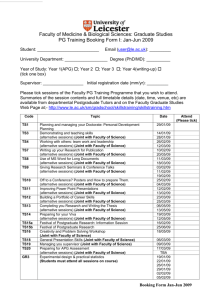

02 Cover Story The Economic Times Wealth, July 17-23, 2017 KOLKATA `3,614 `3,570 `3,572 Jan-Jun 2016 Jan-Jun 2017 `3,495 Jan-Jun 2014 REAL ESTATE INVEST NOW Investments in property have earned insipid returns in the past few years. Find out why this trend is likely to continue for some time. ome loan rates are down, property prices are stagnating and the new Real Estate (Regulation and Development) Act (RERA) promises to safeguard the buyer against delays and frauds. If you go by what real estate developers, housing finance companies and property agents say, this is the best time to invest in property. Or is it? A recent research report by consultancy firm Knight Frank shows that home prices in eight major cities rose very tardily in the past three years (see graphics). In some markets, including the National Capital Region (NCR) and Kolkata, property prices have actually come down since 2014. Of course, this is not true for the entire real estate market. While prices have come down in some markets, some cities have witnessed a consistent rise. Within cities too, some pockets have done poorly, while others have flourished. This is why ET Wealth assumed four different growth rates to see what investors can gain from real estate. We assumed that the buyer would put a downpayment of `10 lakh and take a home loan of `50 lakh (at 8.5%) to buy a property. Another `6 lakh would be spent on legal costs and registration, taking the total cost of property to `66 lakh (see graphic). We then looked at the situation after three years. If the property prices rose by 3%, the investor would be in `7.86 lakh in the red. Even though he earns rent (`10,000 a month increasing by H MUTED GROWTH, DULL PROSPECTS Property prices in most cities have risen at a slow pace in the past three years. The large number of unsold units and long selling time only add to the problem. HYDERABAD `3,710 BENGALURU `4,805 `3,620 Weighted avg price per sq ft `4,831 Unsold units Quarters to sell -0.4% 39,114 10.6 POOR OUTLOOK MUMBAI MR `7,994 `8,093 `8,044 Jan-Jun 2016 Jan-Jun 2017 `7,382 Jan-Jun 2014 Jan-Jun 2015 3-yr return Unsold units Quarters to sell 2.9% 138,653 8.8 Though demonetisation hit new launches, sales were not too badly affected. Prices too have stagnated after a spurt. MODERATE OUTLOOK NCR `4,511 `4,400 `4,650 `3,509 3-yr return Prices have remained flat and new launches and sales have slackened in recent quarters. High quarter to sell level is a worry. WHY NOT TO BABAR ZAIDI Jan-Jun 2015 `4,346 `4,473 `4,250 `3,390 Jan-Jun 2014 Jan-Jun 2015 Jan-Jun 2016 Jan-Jun 2017 Jan-Jun 2014 Jan-Jun 2015 Jan-Jun 2016 Jan-Jun 2017 Jan-Jun 2014 Jan-Jun 2015 Jan-Jun 2016 Jan-Jun 2017 3-yr return Unsold units Quarters to sell 3-yr return Unsold units Quarters to sell 3-yr return Unsold units Quarters to sell 3.1% 22,658 2.6% 114,064 -1.1% 180,370 5.9 Prices rising steadily and sales remain buoyant. Low inventory is a plus. RERA implementation can be the next trigger. GOOD OUTLOOK CHENNAI Has got over demonetisation blues, with rise in new launches and sales. But the high inventory remains a worry. MODERATE OUTLOOK `4,662 `4,700 10 AHMEDABAD `2,758 Prices have slipped and may not recover in a hurry. The high inventory level may keep the market depressed for years. VERY POOR OUTLOOK `2,770 17.8 PUNE `4,819 `4,860 `4,860 Jan-Jun 2016 Jan-Jun 2017 `4,532 `2,635 `4,407 Jan-Jun 2014 Jan-Jun 2015 Jan-Jun 2016 Jan-Jun 2017 3-yr return Unsold units Quarters to sell 2.2% 28,110 6.6 Prices have been rising steadily and new launches are on the rise. Affordable housing will boost growth. OUTLOOK `4,614 `2,551 GOOD Jan-Jun 2014 Jan-Jun 2015 Jan-Jun 2016 Jan-Jun 2017 3-yr return Unsold units Quarters to sell 2.8% 32,934 7.7 Prevailing lull seems transient. New project launches are down but sales are picking up due to RERA. OUTLOOK MODERATE Quarters to sell denotes the number of quarters it takes to sell a property in the city. Jan-Jun 2014 Jan-Jun 2015 3-yr return Unsold units Quarters to sell 1.7% 40,141 4.5 Prices slowed down and new launches hit a speedbreaker even before demonetisation. Now sales picking up. OUTLOOK MODERATE Source: India Real Estate study by Knight Frank