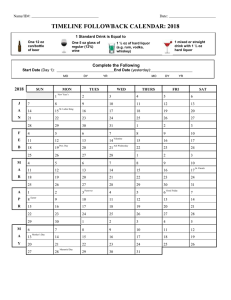

HUSQVARNA GROUP Overview • • • • • About the company About the industry Financial Analysis Risks & Mitigation Recommendation 1 COMPANY OVERVIEW • The Group was founded in 1689 • Headquarters: Stockholm, Sweden • CEO: Kai Wärn • Parent organization: Investor AB • Sales in more than 100 countries • More than 13000 employees in 40 countries • It is a Swedish producer of outdoor power products including chainsaws, trimmers, brushcutters, cultivators, garden tractors, mowers, and sewing machines • The Group is also the European leader in consumer watering products and one of the world leaders in cutting equipment and diamond tools for the construction and stone industries Vision Core Purpose • • • • • • Turning technology into opportunity and eventually Profitability Passion for Innovation Creating Performance Creating Pride Improved results for customers • • • Building great experiences for customers Making a difference Helping shape greener, better environments User and customer centric solutions “ The customer and the environment matters” • • • Collaborting Staying in touch with customers to understand their expectations Focusing on simplicity & solutions 2 INDUSTRY OVERVIEW CONSUMER DURABLES • The Consumer Durable industry consists of durable goods and appliances for domestic use such as televisions, refrigerators, air conditioners and washing machines. • This industry includes all those goods which are durable i.e. products whose life expectancy is at least 3 years and more • According to recent industry reports, the steadily growing market for consumer durables is estimated at INR 300 billion • The consumer durables industry has always exhibited impressive growth despite strong competition and constant price cutting. • It shows a very strong correlation between demand for durables and income. • The consumer durables industry can be broadly classified into 2 segments: Consumer Electronics Consumer Appliances • Porter’s five forces analysis- Consumer Durable 1) Threat of new entrants – LOW Consumer Appliances 2) Bargaining Power of buyer - HIGH 3) Threat from substitute - HIGH Consumer Electronics 4) Bargaining power of supplier - LOW 5) Competitive rivalry - HIGH Brown Goods kitchen appliance White Goods like Refrigerator, ac Mobile phone,televisio n ,DVD etc… 3 FINANCIAL PERFORMANCE ANALYSIS FOR 2018 AND 1H19 • Working capital Analysis • Activity Analysis Current ratio= Current assets/current liabilities Accounts Receivable Turnover Ratio= Net credit sales/average accounts receivale • 2018 = 1.4 2018 = 9.32 1H19 = 1.45 1H19= 9.10 Quick ratio= current assets-inventory/current liabilities Total Assets Turnover Ratio= Net sales/ total assets 2018= 1.19 2018 = 1.10 1H19= 0.749 1H19= 1.38 Financial structure Analysis Inventory turnover = Cost of Goods sold/average inventory 2018 = 2.87 1H19= 3.28 Debt to equity ratio= Total Liabilities/Total Shareholder Equity 2018 = 0.62 2018 = 1.10 1H19= 0.509 Fixed asset turnover =Net sales/ average fixed assets 1H19= 1.63 Price to earning Ratio= Market value per share/Earning per share 2018 = 19.83 • Profitability Analysis 1H19= 32.41 Gross profit margin = Cost of good sold-Total Revenue/total Revenue 2018= 26.79% Interest coverage ratio = Earning before interest and tax/Interest expenses 1H19=25.6% 2018=6.30 1H19=6.71 Return on eqity = Net income/Shareholders equity 2018 = 7.38 1H19= 9.1 4 The liquidity position of the Husqvarna group is satisfactory as the current ratio is 1.4:1 The operational position of the company is efficient. Cash flow from operations are has decreased to 1987 We can see that the net sales of the company has increased from 39394 to 41085. Management expenses has also increased from 1879 to 2014. The ratio of Administration expense to the overall revenue has increased Expense ratio has also increased 5 KEY RISKS AND MITIGANTS 1. Market and operational risk 2. Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. Some of the market and operational risk in Husqvarna Groupare as followsi. Competitive market risk ii. Weather related risks iii. Sales channels risks iv. Environmental, health and safety risks v. Product compliance risks Financial risk is the risk that a company won't be able to meet its obligations to pay back its debts. Which in turn could mean that potential investors will lose the money invested in the company. The more debt a company has, the higher the potential financial risk. MITIGANTS – ACCEPT STRATEGY MITIGANTS – TRANSFER STRATEGY i. ii. iii. iv. v. Financial risks Financing risks Interest rate risk Foreign exchange risk Credit risks Tax risks o Identification of risks and risk areas – Firstly, an organisation have to identify areas where o Transfer – An organisation cannot ignore the financial risk. In order to mitigate risk is present in the organisation so that the concern department will do necessary steps financial risk organisation appoint third party who involve in handling the risk off. For example- Insurance which will help in accepting the risk. o Perform a risk assessment – After identification of risk, the next step is to find the quantitative risk of each event by weighting its potential impact and the likelihood of itsoccurance. o Prioritize – Once the risk assessment has been completed, rank the potential risk from most severe to least areas with the lowest level of acceptable risk should be the priority. o Track risk – If a risk can be followed, keep track of it and the threat it poses. o Implement and monitor progress – Once the plan is in place, continue to monitor how it is working and perform test to ensure the plan is up to date. o Reduce – An organisation should focus on reducing the Financial risk of the company if it cannot transferred. For long run in the competitive market it is important for an organisation to have less risk. 6 RECOMMENDATION • The company is known to invest its money in innovation • Term loans are useful incase of large investments as the overall duration to manage such funding is longer and is less risky • Such term loans can be the best option to focus the investment on recruitments, investing in newer equipments and technology at lower interest rates • Having a sustainable and a durable funding as such as a long term loan also allows the operational cash flow of the company to be used elsewhere • Strategic focus areasInvestments made in battery, robotics and digital commerce leverage growth opportunities in the market. • The interest of a term loan is tax deductible, and the regular payment amounts allow for straightforward budgeting – the same amount is paid every month or — as in Bond Street’s case — every two weeks for the duration of the loan. • In 2018, the ratio was 25.9 percent • For the next phase, as from 2020, the Group's three financial targets are: 1) Annual net sales growth of 4-5%, defined as 2 percentage points above market growth (historically 2-3%). 2) An operating margin above 10%. 3)Operating working capital in relation to net sales of a maximum of 25%. • As the Company is planning to expand its business by 2020 term plan would be the best option after looking at their financials. • As they have decided to dissolve the underperforming consumer brand devision. This has enabled full focus on strengths in premium roducts and services under core brands in the Husqvarna, Gardena and Construction divisions, three divisions with good growth prospects. 7 The ideal scenario is to increase both the net as well as the marginal profit with the dip in the last 3 year trends the operating margin has been increasing but there is dip in net margin. The funding will help to invest in innovation which would lead to increase in productivity and decrease in expenses leading to a higher net margin 40000 39394 35982 41085 9,89 9,8 9,68 35000 9,6 SALES 30000 9,4 25000 20000 9,2 8,94 9 15000 8,8 10000 5000 0 sales operating profit net income net margin operating margin sales 10 3815 2654 3218 2100 5,84 2016 35982 3218 2100 5,84 8,94 operating profit 6,74 2017 39394 3815 2654 6,74 9,68 YEARS net income net margin 3241 1212 2,95 2018 41085 3241 1212 2,95 9,89 НАЗВАНИЕ ОСИ 45000 8,6 8,4 operating margin 8