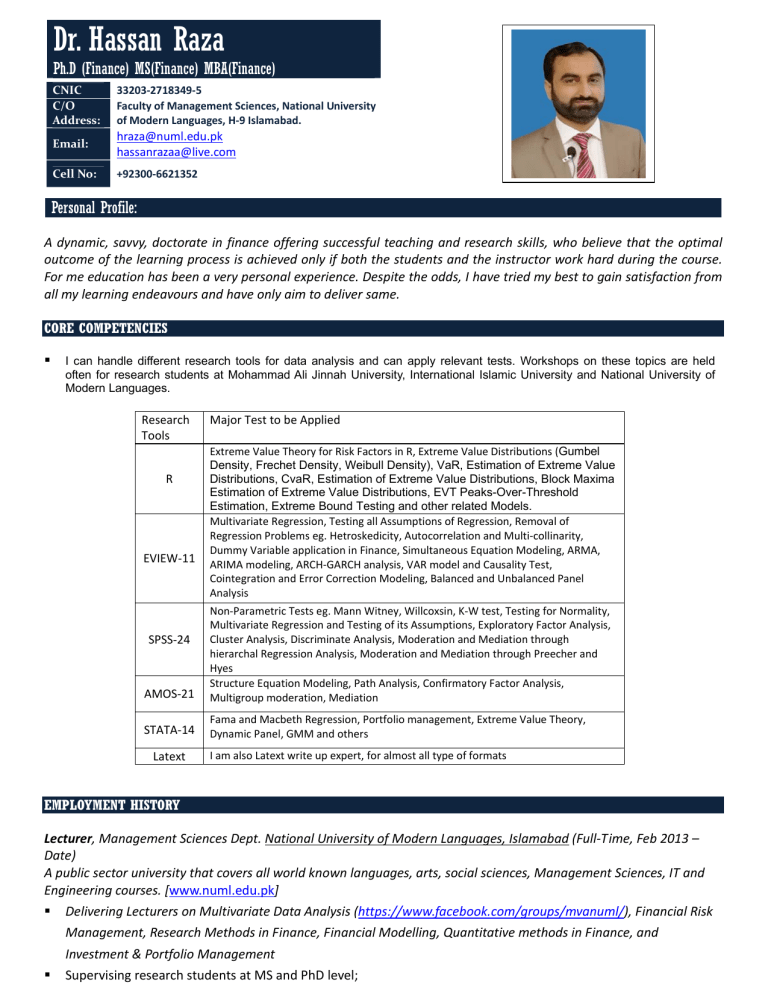

Dr. Hassan Raza Ph.D (Finance) MS(Finance) MBA(Finance) CNIC C/O Address: 33203‐2718349‐5 Faculty of Management Sciences, National University of Modern Languages, H‐9 Islamabad. Email: hraza@numl.edu.pk hassanrazaa@live.com Cell No: +92300‐6621352 Personal Profile: A dynamic, savvy, doctorate in finance offering successful teaching and research skills, who believe that the optimal outcome of the learning process is achieved only if both the students and the instructor work hard during the course. For me education has been a very personal experience. Despite the odds, I have tried my best to gain satisfaction from all my learning endeavours and have only aim to deliver same. CORE COMPETENCIES I can handle different research tools for data analysis and can apply relevant tests. Workshops on these topics are held often for research students at Mohammad Ali Jinnah University, International Islamic University and National University of Modern Languages. Research Tools Major Test to be Applied AMOS‐21 Extreme Value Theory for Risk Factors in R, Extreme Value Distributions (Gumbel Density, Frechet Density, Weibull Density), VaR, Estimation of Extreme Value Distributions, CvaR, Estimation of Extreme Value Distributions, Block Maxima Estimation of Extreme Value Distributions, EVT Peaks-Over-Threshold Estimation, Extreme Bound Testing and other related Models. Multivariate Regression, Testing all Assumptions of Regression, Removal of Regression Problems eg. Hetroskedicity, Autocorrelation and Multi‐collinarity, Dummy Variable application in Finance, Simultaneous Equation Modeling, ARMA, ARIMA modeling, ARCH‐GARCH analysis, VAR model and Causality Test, Cointegration and Error Correction Modeling, Balanced and Unbalanced Panel Analysis Non‐Parametric Tests eg. Mann Witney, Willcoxsin, K‐W test, Testing for Normality, Multivariate Regression and Testing of its Assumptions, Exploratory Factor Analysis, Cluster Analysis, Discriminate Analysis, Moderation and Mediation through hierarchal Regression Analysis, Moderation and Mediation through Preecher and Hyes Structure Equation Modeling, Path Analysis, Confirmatory Factor Analysis, Multigroup moderation, Mediation STATA‐14 Fama and Macbeth Regression, Portfolio management, Extreme Value Theory, Dynamic Panel, GMM and others R EVIEW‐11 SPSS‐24 Latext I am also Latext write up expert, for almost all type of formats EMPLOYMENT HISTORY Lecturer, Management Sciences Dept. National University of Modern Languages, Islamabad (Full‐Time, Feb 2013 – Date) A public sector university that covers all world known languages, arts, social sciences, Management Sciences, IT and Engineering courses. [www.numl.edu.pk] Delivering Lecturers on Multivariate Data Analysis (https://www.facebook.com/groups/mvanuml/), Financial Risk Management, Research Methods in Finance, Financial Modelling, Quantitative methods in Finance, and Investment & Portfolio Management Supervising research students at MS and PhD level; Universities served as Visiting Lecturer Arid Agriculture University Rawalpindi, International Islamic University Islamabad, Capital University of Science and Technology, Islamabad Finance Theory Research Paradigm in Finance Financial Risk Management Analysis of Derivatives Financial Modelling and Risk Analysis Quantitative Techniques in Finance Investment analysis and Portfolio Management Allied Bank Limited, Business Analysts/T‐24 Trainer One of the Fifth bigger Bank of Pakistan. [www.abl.com.pk] (Mar 2011 – Jan 2013) Operation Manager for five months Trainer of all modules of Banking Software Temonos‐24 Analysis of Branch data, and prepare it for migration Work as a roll out team member that enable transformation of UNI‐BANK to T‐24 software EDUCATIONAL, PROFESSIONAL QUALIFICATIONS, RESEARCH PUBLICATION AND OTHERS PhD (Finance) (Capital University of Science and Technology, Islamabad) MS (Finance) from Muhammad Ali Jinnah University Islamabad, CGPA 3.79 MBA (Finance) from COMSATS Institute of Information Technology Islamabad, CGPA 3.73. Passed papers of CA (Chartered Accountant) of Functional English, Quantitative Mathematics, Business Economics, and Financial Accounting Doctoral Research‐Cost of Equity Dynamics: A Comparison Across Emerging and Developed Markets: The basic purpose of the study is to calculate the cost of equity by using Capital Asset Pricing Framework. For this purpose, various existing CAPM’s models i.e. Local, Global, Modified Global, Downside, Hybrid, and Extended Hybrid model by adding industry risk premium have been evaluated using the Fama‐Macbeth 1973 methodology. Empirical results clearly support the applicability of Extended CAPM for the calculation of cost of equity, for both emerging and developed countries. EXTRACURRICULAR ACTIVITES/ WORKSHOPS University Name Capital University of Science and Technology ORIC CIIT Islamabad Capital University of Science and Technology NUML‐ ISB NUML Lahore Topics Introduction to Moderation and Mediation Regression and Correlation Introduction to AMOS Moderation and Mediation through AMOS EVIEW‐SPSS‐and AMOS workshop HONOURS/AWARDS Reviewers of HEC recognized Journal‐ “NUML Journal of Management & Technology” Bronze Medallist in MS from Muhammad Ali Jinnah University Islamabad Chancellors Award for 4 GPA in MS from Mohammad Ali Jinnah University Islamabad Certificate of Participation in Virginia International University USA Conference 2018 Certificate of Commendation to 8th CUST International Business Research Conference 2019 Silver Medallist in MBA from COMSATS Institute of Information Technology Audience MS/PhD Doctor/Eng Faculty MS/PhD RESEARCH PUBLICATIONS Raza, H, Hassan, A, & Rashid, A. (2019). The Impact of Downside Risk on Expected Return: Evidence from Emerging Economies. The Lahore Journal of Business 8(1), (Y-Category) Raza, H. (2018). Is D-CAPM Superior to CAPM: The Case of PSX. NUML Journal of Business and Management 13(1), (Y-Category) Misbah, N. Raza, H., Mubarik, F. (2018). Determinants of Profitability of Banking Industry in Pakistan. NICE Research Journal 11(2), (Y-Category) Mashkoor, A. Raza, H. (2016 ). Impact of Judicial Efficiency on Financial Leverage. Jinnah Business Review 4(2), 38-49 (Z-Category) Raza, H., Shah, S. A., & Malik, A. S. (2015). Day of the Week Anomaly and Market Efficiency: Evidence from KSE Pakistan. International Journal of Business and Social Science, 6 (9), 22-29. (Scopus Index) Shah, S. A., & Hassan, R. (2014). A Comparative Analysis of Stock Return through VaR: Varriance Co-Varriance and Historical Simulation Method (Empirical Evidence form KSE-100) . NUML Journal of Management & Technology, 9 (1), 5-20. (Y-Category) Saleem, A. Malik, Raza, H. (2016). Capturing effect of exchange rates on Exports: A case from Developing Economy. International Journal of Humanities and Social Sciences, 6(3), 112-121. (Scopus Index) Raza, H., Malik, Shafaq. (2013). Impact of Political Instability and Terrorism on stock returns: Evidence from Pakistan. Jinnah Business Review 1(2), 47-54 (Z-Category) SUPERVISION OF RESEARCH THESIS Student Name Topic of Thesis Completed Completed Completed Year of Completion 2015 2016 2016 2017 The Long Term and Short Term Interlinkages of Islamic Banking and Economic Growth of Pakistan: A Co‐ integration Approach Impact of Corporate Governance in predicting business failure Completed 2017 Completed 2017 Misbah Nadeem Determinants of Profitability of Banking Industry Fizzah Batool Inter-Sectoral Diversification: ADCC GARCH Sana Khan Firm and Industry Specific Determinants of Capital Structure: Evidence from Pakistan Exploring Relationship between Digital Currencies and Other Financial Assets: An Empirical Investigation from PSX Completed Submitted Submitted 2018 2019 2019 Submitted 2019 Syeda Farwa Kazmi Saira Yamin Aroosa Zeb Robina Qadeer Tax Loss Hypothesis, Evidence from Pakistan Impact of Investor Sentiments on Stock Returns A Model for Prediction of Failure Companies Impact of Corporate Governance and Earning Management on organizational performance Uzma Perveen Raeesa Shoib Urooj Akram Progress REFERENCES. Dr. Arshad Hassan. Dean Faculty of Management Sciences, Capital University of Science and Technology Email ID: aarshad.hasan@gmail.com; arshad@cust.edu.pk Ph: 051‐4486700‐4 Ext. 300, Cell No. 0092‐321‐5532408 Dr. Abdul Rashid. Associate Professor, Chairperson of Economics and Finance department, International Islamic University Islamabad. Email ID: abdulrashid@iiu.edu.pk; Cell No. 0092‐333‐2277507 Dr. Syed Zulfiqar Ali Shah. Associate Professor / Deputy Dean / Acting Chairman, Department of Higher Study & Research (HS&R), Department of Accounting & Finance. Email: zulfiqar.shah@iiu.edu.pk Phone: 051‐9019764