Chapter 8 Risk and the Required Rate of Return by Gitman (P8-1, P8-2, P8-3

advertisement

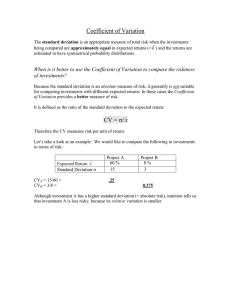

Solution Manual of Principles of Managerial Finance Chapter 8 Risk and the Required Rate of Return Problems P8-1. Rate of return A financial analyst for Smart Securities Limited, Paul Chan, wishes to estimate the rate of return for two similar-risk investments, A and B. Paul’s research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year ago, investment A and investment B had market values of $63,000 and $35,000, respectively. During the year, investment A generated cash flows of $6,100, and investment B generated cash flows of $2,800. The current market values of investments A and B are $71,000 and $32,000, respectively. a. Calculate the expected rate of return on investments A and B using the most recent year’s data Calculate the expected rate of return on investments A on the following: 𝑟= 𝐶𝑡 + 𝑃𝑡 − 𝑃𝑡−1 $6,100 + ($71,000 − $63,000) = = 22.38% 𝑃𝑡−1 $63,000 Calculate the expected rate of return on investments B on the following: 𝑟= 𝐶𝑡 + 𝑃𝑡 − 𝑃𝑡−1 $2,800 + ($35,000 − $32,000) = = 18.13% 𝑃𝑡−1 $32,000 b. Investment A should be selected because it has a higher rate of return for the same level of risk. P8-2. Return calculations For each of the investments shown in the following table, calculate the rate of return earned over the unspecified time period. 14th Global Edition Solution Manual of Principles of Managerial Finance Investment Calculation 𝐾𝑡 (%) A −$2,800 + ($20,100 − $23,400) $23,400 −26.07% B 16,000 + (324,000 − 225,000) 225,000 51.11% C 700 + (8,000 − 6,500) 6,500 33.85% D 3,580 + (46,500 − 36,600) 36,600 36.83% E −500 + (52,800 − 62,700) 62,700 −16.59% P8-3. Risk preferences Stephen So, the financial manager for Cathay Pacific Incorporation, wishes to evaluate three prospective investments: A, B, and C. Stephen will evaluate each of these investments to decide whether they are superior to investments that his company already has in place, which have an expected return of 15% and a standard deviation of 8%. The expected returns and standard deviations of the investments are as follows: a. The risk-neutral manager would accept Investments A and B because these have higher returns than the 12% required return and the risk don’t matter. b. The risk-averse manager would accept Investment A because it provides the highest return and has the lowest amount of risk. Investment B offers an increase in return for taking on more risk than what the firm currently earns. c. The risk-seeking manager would accept Investments B and C because he or she is willing to take greater risk without an increase in return. 14th Global Edition Solution Manual of Principles of Managerial Finance d. Traditionally, financial managers are risk-averse and would choose Investment A, since it provides the required increase in return for an increase in risk. P8 - 9. Rate of return, standard deviation, and coefficient of variation Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech, Inc.; he has been impressed with the company’s computer products and believes that HiTech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 0.90. Mike has obtained the following price information for the period 2012 through 2015. Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. T o c a l c a. To calculate the rate of return for each year, 2012 through 2015, for Hi-Tech stock. Year 2012 2013 14th Global Edition Computation $21.55 − $14.36 $14.36 64.78 − 21.55 21.55 Percentage (%) 50.07% 200.60% Solution Manual of Principles of Managerial Finance 2014 2015 72.38 − 64.78 64.78 91.80 − 72.38 72.38 11.73% 26.83% b. To calculate the average return over this time period: 50.07% + 200.60% + 11.73% + 26.83% = 72.31% 4 c. To calculate the standard deviation of returns over the past 4 years. 𝜎𝑟2012−2015 =√ (50.07% − 72.31%)2 + (200.60% − 72.31%)2 + (11.73% − 72.31%)2 + (26.83% − 72.31%)2 (4 − 1) = 86.97% d. To determine the coefficient of variation of returns for the security: 𝐶𝑉 = 86.97% = 1.20 72.31% e. With his rule of only including securities with a coefficient of variation 0.90 less than, he should not include Hi – Tech in his portfolio. 14th Global Edition