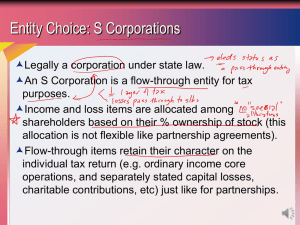

1. Course Intro 2. Chapter 1 “Business and Risk” a. Problem: Of Grapes and Winemaking i. Important to know why Julia bought the vineyard 1. Have to know your client b/c that helps you frame the nature of the risk and alternatives about which you give advice 2. Julia lives in LA, making her an absentee owner, which changes the structure of the enterprise 3. Have to look at controllable vs. uncontrollable risk 4. Need to know if Jonathan is someone Julia want to partner w/ a. Has equipment, expertise, desire i. But need to find out about all 3: ex. Quality of equipment 5. Law reduces transaction costs of negotiation and comes w/ its own enforcement a. Leads to consistent, predictable results ii. Employment Model 1. Jon and Jul have different interests a. Have to give incentives to avoid shirking b. Incentive would be “honey” 2. Clout of employer/employee agreement is the “whip” a. But this comes w/ monitoring costs iii. Tenancy Model 1. Less risk for Julia, but less reward 2. More incentive and risk for Jon b. Risk i. Categories ii. Risk Preference c. Allocating Risk i. Non controllable risk ii. Controllable risk iii. Allocation to owner iv. Allocation to employee v. Middle ground? 3. Chapter 2 “Intro to Business Entities and Concepts a. Taxonomy of Business organizations i. Corporation 1. Form grounded in ability to aggregate capital for the purpose of engaging in unified economic activity in which management can be separated from ownership 2. Corps are double taxed a. Corp taxed and divided paid to shareholders taxed ii. S-Corp 1. Permits a flow through income so it is taxed only when distributed to individuals 2. Not all corps can be S-Corps iii. C-Corp 1. Taxed at both levels 2. This is most corps iv. Non-Profit Corp 1. Still concerned about revenue, but not residual income and no shareholders v. Closed v. Public Corp 1. # of shareholders is key 2. In closed, no public offering and restrictions on ways to transfer 3. Public= Nike, Apple, etc. 4. Differences determined by both statute and common law vi. Transaction costs from running a corporation are one reason why ppl chose other entities 1. Like: general partnership, limited partnership, LLC 2. GPs and most LPs aren’t separate legal bodies, they’re just a nexus of ppl in common business pursuit 3. Partners are fully liable for their business, unlike LLCs and Corp where liability in the extent of investment vii. Limited Partnership 1. A general partner and a limited partner 2. Limited partners are passive investors and liability is only the extend of investment viii. General partnership 1. All partners are open to personal liability to creditors 2. Can be created w/o intent to do so ix. Limited Liability Company 1. Easy to form and flexible relative to corps 2. No double taxation b. Why do firms exists? c. Agency Problem i. The central legal issue re: corporate officers ii. Not a matter of statutory law, but common law iii. Laws vary from state to state iv. 1st place to go when presented w/ agency problem =Restatement 1. Actual authority a. Created when at the time of the act, the agent reasonably believes the principal wishes the agent to act b. Grounded in evidence of the agent’s understanding of the course of dealing w/ the principal c. 3rd party belief is irrelevant d. 2 sub-parts i. Express actual authority 1. What BoD tells agent to do ii. Implied actual authority 1. From a course of dealing, or words of the principal 2. Apparent authority a. Focus on the 3rd party b. Reasonableness of belief of the 3rd party given the nature of the manifestation of authority that is given by the board i. ex: board appoints Sean Pié as President 3. Inherent agency power a. The conduct was reckless, illegal, etc. but there is enough authority that the risk of liability in that context given the relationship between the principal, agent and 3rd party militates in favor of pushing liability to the principal i. Menard case b. On whom is it most fair to allocate liability? 4. Estoppel a. Equitable b. Agent’s actions have induced 3rd party to change their position to their detriment c. Tends to apply when principal has obtained the benefit of a bargain before is disavows 5. Ratification a. Can be implied by estoppel b. Can be explicit too i. Ex: Sean shouldn’t have bought that yacht, but is ok, don’t do it again 6. *Agency disputes are very fact intensive, require a balancing of equities and even a slight change in facts can be the difference v. Gay Jensen Farms v. Cargill 1. Group of farmers suing creditor of a bankrupt company 2. Doesn’t matter what relationship you think you’re in, your course of dealing can lead to a principal/agent relationship 3. Cargill assumed large portion of control over Warren’s operations and thus were liable to Warren’s customers 4. Cargill loaned money to Warren, then supervised Warren’s dealing 5. Court listed 9 key factors including a. Constant recommendations to W b. W couldn’t enter into mortgages, buy stock, or pay dividends w/o C approval c. Financing W’s operation and right to stop doing so d. Agency Authority in non-corporate entities i. P.34 ii. RUPA 304 1. In a partnership, each partner is an agent of the partnership 2. Have actual authority unless some agreement says otherwise iii. ULPA 302 1. Limited partner does not have authority to bind the limited partnership iv. ULLCA 1. Agency authority is vested in persons who manage the LLC, which can be either members or managers 2. RUULCA 301 (a) says that a member is not an agent solely because they are a member e. Agency authority in corporations i. Del 141 (a), RMBCA 8.01(b) 1. Vests in BoD power to manage business and affairs of corporation 2. But, it is the officers that bind corporations to 3rd parties 3. Reason for uniformity in names of corporate officers is agency law a. Industry specific b. Common law will generate what typical course of dealing of various positions is ii. Summit Properties 1. About apparent authority and ratification 2. Can be reduced to discussion about Coleman’s actions on p42-43 3. Newtech was owned by Coleman, sold to IES, but C stays as Pres and treats company as if he owns it 4. Coleman negotiated lease w/ Summit and intimated that NewTech and IES were the same a. This was the key fact 5. Board had told C “No” but C didn’t listen 6. IES also didn’t monitor and condemn C’s actions 7. Another key was that IES derived advantage from the lease, in addition to sitting on rights iii. Menard 1. Case of apparent authority typically, but court doesn’t view it as such b/c agent acting in opposition to Board’s wishes 2. Real estate deal 3. Sterling acted as he should have on 1st offer, but 2nd offer he didn’t 4. Everyone knew he didn’t have authority on 1st offer, but arguable Menard thought 2nd offer would be different 5. Court said key was that Dage Board didn’t notify Menard that Sterling had acted w/o its authority until 104 days after it learned of Sterling’s actions iv. *not every state has adopted inherent agency power, and instead think of it as a species of apparent authority v. Context is important 1. $100k purchase by Apple officer much different than $100k purchase by Mom and Pop Inc. officer f. Agency Problem g. Overview of basic Attributes of Firms i. Legal personhood 1. Firm is liable separate from its members 2. Depends on firm structure 3. Can sue and be sued; buy and sell property ii. Limited liability 1. “asset partitioning” 2. Separation of liabilities 3. Equity holders are insulated from the debts of the enterprise iii. Perpetual existence 1. duh iv. Equity holders 1. Investors in firm entitled to firm’s equity 2. Equity is comprised of a. Profits b. Nets assets 3. Way to aggregate capital v. Managers 1. General partnership: all partners are managers 2. LP: general partner is a manager, limited partner is not a manager a. Limited partner’s price for protection form liability is lack of control 3. LLC: can be member managed or manager managed a. Changes rights of the equity holders 4. Corps: separate ownership from management vi. Separation of ownership from control 1. Chesapeake Marine Problem vii. Basic Terms and Concepts 1. Sources of law a. US const b. State statues c. Agency codes and regulatory enactments d. caselaw 2. Internal affairs rule 3. 4. 5. 6. 7. a. Law of state of filing governs internal affairs of the entity Charter documents a. Articles of Incorporation i. Hard to change b. By-Laws i. Easier to change Private ordering Stakeholders a. Ppl relying on the entity aside from equity holders, like employees, the community, creditors, etc. Fiduciary duty a. Bayer v. Beran i. Loyalty, care, disclosure ii. Corp ran a radio campaign featuring the president wife, a pro singer iii. Claim that this was a breach of fiduciary duty iv. Fiduciary duty is a duty to exercise judgment that one would exercise in similar situation to conduct your own affairs v. Decisions must be in furtherance of the interests of the company even if such a decision would be a personal detriment vi. Hiring wife was a conflict of interest, but court found no breach of fiduciary duty b/c evidence showed that the program wasn’t designed to benefit wife’s career Equitable limitations a. Schnell v. Chris Craft i. Equitable estoppel of otherwise lawful action ii. Board changed date and place of meeting to Cortland, NY in the winter in order to subvert attempt to elect a new board iii. Act was technically legal, but court struck it down b/c purpose was to impede shareholder participation b. Bove v. Community Hotel Corp i. Board wanted to change status of preferred shareholders by changing nature of a transaction ii. Doctrine of independent legal significance 1. Can choose an legal way to do something, even if it is banned by other laws as long as it is legal 2. Court held for the board 3. Said underlying purpose of a legal action is irrelevant 4. Holding statute above policy 4. Intro into Statutes a. Traditional: Delaware i. Basic organizational forms ii. The relationship between common law and statute iii. Order of exposition b. Contemporary: Revised Model Business Corporation Act i. The important of definitions ii. The role of official commentary iii. The multiple variable of the RMBCA adopted by the states iv. The role of judicial application (the power of interpretation) c. DGCL i. Doesn’t have a definitions section ii. If specific statutes don’t define terms, go to the cases iii. Can also find definitions in corporate charters, by laws, etc iv. Semicolons are bitches, means that anything before could be turned on its head 1. Have to pause and make sure you understand what was written before semicolon v. Be aware of sentences beginning w/ dependent clauses vi. Subchapter IV: Directors+Officers is the key chapter vii. Subchapter V: Stock is all about money viii. Things not covered by Del 1. Fiduciary duty, agency, veil piercing d. RMBCA i. More detailed than Del ii. But permits a relatively free reign of interpretation iii. RMBCA is an enabling code, so watch out for dependent clauses that start sentences 5. Chapter 3: “Asset Partitioning and Veil Piercing”: limits to limited liability a. Asset partitioning: separating assets into different places. Allowed by limited liability. Makes it impossible for creditors to touch certain assets b. Limited liability basic rule: shareholders are liable only for the amount of their investment c. Veil piercing is the exception to this rule i. Equitable concept: think Chris Craft 1. Look for evidence of wrongful conduct, fraud, deceit, control, alter ego, etc. 2. Defrauding those who trusted in the corporate structure and had the wool pulled over their eyes 3. Evidence is based on standards supplied by courts a. Court standard create terms like alter ego and undercapitalization 4. You should always test piercing the corporate veil, especially in closely-held corporations w/ a small number of shareholders a. Can help you get broader discovery and increase chances of settlement ii. Theoretical justifications 1. Public versus closely held corps 2. Individual versus groups iii. Tort versus Contract Creditors 1. Walkovszky a. Example of a tort creditor b. Taxi case where cab driver ran over someone. Carlton was a stockholder in 10 cab corps, each comprised of two cars that carried minimum liability insurance of 10k c. Court says its important whether or not a stockholder is operating a business in his individual capacity when deciding whether to pierce the veil i. Has to be control or domination and that control has to have bad intentions, i.e. corporation formed to defraud other into believing they were dealing with the corporation d. Walkovsky wants to vertically pierce veil to get to Carlton i. Has to 1st pierce from Seon Cab Corp to Carlton’s Corp, then pierce Carlton’s corp to Calrton personally e. If W wanted to get to the 9 other cab corps, he would have to horizontally pierce by showing that all 10 corps operated as one subsidiary i. Requires different evidence than piercing vertically f. Here, no sufficient evidence that Carlton was conducting cab corps in his individual capacity g. “Undercapitalization”= not giving a company enough capital to handle its day to day business 2. Radaszewski (improper motives; undercapitalization) a. P didn’t allege that there was improper motivation in addition to control, but instead argued that Contrux, subsidiary of Telecom, was undercapitalized b. In this case, the alleged undercapitalization was the liability insurance purchased for Contrux c. At the time that C injured P, it had $1M in basic insurance, plus $10M in excess coverage, but excess insurance company went out of business after the accident d. Court said there was nothing wrong with the fact that the excess insurance was purchased from another subsidiary of Telecom e. “we think that the doctrine would largely be destroyed if a parent corporation could be held liable simply on the basis of errors in business judgement.” iv. The problem of Vertical vs Horizontal veil piercing 1. Walkovsky v. Contract Creditors 1. Freeman (equitable ownership) a. Glazier developed software at Columbia, C3 was created to market and develop the software. Glazier’s friend was the sole shareholder b. Glazier created Glazier Inc. which became a consultant to C3 i. Glazier had control over C3 c. G entered into agreement with Freeman to sell software, then after another sale terminated the agreement and left F out to dry Court said that through extended control, G was the equitable owner of C3, even though he was not a shareholder d. Remanded to see if G used his control to commit fraud of F 2. Kinney (due diligence requirements) a. Due diligence requirements b. Those who wish to enjoy limited liability under a corporate umbrella should be expected to adhere to the corporate structure of creating and maintain a corporation c. Used two pronged test i. (1) the shareholder must have failed to maintain the separate character of the corporation, and (2) refusing to impose liability on the shareholder would cause “an inequitable result.” vi. Parent-Subsidiary (to what extent is intent to defraud or abuse of corporate franchise important) 1. Gardemal (alter ego doctrine) a. A parent corporation is not liable for acts committed by its subsidiary if the two corporations, although closely related, keep their corporate entities separate. 2. OTR Associates (domination and control) a. The corporate veil of a parent corporation may be pierced if the parent: (1) dominates and controls the subsidiary and (2) abuses the privilege of incorporation by using the subsidiary to commit a fraud or injustice. vii. Are LLC’s Different? 1. Net-Jets Aviation (transposition of corporate veil piercing rules— alter ego theory viii. Reverse Veil Piercing 1. Attempting to get to corporate funds to satisfy debts against shareholder personally 2. Courts will allow this if person if hiding assets in a corporation ix. Both reverse and normal veil piercing, start w/ assumption that corps and LLCs are treated the same, but 1st step is to look at your state’s caselaw x. No veil piercing w/ general partnership, but there is for limited partners b/c limited partners give up control for a veil 6. Chapter 4: The business Entity and Legal Personality a. Basic issues i. Are corporations property in the hands of individual or an autonomous institution partitioned from those w/ interests in its income, assets or control ii. What are the consequences of each of these views iii. Corporations have property rights but don’t have right to not selfincriminate b/c they have no human dignity iv. Corporate rights broken up into two categories 1. Politics and religion v. If Corps are property in the hands of shareholders and this mouthpieces, they could have better argument for having these rights vi. If corps are autonomous, then they should operate in the best interest of the shareholders no matter the political or religious stance vii. Legislatures that see corps as property are more likely to enact laws empowering shareholders viii. Legislatures that see corps as autonomous more likely to enact director friendly laws b. Problem: Regulating Corporation Lobbying c. Corporate Rights under the 1st Am i. Belloti 1. Statute prohibiting corps from spending to influence referendum proposals other than those that materially affected the property, business or assets of the corp 2. Held invalid b/c it interfered w/ corporate ability to protect the property that the state gave it: interfering w/ the legal rights of a legal person 3. Specific issue was effect of personal income tax on the bank 4. Court said the attempt to protect shareholders didn’t matter b/c corps are autonomous a. Also shareholders have judicial remedy of derivative suits ii. Austin v. Michigan Chamber of Commerce 1. Upheld statute banning use of corporate funds to make direct contributions to campaigns or indirectly supporting a campaign iii. Citizens United 1. Overruled Austin and held that BCRA regulation of independent corporate expenditures to be violative of 1stA 2. Corporations have some speech rights as ppl b/c it shouldn’t matter where speech comes from 3. Courts obligation isn’t to protect corps right to speak, but do protect right to generate speech 4. Austin was anomalous and interferes w/ open marketplace of ideas protected by 1stA d. Separate Entity or Association of Individuals i. Hobby Lobby 1. RFRA protection extends to corporations 2. Owners of Hobby Lobby felt their religious views should also be expressed through their business 3. If religion of owners should apply to corps, then the corp must be property and not autonomous 4. Nonprofit corp could be a “person” under RFRA so for profit corp should be too e. Consequences for Corporate Law i. Property approach tends to produce shareholder protective statutes ii. Entity approach tends to produce statutes that increase power of directors 7. Chapter 5: The Corporation and Society a. Basic Issues i. Who does the corporation serve? ii. To what extent do courts mediate conflicts among corporate stakeholders w/ respect to director decision making? iii. What are the standards courts use? b. Problem: Exogen Inc. Part I c. Judicial Approaches i. Dodge v. Ford 1. D sued F b/c F stopped paying special dividends 2. D needed $ to fund their own company 3. F wanted to expand production and create more jobs 4. D also argued F could be selling cars for much more but was choosing not to 5. F also wanted to pay workers more, claimed it had a social respon 6. Court says a corporation’s purpose is primarily to make more profit for shareholders a. Shareholders can be defined as both current and future shareholders 7. Cant justify decision on worker or societal welfare, but can justify based on long term gain over short term loss ii. E-Bay Domestic Holdings 1. eBay a minority shareholder in Craigslist 2. C wanted to maintain a free, community based site, EBay wanted to monetize 3. C created a new shareholder agreement w/ a poison pill clause in order to maintain Craigslist culture in perpetuity 4. Court said this was not good b/c it didn’t maximize shareholder wealth 5. Craigslist concerns about the future of the corp not good enough reason to stifle shareholder gain d. Historical View i. Allen versus Strine e. Multinational Corporations i. Multinational Corporations, Transnational Law 1. Corps whose chain of production goes through multiple countries 2. Apex multinational corps sit at end of production chain at point where the ultimate consumer comes in 3. Problem is who controls the chain f. The Law of Corporate Charity i. Problem: Union Airlines ii. Judicial approaches 1. Theodora Holdings a. Established test of reasonableness for charitable corporate gifts b. CEO and wife get divorced and wife wants to stop CEO from donating parcel of land for a kids camp c. Theodora Holding was ex-wife’s daughter, said gift was a waste d. Court suggest the IRS Code is helpful in determining reasonableness, though not definitive e. If you fall within IRS guidelines, you save money on taxes that can be distributed to shareholders f. In this case the gift reduced the Alexander Dawson Inc reserve for unrealized capital gains taxes by $130klmwhich increased the net worth of stockholders g. Also, gift was within the tax deduction limit of 5%, meaning it cost stockholders 80k i. So net gain of 50k h. This numerical inquiry is the quantitative inquiry i. Also have a qualitative inquiry i. Looks at the recipient of the gift and the purpose behind it ii. Is the donation personal or justified institutionally? iii. Qualitative test is a loyalty test and more lawyerly 2. Kahn v. Sullivan a. Blueprint for this kind of thing right b. Hired separate lawyers for the museum and for the board c. Board named a special committee where everyone was independent d. Have to maximize business, but some societal actions are also good for business e. Corps serve themselves by being socially responsible f. Some states have passed laws that give BoDs discretion to determine the social outcomes of decisions so long as they also maximize the corp i. Benefit Corps: allow for the declaration of a purpose along w/ profit iii. Perspectives at the outer limits of charity 1. Or back to the issue of corporate personality 8. Chapter 6: Planning for the Close Corporation a. Model Standard Corporate Governance (Big Corp) i. 3 critical internal stakeholders are officers, directors, shareholders ii. Direction of corp is taken by and thru BoD. (MBCA 8.01, Del 141) iii. Officers operate business day to day in accordance w/ actions of the board iv. Shareholders vote. That’s all they do 1. Vote for board members, but in and out 2. Approve or disapprove board actions that the law requires the board to submit to shareholders a. Ex. Mergers, sale of assets, big stuff 3. Also anything enumerated in articles of incorp v. Shareholders have no fiduciary duty b. 3 ways to define Close Corp i. Common law (Donahue v. Rodd) ii. Legislative definition (CA, NJ) 1. Usually based on # of shareholders 2. Usually 35 or 50 iii. By looking to see if a state has enacted a close corp charter 1. Delaware has a close-corp opt-in c. Donahue v. Rodd Electrotype i. Defined close corp as 1. Small # of stockholders d. e. f. g. h. 2. No ready market for corporate stock 3. Substantial majority stockholder participation in management, direction, operation ii. Ruled that shareholders in a close corp owe strict duty of loyalty to each other MBCA 7.32 i. Governs shareholder agreements, which eliminates distinction between directors and shareholder Smith v. Atlantic Holding i. When a shareholder effectively runs a company, they can be held liable for actions in breach of fiduciary duty to other shareholders Ways to protect Minority shareholders i. Require everything to be voted on by shareholders ii. Setting a high vote % for passage (supermajority voting) Shareholder Voting Arrangements i. Voting trusts, proxies, vote pooling ii. Shareholders agreeing amongst each other to vote certain ways iii. These shareholder agreements are subject to specific enforcement iv. A way to secure agreement is to give each other an irrevocable voting proxy subject to the agreement v. Voting trusts are when shareholders transfer shares to the trust and the trustee must vote shares in accordance w/ instructions 1. Those giving up the shares are beneficiaries of the trust vi. Class Voting (p.233) vii. Cumulative Voting 1. X=(s x d)/(D + 1) +1 a. X= # of share required to elect director b. S=# of shares represented at the meeting c. d= # of directors it is desired to elect d. D= total number of directors to be elected Dissension and Oppression i. Investors in a close corp expect significant voice ii. Common law approaches to dissension 1. Massachusetts a. Wilkes v Springside Nursing Home (common law remedy) i. Group bought a nursing home and all worked at it ii. Group decided they didn’t want Wilkes to benefit anymore and chose not to re-elect him to the board as an officer after Wilkes announced his intention to sell his shares iii. Wilkes continued to do his job and did not do anything wrong iv. Group using the formalities of corporate law to undermine the purpose (Chris Craft) v. Court said majority must show a legitimate business purpose for severing Wilkes vi. Standard of “utmost good faith and loyalty” vii. Cant frustrate the minority’s purpose for joining the venture viii. 3 part test 1. Allegation of breach of good faith 2. Burden shifts to Ds who must show a proper business purpose 3. If business purpose shown, burden goes back to the P who must show there was a less burdensome alternative that would have met the business purpose alleged 2. Delaware a. Nixon v Blackwell (Statutory remedy) i. Del 341,342 ii. Owners of Class B- non voting stock on the wrong end of a reorganization iii. Employee stock ownership plan provided for some owners, but not for Class B iv. b/c the corp didn’t opt in to close corp statute, Class B gets no relief v. court says Class B chose to invest, even though they knew they couldn’t get certain protections 1. could have also negotiated for the desired protections b. Delaware a stricter approach b/c you have to opt in to close corporation i. Statutory scheme serves as a notice to 3rd parties 1. i.e. creditors, labor, banks ii. once a 3rd party has notice, they can perform due diligence – see Kinney Shoe case c. RMBCA also has a close corp statute, but not all states have adopted it d. RMBCA 14.30, Del 342 et seq. iii. Corporations end by voluntary or involuntary dissolution 1. Del 272-275: assumes dissolution is voluntary a. But selling corp is way more common 2. RMBCA 14.30 provides for judicial dissolution based on claim brought by shareholders if they can show oppression 3. “Oppression” a. Majority perspective courts find oppression liability when the majority’s actions are not justified by a legit business purpose. b. Minority perspective courts fins oppression when majority action, justified or not, harm the interests of a minority shareholder i. Book p.251 iv. Kemp v. Beatley 1. Employees who owned shares frozen out by maj. 2. Court espoused reasonable expectation test 3. Also what majority knew or should have known were the expectations of the minority a. Standard is substantial defeat of expectations that were central to the decision to invest 4. P has to show reasonable expectation, knowledge or imputed knowledge, substantial defeat (not entire defeat), and that the expectation was central to decision to invest 5. What is a substantial defeat? 6. There is a bad faith exception to this, though a. Minority holder can’t threaten dissolution in bad faith b. PRINCIPLE IS EQUITY v. Remedies 1. If case made for oppression, court will order dissolution, provided that parties get 30-120 or so days to come to an alternative agreement 2. Settlements after judgment will be enforceable a. Usually what winds up happening vi. Transfer Provisions in Close Corps (p.237) 1. Right of 1st refusal a. Changes who the 3rd party negotiates with in order to buy shares. b. Have to negotiate w/ the other shareholders who own right of 1st refusal in addition to holder from whom you are buying 2. Consent a. Consent provisions are weapons b. Have to either pay more @ beginning to not have consent, or pay later when seeking consent c. Cheaper @ beginning (contingency discount) than at a later time 3. Sale Option 4. Buy-Sell Agreement 5. First option vii. Valuation of Restricted Shares (p.239) 1. Capitalized earnings is the “Maserati” of valuation of restricted sales a. Book value not really used 2. Right of first refusal 3. Appraisal 4. Mutual agreement 5. Book value viii. i. Close Corp Summary i. Wilkes Approach 1. Treat close corps as partnerships in terms of duty and loyalty in order to protect minority shareholders from freezeouts 2. Shifting burden in order for P to recover ii. Delaware (Nixon) approach 1. 2 options a. Negotiate protections b. Opt-in to close corp statute 2. If you choose not to do either, you’re out of luck 3. Delaware courts don’t create common law standards of duty iii. Oppression= denial of your reasonable expectations. “Substantial defeat” of expectations 9. Chapter 7: Partnerships (General and Limited Partnerships) a. General Partnerships i. Definitions (RUPA 101(6)) 1. Association of 2 or more persons to carry on as co-owners of a business for profit ii. Formation 1. Partnerships can be formed even if the parties don’t intend to. Can also intend to, but fail to do so in practice 2. If you receive profits, you’re presumed a partner, unless: a. You get them to satisfy a debt b. You get the for services as an independent contractor or as wages or other employee compensation c. You get the as interest or other charge on a loan, even if the payment varies w/ profit 3. Partner can be a natural person or a legal person 4. In the end, courts decide what a partnership is 5. Martin v. Peyton a. Rule: for a creditor to cross line to being a partner, the creditor must be closely enough associated with the firm so as to make it a co-owner carrying on the business for a profit b. Here, the creditor was not a partner. Its actions were reasonably taken to protect is loan, not to run the business c. *fact dependent iii. The partnership agreement 1. Default rules a. Equal financial rights b. Equal management rights c. Transfer of equity interest d. Dissociation e. P.271-274 iv. Fiduciary Duty 1. Meinhard v. Salmon a. Partners owe higher level of fiduciary duty then BoD of a corp b. “not honesty alone, but the punctilio of an honor the most sensitive” v. Unlimited Liability 1. Incurred by GPs 2. Formal rule is fully liable, but in reality you go to a bankruptcy lawyer and figure shit out b. Limited Partnerships i. Definition, Management Structure and Fiduciary duty 1. Control in GP: are you a partner or not? 2. Control in LP: are you a general or limited partner? 3. 2 differences from GPs a. Filing requirements b. Limited liability for limited partners i. At least one partner MUST have unlimited liability ii. Limited partner , in return for asset partition, gets must less control than general partner 4. Good faith and Fair Dealing a. Applies to reading of partnership agreement b. Cant be read to subvert expectations of parties c. Interpret contract based on the position of the parties at the time of the agreement, not at the time of the dispute d. Gerber v. Enterprise Products i. “Court asks whether is it clear from what was expressly agreed upon that the parties who negotiated the express terms of the contact would have agreed to proscribe the act later complained of as a breach of the implied covenant of good faith, had they thought to negotiate with respect to that matter” ii. Implied covenant looks to the past iii. Purpose of good faith and fair dealing is protect the essential points of the bargain iv. Some commons terms are easily implied b/c the parties must have intended them and have only failed to express them because they are so obvious e. Dieckman i. IDK 5. Financial Rights and Limited Liability a. RULPA 303 (p.296) i. Lists things that limited partners can do w/o losing their protection b. Gateway Potato Sales i. A limited partner may be personally liable for partnership debts if the limited partner has performed substantially the same role as a general partner, even if the limited partner had no interaction with the creditor. 6. 10. Chapter 8: LLCs a. Perhaps more than partnerships, the LLC for emphasizes the contractual relationship among owners and the contractual flexibility of the form b. As part of this, the LLC form can easily accommodate the broadest range of governance structures, from the centralized authority structure of the corporation to the communitarian approach of general partnerships c. Issue is ALWAYS contract interpretation d. Can be member-managed or manager-managed i. Only need 1 member to form e. Problem: Precision Tools Problem 6 (7 overall) f. Organizational Matters i. Membership/contracting g. Fiduciary Duty i. Members and Managers 1. LLCs allow member to define and limit fiduciary duty 2. In Delaware, you can entirely eliminate fiduciary duty a. DLLCA 18-1101 b. But can’t eliminate the implied contractual covenant of good faith and fair dealing ii. Role of Contract: McConnell v. Hunt Sports 1. Wrote-out fiduciary duty w/ clause in contract that allowed members to compete w/ the LLC iii. Delaware: Norton v. K-Sea 1. Can contract out of fiduciary duties h. Limited Liability i. Cortez v. Nacco 1. Limited liability can hinge on control 2. Looked at whether the control expected by the manager of the LLC was enough that a jury could infer they were responsible i. Dissociation-Dissolution i. Haley v. Talcott 1. A court may dissolve an LLC when it is not reasonably practical to carry on the business in conformity with the LLC agreement and the LLC agreement does not provide a sufficient exit mechanism 2. Judicial dissolution was appropriate b/c the exit mechanism in the contract was inequitable in this case 3. Analogized to corporate law 4. Did here what was done in Chris Craft 11. Chapter 9: Financial Accounting and Valuation a. Understanding the way that corporations represent themselves i. Connection between shareholder/institutional welfare maximization and financial statements b. The lawyer and financial statements; gateway to understanding legal rights c. Problem Precision Tools Part 7 i. Useful analytical tools for financial statement analysis: (1) working capital; (2) current ratio; (3) liquidity ratio; (4) quick ratio; (5) debt-equity ratio; (6) interest coverage ratio; (7) profit margin; (8) return on equity d. Interplay of Balance Sheet, Income Statement and Statement of Cash Flows e. 3 key financial aspects i. Assets ii. Liabilities iii. Equity iv. Basic premise is assets=liabilities+equity; assets-equity=liability f. Industry is important to consider when reading financial statements g. Enterprise valuation i. Precision Tools Problem 8 h. What about non-balance sheet items 12. Chapter 10: Financing the Enterprise a. Problem: Precision Tools Part 9 b. Del 102 (a)(4); 151-169, 221 c. RMBCA 202, 6.01-6.28 d. Introduction to Corporate securities i. All securities are discrete combinations of rights to income, assets and control ii. Equity 1. Common stock v. Preferred stock iii. Debt 1. Binds, indentures, (but not loans) iv. 3 types of Securities 1. Common stock 2. Preferred stock 3. Debt a. All contain legally binding understanding of right v. Equity 1. Get paid last (residual holders) 2. Have bigger risk, but capture all the gain if company is successful 3. Also have greatest right to control 4. Common stock owners can elect and remove directors and can veto transactions allow by law 5. Preferred stock gets paid before common stock a. Gets a fixed preference w/ respect to assets and income superior to common stock holders b. Under classical model, have no control rights c. Preference can be cumulative or non-cumulative i. Cumulative is better d. Participating vs Non-Participating i. vi. Debt 1. Bears no risk usually (for sure the least risk) 2. Entitled to be paid first 3. Entitled to fixed interest and return (principal) vii. These concepts can be flexible viii. Equity can be separated into classes 1. Just required that all classes of equity together have full rights to income, assets and control a. Ex: Class A has right to vote, not income, Class B has no vote, but income, Class C has ½ vote and income in certain situations ix. Shares can be convertible 1. i.e. preferred stock to common stock or some other form of preferred stock x. **When companies issue stock other than common stock, they must specify the rights in the Articles 1. Common stock needs just the # of authorized shares 2. RMBCA 6.01; Del 1.51 xi. Debt not really recognized on corporate law, but loan agreement and contract law xii. Corporate law recognizes debtholders only when creditors exert control enough for courts to recharacterize a creditor as an equity holder for tax and insolvency purposes xiii. RMBCA 6.01 1. If you can split everything up, the sum of all types of shares must receive full voting rights and full rights to assets 2. Aka cant withhold rights by splitting everything up but don’t need one class that has full, traditional rights e. Statutory elements i. Authorization ii. Placement in the articles of incorporation; board authority to set terms iii. Contractual nature of preferences f. Legal Capital and Constraints on Distributions i. Concept of legal capital (Delaware) 1. Par value a. Completely arbitrary number b. Cant be greater than what is charged for the share c. Cant sell for less than the par value i. Corps usually make par value like 1 cent d. Consideration for shares can be whatever the BoD deems acceptable. Del 152. i. Can be $, services, items, debt, anything ii. “cash, tangible or intangible property, benefit to corp” iii. Determination of the board will be valid unless there is fraud or bad faith 2. No par value shares a. Allowed by Del 151 b. Can be issued for consideration as determined by the board c. More flexible= can sell for anything (diff between 151 and 152) 3. Del 151-154, 160, 170, 244 a. Read 151 in light of 102(a)(4)(provides that if you’re issuing one class or series of stock, you just have to state the # of shares and their par value) b. 154 i. Corp can, by resolution, say that part of consideration for stock is capital and the their part is “surplus” ii. But if any shares have a par value, the capital has to be greater than the aggregate par value, unless all shares have par value, then the capital account has to be equal to the aggregate par value 1. Ex: if par value is 100 and sold for 100, all 100 has to be capital 2. If par value is 10 and sold for 100, at least 10 must be capital, but up to 100 can be capital a. Up to 90 can go to surplus 3. If sold 2 shares, 1 w/ par value of 10 and 1/ 0 par value, for 100 each, capital would have to be greater than 10 a. Could be 10.01 up to 200 iii. If corp forgets to designate some amount as capital, 154 says either at issuance of security for cash, or within 60 days if consideration is not all cash 1. Ex: when capital is not determined a. All cash= statutes applies automatically b. $100 and 4 goats= 60 days to designate capital 2. Mandatory provision says capital shall be equal to aggregate par value of share w/ par value, plus amount of consideration of shares w/o par value a. Ex: 2 shares sold for 100 each (1 w/ par of 10, 1 w/o par) i. Mandatory designation would be 110 3. Can move this around later, but this is the initial designation 4. This is an inducement to get your business together if planning to offer no par stock c. Capital of corp can be increased or decreased by resolution of the board i. Increase can be whenever ii. Decrease pursuant to Del 244 1. Says you can reduce up until the aggregate par value. Just cant reduce capital below minimum you had to put in capital account at beginning 2. UNLESS, the company would be insolvent by decreasing (244(b)) d. Surplus= consideration above capital i. Normally used to pay dividends e. Nimble dividend i. Distributing divided out of net profits, not surplus f. Can also distribute accumulated, banked funds 4. How is this reflected on the balance sheet a. Klang v. Smith’s Food & Drug i. Courts will defer to the board’s measurement of surplus, absent evidence of bad faith or failure, on the part of the board, to evaluate the assets on the basis of acceptable data it reasonably believed reflected current value. ii. RMBCA Approach 1. 6.40 a. Balance sheet test b. Insolvency test 13. Chapter 11: Forming the Entity; Internal Affairs Doctrine a. Problem: Precision Tools Part 10 b. Advising the Entity i. ABA Model Rules (p.435-) 1. 1.4: Communication 2. 1.6: Confidentiality of Info a. Lawyer shall not reveal info relating to representation of a client w/o client’s informed consent 3. 1.7: Conflict of Interest: Current Clients a. Conflict of interest exists if the rep of one client will directly adverse another client or there is significant risk that the rep of one or more clients will materially limit the lawyer’s responsibilities to another client, a former client, or a third person or by a personal interest of the lawyer 4. 1.13: Organization as Client a. Retained by org= rep the org b. Serve best interests of the org c. See sec. f 5. KNOW THIS ii. Entity Theory of Representation 1. Danforth a. Retroactively applied entity rule in a case where the lawyer was retained for purposes of forming the entity b. Pre-incorporation activity was deemed to be repping the company 2. AZ State Bar Opinion iii. Aggregate theory of representation 1. Represent all members of the entity at once iv. Reasonable expectations test 1. Represent who you reasonably led to believe you represent c. Choice of Entity and Formation i. Forming a corp 1. Book a name a. RMBCA 2.01(a)(2); Del 4.01 2. Find incorporators a. RMBCA 2.01 says at least 1 needed b. Can be either an individual or an entity b/c RMBCA defines person as individual or entity 3. Create articles of Inc. and send it w/ money to wherever the statute tells you to, usually secretary of state a. Require certain things per Del 102 and RMBCA 2.02 i. Name ii. # of shares iii. Address of corp iv. Name and address of incorporator b. Easier to amend the by-laws than articles, so anything in the articles should be much more concrete c. Nothing beyond these 4 things are required 4. After incorporation, initial directors hold a meeting to appoint officers, adopt bylaws, etc. a. RMBCA 2.05 b. don’t have to name directors in articles, but you can i. if you don’t then the incorporators hold a meeting after incorporation to select initial directors who will take care of the other stuff 5. By-laws are required, but RMBCA 2.06 doesn’t require anything specific, as long as they aren’t inconsistent w/ the law or the articles of inc d. Planning and Structuring i. Precision Tools part 11 e. Internal Affairs doctrine (p.488-503) i. Constitutional doctrine or choice of law rule ii. State of incorporation’s law governs the right of shareholders and other corporate issues, even if suit is filed in another state iii. Cal Corp Code 2115 14. Chapter 13: Role of Directors in Governance a. Problem: Widget Corp b. RMBCA 8.01-8.25 governs board actions i. Actions that don’t comply are not binding on the corporation ii. Boards manifest their will through resolution, in writing iii. Resolutions can be written by a secretary, or by officers iv. Per MBCA 8.40(c), an officer is responsible for maintaining and authenticating records of the corporation c. The Role of the Corporation director in the “standard model” or corporate governance d. Formalities of corporate action i. How does a board act? Collective vs individual action 1. Individual directors may not bind the corporation, only collective BoD action 2. Directors CAN’T vote by proxy 3. Rule is you have to be able to hear each other for it to be a meeting a. RMBCA 8.20(b): “any means of communication by which directors participating may simultaneously hear each other” 4. BUT, corp can be bound on agreements never formally approved at a formal board meeting if: a. Unanimous director approval i. When all directors separately agree, no meeting necessary b. Emergency i. Situations where quick decisions must be made to prevent great harm or take advantage of a great opportunity ii. REAL emergencies c. Unanimous Shareholder Approval d. Majority shareholder-director approval i. If directors who participate in the informal action constitute a majority of the board and own a majority of shares, the corp is bound ii. Notice and quorum 1. MBCA 8.22 a. 2 days’ notice for special meetings b. No notice for regular meetings c. Action w/o notice is invalid i. But valid notice can be waived by signing a waiver (8.23(a)), or by attending the meeting and not protesting the absence of notice (8.23(b)) 2. Quorum a. 8.24 i. Majority of board members is default ii. Can be reduced to no less than 1/3 of the board iii. Action w/o quorum is invalid iii. Committees and the strategic use of corporate law 1. Executive committee is common because it can have full authority of the board in all but a few essential transactions, such as declaration of dividends or approval of mergers. MBCA 8.25(e) 2. MBCA 8.30(b) allows directors to rely on the reports of committees or actions of committees on which he does not serve so long as the committee reasonably merits confidence e. Board Composition i. NYSE Governance Rule 303A 1. Boards of listed companies must consist of at least a majority of independent directors who meet regularly in executive session without management 2. 303A.02 Independence Tests a. Independent= no material relationship w/ company b. Also not independent if been employee of company in last 3 years, or immediate family member was an executive officer in last 3 years, received, or immediate family member received 120K or more in direct compensation in last 3 years, or if director is a current partner or employee of internal auditor of listed company ii. NYSE and NASDAQ require 3 committees 1. Audit a. At least 3 members who are independent directors 2. Compensation a. Solely independent directors 3. Nominating a. Solely independent directors f. Governance in the modern enterprise i. “best practices” 1. See p.526-527 g. Social justice and boards of directors 15. Chapter 14: Shareholder Voting Rights; Shareholder Proposals i. Del 141, 143-145, 211-233 ii. RMBCA 7.01-7.29, 8.03-8.07, 16.01-16.21 b. Mechanics of shareholders meetings i. Calling the meeting 1. Del 211(d): only BoD or ppl authorized by art of Inc. or bylaws can call a meeting 2. Del 228 allows shareholders to act by written consent ii. Notice 1. Corp must give written notice of all meetings to shareholders entitled to vote at meetings 2. “Record Date”= date that determines shareholders who can vote. Only shareholders of “record” on that date may vote 3. Del 213(a): BoD can fix a record date for holders entitled to vote no more than 60 days nor less than 10 days before, and another record date for determining stockholders entitled to vote a. This is about notice of the meeting b. If you set this record date, then it is also the date that determines who can vote, unless the board sets another record date for who gets to vote, which can be up to the date of the meeting iii. Quorum 1. MBCA sets no min or max quorum, but says amendment is required for supermajority quorum 2. Del 216 allows majority of shares to amend bylaws to increase quorum or reduce to no less than 1/3 iv. Action by written consent 1. In lieu of voting @ meeting 2. MBCA 7.04(a) requires written consent of ALL shareholders entitled to vote, even if there’s a supermajority voting requirement 3. Del 228 allows a MAJORITY of shareholders entitled to vote on action by written consent a. This is the default provision. Del corps may alter or eliminate shareholders right to act via written consent b. If there’s a supermajority voting requirement, need supermajority of consen v. Voting 1. Can be in person or by proxy, which can have discretion or instructions 2. MBCA 7.22: validity of proxy limited to 11 months from execution date, unless the appointment specifies a longer term 3. Del 212: no time limit for proxies 4. MBCA 7.25(c): votes cast for must outnumber votes cast against 5. Del 216: need a majority of the shareholders entitled to vote in matters other than the election of directors 6. Majority voting is the default rules a. Can make it a supermajority if you want (MBCA 7.27; Del 242) 7. Shareholders vote on 3 things a. Election of directors b. Removal of directors c. Key transactions c. Election and Removal of directors i. Election 1. Right belongs to shareholder, unless the seat is vacant, in which case can be filled by shareholders or the board, depending on the articles. P.542 2. Default rule is plurality voting, where candidate with most votes wins a. Del 216 says that if shareholders adopt a bylaw specifying the vote necessary for election, the board cannot amend or repeal that bylaw ii. Removal 1. RMBCA 8.08 a. w/ or w/o cause unless articles say only for cause 2. Can be done w/ or w/o cause (Delaware rule) 3. Campbell v. Loew’s a. Right of due process are key in board removal b. Have to give notice and a chance to defend d. Inspection of books and records i. Del 220, RMBCA 16.01ii. 220: presumption that shareholder is always entitled to a list of shareholders, Burden is on the shareholder to show a business purpose for records other than list of shareholders iii. Pillsbury v. Honeywell 1. About what a business purpose is 2. Guy only got shares to protest napalm in Vietnam 3. Shareholders must have a proper purpose germane to their economic interest in the corporation to inspect corporate records. e. Shareholder Proposals i. General standard: Auer v. Dressel 1. Board can’t remove for a ballot a shareholder resolution that has a proper business purpose and is not otherwise limited by law 2. Even if shareholder resolution is passed, board as no obligation to follow it a. Board must be protected in its own fiduciary duty 3. But board would be smart to implement resolutions that are popular b/c shareholders could always vote to remove directors ii. Substantive grounds for exclusion 1. Rule 14a-8(i) specifies grounds for exclusion a. P.578 f. Ordinary business vs public policy 16. Chapter 14/15: Shareholder Nomination; Shareholder Disclosure a. Shareholder nomination of directors i. Interplay of Federal securities laws (Proxy rules) and corporate law 1. AFSCMEEPP v. AIG a. Rule 14a-8(i)(8) applies only to a particular election b. A shareholder proposal does not “relate to an election” under the SEC’s rules for exclusion from a proxy statement if it seeks to amend the corporate bylaws to establish a procedure by which certain shareholders are entitled to include in the proxy materials their nominees for the board of directors. 2. CA, Inc. v. AFSCME a. The shareholder proposal requiring BoD to reimburse shareholder nomination of potential board directors was (1) a proper subject of bylaws under Del 109, but (2) b/c of 109’s interplay w/ 141 (board gets to run company) the resolution would limit the board’s fiduciary duty and thus violated Delaware law b. 109 creates an unwaivable right of shareholders to amend bylaws even if board also can c. But shareholder primacy in bylaws is constrained by Delaware’s decision to vest control of corp in BoD, thus because of 141, there are limits on shareholder primacy of by-laws d. Limit here was taking power from the BoD (fiduciary power) e. If you want to limit board authority put it in the articles 3. Del Response to CA, Inc.: del 112-113 a. Allows shareholders to propose by-laws like in AFSCME i. AFSCME not good law, but important in demonstrating constraint of 141 on shareholder bylaw primacy b. 112 authorizes a corp to adopt a bylaw granting shareholders the right to include their nominees in a corporations proxy soliciting materials subject to certain conditions c. 113 codifies the decision in CA and permits a corporation to adopt a bylaw providing for corporate reimbursement of shareholder expenses incurred in connection with an election of directors b. Note on Say-on-Pay rules and advance notice provisions i. Point to general issues of increased shareholder activism c. Duty to disclose under state law i. Delaware rule 1. Gantler v. Stephens a. “it is well settled law that directors of Delaware corporation have a fiduciary duty to disclose fully and fairly all material information within the boards control when it seeks shareholder action. That duty attaches to proxy statements and any other disclosures in contemplation of stockholder action 2. Courts apply duty of disclosure to directors or controlling shareholders when they place the shareholders in a position where they have to decide whether to sell their stock or seek appraisal ii. Malone v. Brincat 1. If board doesn’t have to speak, but it does, it has to speak truthfully and entirely a. “”when directors communicate publically or directly with shareholders about corporate matters the sine qua non of directors’ fiduciary duty to shareholders is honesty” 2. If info is required for shareholders to vote properly, board is obligated to full disclosure iii. Application of Del 102(b)(7) 17. Chapter 16: Intro to Shareholder Litigation a. Direct vs. derivative actions i. Derivative: 1. Suit brought against 3rd parties, usually, officers and directors, brought by a shareholder on behalf of the corporation 2. $ recovered is for the corp. not the shareholder 3. Corp is a nominal defendant 4. Counsel for Ps gets paid by corp ii. ALI principles 7.01 1. Distinguishes direct and derivative actions a. Derivative: action in which the holder can prevail only by showing an injury or breach of duty to the corporation b. Direct: an action to redress an injury to the shareholder, not corp as a whole. An action in which holder can prevail w/o showing injury or breach of duty to corp iii. In derivative actions, all shareholders benefit equally iv. In direct, only the injured shareholder benefits v. Derivative actions only maintainable when board violates legal duty vi. Tooley v. Donaldson, Lufkin & Jenrette 1. 2 part standard a. Who suffered the alleged harm? i. Corp or individual shareholder? b. Who would receive the benefit of any recovery? vii. Example of direct claims 1. Failure to enforce terms of a stockholder voting agreement 2. Discrimination against particular shareholder 3. Withholding of dividends 4. Deprivation of preferred stockholder contract-based rights 5. Interference w/ shareholder right to vote 6. Challenges to price and process in a merger 7. Abdication of a boards statutory duties b. Who qualifies as plaintiff i. Plaintiffs must be capable of adequately and fairly representing the interests of the shareholders on whose behalf the suit is brought ii. In re Fuqua 1. A plaintiff who understands the basic nature of a shareholder derivative action brought in her name, but is unfamiliar w/ the facts and exercises little control over the cases, is nevertheless an adequate rep. of the shareholder class 2. Poor health doesn’t bar a P 3. Lack of proficiency in matters of law doesn’t bar a P 4. Just need competent support from advisor and attorney and have no disabling conflicts iii. Also need standing as a P 1. Contemporaneous ownership a. Owned stock @ time of wrong and must retain the stock throughout the litigation 2. Continuing interest a. Have to remain a shareholder. b. A shareholder of a corp that does not survive a merger lacks standing to sue derivatively for misconduct that occurred before the merger because the claim now is an asset of the surviving corporation i. Unless the merger is the subject of the derivative claim 3. Security ownership a. Have to be the owner of record or beneficial owner of the stock i. MBCA 7.40(e) c. Inspection of books and records i. Del 220; RMBCA ch.16 1. Important for derivative actions so that you can file the best possible claim 2. Thus, a proper purpose for inspecting books and records is investigation possible corporate mismanagement ii. Saito 1. When a shareholder has a proper purpose to inspect, the right to do so isn’t limited b/c there exists a secondary improper purpose or b/c relevant documents were produced by a 3rd party 2. Also, Del 327, which deals w/ timing of ownership for derivative actions, doesn’t affect Del 220 a. If proper purpose applies, shareholder can get all records dealing w/ that purpose, even if the document is from before the holder bough shares iii. Seinfeld 1. A plaintiff must present some evidence to establish a credible basis that the court could infer that the board did something wrong in order to involve 220 2. Establishes a burden of proof for pre-litigation discovery 3. “Credible basis test” d. Demand Requirement i. Del Ch Rule 23.1; FRCP 23.1 (traditional); RMBCA 7.40-7.47 (modern) 1. Aronson v. Lewis (Delaware Approach) a. Must make demand on board before filing derivative suit, unless you can prove demand would be futile b. Demand is excused if plaintiff alleges sufficient facts to support a reasonable doubt that the challenged transaction was the product of a valid business judgment c. Court must decide whether a reasonable doubt is created that i. The directors are disinterested and independent; AND ii. The challenged transaction was otherwise the product of valid business judgment 1. **says “and” but other cases have said its really “or” see Brehm v Eisner p.691 d. Keys are INTERESTEDNESS and INDEPENDENCE e. Interestedness: benefit or detriment related to transaction that others in your class don’t receive i. Ex: director gets a benefit from the transaction that other directors do not f. Independence: NOT found when you’re dominated, controlled, beholden to by another or dependent on another g. Demand is excused if a MAJORITY of board IS interested OR NOT independent h. In derivative suits there is tension between shareholders rights to act on behalf of the corp and statutory grant of control over corp given to the board by 141 i. Purpose of demand is the exhaustion of internal remedies j. “Demand futility is inextricably bound to issues of business judgment” k. Business Judgment Rule: i. Presumption that in making business decisions, directors act on an informed basis, in good faith, and in honest belief that the action take was in the best interests of the company (p.686) 1. “Its protections can only be claimed by disinterested directors whose conduct otherwise meets the tests of business judgment” 2. “to invoke the rule’s protection directors have a duty to inform themselves, prior to making a business decision, of all material reasonably available to them” ii. BJR respected absent an abuse of discretion iii. Sets the burden of proof iv. In other words, directors acted w/ care and good faith (duty of care, duty of good faith) 1. Good faith is an intention to do right 2. 3rd duty is loyalty 3. So 3 duties are care, good faith, and loyalty v. Presume that directors complied w/ their 3 fiduciary duties vi. Only have to show that a majority of the board members breached care, good faith, or loyalty l. **Saying demand is futile is saying a future action of the board will more likely than not be tainted b/c a majority of the directors are tainted i. i.e. decision whether or not to pursue the derivative action 2. Rales v. Blasband a. Under Delaware law, in a double derivative action, demand on the parent company’s board is excused if there is reasonable doubt as to whether a majority of directors can exercise independent business judgment. b. Case where demand is made on the board that did not make the decision c. 3 principle scenarios where a court should not apply Aronson test for demand futility i. Decision is made by the board of a company but a majority of the directors have been replaced ii. Where the subject of derivative suit is not a business decision of the board iii. Where, as in the case, the decision challenged was made by the board of a different corporation d. Instead of Aronson test, a court must determine whether or not the particularized factual allegations of a derivative ii. iii. iv. v. stockholder complaint create a reasonable doubt that, as of the time the complaint is filed, the board of directors could have properly exercised its independent and disinterested business judgment in responding to demand. Modern Approach (RMBCA 7.40-7.47 1. No excusal of demand for futility 2. Always have to make a demand on the board, then if demand is rejected, you attack the decision to reject demand on same basis that you attack the yet-to-occur decision under the traditional approach Difference between Delaware and MBCA approaches 1. Under traditional, demand may be excused if demand futility is established. Demand futility est. when it is shown that a majority of the board is either interested in the transaction giving rise to the derivative suit, or is not independent. This is a prospective challenge, saying that they would not be able to property consider a demand because interested or not independent a. If you fail to overcome the BJR on the prospective challenge, then you can attempt to claim that the decision to reject demand was done in violation of the board’s fiduciary duties 2. Under the modern approach, must make a demand on the board. If the board rejects demand, then you can try to show that the board improperly rejected demand by showing that a majority of the board members were either interested or not independent a. I.e.: in Delaware, you say “demand will be futile because a majority of directors are interested or not independent”. b. Under RMBCA you say “my demand was rejected because a majority of directors were interested or not independent” Bylaw provisions 1. Compare 707-709 w/ CA, Inc. (p.601) Termination when demand excused 1. Special Litigation Committees a. Einhorn v. Culea i. A corporation may create a special litigation committee composed of independent directors to determine whether a derivative action is in the best interests of the corporation. b. Usually formed by corps in response to derivative suits c. Given authority by the board to investigate the derivative claim and make a decision whether to go forward with the suit or not d. SLCs subject to judicial review e. 2 factor test from Zapata (Del) p.709 i. Inquire into the independence and good faith of the SLC ii. Court then applies its own BJ, weigh and balance equities between legitimate corporate claims in derivative stockholder suit and a corporation’s best interests as expressed by the SLC to determine whether the motion to dismiss should be granted 1. In NY, there is a presumption against overruling a lower court in the case of an appeal from an SLC decision. Only overrule is the lower court was totally wrong w/ weird reasoning vi. Director independence 1. Ormond v. Cullman a. “key issue is not whether a particular director receives a benefit fro the challenged transaction not shared with the other shareholders, or solely whether another person or entity had the ability to take some benefit away from a particular director, BUT whether the possibility of gaining some benefit or the fear of losing a benefit is likely to be of such importance to that director that it is reasonable for the court to question whether valid business judgment or selfish consideration animated that director’s vote on the challenged transaction b. Director can be dominated by another, or beholden to another c. Has to be some element of materiality i. Ex: ability to fire, large portion of business, donates to charity 2. In re InfoUSA a. Crazy spending by the CEO and the board, that was wasting corporate assets. i.e. giving corporate money to themselves b. P tried to show that a majority of the board was interested/dominated by CEO Gupta c. Have to show interestedness or lack of independence for each board member, which P did d. Gupta clearly interested e. Kaplan not independent because his law firm’s business coming from InfoUSA was so great i. “the threat of withdrawal of one partner’s worth of revenue from a law firm is arguably sufficient to exert considerable influence over a named partner that his independence may be called into question” f. Raval, Prof. at Creighton. Board earnings more than prof. salary, received 50k grant from Gupta and had social and professional ties to Gupta i. Board earnings is not enough standing along (In re Walt Disney). But the grant obtained from relationship was determinative g. Haddix and Walker both received rent free office space to operate their own businesses, this was enough. 3. Disney Litigation a. Director’s earnings without more not enough to establish interest b. Elementary school teacher on Disney board 4. Oracle Litigation a. Dealt with the independence of an SLC that was 2 people, one of who, was a Stanford prof w/ personal relationship w/ board members who donated to Stanford b. Some prof. or personal relationship, which may border on or even exceed familial loyalty and closeness, may raise a reasonable doubt whether a director can appropriately consider demand. c. Not all friendships, or even most of them rise to this level and the court cannot make a reasonable inference that a certain friendship does without specific factual allegations 5. In re EBay a. Directors of a corporation are not permitted to personally accept private stock allocations in an initial public offering of the corporation’s stock when the corporation itself could have purchased said stock. 18. Chapter 17: The Duty of Care: Intro a. Intro to Fiduciary Duties b. Standards of Care i. MBCA 8.30: Standards of Conduct for Directors 1. (a) each member of the BoD, ehn discharging the duties of a director shall act: a. (i) in good faith, and (ii) in a manner the director reasonably believes to be in the best interests of the corporation 2. (b) the members of the BoD or a board committee, when becoming informed in connection with their decision making function or devoting attention to their oversight function, shall discharge their duties with the care that a person in a like position would reasonably believe appropriate under similar circumstances c. Business Judgment Rule i. Scope: doesn’t apply when there has been no exercise of judgment resulting in a decision, but intentional omissions are protected (p.751) ii. Aronson is the key case iii. Burden Shifting 1. P has initial burden of producing evidence which if believed and uncontradicted would be sufficient to establish that the board decision was not made within the duty of care, loyalty or good faith 2. If P meets this burden, burden shifts to board to challenge the evidence or to show TOTAL FAIRNESS, which is fairness of process and substantive fairness (price) 3. If board meets their burden, burden of persuasion shifts back to P to claim there was waste iv. A corps’ principle defense to such a claim is usually waiver of liability in the articles of incorporation 1. Can waive duty of care violation, BUT NOT duty of loyalty v. Del 144: all this goes away if a majority of disinterested directors, or a majority of disinterested shareholders that are fully informed, ratifies the transaction vi. Shlensky v. Wrigley 1. Cubs BoD refused to install lights, thus no night games 2. Other teams did this and it was profitable 3. Court found not violation of duty of care 4. Need to show fraud, illegality, or conflict of interested in making the decision vii. Negligence 1. “due care in the decision making context is process due care only”Brehm v. Eisner viii. Waste (p.758) 1. Should always include a waste claim in litigation 2. Del: there is waste only if “what the corporation has received is so inadequate in value that no person of ordinary, sound business judgment would deem it worth that which the corporation has paid. Grobow v. Perot: “No Benefit Rule” a. Look at where the benefit of the decision has gone 3. Usually on when the corporation has engaged in a transaction from which it receives no benefit 4. Irrationality is the functional equivalent of the waste test- Brehm v, Eisner a. “Irrationality Rule” i. Look at the character of the decision b. USE BOTH STANDARDS ix. Options Backdating (759-760) 1. One of the rare cases in which a transaction may be so egregious on its face that approval cannot meet the test of business judgment and a substantial likelihood of director liability exists- Ryan v. Gifford a. Giving away value for nothing x. Traditional Waste Standard 1. Rogers v Hill a. “Gift as Corporate Waste”: if a bonus payment has no relation to the value of services for which it is given, it is in reality a gift in part and the majority stockholders have no power to give away corporate property against protest of the minority xi. Executive Compensation 1. In re Walt Disney Litigation a. Issue was severance package for failed director Michael Ovitz 19. Chapter 17: Duty of Care: Duty of Oversight a. Supervision of Ongoing Business i. Francis 1. Determination of liability requires findings that a director had a duty, breached that duty and the breach was the proximate cause of losses 2. Directors should a. Acquire at least a rudimentary understanding of the business b. Have a continuing obligation to keep informed about the activities of the corp c. Attend board meetings d. Remain familiar w/ financial statements e. Inquire into issues that arise 3. A directors duties should be considered in relation to the specific situation a. i.e. company, industry, director’s experience, etc. b. Monitoring i. Graham v. Allis-Chalmers 1. Imposed a duty of inquiry only when there are “obvious signs” of employee wrongdoing a. “Red Flag” test ii. In re Caremark 1. Kind of overrules Graham 2. The directors of a corporation have a duty to make good-faith efforts to ensure that an adequate internal corporation information and reporting system exists 3. Says corp need some system of oversight, but the system is subject to business judgment rule 4. Implementation and carrying out of program 5. “only a sustained or systematic failure of the board to exercise oversight will establish the lack of good faith that is a necessary condition to liability”-p.785 iii. In re Citigroup 1. Ps wanted to extend Caremark rule for legal risk to decision involving business risk 2. Court declines to extend the rule. Says directors will only be liable for failure to manage business risk in the case of gross negligence 3. Caremark didn’t create a new duty, duty to monitor is part of duty of loyalty (quoting Stone v Ritter) 4. Important because lots of states have statutory waivers of duty of care, not duty of loyalty a. Del 102(b)(7) RMBCA 202 c. Where is the Business Judgment Rule i. Ps have to overcome BJR initially by showing interestedness or lack of independence ii. If they overcome BJR, burden shifts to board, who then must show “Entire Fairness” 1. Entire Fairness: Fair dealing and fair price a. Fair dealing relates to the process b. Fair price relates to economic concerns i. Range of values that 2 independent parties might agree to in an arm’s length transaction-p.827 c. Had its origins in the duty of loyalty d. “entirely fair” to the corporations iii. But, a transaction can be ratified by the board, or by a majority of fully informed shareholders 1. Then burden shifts to the Ps to show the board was not fully informed 20. Chapter 17: Duty of Care: Duty to become informed; avoiding liability a. Problem: FiberNet Corp part 4 b. The Basic Rule i. Smith v. Van Gorkom 1. Duty of care in transactions 2. Rule: there is a rebuttable presumption that a business determination made by a corporations BoD is fully informed and made in good faith and in the best interests of the corp 3. Standard of care in duty of care contexts is gross negligence a. Have to show gross neg to show breach of duty of care b. If you can show more, you move from breach of care to breach of duty of good faith, which is an aspect of the duty of loyalty (Stone v Ritter) 4. Have to make decisions w/ informed business judgment 5. Didn’t do that here for 3 reasons a. Didn’t inform themselves as to Van Gorkim’s role in forcing the sale and establishing the price b. Were uninformed about the intrinsic value of the company c. Were grossly negligent in approving the sale of the company upon two hours consideration without prior notice and without exigency or crisis 6. Presumption is rebuttable if the Ps can show that the directors were grossly negligent in that they did not inform themselves of “all material information reasonably available to them.” 7. But even if the board did not vote in a fully informed manner, a merger can be sustained if approved by an informed electorate of shareholders 8. There was no issue that the directors relied on Van Gorkin’s representations, but it was no ok that they didn’t have the documents 9. Experience of the board doesn’t influence the duty of care, except it bears on what is reasonable in what they did a. Here it didn’t matter what their experience was because they literally did nothing 10. Legal opinions aren’t enough either, and neither are threats of suit a. Suits are part of business 11. Normally would have to show that a majority of directors participating in the decision breached their duty of care, like in demand futility, but in this case this did not happened because the board presented a unified defense 12. Key facts a. Publicly traded diversified holdings company b. VG met w/ senior management on his own and discussed selling the company. But he didn’t have authority to do this because only the board as a whole has this authority c. VG came up with $55 per share by saying that’s what he would sell his shares for i. Issues: authority, duty of loyalty, domination/control 13. Focus on the facts when looking at duty of care in a transaction c. The rest of the elements of liability i. Reliance 1. Del 141(e): can reasonably rely on officers and employees a. Look at the person relied upon and information relied upon b. Can also rely on reports that are pertinent to the subj matter upon which the board is called to act, and otherwise be entitled to good faith, not blind, reliance ii. Lack of objectivity 1. Kind of like independence, but the proof required is less than independence a. P.822 iii. Causation 1. P.822 2. Need to show causation and loss, but causation can be inferred iv. Rebutting the BJR 1. P.825-827 2. Cede v. Technicolor (Cede II) a. If the BJR is rebutted, the burden shifts to the directors to prove to the trier of fact the “entire fairness” of the transaction i. To rebut, have to present evidence 3. Even if you show breach, causation and damages, the board can still say its within the best interest of the corporation, in exercise of their role as fiduciaries, to bring the claim or not d. Avoiding liability i. Statutory exculpations (Del and RMBCA) 1. Del 102(b)(7) enables exculpation of director liability for breaches of duty of care 2. RMBCA 202(b)(4): same 3. So, never bring solely an action for breach of duty of care. Always bring a duty of loyalty claim, like domination and control ii. Indemnification Del 145 iii. Insurance 21. Chapter 18: The duty of Loyalty: Self-Dealing a. Problem Starcrest Corp b. Director Self-dealing and conflicts of interests i. BJR is at the center ii. Current statutory approaches 1. Traditional: Remillard Brick Co. iii. Contemporary 1. Del 144 a. Is an “or” statute b. Informed board OR informed shareholders 2. Fliegler vs Marciano (p.853-853) a. Fliegler requires disinterested shareholders vote b. Marciano says that just showing board or shareholder ratification doesn’t mean the litigation ends, but some courts say that once you show ratification, the entire fairness inquiry in precluded 3. BeniHana of Tokyo Inc (Director Ratification) a. If an informed board ratifies a decision, its valid 4. RMBCA Subchapter F c. What is fairness i. Substantive fairness 1. Fair price a. Look at price, need (business purpose), and ability to make the transaction b. Ex: even if RR paid a fair price for the yacht, they have no need for it, so there is no fairness ii. Process fairness 1. Fair dealing a. Disclosure b. Director ratification: independence, full disclosure and good faith c. Shareholder ratification and waste 22. Chapter 18: The Evolution of Good Faith a. Ubiquity of good faith in fiduciary duty analysis i. Dell 144; can cite in loyalty cases, not in good faith cases 1. Don’t get here until P has met burden of production showing that an abuse of discretion has tainted a board decision 2. GO TO STATUTE FOR THIS ii. BJR; independence in decision making; reliance on experts; indemnification 1. If the tainted decision comes from 11 ppl violating different standards (care, loyalty, domination, etc.), P still has to meet burden of production, and the Board has burden of showing entire fairness, ratification by board, shareholders, etc. through either 144 (loyalty), business judgment rule (good care), or judicial standards (good faith) 2. Burden of production for P—Board then has burden for entire fairness—if Board meets burden, P has to resort to showing waste--even then, board can say “eh, this action isn’t in the best interest of the corp” b. The concept of good faith i. Abuse of discretion 1. Director decision that violates conduct norms 2. The source of all this stuff. Every shareholder complaint comes from a director’s abuse of discretion 3. Used to be only about breaches of duty of care ii. Misfeasance 1. Failure to act in good faith a. E.g. Disney Case iii. Nonfeasance 1. Failure to monitor a. E.g. Caremark c. The cases (standards, tests and application) i. Disney 1. Subjective bad faith (actual intent to do harm) 2. Negligent bad faith (more than gross negligence) a. Intentional dereliction of duty b. A conscious disregard of one responsibilities 3. A failure to act in good faith requires conduct that is qualitatively different from, and more culpable than, the conduct giving rise to a violation of the fiduciary duty of care ii. Stone v. Ritter 1. Standard 2. Duty of good faith is found within the duty of loyalty 3. Breaching duty of loyalty by failing to act in good faith 4. “Liability requires a showing that the directors knew that they were not discharging their fiduciary obligations. When directors fail to act in the face of a known duty to act, thereby demonstrating a conscious disregard for their responsibilities, they breach their duty of loyalty by failing to discharge their fiduciary obligation in good faith.”