumers. TV commercial should be considered during the half time of a football match to increase the interaction with consumers. The company can come up with a slogan that is easy to remember, like “Choose Wake-up 247, Choose Health”. Whenever the consumers think of an energy drink, they will think about Wake-up 247 as a healthy option among others. Masan should also expand their sponsorship not only in football, but other popular sports in Vietnam, too. A campaign with all the famous Vietnamese athletes will strongly increase the brand awareness. The R&D department should be invested more resources to continuously improve the product quality that best suitable the Vietnamese people taste. Wake-up 247 should not contain harmful chemicals, MSC should provide a certificate of health facilities publicly so the consumers will be comfortable when choosing this energy drink. 17 9. Conclusion As an emerging market, Vietnam is very sensitive to macroeconomic fluctuations. To be a “market leading position” business, the investment plans and leadership will play a big role in the expansion of business and market development. Through these criteria, Masan Consumer Corporation, one of the Vietnam’s largest local diversified FMCG companies, have their own targets to achieve sustainable growth and to compete successfully with multinational companies. The sponsorship for V.League with a 5-year contract with the main product, Wake-up 247 energy drink is the right move for the company to affirmed their position in the FMCG market, especially energy drink market. To successfully expand the market share, Masan should carefully come up with strategies taking advantages from all resources to gain more and more brand recognition for Wake-up 247. 18 Reference 1. Techcombank Ho Chi Minh City International Marathon (2017) Wake-Up 247 Energy Drink. Available at: https://www.facebook.com/Techcombank.HoChiMinhCity.International.Marat hon/posts/wake-up-247-energy-drinkwake-up-247-is-the-first-and-the-onlycoffee-based-energ/160145201250433/ (Accessed: 17 April 2019). 2. Nhân Dân Online (2019) Masan named as main sponsor of V-League 2019. Available at: http://en.nhandan.org.vn/sports/item/7169402-masan-named-asmain-sponsor-of-v-league-2019.html (Accesed: 17 April 2019). 3. Masan Consumer (2019) Overview. Available at: https://masangroup.com/masanconsumer/about-us/overview (Accessed: 17 April 2019). 4. Cafe F (2018) Gia nhập thị trường chưa lâu, Wakeup 247 của Vinacafe đã đánh bại Red Bull Việt Nam về doanh số. Available at: http://cafef.vn/gia-nhapthi-truong-chua-lau-wakeup-247-cua-vinacafe-da-danh-bai-red-bull-viet-namve-doanh-so-20180914070443243.chn (Accessed: 17 April 2019). 5. Cafe F (2019) Trong khi Trung Nguyên lục đục vì mâu thuẫn, Vinacafe đã tìm được ‘mỏ vàng mới’, lợi nhuận tăng trưởng 70%. Available at: http://s.cafef.vn/VCF-292961/trong-khi-trung-nguyen-luc-duc-vi-mau-thuanvinacafe-da-tim-duoc-mo-vang-moi-loi-nhuan-tang-truong-70.chn (Accessed: 17 April 2019). 6. Kỹ Năng Quản Trị (2018) Ma trận BCG là gì – Ví dụ Ma trận BCG của doanh nghiệp. Available at: https://kynangquantri.com/ma-tran-bcg-la-gi.html (Accessed: 17 April 2019) 7. Trading Economics (2019) Vietnam Consumer Confidence. Available at: https://tradingeconomics.com/vietnam/consumer-confidence (Accessed: 17 April 2019). 8. Trading Economics (2019) Vietnam Interest Rate. Available at: https://tradingeconomics.com/vietnam/interest-rate (Accessed: 17 April 2019. 9. Trading Economics (2019) Vietnamese Dong. Available at: https://tradingeconomics.com/vietnam/currency (Accessed: 17 April 2019). 10. Trading Economics (2019) Vietnam Inflation Rate. Available at: https://tradingeconomics.com/vietnam/inflation-cpi (Accessed: 17 April 2019) 19 Appendix A: SWOT Analysis (Dan Shewan, 2018) 20 Appendix B: PEST Analysis (Expert Program Management, 2018) 21 Appendix C: Porter 5 Forces (Mind Tools, 2017) 22 Appendix D: BCG Matrix (Expert Program Management, 2018) 23