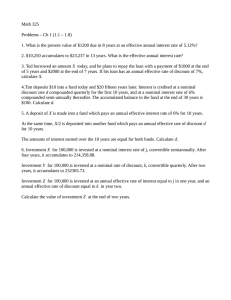

Interest and Discount Rates Interest may be regarded as a reward paid by one person or organisation (the borrower) for the use of an asset, referred to as the capital or the principal, belonging to another person or organisation (the lender). The accumulated value is the total value received by the lender after a period of time. The difference between the principal and the accumulated value is the interest received assuming no other payments (eg. charges, expenses) are made or incurred. Factors influencing the rate of interest: - Risk of default - the higher the risk of default the higher the rate of interest required - Inflation – the higher the expected rate of inflation the higher the rate of interest required to maintain purchasing power - Currency fluctuations Two methods of accumulating interest: - Simple Interest – interest once earned does not earn further interest - Compound Interest – the interest itself earns further interest Accumulation function, A(t), is the accumulated value at time t of an investment of €1 made at time 0. Simple Interest: A(t) = 1+it Compound Interest: A(t) = (1+i)t The accumulated value of €1 between time t1 and t2 is expressed as A(t1,t2). 1 Example 1 €1000 invested for 25 years at 10% per annum simple and compound interest respectively 12000 Accumulation 10000 8000 6000 Simple 4000 Compound 2000 0 1 3 5 7 9 11 13 15 17 19 21 23 25 Year Example 2 An investor invests €10,000 in a bank account. Calculate the accumulated value after 3 years assuming: - Simple interest of 5% pa - Compound interest of 5% pa 2 Present Value (PV) The present value of €100 due in 1 years’ time is the amount of money which must be invested now in order to accumulate to €100 in 1 years’ time. PV(1+i) = 100 => PV = 100(1+i)-1 Let v = (1+i)-1 Therefore: PV = 100v The present value of €100 due in n years’ time is the amount of money which must be invested now in order to accumulate to €100 in n years’ time assuming a compound rate of interest is: PV(1+i)n = 100 => PV = 100(1+i)-n or PV = 100vn 𝑣𝑛 = 1 (1+𝑖)𝑛 = (1 + 𝑖)−𝑛 is referred to as the discount factor assuming a compound rate of interest. In the case of simple interest the discount factor for n years is: 1 (1+𝑖𝑛) . The present value can be calculated at any point in time. If the date is not specified we assume time 0. To specify any other time we refer to the “present value at time t”. Future Value (FV) FV = PV(1+i)n Therefore: PV = FV(1+i)-n = FVvn 3 Example 3 - Calculate the amount that must be invested at a rate of compound interest of 9% per annum in or der to accumulate to €1,000 at the end of 3 years. - Find the amount that must be invested at a rate of simple interest of 9% per annum in order to accumulate to €1,000 at the end of 3 years. Example 4 Assuming an interest rate of 4% pa calculate: - the accumulated value after 10 years of an investment of €10,000 - the present value of €10,000 due in 10 years’ time. Example 5 €10,000 was invested for 10 years at a rate of 3% pa for the first 4 years and 4% pa thereafter. - Calculate the value of the investment at the end of the 10 years. - What is the constant rate of interest achieved over the 10 year period. 4 Effective and Nominal Rates of Interest Effective rates are compound rates where the interest is paid once per unit time unlike nominal interest rates where the interest is paid more frequently than once per unit time. Effective Rate of Interest The effective rate of interest over a given time period is the amount of interest a single initial investment will earn at the end of the time period expressed as a proportion of the initial amount. 𝐴(𝑛) = (1 + 𝑖𝑛 )𝐴(𝑛 − 1) 𝑖𝑛 = 𝐴(𝑛) − 𝐴(𝑛 − 1) 𝐴(𝑛 − 1) Nominal Rate of Interest A Nominal Rate of Interest is an interest rate quoted on an annual basis but compounded based on another period. i(p) is the nominal annual rate of interest compounded or convertible p times per year. 𝑖 𝑝 = 𝑝[(1 + 𝑖)1/𝑝 − 1] where i is the annual effective rate of interest The effective rate of interest for each 1/p ‘th of a year is i(p)/p. Rearranging gives: 𝑝 𝑖 (𝑝) 1 + 𝑖 = (1 + ) 𝑝 5 Terminology: i(12) – nominal interest rate convertible monthly i(4) – nominal interest rate convertible quarterly i(2) – nominal interest rate convertible semi-annually i(0.5) – nominal interest rate convertible bi-annually Example 6 Given that the nominal annual rate of interest convertible quarterly is 4% pa calculate the effective annual rate of interest. Example 7 Given that the nominal annual rate of interest convertible quarterly is 4% pa calculate the nominal annual rate of interest convertible monthly. Example 8 Given an annual effective rate of interest of 4.5% calculate the corresponding nominal rate of interest per annum convertible quarterly. Example 9 Calculate the nominal rate of interest convertible quarterly corresponding to a nominal rate of interest of 3.75% per annum convertible monthly. Example 10 Calculate the accumulated value of €10,000 in 10 years’ time at a rate of 3.5% per annum convertible monthly. Example 11 At what nominal rate of interest convertible quarterly would an investment of €10,000 today accumulate to €15,000 in 10 years’ time. 6 Discount Rates Consider an investor who would like to earn 4%pa over the next year. The investor may invest a sum of money at the beginning of the year at an interest rate of 4% pa. Eg: She may invest €1,000 at the beginning of the year which would accumulate to €1040 at the end of the year. Or alternatively she may require a given sum at the end of the year but take a discount on the amount invested. Eg. She may require €1,000 at the end of the year. The present value of €1,000 at 4% is 1,000v = 1,000(1.04)-1 = 961.5385 She invests €961.5385 at the start of the year and receives €1,000 at the end of the year. The difference between €1,000 and €961.5385 (ie: €38.4615) is referred to as the discount. Government bonds are often quoted on a discount basis. Notation d = annual rate of discount In return for a payment of €1 at time 1 an investor will lend 1-d at time 0. The sum (1-d) may be considered a loan of €1 to be repaid at the end of the year on which interest of amount d is payable in advance. 7 d in terms of i or v d represents the discount paid at the start of a year while i represents the interest paid at the end of the year. (1 − 𝑑) = 𝑣 = 1 1+𝑖 Therefore: 𝑑= 𝑖 = 𝑖𝑣 1+𝑖 We can think of d as the present value of a payment of i payable at the end of the year. Present Values Simple Discount Assuming an annual simple rate of discount d the present value of a payment of C to be made in n years is: C(1-nd) Compound Discount Assuming an annual compound rate of discount d the present value of a payment of C to be made in n years is: C(1-d)n = vn 8 Accumulated Values Similarly the accumulated value after n years of C at a simple and compound rate of discount d is: A(n) = C(1-nd)-1 A(n) = C(1-d)-n = (1+i)n The effective rate of discount is identical to the compound rate of discount. It is the amount of interest a single initial investment will earn at the start of the time period expressed as a proportion of the final amount. 𝑑𝑛 = 𝐴(𝑛) − 𝐴(𝑛 − 1) 𝐴(𝑛) Example 12 Discount €10,000 for 3 years using: - A simple discount rate of 5% pa - A compound discount rate of 5% pa Example 13 Given an investment of €1,000 find the accumulation after 5 years using: - Simple discount of 8% pa - Compound discount of 8% pa - Compound interest of 8% pa 9 Example 14 Given a payment of €2,000 due in 4 years time calculate the present value using: - Simple interest of 3% pa - Simple discount of 3% pa - Compound interest of 3% pa Example 15 Given an annual effective interest rate of 10% over 5 years calculate the equivalent: - Simple annual interest rate Effective monthly interest rate Effective biennial interest rate Effective annual discount rate Simple annual discount rate 10 Nominal Rates of Discount A Nominal Rate of Discount is a discount rate quoted on an annual basis but compounded based on another period. d(p) is the nominal annual rate of discount compounded or convertible p times per year. 𝑑 𝑝 = 𝑝[1 − (1 − 𝑑)1/𝑝 ] where d is the annual effective rate of interest The effective rate of discount for each 1/p ‘th of a year is d(p)/p. Rearranging gives: 𝑝 𝑑 (𝑝) 1 − 𝑑 = (1 − ) 𝑝 Note the following useful relationships: 𝑝 𝑖 (𝑝) 1 1 𝑑 (𝑞) = [1 − [1 + ] =1+𝑖 = = ] 𝑝 𝑣 1−𝑑 𝑞 −𝑞 11 Example 16 Given an effective rate of discount of 8% pa calculate the corresponding nominal rate of discount per annum convertible quarterly. Example 17 Given a nominal rate of discount of 3.25% per annum convertible weekly calculate the corresponding annual effective rate of discount. Example 18 Calculate the nominal rate of discount per annum convertible monthly corresponding to a nominal rate of discount of 6.5% per annum convertible half-yearly. Example 19 Given a nominal rate of interest of 6.25% per annum convertible monthly calculate the corresponding annual effective rate of discount. Example 20 Given an effective rate of discount of 6.75% per annum calculate the corresponding nominal rate of interest per annum convertible monthly. 12 Constant Force of Interest A continuously compounded interest rate is called the force of interest. The constant force of interest (i.e. its value does not change over time) is denoted by δ. It is defined as: 𝛿 = lim 𝑖 (𝑝) = lim 𝑑 (𝑝) 𝑝→∞ 𝑝→∞ δ is also referred to as the nominal rate of interest per unit time convertible continuously or the rate continuously compounded . Formula 1+i = e δ Proof: We know that: 𝑝 𝑖 (𝑝) 1 + 𝑖 = (1 + ) 𝑝 Taking limits at p-> ∞ 𝑝 𝑖 (𝑝) (∞) 1 + 𝑖 = 𝑙𝑖𝑚𝑝→∞ (1 + ) = 𝑒𝑖 𝑝 But 𝑖 (∞) = 𝛿 hence: 1+i = e δ Therefore: δ = ln(1+i) Note: - As 1+i = e δ it follows that (1+i)t = e δt - v = (1+i)-1 = e -δ 13 Example 21 How much will €200 accumulate to in 5 years time at a constant force of interest of 4% per annum. Example 22 What is the present value of €200 in 3 years time at a constant force of interest of 4% per annum. Example 23 N/A 14 Equation of Value & Yield The equation of value equates the present value of money received to the present value of money paid out. PV income = PV outgo PV income – PV outgo = 0 For example the equation of value for a loan of amount L at time 0 which is repayable in four instalments X at times ti for 1 ≤ i ≤ 4 is: 𝐿 = 𝑋𝑣 𝑡1 + 𝑋𝑣 𝑡2 + 𝑋𝑣 𝑡3 + 𝑋𝑣 𝑡4 Can use the equation of value to solve for: - an unknown sum of money (eg: L or X) - an unknown time at which a sum of money is paid or received eg: t2 - the yield i which balances the equation of value Example 24 – solving for an unknown sum of money A loan of €500 is to be repaid in two instalments, payable in 6 and 11 months time respectively. If the first repayment is €250, find the amount of the second repayment on the basis of an interest rate of 8% per annum effective. 15 Example 25 – solving for an unknown sum and an unknown time On 1st January 2007 a student is required to repay various loans to a bank on the following dates: €5,500 on 1/1/2011, €7,500 on 1/1/2014 and €9,500 on 1/1/2020. As part of a review of her future commitments the student now offers either: - to discharge her liability for the 3 debts by making an appropriate single payment on 1/1/2012 or - to repay the total amount owed (ie: €22,500) in a single payment at an appropriate future date. Assuming a rate of interest of 8% per annum effective find the appropriate single payment if offer (a) is accepted by the bank and the appropriate time to repay the entire indebtedness if offer (b) is accepted by the bank. Solving for the yield or the interest rate (i) For an equation of value of the form: 𝑓(𝑖) = 𝐿 − (𝑋1 𝑣 𝑡1 + 𝑋2 𝑣 𝑡2 + 𝑋3 𝑣 𝑡3 + 𝑋4 𝑣 𝑡4 ) The yield is the value of i for which f(i) = 0. We use linear interpolation to approximate i as follows: - find i1 and i2 such that f(i1) and f(i2) are of opposite sign and small in magnitude then i1 < i < i2. - Solve for i using the formula: 𝑖2 − 𝑖1 𝑖 = 𝑖1 − ( )𝑓 𝑓2 − 𝑓1 1 Choosing appropriate starting values i1 and i2 can be difficult! 16 Example 26 A loan of €750 is to be repaid by two equal repayments of €500, the first in 3 years’ time and the second in 5 years’ time. Calculate the effective annual interest rate implied by this transaction. Example 27 An overdue electricity bill of €1,700 is to be settled by making repayments of €500 in 3 months time, €600 in 7 months time and €700 in 11 months time. Calculate the effective annual interest rate implied by this transaction. 17