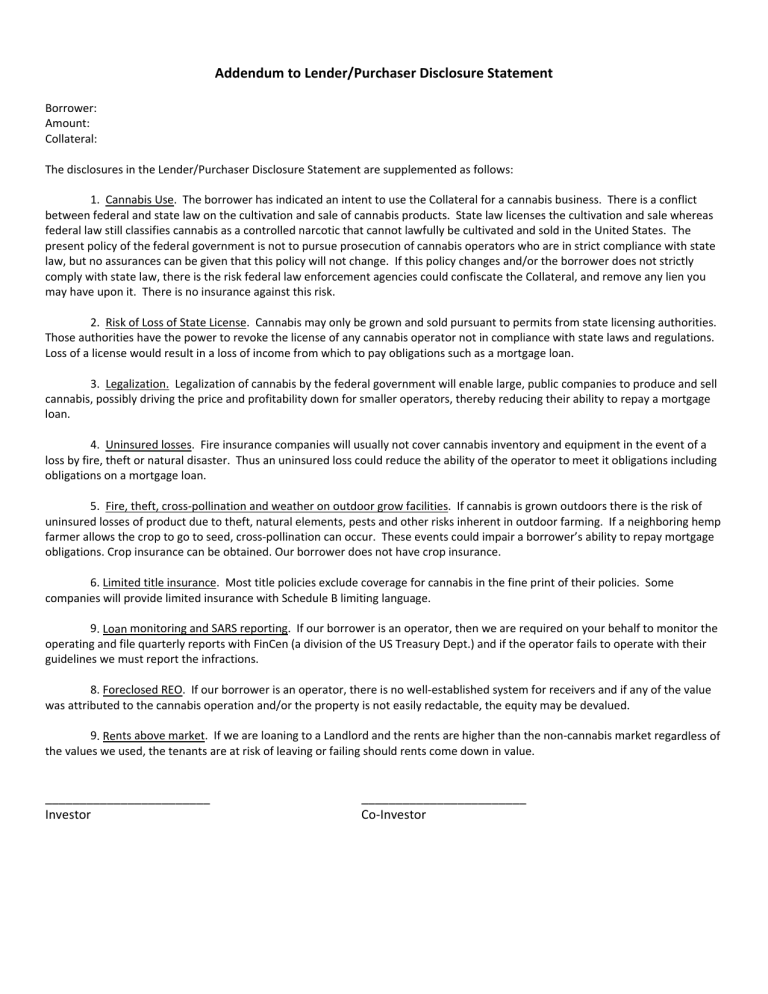

Addendum to Lender/Purchaser Disclosure Statement Borrower: Amount: Collateral: The disclosures in the Lender/Purchaser Disclosure Statement are supplemented as follows: 1. Cannabis Use. The borrower has indicated an intent to use the Collateral for a cannabis business. There is a conflict between federal and state law on the cultivation and sale of cannabis products. State law licenses the cultivation and sale whereas federal law still classifies cannabis as a controlled narcotic that cannot lawfully be cultivated and sold in the United States. The present policy of the federal government is not to pursue prosecution of cannabis operators who are in strict compliance with state law, but no assurances can be given that this policy will not change. If this policy changes and/or the borrower does not strictly comply with state law, there is the risk federal law enforcement agencies could confiscate the Collateral, and remove any lien you may have upon it. There is no insurance against this risk. 2. Risk of Loss of State License. Cannabis may only be grown and sold pursuant to permits from state licensing authorities. Those authorities have the power to revoke the license of any cannabis operator not in compliance with state laws and regulations. Loss of a license would result in a loss of income from which to pay obligations such as a mortgage loan. 3. Legalization. Legalization of cannabis by the federal government will enable large, public companies to produce and sell cannabis, possibly driving the price and profitability down for smaller operators, thereby reducing their ability to repay a mortgage loan. 4. Uninsured losses. Fire insurance companies will usually not cover cannabis inventory and equipment in the event of a loss by fire, theft or natural disaster. Thus an uninsured loss could reduce the ability of the operator to meet it obligations including obligations on a mortgage loan. 5. Fire, theft, cross‐pollination and weather on outdoor grow facilities. If cannabis is grown outdoors there is the risk of uninsured losses of product due to theft, natural elements, pests and other risks inherent in outdoor farming. If a neighboring hemp farmer allows the crop to go to seed, cross‐pollination can occur. These events could impair a borrower’s ability to repay mortgage obligations. Crop insurance can be obtained. Our borrower does not have crop insurance. 6. Limited title insurance. Most title policies exclude coverage for cannabis in the fine print of their policies. Some companies will provide limited insurance with Schedule B limiting language. 9. Loan monitoring and SARS reporting. If our borrower is an operator, then we are required on your behalf to monitor the operating and file quarterly reports with FinCen (a division of the US Treasury Dept.) and if the operator fails to operate with their guidelines we must report the infractions. 8. Foreclosed REO. If our borrower is an operator, there is no well‐established system for receivers and if any of the value was attributed to the cannabis operation and/or the property is not easily redactable, the equity may be devalued. 9. Rents above market. If we are loaning to a Landlord and the rents are higher than the non‐cannabis market regardless of the values we used, the tenants are at risk of leaving or failing should rents come down in value. ________________________ Investor ________________________ Co‐Investor