HIDDEN TEXT TO MARK THE BEGINNING OF THE TABLE OF CONTENTS

Credit Proposal

(Form DD)

Name of Unit :

TRANSFORMERS AND ELECTRICALS KERALA

LIMITED

Customer Id :

C00050409

Proposal No. :

P0005040905

Sanctioning Authority :

CCSC

Branch :

CB ERNAKULAM (4062)

Business Group :

COMMERCIAL CLIENTS GROUP

Proposal Date :

21-08-2019

Proposal For :

Sanction / Approval / Confirmation

Ratings :

CRA - Rating

ECR

IRAC

Previous

Current

SB-8

SB-9

BRICKWORK / BBB / 24-10-2018

Standard

BRICKWORK / BBB / 21-02-2020

Standard

INDEX

Contents

Abbreviation

Section A - Borrower Unit’s Profile and Details of Due Diligence

Section B - Proposal for Sanction / Approval / Confirmation

Section C - Performance and Financial Indicators

Section D - Loan Policy/Deviations/Compliance/Regulatory

Prescriptions

Section E - Summary of Critical Risk Factors / Mitigations

Section F - Assessment of Fund Based Limits

Section G - Assessment of Non Fund Based Limits

Section H - Capital commitment and Pricing

Section I - Security

Section J - Other Terms and Conditions

Section K - Justification and Recommendation

Annexure - RAROC

Annexure-2 - Details of Due Diligence

Annexure-5 - Details of Diversion of Funds to Related/Unrelated

Entities or Unrelated Activities

Page No.

1

2

23

35

67

70

91

95

100

108

117

120

131

136

140

Abbreviation

Abbreviation Name

Abbreviation Description

BHEL

BHARATH HEAVY ELECTRICALS LIMITED

BIFR

BOARD FOR INDUSTRIAL AND FINANCIAL

EE .

ELECTRICAL AND EQUIPMENTS

KSEB

LT & HT CIRCUIT

BREAKERS

MCB

MCCB

KERALA STATE ELECTRICITY BOARD

LOW TENSION & HIGH TENSION CIRCUIT BREAKERS

MINIATURE CIRCUIT BREAKER

MOULDED CASE CIRCUIT BREAKER

MEIL

MEGHA ENGINEERING INFRASTRUCTURE LIMITED

NABL

NATIONAL ACCREDITATION BOARD FOR TESTING AND

CALIBRATION LABORATORIES

NLCL

Neyveli Lignite Corporation Limited

NPCIL

NUCLEAR POWER CORPORATION OF INDIA LIMITED

NTPC

NATIONAL THERMAL POWER CORPORATION

PGCIL

POWER GRID CORPORATION OF INDIA LIMITED

PPA

POWER PURCHASE AGREEMENT

RCD

RESIDUAL CURRENT DEVICE

TELK

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

UDAY

UJWAL DISCOM ASSURANCE YOJANA

Confidential and Property of State Bank of India

NEWFORMAT

Page 1 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Section A

Borrower Unit’s Profile and Details of Due Diligence

Circle / SBU : CCG

Branch : CB ERNAKULAM-4062

A1. Borrowing Unit's Profile

Name of the Unit : TRANSFORMERS AND CIF No. : 78760281576

ELECTRICALS KERALA LIMITED

Whether the Unit is a Central Government PSU: Yes

Date of incorporation : 09-12-1963

Date of commencement of operations :

09-12-1963

Segment : C&I

Constitution : PSU - Unlisted

Industry : ELECTRICAL EQUIPMENT

Activity : MFG. OF MACHINES FOR

ELECTRIC DISTRIBUTN

Group, if any : NA

Chairman / MD / Promoter / CEO/ CFO : Dilip Kumar Dubey-Nominated Director,

PRASAD BHASKARAN NAIR-MANAGING DIRECTOR/ Managing Director,

PRASHANT KUMAR MOHAPATRA-Nominated Director,SHIBU SUBAIDABEEVI

ABDULRASHEED-Nominated Director,MAMMEN JACOB-Nominated Director,

VIJAYAKUMARI PAROL-Nominated Director,RAMACHANDRAN K K-Nominated

Director,MOHANAN N C-CHAIRMAN

Main Contact Person : Ajith Kumar V , Senior

Manager Finance & Accounts

Unit : Existing Unit

Contact Number :

9946660212

If Existing Connection since when : 01-01-1964

Group dealing with us since :

Date of Last Renewal/ Review : 06-022019

If Reviewed valid upto : 29-06-2019

Existing Banking Arrangement:

WC : MBA

TL :

Whether Project Loan :

Proposed Banking Arrangement:

WC : MBA

TL :

Whether Project Loan :

Confidential and Property of State Bank of India

NEWFORMAT

Page 2 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

IRAC Status as on: 31-07-2019

Advances : Standard

Investments : Not Applicable

Previous IRAC Status:

Advances : Standard

Investments : Not Applicable

IRAC status of the constituent with other banks, as per CRILC data search

Advances : Standard

Investments : Not Applicable

Whether a takeover case : No

Whether the account has been restructured / CDR Account :No

A2. Addresses & Locations of the Company/ Firm / Unit

Registered Office

AP VII/336 ANGAMALY SOUTH, City: ERNAKULAM, Dist:

ERNAKULAM, State: Kerala, India, Pin: 683573

AdministrativeOffice

AP VII/336 ANGAMALY SOUTH, City: ERNAKULAM, Dist:

ERNAKULAM, State: Kerala, India, Pin: 683573

Plant / Factory

AP VII/336 ANGAMALY SOUTH, City: ERNAKULAM, Dist:

ERNAKULAM, State: Kerala, India, Pin: 683573

Names & Addresses of Promoters / Directors

DIN

Sr.

No.

Name

Design

ation

DIN

PAN

1

Dilip Kumar

Dubey

Nomina 0813716 AAIPD50

ted

3

37A

Directo

r

2

Government of

Kerala

Corpor

ate

Promot

er

3

MAMMEN

JACOB

Nomina 0825581 AAHPM8

ted

2

753H

Directo

Confidential and Property of State Bank of India

NEWFORMAT

Passport

Others

(Aadhar

Full Address

C/O V N

ubey, 92,

Aakriti

Apartments,

Plot No 62 I P

Extension,

Patparganj,

Shakarpur

Delhi East

Delhi Delhi

India 110092

TC

12/174/2,

Malayil

Page 3 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

DIN

Sr.

No.

Name

Design

ation

DIN

PAN

Passport

r

Others

(Aadhar

Full Address

Mulavana

Kunnukuzhy

Vanchiyoor

PO

Thiruvananth

apuram

Thiruvananth

apuram

Kerala India

695035

4

MOHANAN N C CHAIR 0764852 AOHPM7 J250014

MAN

3

100A

6

Aramam

BROADWAY

ROAD

Perumbavoor

Ernakulam

Kerala India

683542

5

NTPC LIMITED Corpor

ate

Promot

er

NTPC

BHAWAN,

SCOPE

COMPLEX, 7

INSTITUTION

AL AREA

,LODHI

ROAD NEW

DELHI NEW

DELHI Delhi

India 110003

6

PRASAD

BHASKARAN

NAIR

Managi 0742384 AAIPN30 G736164

ng

9

09L

3

Directo

r

MOHANAM

SANKARAMA

NGALAM

COMPOUND

MANAKKARA

SASTHAMKO

TTA Kerala

India 690521

7

PRASHANT

KUMAR

MOHAPATRA

Nomina 0780072 AHNPM5 P562697

ted

2

452E

2

Directo

r

GYAN

CHAND IV,

94-B

INDIRAPURA

Confidential and Property of State Bank of India

AAACN0

255D

NEWFORMAT

Page 4 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

DIN

Sr.

No.

Name

Design

ation

DIN

PAN

Passport

Others

(Aadhar

Full Address

M

GHAZIABAD

GHAZIABAD

Uttar Pradesh

India 201014

8

RAMACHANDR Nomina

AN K K

ted

Directo

r

GGXPK1

515F

Karyangadan

Thalavanikka

ra Ollur

Thalore

Thrissur

Kerala India

680306

9

SHIBU

SUBAIDABEEVI

ABDULRASHEE

D

Nomina 0776676 BKKPS8

ted

9

478P

Directo

r

VARUVILA

VEEDU

NILAKKAMU

KKU

KADAKKAVO

OR POST

TRIVANDRU

M

TRIVANDRU

M Kerala

India 695306

10

VIJAYAKUMARI Nomina 0724750 ABKPV9

PAROL

ted

4

197Q

Directo

r

28/1686D

VARATHA ST

JOSEPH

CHURCH

KADAVANTH

ARA P O

ERNAKULAM

ERNAKULAM

Kerala India

682020

A3. Whether names of borrower, promoters, directors, group concerns,

guarantors figure in defaulter/willful defaulters list:

1

CICs Defaulters List (Rupees 1 Crore and above)

dated 31-03-2019

Confidential and Property of State Bank of India

NEWFORMAT

No

Page 5 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

2

CICs Defaulters List (Rupees 25 Lacs and above)

dated 31-03-2019

No

3

ECGC Caution List

No

4

Credit Information Companies - Credit History

Yes

5

Disqualified Directors

No

6

Banned List of Promoters(SEBI)

No

7

Loan Rejection List

dated 30-06-2018

No

8

IPROBE

No

9

Credit Information Companies - Suit Filed List

No

10

Non-Cooperative Borrowers List

Not Verified

11

Other Defaulter

No

In case of 'Yes' for any of the above

Sr.

No.

1

Name

NTPC LIMITED

Profile

Defaulters

Corporate

promoter

Yes

CIN/LLPIN/

DIN

PAN/ID

AAACN0255D

In case of 'Not Verified' for any of the above

Sr.

No.

1

Name

Government of Kerala

Profile

Defaulters

Corporate

promoter

CIN/LLPIN/

DIN

PAN/ID

Not

Verified

Whether defaulter is a Director : No

Any exposure (Rs. 5 crores and above) of our Bank in the Defaulter Company

(CRILC data search to be made of use of)

Position of Accounts of applicant company with other Banks

(CRILC data search to be made of use of)

Whether reported in ECGC caution list/ Specific approval list:

Confidential and Property of State Bank of India

NEWFORMAT

No

Page 6 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Whether reported in Banned list of promoters of SEBI:

Whether Directors are disqualified as per MCA site:

No

No

Whether information on loan Rejections/ Slippage has been obtained (for proposal of

Rs. 50 crore & above):

Yes

Whether borrower/ associate/ guarantor/ promoter/ director/ is a non-cooperative

borrower?: Not Verified

Non cooperative list cannot be verified for State Government as the same is not

covered by defaulters list .

RBI -CRILC site is verified for TELK and NTPC and both are not classified as noncooperative borrower.

Whether reported in iProbe:

No

Whether reported in IBG defaulters list: No

If yes in any of the above, give details and reasons for accepting the current proposal

Deafulter list cannot be verified for State Government who is the part promoter ,as

the same is not covered by the defaulter list.

Confidential and Property of State Bank of India

NEWFORMAT

Page 7 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

A4. Capital Structure (Shareholding Pattern)

Existing

Proposed

Confidential and Property of State Bank of India

NEWFORMAT

Page 8 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

% of Holding

Description

Existing

Proposed

99.16

99.16

Pvt. Corporate Bodies

0.03

0.03

Indian Public

0.79

0.79

NRI / OCB

0.02

0.02

0.00

0.00

100.00

100.00

Promoters

Mutual Funds

Banks / Financial Institutions

Foreign Institutional Investors

Others

Total

100.00

iii) Promoters' shareholding (%)

Current

99.16 %

Last Year:

99.16 %

Comment on change in shareholding pattern, if any

There is no change in shareholding pattern.

Whether Promoters' shares pledged to our Bank/ other Banks/FIs: No

Confidential and Property of State Bank of India

NEWFORMAT

Page 9 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

A5. Credit Rating

Credit Rating: Borrower

Current

CRA Based on

Balance Sheet

as on

Validated on

31/03/201 31/03/201

7

6

06-09-2018 31-10-2016

CRA Rating

(without any

upgrade on

account of

Navratana /

Maharatna)

Not

Applicable

CRA Rating

(after upgrade

on accounrt of

Navratana /

Maharatna)

Non Trading

Regular

CRA

Model

Previous

Not

Applicable

Not

Applicable

Not

Applicable

Facility Rating

Facility Id and Name

Current

Previous

CRA Rating

SB-9

SB-8

Overall

Score

53.52

57.94

Financial

Score

24.20

32.30

Minimu

m Score

23.00

23.00

Current

Type and

Subtype

Non Trading

Regular

Previous

Rating

Score

Rating

Score

F00050409004

BG

NFB - WC

FR-9

40.12

FR-9

40.96

F00050409003

LC

NFB - WC

FR-10

35.92

FR-9

38.16

F00050409001

Cash Credit

FB - WC

FR-3

85.62

FR-10

34.06

Details of information / update in case of any change after the date of

NIL.

Brief comments on reasons leading to improvement/decline in last available

internal rating

CRA based on ABS 2017-18 is SB-9.

CRA has come down by 1 notch from SB-8 to SB-9 mainly on account of decrease in

Confidential and Property of State Bank of India

NEWFORMAT

Page 10 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Financial risk score. There has been decline in sales during FY 2017-18 compared to

FY 2016-17and the company has achieved only 57.16% of estimated sales and

22.51% of estimated PAT.

A6. Whether subjected to any dynamic review : No

(With triggers: Applicable in case of total exposure of Rs. 10 crores and above in all

Business Groups, including IBG. Without triggers: Half yearly - all borrowers

enjoying aggregate limits of Rs. 500 crores and above.)

ii) If no, reasons and justification there for

No trigger to undertake dynamic review

A7. External Rating

Present Rating

Date of

External

Rating

Agency

Long

Term

Rating

Short

Term

Rating

BBB

A3

21-11-2018 BRICKWORK

Valid upto

21-022020

Long

Term

Rating

Amount

Short

Term

Rating

Amount

12.02

220.40

Rating Rationale : The ratings reaffirmed at BBB.

External rating is based on the audited financials of the Company up to FY17,

provisional financials of FY18 and first 6 months of FY19, management provided

projected financials up to FY20, publicly available information, and

information/clarifications provided by the management.

The ratings draw strength from reputed promoters with strong credit profile,

professional and experienced management, track record of streamlined business

operations of over 5 decades, brand value of having been in technological

collaboration with M/s. Hitachi Limited, Japan, low gearing and moderate Current

Ratio, revenue visibility through moderate order book position as on 31.10.2018, and

steady demand scenario evolving through growing economy, increasing

industrialization, and potential future growth in per capita consumption of electricity

in India.

However, the ratings are constrained by small scale of operations characterized by

low net sales, customer concentration risk, geographical concentration of business

activities in south India, deterioration in ISCR for FY18 compared to FY17, further

deterioration in already stretched Cash Conversion Cycle in FY18, thin profitability

margins, and intense competition among numerous incumbents likely to keep

pressure on margin and market share.

Going forward, ability of the Company to sustainably improve the scale of operations

and profitability margins, prudently manage working capital requirements, diversify

product and customer base, and keep up with the technological up gradations in the

Confidential and Property of State Bank of India

NEWFORMAT

Page 11 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

industry would be the key rating sensitivities.

Rating Outlook: Stable

Details of bank facilities rated

Long Term Rating

1. Cash Credit-Rs.12.02 crs with State Bank of India

Short Term Rating

1. Bill Discounting (LC)-Rs.44.00 crs with State Bank of India

2. Bank Guarantee

-Rs.80.40 crs with State Bank of India

3. Letter of Credit

-Rs.16.00 crs with State Bank of India

4. Cash Credit

-Rs.15.00 crs with South Indian Bank

5. Supply Bill Purchase -Rs.10.00 crs with South Indian Bank

(Non-LC)

6. UBD (LC)

-Rs.55.00 crs with South Indian Bank

Previous Rating

Date of

External

Rating

Agency

Long

Term

Rating

Short

Term

Rating

BBB

A3

25-07-2017 BRICKWORK

Valid upto

24-102018

Long

Term

Rating

Amount

Short

Term

Rating

Amount

12.02

120.21

Rating Rationale : BWR has principally relied upon the audited financial results upto

FY16, provisional financials of Fy17, publicly available information and

information/clarification provided by the TELK's management.

The rating continues to derive strengths from the professional and experienced

management, strong credit profile of Govt. of Kerala and NTPC Ltd, joint venture

with Govt. of Kerala and NTPC Ltd leads to strong support from the promoters and

comfortable gearing profile of TELK. However, the ratings are constrained by modest

scale of operations, streched working capital cycle and intense competition in the

industry.

Going forward, the ability of the Company to improve the scale of operations, to

sustain the gearing level achieved and to withstand in the competitive market will

remain key rating sensitivities.

Comments on changes in rating, if any

Rating of the company continues to remain at BBB.

The internal rating of the company is SB 9 based on ABS 2017-18. As per circular

no:CRO/RMD-IND/7/2018-19 dated 29.12.2018 the ECR mapped to an internal

rating of SB-9 is B. TELK's external rating is better than the internal rating.Hence no

Confidential and Property of State Bank of India

NEWFORMAT

Page 12 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

action required.

Are there any negative events / triggers that happened after Balance-sheet

Date and borrower rating is under watch.: No

Comments

A8. Brief Background of the Company/Group & Management:

(To include competence/reputation including recent development / news related to

company / industry and its impact on the company as well as involvement in legal

disputes, strictures passed against them by Government agencies):

Transformers and Electricals Kerala limited (TELK) was incorporated in 1963 as a

Government of Kerala (GoK) undertaking. Initially TELK was promoted by GoK and

Kerala State Industrial Development Corporation Limited(KSIDC) in collaboration

with Hitachi Limited of Japan. TELK gave India, its first 400kV Class Transformer,

First 315MVA Auto Transformer and Generator Transformer for India's first 500MW

Thermal Unit.

The Company is an ISO certified Company since 1995. TELK is currently an

approved high quality supplier to all power utilities in India and many prestigious

utilities abroad.

TELK started its commercial production in 1966 and was working satisfactorily till

1981-82.The fourth stage of expansion for manufacturing Gas Circuit Breakers led

to cost overrun. This coupled with a demand recession and a few bad years of

production due to power cut, resulted in continuous losses to the Company thus

eroding networth completely.The Company was referred to BIFR during 1995.

After several failed attempts on revival of the unit, during 2006, they had made

negotiations with NTPC for a joint venture for the revival of the unit. Since 2007,

TELK is a joint venture between GoK and NTPC Ltd, with NTPC having 44.60%

shareholding. As per the joint Venture Agreement, Board of Directors of the

Company will have four nominees from NTPC and four nominees from Government

of Kerala .The Chairman of the company is a nominee of Government of Kerala

while Managing Director is a nominee of NTPC Ltd.

The company successfully implemented the rehabilitation package of BIFR. As on

31.03.2011 it could wipe off all accumulated losses.It declared a dividend also in FY

Confidential and Property of State Bank of India

NEWFORMAT

Page 13 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

11. At the request of the Company, BIFR issued orders for allowing the company to

come out of the purview of BIFR as its net worth turned positive.

Till 2014, company was making profits .However, from 2015 onwards it was

reporting losses due to the continued impact of lower demand for transformers

compared to supply in the market and resultant impact on selling price.The profit

margin of the company has substantially dropped due to the above issues faced by

Power sector.

From 2016-17 onwards the market situation has changed as the demand for

transformers increased. During the FY 2016-17,the company has reported a profit

of Rs.4.89 crs and Rs.2.64 crs during FY 2017-18.

The renewal of limits was done on 31.10.2018. As the company could not submit

the audited financials on time, continuation of the limits was sanctioned for six

months from 01.01.2019 by CCSC vide its meeting dated 06.02.2019.

The company presently enjoys working capital facilities under MBA from us and

South Indian Bank, with a total exposure of Rs.123.42 crs.The company is rated

BBB by Brickwork Ratings which is valid till 21.02.2020 .The internal rating of the

company based on ABS as on 31.03.2018 is SB-9 (pending for validation).

A9. Corporate Governance Standards

(family managed/professionally managed etc., compliance with listing agreement):

TELK is a joint venture between Government of Kerala and NTPC, with NTPC

having 44.60% shareholding since 2007.As per the Business Collaboration &

Shareholder's Agreement , the Board of Director's of the Company has been

reconstituted with four nominees of Government of Kerala and four nominees of

NTPC Ltd.The Chairman of the board shall be the nominee of the Government of

Kerala and the Managing Director shall be a nominee of NTPC Ltd.

The list of present Board of Directors is given below:

1. Shri. N.C. Mohanan- Chairman- Government of Kerala have appointed Shri. N.C.

Mohanan as Chairman and Director w.e.f. 08.09.2016.

Confidential and Property of State Bank of India

NEWFORMAT

Page 14 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

2. Shri. Prasad Bhaskaran Nair- Managing Director-NTPC Nominee-Shri. Prasad B.

has taken charge as the Managing Director w.e.f 09.01.2016

3. Shri. Prasant Kumar Mohapatra, Director (Technical), NTPC Limited has been

appointed as a Part-time Director in TELK w.e.f. 21.06.2018. Shri.P.K. Mohapatra

is a graduate in Mechanical Engineering (REC Rourkela). He joined NTPC in 1980

as an Executive Trainee and has more than 37 years of experience from concept to

commissioning of power plants.

4. Shri. D.K. Dubey has been nominated by NTPC Limited as a part-time Director

on the Board of Directors of TELK w.e.f. 20.12.2018. Presently, he is serving NTPC

Limited in the capacity of RED (South) at Secunderabad. Prior to this, he was

Executive Director of NTPC-Ramagundam since November 2016. A Mechanical

Engineer from the Awadesh Pratap Singh University and also an MBA (Finance)

from FMS-Delhi, Shri. Dubey joined NTPC on September 21, 1981. He has varied

experience and has held important positions in a career spanning over three-and-a

half decades in NTPC.

5. Shri. Shibu A - Government of Kerala have appointed Shri. Shibu A.S. as a

Director on the Board of Directors of TELK w.e.f. 05.12.2018. Presently, he is in the

service of Government of Kerala as Under Secretary, Finance Department.

6. Shri. K.K. Ramachandran- Government of Kerala have appointed Shri. K.K.

Ramachandran as a Director on the Board of Directors of TELK w.e.f. 20.06.2017.

7. Smt. P. Vijayakumari- Government of Kerala have appointed Smt. P.

Vijajayakumari as a Director on the Board of Directors of TELK w.e.f. 20.07.2017.

Presently, she is in the service of KSEB Ltd, as Director, Transmission.

8. Shri. Mammen J. has been nominated by NTPC Limited as a Director on the

Board of Directors of TELK w.e.f. 10.08.2018. Presently, he is serving NTPC Limited

in the capacity of GM (Commercial), SR-HQ, NTPC.

Confidential and Property of State Bank of India

NEWFORMAT

Page 15 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

A10. Brief write up on corporate actions done/to be done/proposed like

merger, demerger, corporate restructuring (not CDR), sale of undertakings etc.

NIL

A11. Existing Limits with our Bank(details of last five years)

Amount INR in Crore

Existing

Date of

Sanction

Curre

ncy

FB

NFB

WC

06-07-2012

TL

Net Sales

Average

(Only for the

utilisati

Relevant

on % @

Period)

12.02

88.90

202.37

80.00

24-09-2013

INR

Crore

12.02

88.90

154.56

85.00

31-10-2014

INR

Crore

12.02

88.90

170.00

60.00

23-03-2016

INR

Crore

12.02

88.90

154.64

60.00

18-03-2017

INR

Crore

27.02

96.40

164.74

59.10

04-04-2018

INR

Crore

12.02

0.00

96.40

182.86

89.27

31-10-2018

INR

Crore

12.02

0.00

96.40

06-02-2019

INR

Crore

12.02

0.00

96.40

Confidential and Property of State Bank of India

NEWFORMAT

Page 16 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

A12. Particulars of losses incurred by Bank

Particulars

Notional Loss

Loss/Notional Loss/Haircut

suffered by the Bank on

account of write off/

Compromise

Settlements/References to

CDR in respect of previous

exposures on Companies

floated by Related parties,

Groups, Associates and

Directors (Please quantify).

Specific comments on ‘Right

to recompense’ clauses need

to be furnished

Comments

NIL

NA

A13. Conduct of Account

No.

No.

No. of days

Limit

Peak

of

of

Facility

Curr

Outstan Irregular

to adjust

with our

Irregul times days

Name & Id ency

ding

ity

Peak

bank

arity irreg irreg

irregularity

ular ular

LC /

F000504090 INR

03

16.00

12.18

0.00

Reasons for irregularity Comments : No irregularity in the account

Cash Credit

/

INR

F000504090

01

12.02

5.01

0.00

0.00

0

0

0

Reasons for irregularity Comments : No irregularities

BG /

F000504090 INR

04

80.40

55.23

0.00

Reasons for irregularity Comments : No irregularity in the account

Comment briefly on irregularities in the accounts in the past 12 months –

number of times irregular & time taken for adjustment of peak irregularity

No irregularities during the last 12 months.

Confidential and Property of State Bank of India

NEWFORMAT

Page 17 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Letter of Credit applicable : Yes

Letter of Credit:

Amount INR in Crore

Particulars

Last Financial Year

Current Financial Year up to

previous month

Total No. of LC Bills

58

13

Total Amount of LC

44.95

4.66

No., days & Amount of

LC Bills that devolved

No.

Days

Amount

No.

Days

Amount

0

0

0

0

0

0

% of LC bill devolved

relative to the LC limit

No.

Amount

No.

Amount

0

0

0

0

Of the above, not

adjusted in 15 days

No.

Amount

No.

Amount

0

0

0

0

Maximum no. of days

taken for regularizing

the account

Bank Guarantees applicable : Yes

Bank Guarantees:

Particulars

Amount INR in Crore

Last Financial Year

Current Financial Year up to

previous month

No. of guarantees

invoked, if any

0

0

Amount of guarantees

invoked, if any

0

0

Whether Cash Credit

a/c was rendered

irregular, on account of

above- no. of occasions

No.

Amount

No.

Amount

0

0

0

0

Maximum no. of days

taken for regularisation

Confidential and Property of State Bank of India

0

NEWFORMAT

0

Page 18 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Comments on conduct of account

( LC devolvement, BG invocation, return of bills negotiated, irregularity in CC/OD

account, delay in servicing interest / instalments of term loan) routing of sales

proceeds through the account in proportion to sanctioned limit including comments

in last credit audit report and early warning signals, if any.

No irregularities during the last 12 months.

(Adhoc CC of Rs.15.00 crs released by e-SBT should have been liquidated by

10.09.2017. Due to cash flow mismatch company could not liquidate the ad-hoc

facility.However, company has fully liquidated its Ad-hoc limit and account was

regularised on 08.11.2017.The relevant irregularity got confirmed by the

appropriate authority).

Routing of sales is proportional to our share of limits in MBA.

Credit Audit Observations dated 20.12.2018:

1. Account is irregular and in SMA from 18/09/2018 as the continuation is

available up to 17/09/2018. Renewal to be done immediately to avoid slippage in to

NPA account.

Branch reply: Continuation of limits from 18.09.2018 to 31.12.2018 and thereafter

from 01.01.2019 up to 29.06.2019 sanctioned by CCSC vide its resolution dated

31.10.2018 and 06.02.2019 respectively. The present proposal is for renewal of

limits based on ABS 2017-18 and provisional BS for FY 2018-19.

2.Total FCE is unhedged and company is not having any hedging policy.

Branch reply: The foreign currency exposure of the company as on 31.03.2018 is

Rs.0.93 cr which is only around 0.61% of the total turnover. Since the FCE is very

low, company has not formalised any hedging policy.

Confidential and Property of State Bank of India

NEWFORMAT

Page 19 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

3.Statutory Auditors made qualified observation:

a) Trade receivable of Rs 97.14 crs, Loans (Non-current asset) of Rs 0.19 crs, Loans

(Current Asset) of Rs 0.44 crs, Balance with Govt. authorities of Rs 2.46 crs,

Advances to supplier & contractor of Rs 0.93 crs, Provision for medical

reimbursement of Rs.0.49 crs are subjected to confirmation.

b) Shortfall in insurance of stock is observed by the statutory auditor (mentioned in

other matter paragraph.

c) Reconciliation of fixed asset with fixed asset register is not produced for

verification to statutory auditor of the company.

Branch Reply: a)The Auditors have opined that except for the possible effects of the

material weaknesses described above on the achievement of the control criteria, the

Company has maintained, in all material respects an adequate internal financial

controls system over financial reporting based on the guidelines issued by ICAI. The

auditors have further certified that these material weaknesses do not affect the

standalone IndAS financial statements of the Company.

b) The shortfall in insurance of stock was that pertaining to the stock which are

lying with fabricators. Company has confirmed that these stocks were insured by

the fabricator.

c) We have advised the company suitably in this regard. It has been informed that

necessary steps have been taken to avoid recurrence of this qualification.

4. Non operative income is noticed and is Rs. 2.52 cr and details not provided

Branch Reply: Other income consists of the following: Interest income-Rs.0.80 cr.,

Profit from sale of item of PPE & scrap-Rs.0.006 cr., Duty Draw back and duty

scrip-Rs.0.21 cr. and Miscellaneous income Rs.1.50 crs.

5. Continuation of the Limits is available up to 17/09/2018 only and renewal is

pending.

Branch Reply: Continuation of limits from 18.09.2018 to 31.12.2018 and thereafter

from 01.01.2019 up to 29.06.2019 sanctioned by CCSC vide its resolution dated

31.10.2018 and 06.02.2019 respectively. The present proposal is for renewal of

limits based on ABS 2017-18 and provisional BS for FY 2018-19.

Confidential and Property of State Bank of India

NEWFORMAT

Page 20 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

6. FY 2017-18: Company could not able to achieve the sales and achieved Rs.

174.27 cr against the estimation of 273.28 cr (63.77%). Inventory level is Rs.76.64

cr which is 99.06% more than the estimations. OCA level is Rs. 52.12 cr which is

206.59% more than the estimations and OCL is Rs. 49.20cr which is 24.59% more

than the estimations. Sundry Creditors level is Rs. 17.73 cr which is 172.77% more

than the estimations.

Branch Reply: For FY 2017-18, the company had estimated higher sales of Rs.

268.28 crs based on the orders in hand for execution. For this purpose the

company had requested for enhancement of working capital limits. Since company

could not submit the audited financials, enhancement request of the company was

not considered. The company also experienced delay in realisation of receivables

from two major customers. Most of the orders received by the company for

execution during FY 2017-18 are carried over to FY 2018-19. All these factors led to

non-achievement of estimated sales for the FY 2017-18. As per PBS, the company

could register a growth of 37% in turnover during FY 2018-19.

From FY 2017-18, company started recognizing Revenue only after the goods

reached customers destination point. So all the goods which were under transit as

on 31.03.2018 from the factory gate till the customers destination point were

recognized as Goods in transit and classified along with Finished Goods under

inventory. As on 31.03.2018, Goods in transit under inventory amounts to Rs.26.98

crs.

The overall Current Assets level as per Balance sheet has improved by 6.85% over

the estimated level for FY 17-18, (from Rs.147.43 crs to Rs.157.53 crs). The overall

current liability level as on 31.03.2018 was Rs.96.78 crs which was 12.55% more

than the estimated level. The position is considered as acceptable since the current

ratio is at a comfortable level of 1.63 as on 31.03.2018.

Comments on adherence to Financial Discipline:

The company's adherence to financial discipline is satisfactory. The conduct of

credit facilities with us is satisfactory .

The company is maintaining current account with Federal Bank, which is a nonlender. Previously, the company enjoyed credit facilities under consortium and

Confidential and Property of State Bank of India

NEWFORMAT

Page 21 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Federal Bank was one of the Bankers in the erstwhile consortium. The branch is

following up intensively with the company for closure of current account with

Federal bank. The Branch note to levy penal interest in case the current account is

not closed before 31.12.2019.

Details of intercompany transactions / investments, if any: No

Details of information, shared in consortium meeting under sharing of

information:

N.A .Presently the limits are under MBA .

A14. Review of Cash Credit Account for previous year:

Review of Cash Credit Account applicable : Yes

Amount INR in Crore

Sr. No.

Amount

Comments

i. Total debit

summations

249.58

ii. Total credit

summations

258.11

%of (ii) to total sales

122.87 The company is routing all transactions

through the account.

A15. Review of Term Loans (Term Loans with other Banks/FIs also to be

mentioned):

Review of Term Loans applicable - No

Confidential and Property of State Bank of India

NEWFORMAT

Page 22 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Section B

B1. Proposal for Sanction / Approval / Confirmation

Proposal for Sanction

(i) Renewal of FBWC limits of Rs. 12.02 Crore and NFBWC limits of Rs.

96.40 Crore at the existing levels

Proposal for Approval

(i)continuation of 25% concession in processing charges against card rates i.e. to

recover Rs.0.26 cr+ GST as against the applicable charges of Rs.0.35 cr +GST with

sacrifice amount of Rs.0.09 cr.

Proposal for Confirmation

(i) Action in having continued the limits beyond the validity of last sanction i.e.

beyond 29-JUN-19 .

Amount INR in Crore

This proposal falls within the powers of CCSC as

(i) FB/NFB/Total indebtedness is INR 108.42 Crore

Corporate

Proposal Remark

The present proposal is for renewal of credit facilities at the existing level.

(ii) Involves Policy Level Deviations:

No

(iii) The borrower/ his relative(s) is a director in any other bank:

No

Furnish details of Directors and whether approval from ECCB obtained.

Brief Description of the borrowing entity, their activity and what the proposal

Transformers and Electricals Kerala limited (TELK) was incorporated in 1963 as a

Government of Kerala (GoK) undertaking. Initially TELK was promoted by GoK and

Kerala State Industrial Development Corporation Limited(KSIDC) in collaboration

with Hitachi Limited of Japan. TELK gave India, its first 400kV Class Transformer,

first 315MVA Auto Transformer and Generator Transformer for India's first 500MW

Thermal Unit.

The Company is an ISO certified Company since 1995. TELK is currently an

approved high quality supplier to all power utilities in India and many prestigious

utilities abroad.

TELK started its commercial production in 1966 and was working satisfactorily till

1981-82.The fourth stage of expansion for manufacturing Gas Circuit Breakers led

Confidential and Property of State Bank of India

NEWFORMAT

Page 23 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

to cost overrun. This coupled with a demand recession and a few years of low

production due to power cut, resulted in continuous losses to the Company thus

eroding networth completely.The Company was referred to BIFR during 1995.

After several failed attempts on revival of the unit, during 2006, they had made

negotiations with NTPC for a joint venture for the revival of the unit. Since 2007,

TELK is a joint venture between GoK and NTPC Ltd, with NTPC having 44.60%

shareholding. As per the joint Venture Agreement, Board of Directors of the

Company will have four nominees from NTPC and four nominees from Government

of Kerala .The Chairman of the company is a nominee of Government of Kerala

while Managing Director is a nominee of NTPC Ltd.

The company successfully implemented the rehabilitation package of BIFR. As on

31.03.2011 it could wipe off all accumulated losses.It declared a dividend also in FY

11. At the request of the Company, BIFR issued orders for allowing the company to

come out of the purview of BIFR as its net worth turned positive.

Till 2014, company was making profits .However, from 2015 onwards it was

reporting losses due to the continued impact of lower demand for transformers

compared to supply in the market and resultant impact on selling price.The profit

margin of the company has substantially dropped due to the above issues faced by

Power sector.

From 2016-17 onwards the market situation has changed as the demand for

transformers increased. During the FY 2016-17,the company has reported a profit

of Rs.4.89 crs, followed by Rs.2.64 crs during FY 2017-18 and Rs.3.16 crs during

FY 2018-19.

The renewal of limits was last done on 18.03.2017. The company had submitted

Audited financials for the FY 2016-17 only in August 2018. The delay in preparation

of ABS for FY 2016-17 had spill over effect in the preparation of ABS for FY 2017-18

and the same was submitted in July 2019. As the company could not submit the

audited financials on time, continuation of the limits was sanctioned on three

occasions as follows:

a. For 180 days from 18.03.2018 by WBCC-II vide its resolution dated 04.04.2018

b. Up to 31.12.2018 by CCSC-I in its meeting held on 31.10.2018.

c. For six months from 01.01.2019 by CCSC vide its meeting dated 06.02.2019.

The company presently enjoys working capital facilities under MBA from us (Rs.

Confidential and Property of State Bank of India

NEWFORMAT

Page 24 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

108.42 crs) and South Indian Bank (Rs.15.00 crs), with a total exposure of Rs.

123.42 crs.The company is rated BBB by Brickwork Ratings which is valid till

21.02.2020 .The internal rating of the company based on ABS as on 31.03.2018 is

SB-9.

The present proposal is for:

Sanction:

1.Renewal of Working Capital of INR 108.42 Crore at the existing level (FB-WC:

INR 12.02 Crore, NFB-WC: INR 96.40 crore).

Approval:

1. Continuation of 25% concession in processing charges against card rates i.e. to

recover Rs.0.26 cr+ GST as against the applicable charges of Rs.0.35 cr +GST with

sacrifice amount of Rs.0.09 cr.

Confirmation:

1. Action in having continued the limits beyond the validity of last sanction i.e.

beyond 29.06.2019.

As per the extant guidelines, renewal of limits can be carried out for unlisted

companies, subject to the latest available ABS being not more than 18 months old

and Provisional Balance Sheet not older than 5/6 months. Accordingly, the present

renewal is being proposed based on ABS as on 31.03.2018 and Provisional Balance

Sheet as on 31.03.2019.

Board of directors:

1. Shri. Nellampurath Chellappan Nair Mohanan- Chairman- Government of Kerala

have appointed Shri. N.C. Mohanan as Chairman and Director w.e.f. 08.09.2016.

He is a lawyer and member of CPI(M) Ernakulam District Secretariat.

2. Shri. Prasad Bhaskaran Nair- Managing Director- NTPC Nominee- Shri. Prasad B.

has taken charge as the Managing Director w.e.f 09.01.2016. He is a B.Sc

Engineering Graduate from College of Engineering Trivandrum.

Confidential and Property of State Bank of India

NEWFORMAT

Page 25 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

3. Shri. Prasant Kumar Mohapatra, Director (Technical)- NTPC Limited has

appointed him as a Part-time Director in TELK w.e.f. 21.06.2018. Shri.P.K.

Mohapatra is a graduate in Mechanical Engineering (REC Rourkela). He joined

NTPC in 1980 as

an Executive Trainee and has more than 39 years of experience from concept to

commissioning of power plants.

4. Shri. Dileep Kumar Dubey has been nominated by NTPC Limited as a part-time

Director on the Board of Directors of TELK w.e.f. 20.12.2018. Presently, he is

serving NTPC Limited in the capacity of RED (South) at Secunderabad. Prior to this,

he was Executive Director of NTPC-Ramagundam since November 2016. A

Mechanical Engineer from the Awadesh Pratap Singh University and also an MBA

(Finance) from FMS-Delhi, Shri. Dubey joined NTPC on September 21, 1981. He has

varied experience and has held important positions in a career spanning over threeand- a half decades in NTPC.

5. Shri. ShibuSubaidabeevi Abdulrasheed- Government of Kerala have appointed

Shri. Shibu A.S. as a Director on the Board of Directors of TELK w.e.f. 05.12.2018.

Presently, he is in the service of Government of Kerala as Under Secretary, Finance

Department.

6. Shri. Karaingadan Kumaran Ramachandran- Government of Kerala have

appointed Shri. K.K. Ramachandran as a Director on the Board of Directors of TELK

w.e.f. 20.06.2017.

7. Smt. Parol Vijayakumari- Government of Kerala have appointed Smt. P.

Vijajayakumari as a Director on the Board of Directors of TELK w.e.f. 20.07.2017.

Presently, she is in the service of KSEB Ltd, as Director, Transmission.

8. Shri. Mammen Jacob has been nominated by NTPC Limited as a Director on the

Board of Directors of TELK w.e.f. 10.08.2018. Presently, he is serving NTPC Limited

in the capacity of GM (Commercial), SR-HQ, NTPC.

Confidential and Property of State Bank of India

NEWFORMAT

Page 26 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

B2. Credit Limits (Existing and Proposed)

Amount INR in Crore

Table 1A

Existing

Currency Our Bank

(i)

Proposed

Change

%

Total Cons / Our Bank

%

Total Cons /

(i /

MBA/

(iii)

(iii /

MBA/

ii)*100 Syndication

iv)*100 Syndication

(ii)

(iv)

44.49

27.02

12.02

44.49

27.02

Our Bank

(iii - i)

Total Cons /

MBA/

Syndication

(iv - ii)

0.00

0.00

Total FB-WC (i)

INR

12.02

Total FB-TL (ii)

INR

0.00

Total FB

(i)+(ii)=(a)

INR

12.02

44.49

27.02

12.02

44.49

27.02

0.00

0.00

Total NFB-WC (iii)

INR

96.40

100.0

96.40

96.40

100.0

96.40

0.00

0.00

Total NFB-TL (iv)

INR

0.00

0.00

0.00

Total Derivatives

(v)

INR

0.00

0.00

0.00

Total NFB

(iii)+(iv)+(v)=(b)

INR

96.40

100.0

0

96.40

96.40

100.0

0

96.40

0.00

0.00

Total

Indebtedness

(a)+(b)=(c)

INR

108.42

87.85

123.42

108.42

87.85

123.42

0.00

0.00

108.42

87.85

123.42

108.42

87.85

123.42

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Investments (d)

INR

Leasing (e)

INR

Total Exposure

(c)+(d)+(e)=(f)

Financial/cash collateral (as per Basel norms) (g)

Effective

Exposure (f)-(g)

Capital Charge

108.42

87.85

123.42

108.42

4.81

5.16

ROCC

26.31

21.79

RAROC

22.65

18.46

Confidential and Property of State Bank of India

NEWFORMAT

87.85

123.42

0.35

Page 27 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

B3. Individual items detailed below

1B. Working capital applicable:

Yes

Table 1B

Working Capital

Facility Name

Currency

Existing

Proposed

Change in

exposure

LTV

proposed

12.02

12.02

0.00

75.00

12.02

12.02

0.00

Existing

Proposed

Change in

exposure

LTV

proposed

F00050409003 - LC INR

( LC )

16.00

16.00

0.00

90.00

F00050409004 - BG INR

( BG )

80.40

80.40

0.00

90.00

96.40

96.40

0.00

108.42

108.42

0.00

FB Working Capital

F00050409001 Cash Credit

( CC )

INR

Fund based Sub-Total

Facility Name

Currency

NFB Working Capital

Non Fund based Sub-Total

Total Working Capital

1C. Term exposures applicable:

No

1D. Project Financing Exposure applicable:

1E. Derivatives applicable:

No

No

Inter-changeability

From Facility

To Facility

Existing

Percentage

Amount

Proposed

Percentage

Amount

None

Confidential and Property of State Bank of India

NEWFORMAT

Page 28 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

B4. Credit Limits (Company and Group)

Amount INR in Crore

Company

Group

Exposure

Existing Proposed Existing Proposed

Fund Based

12.02

12.02

12.02

12.02

Non Fund Based

96.40

96.40

96.40

96.40

108.42

108.42

108.42

108.42

108.42

108.42

108.42

108.42

Bank's Share in Total Exposure (%)

87.85

87.85

87.85

87.85

Bank's Share in WC (%)

44.49

44.49

44.49

44.49

100.00

100.00

100.00

100.00

Total Indebtedness Incl. letter of Comfort #

Out of total indebtedness,outstanding of

overseas exposure, if any, against LOC or

Investments

Leasing

Total Exposure

Bank's Share in TL (%)

Bank's Share in NFB (%)

# Issued against the counter guarantee of the company/ group

B5. Banking Arrangement and Sharing Pattern

Existing

Financial

Arrangements

Proposed

Lead Bank (if

consortium /

Financial

Arrangements

Lead Bank (if

consortium /

TL

WC

MBA

MBA

Amount INR in Crore

FB

@ (Proposed)

NFB @

(Proposed)

Investments &

Leasing

(Proposed)

Total @

(Proposed)

SHARE(%) @

(Proposed)

TL (Proposed)

WC (Proposed)

0.00

12.02

96.40

0.00

108.42

87.85

(0.00)

(12.02)

(96.40)

(0.00)

(108.42)

(87.85)

SBI

Confidential and Property of State Bank of India

NEWFORMAT

Page 29 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

0.00

12.02

96.40

0.00

108.42

87.85

(0.00)

(12.02)

(96.40)

(0.00)

(108.42)

(87.85)

0.00

15.00

0.00

0.00

15.00

12.15

(0.00)

(15.00)

(0.00)

(0.00)

(15.00)

(12.15)

SBI (Total)

Total Exposure of the

constituent with Other

Banks as per CRILC data

search

Top Five other Banks in terms of their Exposure

0.00

15.00

0.00

0.00

15.00

12.15

(0.00)

(15.00)

(0.00)

(0.00)

(15.00)

(12.15)

0.00

27.02

96.40

0.00

123.42

100.00

(0.00)

(27.02)

(96.40)

(0.00)

(123.42)

(100.00)

South Indian Bank

Total (SBI + Other Banks)

Confidential and Property of State Bank of India

NEWFORMAT

Page 30 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

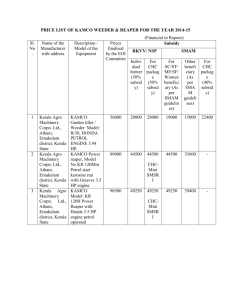

Sharing Arrangement (existing &proposed)- presentation by way of Pie Chart

Existing

Proposed

Any major change proposed in sharing arrangement : No

*Action plan to reduce SBI % share if beyond the acceptable limits.

Rationale

Corrective Action Plan to bring

exposure to within norms, In case SBI

exposure exceeds the norms

B6. Group exposure particulars

Confidential and Property of State Bank of India

NEWFORMAT

Page 31 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

*List activity contributing more than 20 % of group’s turnover. Club rest in other

B7. External rating analysis of the group (Below investment grade only)

Name of the

Company *

Currency

Exposure

Our Share

Amount

%

Rating

LT

Rating

Agency

ST

None

* Company having more than 20% share in the group turnover to be covered

individually and all others are to be clubbed.

B8. Risk appetite of the Bank on the industry (Risk advisory) as per latest

update

Amount INR in Crore

Industry:

ELECTRICAL EQUIPMENT

Activity:

MFG. OF MACHINES FOR

ELECTRIC DISTRIBUTN

Sub Industry: POWER TRANSMISSION

AND DISTRIBUTION EQUIPMENT

RMD Guidance Note Dated:

2019

12-06-

(i) RMD Guidance Note

Some of the factors which should be examined while appraising loan proposals are

listed below:

(a) Competitive manufacturing capabilities: The electrical equipment companies

must have a good understanding of its market, customers and their needs and

should be capable of manufacturing products in response at low cost.

(b) Collaborative Partnerships for technology and R&D: Indian firms can augment

their technological know-how and R&D capabilities through JVs and collaborative

partnerships with global majors in the field.

(c) Concentration risk: The units dependence on a single/ very limited number of

buyer(s) or product(s) may adversely impact the company. Also relying on very

limited number of suppliers may prevent manufacturers from getting raw materials

at competitive prices. This factor plays an important role in overall cost management

in rising prices scenario.

(d) Efficient working capital management: Efficient working capital management is

crucial for electrical equipment companies due to commodity risk.

e) Financial strength: In view of rising defaults, technological changes, competition

and threat of cheaper imports for the electrical equipment units ensure that the

finance is extended to units with sound financial strength and business plans.

(f) In-demand product portfolio: While considering exposures to units in Electrical

Equipment sector, it must be ascertained that the units are operating in the growing

business segments and product lines like boilers, turbines, transformers,

switchgears, energy meters, etc.

(g) Skill Development: Although inexpensive and abundant manpower is available,

focus should also be on their skill development and technical competence so that

the units are able to better cope up with technological upgradations.

Confidential and Property of State Bank of India

NEWFORMAT

Page 32 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

(ii) (a) Qualitative

Approach

(ii)(b) Threshold Level

Approved Outlook:

Neutral

Approved Level

Enhancements

New Connections

SB-8 & above* / A & Better

SB-6 & above / AA &

Better

(iii) Quantative Approach

A. As per CRMD

Guidance Note

B. As per Quarterly

Exposure Norms Industry Level

Bank's Total

Advances

3103627

As On

31-03-2019

Actual Level (%)

Approved Level

(%)

Sub Industry Level

1.61

2.37

Industry Level

1.61

2.37

Bank's Total

Advances

2859517

As On

Actual Level (%)

30-09-2018

Approved Level

(%)

Industry Level

Industry Specific Risks Identified by CRMD

(iv) Comment

A head-room of Rs. 22,300 Cr for taking additional exposure on the sector is

available.

RBI Ceiling

Internal Ceiling

Proposed Exposure

Individual Company

41048.00

6157.00

108.42

Group

51310.00

28733.00

108.42

If breaching the limit, comments on risk mitigation.

The company is rated SB-9 based on ABS 2017-18 and the approved ceiling allows

an additional exposure to the tune of Rs.22300.00 Cr. for enhancements / new

connection.There is no enhancement proposed and the present proposal is for

renewal of limits at the existing level.

Confidential and Property of State Bank of India

NEWFORMAT

Page 33 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Confidential and Property of State Bank of India

NEWFORMAT

Page 34 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Section C

Performance and Financial Indicators

C1. Performance and Financial Indicators (Company as a whole & Division-wise,

if available, separately)

Amount INR in Crore

2017-18

2018-19

2019-20

2020-21

Estimated

Audited

Estimated Provisional Estimated Projected

01-04-2017 01-04-2017 01-04-2018 01-04-2018 01-04-2019 01-04-2020

to

to

to

to

to

to

31-03-2018 31-03-2018 31-03-2019 31-03-2019 31-03-2020 31-03-2021

Gross Sales (Value)

292.88

155.73

247.01

210.07

240.57

258.02

Net Sales (Value)

268.28

153.36

247.01

210.07

240.57

258.02

1.00

1.10

Subsidy in Sales

Exports (value)

0.08

Net Sales (Quantity)Units in

Exports (Quantity)Units in

Capacity Utilization

Raw Materials

169.57

143.53

119.85

92.64

138.78

152.66

5.00

3.59

4.00

3.02

4.52

4.97

Direct Labour

50.00

54.98

53.11

48.71

58.19

61.00

SG & A costs

11.55

13.69

17.27

14.64

13.26

14.59

3.00

5.81

4.85

5.66

5.82

6.40

Operating Profit(OP) After

Interest

18.73

-12.55

12.94

5.06

11.72

13.50

PBT

20.73

7.44

12.94

7.99

11.72

13.50

PAT

11.73

2.64

9.26

3.16

4.65

7.95

Cash Accruals

13.23

3.95

10.86

4.72

6.63

10.13

EBIDTA

25.23

14.56

19.39

15.21

19.52

22.08

9.40

9.49

7.85

7.24

8.11

8.56

Power and Fuel

Interest

EBIDTA Margin

If the latest Audited B/S is not available, explanation as to why they are not

available, to be given.

Since the Joint Venture partner NTPC has published the financials under IndAS,

TELK also had to prepare their accounts for FY 2016-17 under IndAS. Migration to

IndAs and finalisation of audit for the first time under the same took a lot of time.

Confidential and Property of State Bank of India

NEWFORMAT

Page 35 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

The company had submitted Audited financials for the FY 2016-17 only in August

2018. The delay in preparation of ABS for FY 2016-17 had spill over effect in the

preparation of ABS for FY 2017-18 and the same was submitted in July 2019.

The present proposal is hence based on ABS as on 31.03.2018 and provisional

financials as on 31.03.2019.

@ figures in brackets denote estimates at the time of renewal

# the estimates, projections should be backed by facts / logical assumptions and

should be prepared by the person having sufficient knowledge of the economy,

industry, business and past record.

If the account has been restructured in the past, actual performance of the

unit should invariably be compared with the estimates / projections made at

the time of restructuring and commented on.

Comments on

i) Critical risks including change in accounting policies during the year and

their impact on P&L, low capacity utilization, stagnant growth etc. in sales,

profitability etc.(other than project funding, which are covered in separate

section)

Nil

ii) Reasonability of estimates/projections for Current Year/Next Year.

Performance of the company during FY 2017-18 and FY 2018-19

Net Sales

The company registered a turnover of Rs.153.36 crs during FY 2017-18, a decline of

5.53% over PY and 57.16% of the estimated turnover. For FY 2017-18, the company

had estimated higher sales of Rs.268.28 crs based on the orders in hand for

execution. For this purpose the company had requested for enhancement of working

capital limits. Since company could not submit the audited financials, enhancement

request of the company was not considered. The company also experienced delay in

realisation of receivables from two major customers. Most of the orders received by

the company for execution during FY 2017-18 are carried over to FY 2018-19. All

these factors led to non-achievement of estimated sales for the FY 2017-18.

Further, from FY 2017-18, company started recognizing Revenue only after the

goods reached customers destination point. Hence, all the goods which were under

transit as on 31.03.2018 from the factory gate till the customers destination point

Confidential and Property of State Bank of India

NEWFORMAT

Page 36 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

were recognized as Goods in transit and classified along with Finished Goods under

inventory. As on 31.03.2018, Goods in transit under inventory amounts to Rs.26.98

crs and not considered under sales.

As per the provisional data, TELK had a net sales of Rs.210.07 crs during FY 201819, registering a growth of 37% over the PY level (85% of estimated sales of Rs.

247.01 crs for FY 2018-19).

Theorder position (as on 30.06.2019) of the company is as follows:

Sl No:

Equipment

No

MVA

Amount

(Rs. in crs)

1

Power

Transformers

60

54.31

197.25

2

Current

Transformers

7

0.20

3

Potential

Transformers

7

0.21

4

CSD(including

3

2.72

25.36

spares/services

)

TOTAL

77

223.02

The major customers of the company include NTPC, NPCIL, PGCIL, NHPC, state

electricity boards etc. Apart from these, M/s MEIPL and M/s GVPR Engg are two

companies to whom company has been supplying transformers since last three

years. Company's supplies to Non-PSU companies are mostly against LCs.

The quarterly sales of the company up to Q1 of FY 2019-20 is Rs.21.63 crs (Rs.

35.44 crs during Q1 of FY 2018-19). The company normally books maximum sales

during the last quarter of the financial year. During FY 2018-19, sales during

Q4was Rs.99.74 crs and that during Q4 of last FY 2017-18 was Rs.107.54 crs

which is 47.48% and 69.05% of net sales during the respective years. The

estimated sales of Rs.240.57 crs for the FY 2019-20is hence considered achievable.

Profit & Profitability

There is a Y-o-Y decline of 46.01% in PAT from FY 2016-17 to FY 2017-18 and the

company achieved only 22.50% of the estimated figure. Though there has been Y-oY growth of 11.04% in PBT (Rs.7.44 crs during FY 2017-18 as against Rs.6.70 crs

during FY 2016-17), deferred tax of Rs.4.80 crs during the year led to decline in

profit compared to previous year. Hence, profitability also declined from 3.01% (FY

2016-17) to 1.72% (FY 2017-18).

Confidential and Property of State Bank of India

NEWFORMAT

Page 37 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

As per the provisional data, TELK had a net profit of Rs.3.16 crs. during FY 201819, recording a growth of 20% over the PY level.

TNW

TNW of the company has increased from Rs.58.71 crs (as at 31.03.2017) to Rs.

66.61 crs (as at 31.03.2018) on account of plough back of profits and reduction in

Deferred Tax Assets. As per the PBS, the same has improved further by Rs.7.19 crs.

TOL/TNW

The gearing ratio of the company improved from 1.64 as on 31.03.2017 to 1.60 as

on 31.03.2018 on account of improvement in TNW. The ratio is well below the

desired level of less than or equal to 3.50 (as per the CRA model). Improvement in

TNW has led to further improvement in the ratio to 1.47 as on 31.03.2019.

TOL/Adj TNW

No investment in associates and subsidiaries and hence TOL/Adj TNW is same as

the TOL/TNW of the company. The ratio is well below the desired level of less than

or equal to 3.50 (as per the CRA model).

Current Ratio

The current ratio of the company as on 31.03.2018 is 1.63 as against 1.46 as on

31.03.2017 which is above the desired level of >=1.40 (as per the CRA model). The

ratio has further improved to 1.65 as on 31.03.2019. The NWC position has also

improved from Rs.42.04 crs as on 31.03.2017 to Rs.60.75 crs. as on 31.03.2018

and to Rs.65.66 crs as on 31.03.2019.

Comparison of industry specific financial parameters[Electrical Equipments]

for Current Ratio, TOL/ Adj TNW, Interest Coverage Ratio and Long Term

Debt/ EBIDTA as per Banks guidelines and company's level as per audited

financials for 2017-18.

Current Ratio

TOL/Adj TNW

Interest

Long Term

Coverage Ratio Debt/EBIDTA

Approved level >=1.00

<=4.00

>=2.60

<=3.60

>=0.75

<=5.00

>=2.00

<=4.50

Min

Acceptable

level/*Max

Acceptable

level

Confidential and Property of State Bank of India

NEWFORMAT

Page 38 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Company's

1.63

1.60

2.51

0.82

level

*Max Acceptable level for TOL/Adj TNW and Long Term Debts/EBIDTA

iii) Whether export oriented unit: No

iv)Whether the facility proposed envisages capacity expansion: No

Division-wise data exists : No

C2. Interim Financials

Amount INR in Crore

Interim Financials

Particulars

Q1 30-06-2019

Net sales

21.63

Q1 30-06-2018

Q4 31-03-2019

35.44

Q4 31-03-2018

99.74

107.54

Export

PAT

-10.75

18.84

Industry Exposure as on 30-06-2018

FBL

NFBL

Total

48986

Auditors (Membership No. of the Auditor / Firm registration number in case of

Audit firm):

Name of Auditor / Audit Firm

Membership No / Firm Regn No.

George John and Prabhu

000917S

Date of Last Audit :25-07-2019

Change in Accounting year : No

Change in Auditors : No

Confidential and Property of State Bank of India

NEWFORMAT

Page 39 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

Comments on financial management of the Company

The Auditors have identified the following material weaknesses

The Company did not have an appropriate internal control system for:

1.

Obtaining confirmation of balances in respect of Trade Receivables, Advances

to Suppliers and Contractors, Balance with Government Authorities and Loans as on

31.03.2018.

2.

Physical verification of material (owned by the Company) lying with fabricators

as on 31.03.2018.

3.

Authentication of vouchers and approval thereon by the superior officer is not

available in most of the cases.

However , except for the possible effects of the material weaknesses described above

on the achievement of the control criteria, the Company has maintained ,in all

material respects an adequate internal financial controls system over financial

reporting based on the guidelines issued by ICAI. The auditors have further certified

that these material weaknesses does not affect the standalone IndAS financial

statements of the Company.

C3. Market & Industry Analysis

Write up on the Product /industry/Sector and the Company’s Standing

(Comments on domestic/international standing, business strategies, competitive

advantage, price trend, competitiveness of the borrower etc. The para to conclude

with the outlook for the unit)

[Source:CRMD guidelines dated 12.06.2019]

Indian Electrical Equipment industry comprises of two segments:

1.Generation Equipment: Boilers, Turbines, Generators (BTG) and

2. Transmission & Distribution (T&D) and allied equipments: Transformers, Cables,

Transmission lines, Switchgears, Capacitors, Energy meters, Surge arrestors,

Stamping and lamination, Insulators, Insulating material, Indicating instruments,

and winding wires, etc.

1.Transformers:

Transformer is a device that helps in changing the voltage level while transmitting

electrical energy over long distances, so as to avoid energy losses during

transmission and make the required current available to consumers. Step-up

transformers are used to increase the voltage while decreasing the current during

transmission and step-down transformers are used to decrease the voltage while

increasing the current. Both these types when present in upper part of value chain

Confidential and Property of State Bank of India

NEWFORMAT

Page 40 / 144

Form DD for Credit Proposal No. P0005040905 Generated by Anand J S (8158258), CB ERNAKULAM (4062, Team Code :

T00406201) On 21-08-2019 2.16 PM

TRANSFORMERS AND ELECTRICALS KERALA LIMITED

(i.e. transmission part) are called power transformers. Distribution transformers are

used to transmit power to the end consumer and appear in the distribution part of

the value chain. The size of transformers market is expected to expand at a CAGR of

12% over next three years.

In 2016-17, transformers category witnessed a growth of around 6% y-o-y primarily