1-21-20 HCS 401 Sp 2020 Basics of US Healthcare SAMPLE CARD and VOCABULARY PART 1

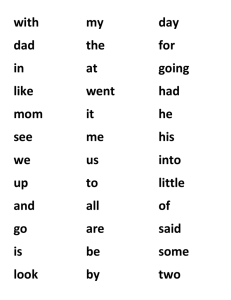

advertisement

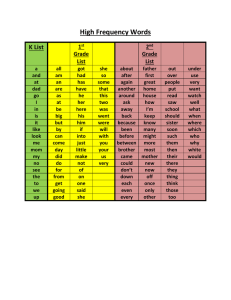

HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 1 HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 2 Must Knows About Your Health Insurance ID CARD! PART 1, Section 1 HCS 401-SP 2020 Your Health Insurance ID Card, in USA: • A tiny piece of plastic (CARD) that sits in your wallet! Drawer! * NOT sitting in your Car, House or Desk • This little CARD is a MINI Version of Mom or Dad’s (your) Health Insurance Plan. • MAIN PURPOSE of this CARD: • PROOF of Valid Healthcare Insurance. • MAIN OUTCOME of this CARD: • Allow Patient and Physician PAYMENT. • A “MUST”: With Your PHONE, Take a PICTURE of the FRONT & BACK of Your ID CARD!!!! 3 Must Knows About Your Health Insurance ID CARD! PART 1, Section 1 HCS 401-SP 2020 Your Health Insurance ID card, in USA: • Why is this ID CARD Important? Healthcare Insurance – The Information on a Health Insurance ID Card Identifies YOUR • Where does Healthcare Insurance Come From? A BENEFIT, from Mom or Dad’s Place of Work – • For What Population is Healthcare Coverage a CIVIL RIGHT? Our Native Americans and the Incarcerated (in jail) – • Who Chooses Your Health Insurance? SELECTED by Mom or Dad – • What are the Requirements for Choosing Health Insurance? a FULL-TIME Employee – 4 Must Knows About Your Health Insurance ID CARD! PART 1, Section 1 HCS 401-SP 2020 Your Health Insurance ID card, in USA: • How Long are YOU Covered Under Mom or Dad’s Health Insurance? You’re Covered, under YOUR Mom or Dad’s Health Insurance, from birth through age 26 – *Per the 2010 Federal ACA “Affordable Care Act”, a.k.a. “Obamacare” – • How Did College Students, have Health Insurance Coverage, PRIOR to the ACA 2010? FULL-TIME students were Offered Coverage through their College/University. * Included in your Tuition Payment – (usually ages 18 to 22+) • How Many Health Insurance PLANs Can Mom or Dad CHOOSE From? Three (3) Plans – • How Often Can Mom or Dad CHOOSE their Health Insurance Plans, form their Work Place? Once a Year - “Annually” 5 Must Knows About Your Health Insurance ID CARD! PART 1, Section 1 HCS 401-SP 2020 Sample ID Card FRONT 1). Policy Number 2). Group Number 3). Copay Amounts 4). Coinsurance Amounts 5). In-Network 6). Out-of-Network 6 Must Knows About Your Health Insurance ID CARD! PART 1, Section 1 HCS 401-SP 2020 Sample ID Card * BACK *See 11 , on Left Side of this Slide: 1). Member Services 2). 24/7 Nursing Info Line 3). Provider Services 4). Mental Health (Behavioral) 5). Prior Authorization 6). Pharmacy Services & Benefits 7 st 1 Quiz Topics: HCS 401-SP 2020 Must Knows About Your Health Insurance ID CARD? PART 1, Section 1 Quiz = 20 Questions, Multiple Choice. 8 HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 9 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ 1. The NAME of your, Mom or Dad’s HEALTH INSURANCE COMPANY & LOGO: Veterans (VA) Blue Cross Blue Shield Cigna Harvard Pilgrim TUFTS MassHealth 10 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ 2. The NAME & TWO (2) Digit NUMBER (Policy Holder’s Name/Number & Numbers for Other Family Members): • The NAME of the subscriber or policyholder (i.e. Mom or Dad). ( A.) • The NAME(S) of other covered family members (i.e. Spouse, Children (YOU)) may also appear here. ( B.) • The Two (2) Digit “Member Suffix”. ( B.) Subscriber or Policy Holder = 00 ( A.) Spouse = 01 1st Child = 02 (oldest) 2nd Child = 03 (next Oldest) ( B.) 3rd Child = 04 (etc. ) 11 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ 3. Member ID (Policy Holder/Employee): • Each Covered Family Member (Policy Holder, Spouse, 1st Child, 2nd Child, etc.) Receives an ID CARD, with their NAME, and an Assigned Unique ID Number, which allows Hospitals, doctors, and other health care providers, to verify your health insurance coverage and eligibility. (A.) *The Member ID is like Your Social Security Number - Unique and Assigned ONLY to YOU! (A.) 12 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ 4. Group Number (Mom or Dad’s EMPLOYER): • A Health Insurance Company assigns a unique ID number, to each Employer (Mom or Dads Work Place) that purchases one of its Health Plans. (A.) (A.) • a Group Number, identifies the Health Benefits Covered by YOUR Plan, and • your doctor’s office will use Group Number & your Member ID, to submit claims for PAYMENT. 13 “FRONT 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2a • The FRONT of the ID CARD, in USA: HCS 401-SP 2020 “ The Basics “ 5. Payment Information: Most health insurance cards will show how much you will be expected to PAY (your out-of-pocket costs) for common services like: • Office visits with Primary Care Physician (PCP), (A.) • Specialist visits, and (B.) • Urgent Care and Emergency Room visits. (C.) (A.) (B.) (C.) • This may be listed as a “flat rate” (copay) or a “percentage of the total cost” of the service (coinsurance). 14 “FRONT 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2a • The FRONT of the ID CARD, in USA: Prescription Benefits (RX): 6. Formulary: • A formulary is a list of prescription drugs that your insurance company will cover and PAY for! (A.) HCS 401-SP 2020 “ The Basics “ (A.) (A.) • Some insurers have several formularies. Each member will have one of three formularies or Tiers listed on his or her ID CARD – Formulary 1, Formulary 2 or the Medicaid Formulary. • If your Member ID CARD does not have a formulary listed, you have Formulary 1. (A.) 15 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ Prescription Benefits (RX): 7. Prescription Formulary Costs: • Formularies are commonly divided into three tiers. • A tiered formulary divides drugs into groups, based primarily on cost. • Your ID CARD may list the Price you’ll PAY at, each tier level, when you use a participating pharmacy. **Including BRAND and GENERIC! (A.) (B.) (C.) • KEY: Health Plans negotiate pricing with Drug companies. 16 “FRONT 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2a HCS 401-SP 2020 • The FRONT of the ID CARD, in USA: “ The Basics “ 8. Rx BIN (Banking Identification Number): • Your Pharmacist will use this RX BIN Number to Process & PAY for your prescription. • RX BIN Number indicates which Health Insurance Company will: • Reimburse the pharmacy for the COST of the Prescription, and • Where to send the RX – Prescription CLAIM for Reimbursement/PAYMENT. (A.) 17 “FRONT 101” How to USE Your Health Insurance ID CARD? HCS 401-SP 2020 PART 1, Section 2a • The FRONT of the ID CARD, in USA: “ The Basics “ 9. Medical Network: • Your Health Insurance Company may provide Out-of-Area Coverage, through a different health care provider network. If so, Contracted Company will be listed here. (A.) (A.) 18 “BACK 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2b • The BACK of the CARD: HCS 401-SP 2020 “ The Basics “ • Important Telephone Numbers & Addresses & WEBSITE (for Doctors and Hospitals) to: 1. 2. 3. 4. Verify Members Eligibility – to Receive Medical & Pharmacy Services, Confirm Health Insurance Coverage – to Ensure the Member is Valid, Claim Submission – for Patient & Provider PAYMENT, Obtain Pre-Authorizations (for USE and/or EXTENSION of Required Services), such as PT, OT SLP, Surgeries, etc. (A.) (A.) 19 “BACK 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2b • The BACK of the CARD: HCS 401-SP 2020 “ The Basics “ • It might also provide Hotlines and other Medical-Reated Resources for a variety of Specific Situations: (i.e. 24/7 Nurse Representatives, Prior Authorizations/Pre-Certifications, Vision Services, Dental Services, Chemical Dependency Services Number, Mental/Behavioral Health Hotline, Fraud Hotline, Case Management, etc.). (B.) 20 “BACK 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2b • The BACK of the CARD: HCS 401-SP 2020 “ The Basics “ • Customer Service and/or Claim Submission/Payment– Educated to Assist Providers, and Patients, with Answers to Questions, and Trouble Shoot ID CARD information issues, and concerns! (C.) (C.) 21 “BACK 101” How to USE Your Health Insurance ID CARD? PART 1, Section 2b • The BACK of the CARD: HCS 401-SP 2020 “ The Basics “ ID CARD ACCESS: 1. Online, through Health Insurance Co. secure member site, 2. Phone access, through Health Insurance Co. #1-800, 3. In-person appointment, with Representative of Health Insurance Co. 4. Paper application – Complete and Submit, via mail. 5. Telehealth: Have Access – Any time & Any Where through your Smartphone’s Mobile App! 22 RECAP Exercise & The Health ID CARD of the FUTURE….. 23 nd 2 Quiz HCS 401-SP 2020 Topics: The Basics – FRONT & BACK How to USE Your Health Insurance ID CARD? PART 1, Section 2 Quiz = 20 - 25 Questions, Multiple Choice. 24 HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 25 The ABC’s of Health Insurance & Vocabulary: Insurance? PART 1, Section 3 What is Health 1. DEFINITION: YOUR U.S. Healthcare Insurance is a….. BENEFIT! 2. DEFINITION: **ONLY for Native Americans and the Incarcerated is U.S. Health Insurance a RIGHT! 26 The ABC’s of Health Insurance & Vocabulary: What is Health Insurance? PART 1, Section 3 3. DEFINITION: HEALTH INSURANCE, in the USA = Legal entitlement, to Payment, for YOUR healthcare costs, THROUGH a Contract with a Health Insurance Company. 27 The ABC’s of Health Insurance & Vocabulary: What is Health Insurance? PART 1, Section 3 4. DEFINITION: This CONTRACT is Between the Member (Full-time Employee), AND, their Chosen Health Insurance Plan. • This CONTRACT requires the Chosen Health Insurer (*See Below) to PAY some or all of your Health Care costs. * The Member (Full-time Employee) MUST PAY $ (Money) = A Premium, from their Workplace Pay Check, for this CONTRACT. 28 The ABC’s of Health Insurance & Vocabulary: Insurance? Who Offers Health PART 1, Section 3 5. DEFINITION: A “Job-based, FULL-time “Employee” Health Insurance PLAN = Purchased by Mom or Dad’s Employer, from an Insurance Company. 6. DEFINITION: A “Job-based, PART-time “Employee” Health Insurance PLAN = Purchased by a Person, Directly, from an Insurance Company. *These Individual Health Insurance Policies are regulated under state & Federal law. (i.e. Medicaid or ACA, Affordable Care Act (ObamaCare). 7. DEFINITION: A “Person” Officially Deemed Disabled or Blind Health Insurance PLAN = Health Insurance is NOT Purchased, Coverage is provided Social Security Disability Income (SSDI) and Medicare. 29 The ABC’s of Health Insurance & Vocabulary: TYPES of Health Plans PART 1, Section 3 8. DEFINITION: An “Individual” Health Insurance PLAN = offered by YOUR Mom or Dad’s EMPLOYER, to provide COVERAGE for One Person, usually the Member/ Employee. 9. DEFINITION: A “GROUP” Health Insurance PLAN = YOUR EMPLOYER is offering, to provide COVERAGE for the Employee AND a Spouse and/or Children. 10. DEFINITION: A “STUDENT” Health Insurance PLAN = YOUR College is offering, to YOU ONLY (Student), to provide COVERAGE. 30 The ABC’s of Health Insurance & Vocabulary: Plan 11. DEFINITION: Do I Have a HMO or PPO Health PART 1, Section 3 HMO PLAN - *Young Family Based • Health Maintenance Organizations. • MUST pick a Primary Care Physician/PCP (or your insurer will pick one for you!) • The PCP = “Gatekeeper,” meaning you’ll need to see your PCP, for a REFERRAL, before you can see a Specialist. • To be fully covered by the PLAN, a Hospital, Clinic, Doctors or Specialist MUST be “INSIDEthe-NETWORK”! • If you seek and receive Medical Services “OUTSIDE-the-NETWORK”, they will NOT be covered! *EXCEPTION = Emergency situation. • **Essentially, You pay out-of-pocket – i.e. YOUR Choice = YOUR Money! 31 The ABC’s of Health Insurance & Vocabulary: Plan Do I Have a HMO or PPO Health PART 1, Section 3 12. DEFINITION: PPO PLAN - *Healthy Members • Preferred Provider Organizations. • This is a “Health Insurance Arrangement” that allows Plan Members relative FREEDOM to CHOOSE the doctors and hospitals they want to visit. • If YOU Obtain Medical Services from doctors, within the health insurance Plan’s Network, called "preferred providers”, YOU will be charged & pay lower fees! ***REMEMBER, the Premiums are typically higher as a result. • YOU may seek (WITHOUT a PCP Referral!) and receive Medical Services “OUTSIDE-theNETWORK”, HOWEVER, straying from the PPO network means that participants may pay a greater share of the costs! 32 The ABC’s of Health Insurance & Vocabulary: HMO vs. PPO Health Plans PART 1, Section 3 HMO PLAN PPO PLAN • All Coverage – FAMILY-Based! Coverage – Healthy People Based! • Health Maintenance Organizations. Preferred Provider Organizations. • MUST pick a primary care physician/PCP (or your insurer will pick one for you)! DO NOT Require a PCP! • PCP = “gatekeeper,” MUST make REFERRAL, before you can see a specialist. DO NOT Require a REFERRAL, • To be fully covered by the PLAN, ALL Medical Providers MUST be “INSIDE-the-NETWORK”! OPTION to see ANY Medical Provider; EITHER “INSIDE-the-NETWORK” OR “OUTSIDE-the-NETWORK” • YOU Pay “Co-Payments”, for INSIDE-the-NETWORK. YOU Pay “Co-Payments”, for INSIDE-the-NETWORK. *To Help Pay for Out-of-Pocket Costs, Use a FSA/Flexible Spending Account (credit card - $2,650 annual limit) • Size of “INSIDE-the-NETWORK” = Small! Size of “INSIDE-the-NETWORK” = Large! • If YOU - Seek/Receive Medical Services “OUTSIDE-the-NETWORK” = 100% NOT COVERED! *YOU Pay 100%, for Medical Services, Out-of-Pocket! Pocket! YOU - Seek/Receive Medical Services “OUTSIDE-the-NETWORK” = COVERED! * BUT…YOU Pay 100%, for Medical Services, Out-of- • Policy Holder = Pays Larger Premiums (Auto-Deducted, pre-tax, from Paycheck)! 33 The ABC’s of Health Insurance & Vocabulary: HMO & PPO Plan Time Periods PART 1, Section 3 13. DEFINITION: PLAN Year (Also called a “Policy Year”) • A 12-month period of Benefits Coverage under a Group Health Plan. This ROLLING 12-month period. • To find out when your PLAN Year begins, check your Plan Booklet, Website or ask your Employer. *Example: Hire date = 1/1/18; PLAN effective Date = 4/1/18 (90 days); so…… ROLLING 12month period = 4/1/18 – 3/31/19. *Example: Hire date = 6/21/19; PLAN effective Date = 9/21/19 (90 days); so…… ROLLING 12month period = 9/21/19 – 9/20/20. 14. DEFINITION: Benefit Year • A Year of Benefits Coverage under an Individual Health Insurance Plan. The Benefit Year for PLANS, BEGINs each CALENDAR YEAR, on January 1st of each year and ends December 31st , of the same year. • Any changes to Benefits or Rates, to a Health Insurance Plan, are made at the beginning , of 34 the Calendar Year. rd 3 Quiz HCS 401-SP 2020 Topics: What is Health Insurance – Who Chooses Your HMO or PPO Plan? PART 1, Section 3 Quiz = 20 - 25 Questions, Multiple Choice. 35 HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 36 What YOU Pay Out-of-Pocket, With a Health Insurance Plan: What is a PCP? PART 1, Section 4 1. DEFINITION: Primary Care Physician/PCP a. A PCP is a physician who provides both: *First Contact for a person with an undiagnosed health concern, and * Continuing Care of varied medical conditions. * b. The term PCP is primarily used in the United States. c. The Term PCP was created by the Health Insurance Companies. d. #1 MOST IMPORTANT feature about a PCP for selection = TRUST!!!!!!!!!! e. Most Employees (Mom, Day, and YOU) choose a HMO or PCP Healthcare PLAN, Based on inclusion of the Family's PCP! 37 What YOU Pay Out-of-Pocket, With a Health Insurance Plan: What is a Premium and WHO Pays for it? PART 1, Section 4 2. DEFINITION: A Health Insurance PREMIUM = the Monthly Fee, paid to an Insurance Company’s Health Plan, to provide health coverage. A. Who CONTRIBUTES to the PAYMENT of a PREMIUM? Full-time Employee (Mom, Dad, and YOU)! The EMPLOYER and the • On average, the Employer PAYS 45 – 75% of the Health Insurance costs! • The Full-Time Employee is Responsible for the balance, which is 55 – 25%! B. HOW is the PREMIUM PAID? The Employees’ (Mom, Day, YOU) PREMIUM is taken directly out of their pay check! It is taken along with the required state and federal taxes – FIRST! 38 What YOU Pay Out-of-Pocket, With a Health Insurance Plan: What is a Deductible and WHO Pays for it? PART 1, Section 4 3. DEFINITION: A Health Insurance DEDUCTIBLE = The AMOUNT the Policy Holder ( and their Dependents) must PAY Out-of-pocket BEFORE an Insurance Plan will pay any expenses. *FOR EXAMPLE: Health Insurance Companies, contracted with YOUR Dad’s work, offer Plans, annually, to their Full-time Employees, with high premiums and low deductibles, or Plans with low premiums and high deductibles. • Plan A (Blue Cross/Blue Shield) offers a Premium of $1,087, a month, with a $6,000 Deductible, while a competitive plan…… • Plan B (Cigna) offers a Premium of $877, a month, with a $12,700 Deductible. • If Rafal’s Dad knows his family has been relatively healthy (No very small children, Chronic Illness or Hospitalizations) for the past year, HE may decide to select Plan B – Cigna. • If Dad selected Plan A (BC/BS), HE will PAY the $6,000 deductible (out-of-pocket) in health care costs, BEFORE the Insurance Plan PAYS anything. • If Dad selected Plan B (Cigna), HE will PAY the $12,700 deductible (out-of-pocket) in health care costs, BEFORE the Insurance Plan PAYS anything. 39 What YOU Pay Out-of-Pocket, With a Health Insurance Plan: What is a Co-Insurance and WHO Pays for it? PART 1, Section 4 4. DEFINITION: A Health Insurance CO-INSURANCE (Fixed %) = MONEY a Member (Policy Holder, Spouse or Dependent) PAYS for Medical Services, AFTER a Deductible has been Paid. *EOB Statement is Billed to Policy Holder, AFTER the Medical Service. • specified by an ANNUAL (Yearly) PERCENTAGE (%). • It is Known as the “80/20 % Rule“ ! *For Example: 1. Dependent Austin, Covered Under his Dad’s Work Place Health Insurance Plan – Blue Cross & Blue Shield – BC/BS, Has a MRI (Baseball Injury). 2. The MRI Costs $1,000; Austin’s Dad BC/BS Plan PAYs = $800, 80% toward the charges; Austin’s Dad Receives BILL & PAYS = $200, 20%, for the BALANCE! *For Example: 1. Dependent Tamorah, Covered Under her Mom’s Work Place Health Insurance Plan – Harvard Pilgrim – HP, Has a LAB Work (Check Family History of Diabetes). 2. The LAB Work Costs $2,400; Tamorah’s Mom HP Plan PAYs = $1920, 80% toward the charges; Tamorah’s Mom 40 Receives BILL & PAYS = $480, 20%, for the BALANCE! What YOU Pay Out-of-Pocket, With a Health Insurance Plan: What is a Co-Payment and WHO Pays for it? PART 1, Section 4 5. DEFINITION: A Health Insurance CO-Payment ($) = MONEY a Member (Policy Holder, Spouse or Dependent) PAYS for Medical Services, BEFORE They RECEIVE the Service! *MONEY = Taken BEFORE Medical Visit. • A Specified FIXED DOLLAR AMOUNT ($). • MONEY Paid, to Your PCP or Specialists’ Medical Administrator, BEFORE YOU sit in the “Waiting Room”! • In the USA, the Co-Payment ($), is Defined by Health Insurance Company’s Actuarial, on a Yearly Basis. *For Example: 1. Dependent Hang, Covered Under her Dad’s Work Place Health Insurance Plan – Aetna, Has an Annual Physical (Required for College). 2. The Annual Physical Costs $460; Hang’s PAYS = $25, at Time of PCP Visit; Hang’s Dad Aetna Plan is Billed, by the PCP’s Office, and PAYs = $435. *For Example: 1. Dependent Kass, Covered Under her Mom’s Work Place Health Insurance Plan – Cigna, Has a Prescription to fill (for Strep Throat). 2. The Prescription Costs $71.50; Kass PAYS = $8.40; Kass’ Mom Cigna Plan is Billed, by the Pharmacy – CVS, and PAYs = $63.10. 41 What YOU Pay Out-of-Pocket, With a Health Insurance Plan: Spending Account? PART 1, Section 4 What is a Flexible 6. DEFINITION: A Health Insurance Flexible Spending Account/FSA = is a Special account, the Policy Holder, (Your Mom or Dad), put Money into, yearly. FSA FACTS: • You access this FSA Money through a credit card. • You don’t pay taxes on FSA money = a Savings. • FSAs are limited to $2,650.00, per Plan Year, per Employer. *ACA - If you’re married, your spouse can put up to $2,650 in a FSA, with their Employer, too. USE Your FSA to PAY for: • Certain Medical and Dental Expenses for Policy Holder, their spouse if you’re married, and your dependents. • Deductibles, Co-Insurance & Copayments, but …. NOT for Health Insurance Plan Premiums. • Prescription Medications, as well as over-the-counter medicines, with a doctor's prescription. *ACA - Reimbursements for insulin are allowed, without a prescription. • Purchase Durable Medical Equipment/DME: like Crutches, Canes & Wheelchairs, Adult Diapers, Supplies - like Bandages & Gauze, and diagnostic devices like Blood Sugar Test Kits or Blood Pressure Machines, telemedicine = Ultra Sound Bone Stimulator, etc. 42 th 4 Quiz HCS 401-SP 2020 Topics: Definitions of What YOU Pay Out-of-Pocket, with Health Insurance – and EXAMPLES! PART 1, Section 4 Quiz = 20 - 25 Questions, Multiple Choice. 43 HCS 401-SP 2020 PART 1, Prof. SClaprood-Wagner Sections 1 - 5 Section TOPICS: *Weeks 2 – 8 1. Must Knows About Your Health Insurance ID CARD! 2a. “FRONT 101”- How to USE Your Health Insurance ID CARD? 2b. “BACK 101”- How to USE Your Health Insurance ID CARD? 3. The ABC’s of Health Insurance & Vocabulary. 4. What You PAY Out-of-Pocket, with a Health Insurance Plan! 5. Your Mom & Dad’s Employers Process – Secure Health Insurance. 44 Your Mom & Dad’s Employers Process – Secure Health Insurance Plans PART 1, Section 5 1. Once a Year (Annually): EVERY EMPLOYER’S Human Resource Department/HRD Management and Staff, MUST Perform the following: • Review : Discounted, Health Coverage PLANs, submitted from interested Health Insurance Companies. • Evaluate : Based on “Employee Standards and How their Employees WANT to Live their Work Place Lives”, Management & Staff use Evaluation Guidelines, during the Evaluation process. * Evaluation Guidelines FACTORS, such as: Cost, Coverage, Reimbursement, Restrictions, Wellness Programs, etc. • Negotiate for BEST Plans & Cost : Contact, Meet, and Negotiate with Representatives from the SELECTED, Top Three (3) Health Insurance Companies. * Negation GOAL = Obtain the Lowest Cost offering the BEST Health Coverage! • Choose : The BEST, Three (3) Plan’s, for their Employees. • Obtain Management Approval : Obtain APPROVAL to Offer, their Employees’, the BEST, Three (3) Health Coverage Plan’s! • Sign A Contract with the “Big 3” : HRD Management & Staff SIGN “3” CONTRACTs, with the Approved, Health Insurance Companies. * GOAL: Provide “the BEST Options”, to their FULL-TIME EMPLOYEES , for Choosing, a Health Plan Benefit 45 Package. Your Mom & Dad’s Employers Process – Selecting Health Insurance PART 1, Section 5 1. Once a Year (Annually): EVERY EMPLOYEE MUST : • Meet with their Human Resource Department/HRD Management and Staff, to Review & SELECT their Health Insurance Coverage Plan. HRD MUST Perform the following, for NEW, on-boarding Employees and Existing Employees: a) EMPLOYER, through HRD, MUST provide FULL-TIME Employees (Mom and Dad) with at least Three (3) Health Insurance PLANs. b) An EMPLOYER, through HRD, MUST provide each FULL-TIME EMPLOYEE (Mom and Dad) with each CONTRACTED Health Insurance PLANs’ Materials (Booklet and/or Brochure). c) Each FULL-TIME EMPLOYEE has a limited time, to review each CONTRACTED Health Insurance PLANs’ Materials (Booklet and/or Brochure). d) The FULL-TIME EMPLOYEES take the following, into consideration, when CHOOSING a Health Insurance Benefits PLAN: • • • • • Individual or Family PCP, Costs – Premiums, Deductibles, Co-Insurance, Co-payments, etc. Any Specialists, Wellness Program, Covered and Non-covered Medical Services, etc. 46 Your Mom & Dad’s Employers Process – Selecting Health Insurance 1. Once a Year (Annually): EVERY EMPLOYEE MUST : PART 1, Section 5 *Continued…….. HRD MUST Perform the following, for NEW, on-boarding Employees and Existing Employees: a) The FULL-TIME Employee MUST Select an INDIVIDUAL Plan (if they are covering ONLY themselves) or GROUP Plan (If covering themselves, Spouse and/or family members). b) The FULL-TIME Employee MUST Copy & SUBMIT their Selected Plan Paperwork/Forms, to EMPLOYER’S HRD. c) The EMPLOYER’S HRD retains a copy of the SELECTED Health Insurance Plan, in EMPLOYEE’s File. d) The EMPLOYER’S HRD sends original paperwork/Forms to the Selected Plan, to Finalize the Contract, with the Health Insurance Company. e) The Health Insurance Company creates a Health Insurance Policy and issues an ID CARD, to EMPLOYEE, and/or ID CARDS to Members of their Family. 47 Your Mom & Dad’s Employers Process – Receive ID Card & Health Coverage Plan Booklet PART 1, Section 5 MANDATORY REQUIREMENT: Each CONTRACTED Health Insurance PLAN MUST provide their Health Insurance PLAN Materials (Booklet and/or Brochure), to ANY FULL-TIME EMPLOYEE: • Medical Benefits and Services included in, and excluded from, coverage, • Pharmaceutical management procedures, if they exist, • Copayments and other charges for which members are responsible (out-of-pocket), • Flexible Spending Account for out-of-pocket costs, medical service expenses, and pharmacy costs, • How to submit a claim for covered services, if applicable, • How to obtain information about practitioners who participate in the provider network, • How to obtain primary care services, • How to obtain specialty care and behavioral health care services and hospital services, • How to obtain care after normal office hours, • How to obtain emergency care, including the organization’s policy on when to directly access emergency care or use 911 services • How to obtain care and coverage when subscribers are out of the organization’s service area, • How to File a complaint, • How to Appeal a decision that adversely affects coverage, benefits or a member’s relationship with the organization, • How the organization evaluates new technology for inclusion as a covered benefit. 48 Your Mom & Dad’s Employers Process – What Are Employer Flexible BENEFITS? PART 1, Section 5 1. DEFINITION: Flexible Benefits PLAN = A BENEFIT Program, PROVIDED by the EMPLOYER – OFFERING FULL-TIME EMPLOYEES the COMMON Core 5 Benefits. • A Flexible Benefits PLAN is PAID by the Company, in addition to YOUR Salary! • A Flexible Benefits PLAN is an additional 28 - 30% , Your EMPLOYER pay outs on top of Your Salary!!!! Salary = $60,000 + 28% Flex Benefits ($16,800) ___________________ Total Compensation = $76,800 49 Your Mom & Dad’s Employers Process – What Are Common Core 5 BENEFITS? PART 1, Section 5 1. DEFINITION: Flexible Benefits PLAN = FULL-TIME EMPLOYEES the COMMON Core 5 Benefits: 1. Cash or Compensation for OT/Over Time, 2. Life insurance, 3. Health insurance, 4. PAID Vacations, Holidays and/or Sick time, 5. Retirement plans (includes Company’s Cafeteria Plan or IRS 125 Plan). 50 Your Mom & Dad’s Employers Process – What Are Possible, Additional Common Core 5 BENEFITS? PART 1, Section 5 Flexible Benefits PLAN = FULL-TIME EMPLOYEES the COMMON Core 5 Benefits: 2. DEFINITION: *Possible “Additional Benefits”: • Child Care ($ for off-site or on-site facilities), • Tuition Reimbursement, • Travel Reimbursement, • Exercise Facilities, • Job Sharing/4-Day Work Week/Work at Home Options; etc. 51 Your Mom & Dad’s Employers Process – Sounds Good, So What Are These Employer Flexible BENEFITS? PART 1, Section 5 52 Your Mom & Dad’s Employers Process – Which Benefits are Most VALUED, By Millennials to Baby Boomer Job Seekers? PART 1, Section 5 53 Your Mom & Dad’s Employers Process – Now & Then Employee Flexible BENEFITS? PART 1, Section 5 54 th 5 Quiz HCS 401-SP 2020 Topics: Selecting Health Insurance Coverage PLANS and Flexible Benefits EXAMPLES! PART 1, Section 5 Quiz = 20 - 25 Questions, Multiple Choice. 55 Parts: 2 & 3 HCS 401-Sp 2020 • Healthcare Coverage PARTS: A, B, C, & D • Medicare and Medicaid 56 57 58 59 60 61 62 63 64 65 66 HCS 303 67 68 69