BMTH 100/120 R EVIEW T EST 3A – C HAPTERS 5, 7

Round all monies to dollars and cents (2 decimal places) after each calculation. Round all percents to one decimal place.

1) A television is listed at $800 less 30%, 10%, 8 ⅓ % a) What is the net price of the television? b) Calculate the single equivalent rate of discount.

2) An invoice of $8540 dated November 16 has terms 5/10, 2/30, n/60. The merchandise was received November 20. a) How much would be paid if the bill was paid on December 5? b) How much would be paid if the bill was paid on November 26?

3) The net price of an article is $64.98 after discounts of 20% and 5%. What is the list price?

4) a) What is the regular selling price of an item purchased for $562.50 if the expenses are 30% of the regular selling price and the profit is 25% of the regular selling price? b) During a promotional sale, the item was sold at a reduction of 20%.

What was the sale price? c) What is the rate of markup based on cost price realized during the sale? d) What is the rate of markup based on selling price realized during the sale?

5) An item costs a retailer $1250 less 30%, 14%. The markup based on cost is

33 ⅓ %. The item is marked down by 15% after one month as it remains unsold. a) What is the sale price? b) What is the amount of the markdown? c) If the overhead is 20% of the regular selling price, what is the operating profit or loss at the sale price?

1

BMTH 100/120 R EVIEW T EST 3A – C HAPTERS 5, 7

6) A gross profit (markup) of $135.00 is made on a sale. If the gross profit was 45% based on selling price, what was the cost?

7) Mo’s Appliances bought a washing machine for $275. The markup was 80% of cost. During a sale the washing machine was marked down to $399. a) Calculate the rate of markdown. b) Calculate the operating profit/loss if the expenses are 40% cost.

8) A store received an invoice dated November 15 with terms 4/10, n/45 for 120 dresses at $60.00 less 20%, 10%. a) What was the last day for taking the discount? b) What is the amount of the discount if the invoice is paid before the last day for the discount?

9) Calculate the net price if a discount of 30% amounted to $12.50.

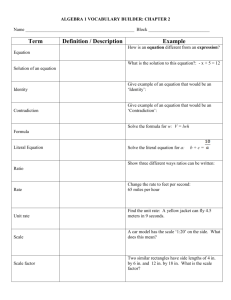

10) Complete the following chart.

Cost

$240

$5.50

$84

Selling Price

$96

$50

Markup

$60

Rate of

Markup based on Cost

60%

25%

Rate of

Markup based on Selling

Price

33 ⅓ %

66 ⅔ %

2

BMTH 100/120 R EVIEW T EST 3A – C HAPTERS 5, 7

11) A shoe store bought 140 pairs of shoes at $65 per pair less 20%, 12.5%.

The store sold 70 pairs of shoes at the regular selling price which included a markup on cost of 120%. Forty pairs were sold during a promotional sale at a markdown of 33 ⅓ %. The remaining pairs were sold during a clearance sale at the break-even price. The store’s overhead is 30% of cost. a) What was the regular selling price of the shoes? b) What was the promotional sale price? c) What was the break-even price? d) What was the total profit on the 140 pairs of shoes?

12) A discount store buys a stereo for $1500 less 25%. The expenses are 40% of cost and the required profit is 30% of cost. All merchandise is marked so that the store can advertise a discount of 30% while still maintaining its regular its regular markup. What is the price marked on the stereo?

13) Market research for a new product indicates that the product can be sold for

$300 per unit. Variable costs are $120 per unit, fixed costs are $14 400 per period and production capacity per period is 250 units. a) Draw a detailed break-even chart showing total cost, total revenue and fixed costs lines, profit and loss areas and the break-even point. b) Compute the break-even point in units, dollars and as a % of capacity. c) Compute the contribution margin and the contribution rate. d) Compute the break-even point as a percent of capacity if the selling price is reduced to $280 per unit. e) Determine the break-even point in dollars if the fixed costs are increased to $16 320 and the variable cost per unit is decreased by 10%.

3