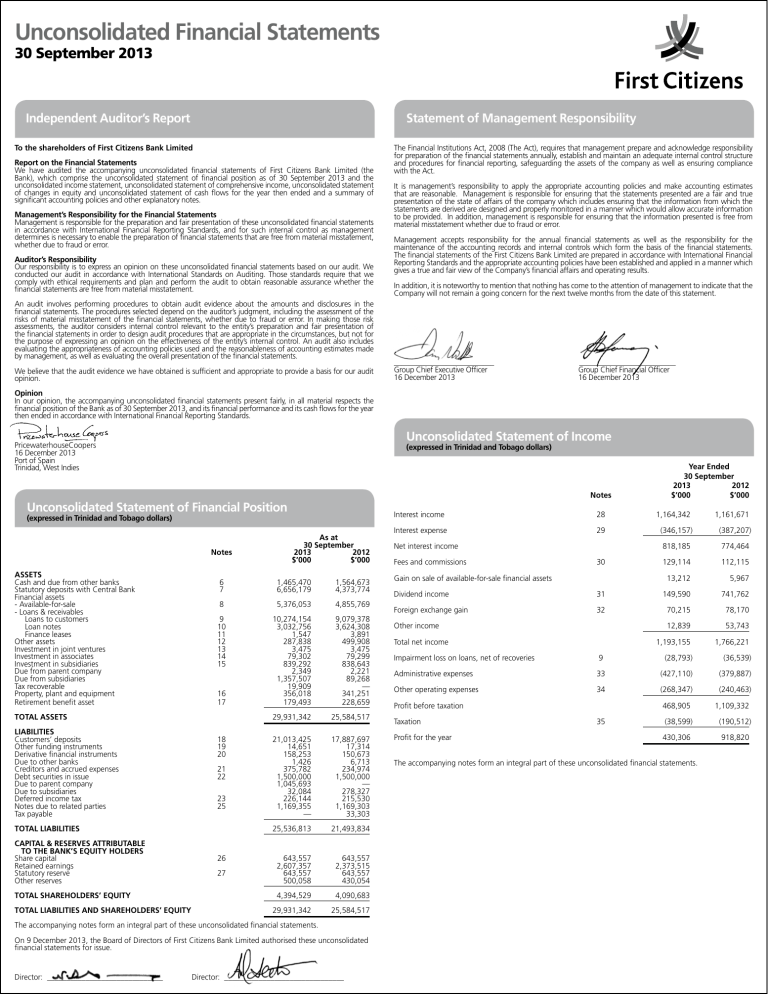

First Citizens Bank Unconsolidated Financial Statement 2013

advertisement