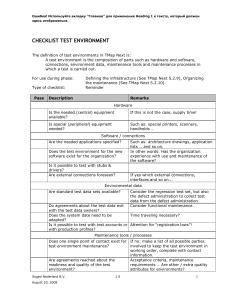

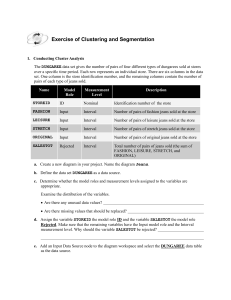

FED TAX I FED TAX I INTRO A. B. C. D. E. F. G. H. I. J. INCOME 2. 3. 4. 5. 1 3 Constitutional Issues Funding Gov’t: Tax Options What is ability to pay? Florida Tax Regime Personal Income Tax Analysis Framework Personal Income Tax Computation Personal Income Tax Computation (pg. 55 Personal Income Tax Computation) Federal Tax Authority Hierarchy Procedure & Choice of Forum (Federal) Policy Analysis Framework GROSS INCOME 8. 9. 8 8 A. B. C. D. E. IRC Treasury Regulations Caselaw IRS Administrative Guidance Examples OBLIGATION TO REPAY 14 A. B. C. D. IRC Treasury Regulations Caselaw Examples GAINS FROM PROPERTY 14 14 14 15 17 A. B. C. D. E. IRC Treasury Regulations Caselaw IRS Administrative Guidance Examples CAPITAL GAINS AND LOSSES 17 17 18 20 21 23 A. B. C. D. E. IRC Treasury Regulations Explanation for the Treatment of Capital Gain & Loss Examples Opportunity Zones 23 25 25 26 28 A. B. C. D. IRC Treasury Regulations Caselaw Examples GIFTS 38 A. B. C. D. IRC Treasury Regulations Caselaw Examples & Explanations LIFE INSURANCE/DAMAGES 38 39 40 42 44 A. B. C. D. E. F. IRC Treasury Regulations Explanations for Life Insurance Caselaw for Damages IRS Administrative Guidance for Damages Examples & Explanations DIVORCE 44 44 44 45 47 47 48 A. B. C. D. E. IRC Treasury Regulations Caselaw IRS Administrative Guidance Examples and Explanations FRINGE BENEFITS 48 48 49 49 49 51 A. B. C. D. IRC Treasury Regulations Caselaw Examples & Explanations 51 52 53 53 EXCLUSIONS FROM INCOME 6. SALE OF PRINCIPAL RESIDENCE (PR) 7. 3 3 4 4 4 4 5 5 6 7 10. 8 8 8 10 10 31 31 31 32 34 35 1 11. DISCHARGE OF INDEBTEDNESS 60 A. B. C. D. E. IRC Treasury Regulations Caselaw IRS Administrative Guidance Examples & Explanations: 60 60 60 61 61 A. Calculation INCOME RECAP 63 A. What is Income? 63 OVERVIEW 12. PERSONAL INCOME TAX COMPUTATION 13. 62 62 62 ОШИБКА! ИСПОЛЬЗУЙТЕ ВКЛАДКУ "ГЛАВНАЯ" ДЛЯ ПРИМЕНЕНИЯ HEADING 1 К ТЕКСТУ, КОТОРЫЙ ДОЛЖЕН ЗДЕСЬ ОТОБРАЖАТЬСЯ.: 2 INTRO A. Constitutional Issues i. 16th Amendment: 1. The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, w/o apportionment among the several States, and w/o regard to any census or enumeration. ii. Commerce Clause (and Dormant Commerce Clause) implicates tax law. 1. Substantial nexus: connection. You need to have a certain connection w/ a state for it to impose tax on you. 2. Wayfair case: prior to Wayfair, for a state to impose tax on a seller, that seller had to have a physical connection w/ the state. a. Now, states can impose tax laws w/ an economic (instead of physical) presence in the state (online sales). Economic presence nexus. iii. Due Process Clause: 1. Can’t take unless due process is involved. If you don’t have the minimum contacts, a state can’t impose taxes. B. Funding Gov’t: Tax Options i. Head tax: don’t see as often 1. Same amount of tax on each person. 2. Not fair b/c of ability to pay. 3. Some states are imposing on businesses for number of employees. ii. Benefits tax: don’t see as often 1. You pay an amount based on the benefit you get. 2. E.g., tolls, vehicle miles traveled, gas. iii. Consumption tax 1. Ex: Sales tax. 2. In other countries: Canada’s goods & services tax. 3. VAT = Value Added Tax: in the EU. A general, broadly based consumption tax assessed on the value added to goods & services. 4. Problem: regressive. Everyone has to spend money on staples and if one poor family spends 50% of net income on food, clothing, etc. and a rich family only spends 5% it is unfair. iv. Wealth tax 1. Estate tax (when someone dies, they’re taxed if estate is over $11m). 2. Inheritance tax. 3. Property tax (biggest source of revenue for localities). v. Income tax ОШИБКА! ИСПОЛЬЗУЙТЕ ВКЛАДКУ "ГЛАВНАЯ" ДЛЯ ПРИМЕНЕНИЯ HEADING 1 К ТЕКСТУ, КОТОРЫЙ ДОЛЖЕН ЗДЕСЬ ОТОБРАЖАТЬСЯ.: 3 C. What is ability to pay? i. It’s fair: even if you don’t believe in a progressive tax, it is important to have some ability to pay standard. D. Florida Tax Regime i. No personal income tax! ii. Sales tax iii. Corporate income tax iv. Property tax 1. “Exemptions” and “caps on increases” v. New: 2/3 supermajority vote required to increase or add new tax E. Personal Income Tax Analysis Framework i. A client walks into your office and tells you about their facts: 1. Is there income? 2. Is there a deduction or credit? 3. If yes: a. To whom? b. When? c. How is it characterized? 4. Can this client pay my fee? F. Personal Income Tax Computation i. What is the base? 1. Income – deductions = base 2. Base x rate = tax ii. Flat v. Progressive Rates 1. Flat tax is easy: same % for everyone. 2. Progressive rates: marginal rates or effective rates. a. It’s not 70% tax on everything— that’s a marginal rate. b. Marginal Rate – amt paid on last $1 iii. 2018 Marginal Rates (Single) 1. $0–$9,525 (10%) 5. $157,001–$200,000 (32%) 2. $9,526–$38,700 (12%) 6. $200,001–$500,000 (35%) 3. $38,701–$82,500 (22%) 7. $500,001+ (37%) 4. $82,501–157,000 (24%) ОШИБКА! ИСПОЛЬЗУЙТЕ ВКЛАДКУ "ГЛАВНАЯ" ДЛЯ ПРИМЕНЕНИЯ HEADING 1 К ТЕКСТУ, КОТОРЫЙ ДОЛЖЕН ЗДЕСЬ ОТОБРАЖАТЬСЯ.: 4 Spring 2019 iv. Calculate Ultimate Tax Due: Multiply income in each bracket by rate % and add together. v. Calculate Effective Rate: Take the total tax amount paid divided by the total income. G. Personal Income Tax Computation (pg. Ошибка! Закладка не определена. Ошибка! Источник ссылки не найден.) i. Business Deductions = above-the-line deductions ii. AGI is used for a lot of limitations iii. Tax Credit vs. Deduction (you want tax credit) 1. Tax credits: dollar for dollar. Comes right off tax liability. If you had $100 tax credit, you take $100 off taxes due. 2. Deductions: $100 tax deduction value would depend on tax b racket. In the top bracket (37%): if you take $100 off your income, it would come off the portion in the 37% tax bracket, so the value of the $100 deduction is actually $37. iv. No more exemptions b/c of tax reform (we have deductions). v. Capital gain against capital loss: 1. $3K is the max per yr. and the remaining loss has to be carried over each yr. (assuming there is no capital gain to offset it). vi. Subtract above-the-line deductions from gross income to get AGI. vii. After tax reform, state & local income tax deduction is capped at $10K. Why should you get a deduction for state & local income tax? 1. Policy reasons: the cost of living in that state would cause people to move. 2. Is this a double tax? It seems like it b/c you never received that money that the state/local income tax took. 3. TPs are subsidizing those living in high tax cities and states (NYC, Chicago). viii. All itemized deductions are below-the-line. 1. Qualified Income Business Deduction ix. § 67: 2% floor not a thing anymore (suspended until 2025). H. Federal Tax Authority Hierarchy U.S. Constitution (Highest authority; Congressional power to enact tax laws) ⬇︎ 5 – – – – – – – U.S. Internal Revenue Code (IRC) (Statutes) (Foundation for all federal tax authority) ⬇︎ U.S. Treasury Regulations Overview of general types: o Final (highest authority issued by the Treasury and binding on the IRS; subject to a change in the IRC) o Temporary (provides guidance until final regulations are issued and have the same authority as final regulations) o Proposed (generally not binding unless the IRS states otherwise) Tax regulation types: o Legislative (same authority as IRC statute) o Interpretive (not specifically authorized by the law and are subject to challenge if they do not reflect congressional intent) o Procedural (generally considered binding on the IRS, e.g., Statement of Procedural Rules [26 CFR 601.105] are only considered directive) ⬇︎ Legislative History ⬇︎ Judicial Authority (Authority based on the rank of court and jurisdiction covered by court) US SC -> US Cr. Ct. Appl. -> US Dist. Ct. -> Tax Ct. -> Ct. of Fed. Claims ⬇︎ IRS Positions Revenue Rulings (official IRS interpretation of IRC and can be relied upon and cited as authority) Revenue Procedures (official IRS interpretation on how to comply w/ the tax law and can be relied upon and cited as authority) Private Letter Rulings, Determination Letters, Technical Advice Memoranda, and Chief Counsel Advice (provide guidance on a specific TP’s situation and cannot be relied upon by other TPs, however, can provide insight on the IRS’s position on certain issues and may lead to a primary source that may not have been previously considered) IRS Forms, Publications, and FAQs (provide guidance only and should not be solely relied upon) ⬇︎ Secondary Sources (Unofficial sources that carry lower weight of authority than primary sources; should not be cited as authority) I. Procedure & Choice of Forum (Federal) i. Audit 1. Why? They think you owe more. 2. Why would you owe more? You might not have reported income. ii. When you receive a letter: 1. Pay (you’re done) 2. Challenge a. Administrative protest. You must exhaust your administrative remedies before you go to court. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—6 b. Tax Court (D.C.): No jury i. ii. TP does not have to pay asserted income tax deficiency to litigate in Tax Court. If TP does not file a Tax Court petition during 90-day period after statutory notice of deficiency, the IRS may begin collection of asserted deficiency. iii. Tax Court decisions are appealable to the federal court of appeals for the circuit where the TP resides. iv. Small claims tax court (subsidiary) 3. Pay and Challenge a. District Court: Jury i. ii. iii. Instead of litigating in Tax Court, TP can pay asserted deficiency and sue for a refund in the federal district court where the TP resides or in the U.S. Court of Federal Claims (D.C.). TP has choice of f orum. U.S. Court of Federal Claims follows precedent of the Court of Appeals for the Federal Circuit. District Court in which TP resides follows precedent of court of appeals for circuit where TP resides. 4. Statute of Limitations: generally, 3 yrs. from date the return for the yr. was filed or, if later, the due date for the return. a. Exception: If TP files a fraudulent return or fails to file a return, there is an open statute of limitation. J. Policy Analysis Framework i. Does it achieve horizontal equity? 1. Is it equitable across the income levels? ii. Does it achieve vertical equity? 1. Does it impact different income levels? Is there a good reason for it? iii. What is the economic impact? 1. Implementing tax change: a. Is it going to generate more revenue? Kickstart the economy? Slow down the economy? iv. Does it make tax sense? v. Would it complicate or simplify? vi. What other policies come into play? Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—7 INCOME 2. GROSS INCOME A. IRC i. § 61(a) Except as otherwise provided in this subtitle, gross income (GI) means all income from whatever source derived . . . B. Treasury Regulations i. § 1.61-1: Gross Income. 1. (a) General definition ii. § 1.61-2: Compensation for services, including fees, commissions, and similar items. 1. (a) In general 2. (d) Compensation paid other than in cash iii. § 1.61-14: Miscellaneous items of gross income. 1. (a) In general a. Punitive damages such as treble damages under the antitrust laws and exemplary damages for fraud are GI. b. Another person’s payment of the TP’s income taxes constitutes GI for the TP. C. Caselaw i. Glenshaw Glass (1955): Test for income 1. Accession to wealth; 2. Clearly realized; 3. Complete dominion & control. ii. Cesarini (N.D. Ohio 1969): Treasure Trove/Found Prop Is Income 1. Facts: a. TPs purchased used piano at an auction in 1957. b. While cleaning piano, TPs discovered $4,467 in old currency in 1964. 2. Held: a. Found money is income to the TP in the yr. in which they found it b/c it satisfies the Glenshaw Glass test. iii. Old Colony Trust (1929): Relief of Obligation to Pay is Income 1. Facts: a. Pet’r paid fed. Income tax owed on salaries for some of its executives. b. Comm’r assessed a deficiency against executives, arguing that pet’r’s payment of their taxes constituted add’l salaries, which was taxable. 2. Held: a. By pet’r paying its executives’ income taxes, that in itself was a form of taxable compensation, whereupon add’l tax was due. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—8 3. Reasoning: a. Accession to Wealth: executives had an obligation to pay & someone paid that obligation for them. b. Realization: Moment obligation was relieved. iv. McCann (Fed. Cir. 1983): Non-Cash/FMV Is Income (Las Vegas Trip) 1. Facts: a. TPs made a round trip to Las Vegas for the purpose of attending a seminar that was conducted by TP’s employer. TPs did not include any amount from trip in GI. b. Employees who qualify for seminars are not required to attend; promotional opportunities are not adversely affected if they fail to attend. c. Employer emphasizes pleasure aspect of seminars. d. Employer schedules sightseeing tours; furnishes participants w/ lists of tennis courts & golf courses at seminar sites; and chooses locations which will have excitement & charisma for qualifying employees. 2. Held: a. Reward to TP, although not in the form of money, was clearly compensation to her for the services she rendered, and therefor taxable income. 3. Reasoning: a. Only way it wouldn’t be income was if it were a work meeting. b. Makes it worse for TP that it’s only for high performers b/c then it’s tied more to compensation for performance. c. When services are paid for in a form other than money, it is necessary to determine the FMV of the thing received. d. If the primary purpose of mixed business-personal travel is personal, the TP is not allowed to deduct any part of the travel costs, even if the TP conducts some business activity while on the trip. v. Pellar (U.S. Tax Ct. 1955): Bargain Purchase Is Not Income 1. Facts: a. TPs contracted w/ stockholder of a corporation for construction of a house for $40K. b. Builder agreed to construct house @ that price even though construction costs would exceed that amount. c. Builder did so in hope of obtaining future business from an individual that had recommended his corporation to the TPs. d. TPs paid $40K for house, total cost of construction was $102K. e. Court found FMV of house was $70K. f. Comm’r argued that TPs received income taxable to them measured by difference b/w price paid & its final cost. 2. Held: Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—9 a. General Rule: a purchase of property for less than its value (bargain) is an accession to wealth but does not give rise to a realization event. Realization normally occurs, and is taxed, upon sale or other disposition. b. Neither TPs nor individual that recommended the builder had any obligation to favor the builder in the future. vi. Rococo (U.S. Tax Ct. 2003): Reward (Qui Tam) 1. Facts: a. TP received a payment from U.S. of $1.57M in 1997 as his share of settlement proceeds in a qui tam action under the False Claims Act. TP did not report this payment. 2. Held: a. Qui tam payment is equivalent of a reward for the TP’s efforts to obtain repayment to the U.S. of overcharges by TP’s former employer. i. Rule: rewards are generally includable in GI per Treas. Reg. § 1.61-2(a). b. Court also compared qui tam payment to punitive damages. i. Punitive damages were not intended to compensate the recipient for actual damages & punitive damages were includable in GI D. IRS Administrative Guidance i. Revenue Ruling 79-24: Barter Transaction Is Income 1. Situation 1: In return for personal legal services performed by a lawyer for a housepainter, the housepainter painted the lawyer’s personal residence. a. The FMV of the services received by the lawyer & the housepainter are includible in their GI under § 61. 2. Situation 2: Apartment owner received a work of art created by an artist in return for rent-free use of apartment for 6 mos. by the artist. a. The FMV of the art & the 6 mos. fair rental value of the apartment are includible in the GI of apartment owner & artist under § 61 & Treas. Reg. § 1.61 -2(d)(1). ii. Notes from class re: barters: 1. When services are traded, there is likely an accession to wealth b/c both pa rties realized a benefit (accession to wealth). 2. There’s probably not an accession to wealth if only goods are traded b/c both parties are in the same position as they were before the trade. E. Examples i. Accountant A normally charges $100/hr. for her time. Amy spends 10 hours preparing her dentist’s tax returns. In return, her dentist provides A & her family w/ approx.. $1K of dental work. 1. A is receiving valuable compensation for her services. A will be t axed on that compensation. The fact that compensation is in the form of services rather than cash is irrelevant. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—10 ii. B writes a will for client & client pays $1K cash. Is that an accession to wealth? 1. Yes, B has something he didn’t have before. iii. B had a root canal for $1K and B’s client (who B wrote will for) paid dentist instead of B. Is that an accession to wealth? 1. B & dentist have an accession to wealth. iv. If B makes a will for himself, it would be an accession to wealth. Would it be taxable? 1. No, imputed income is not taxable. v. C, a lawyer, buys a computer for $750 that is worth $1K. Is there an accession to wealth? 1. Yes, but it is not taxable b/c there is no realization event. vi. D buys a share of Tesla stock for $300. It goes up to $350 by the end of the yr. Should D include increase in GI? 1. No. there is no realization event of the gain. vii. E, a recent law school grad., is an associate w/ a large firm. Which, if any, of the following items must E report as GI? 1. Her salary of $75K. a. Report as GI. 2. Her yr.-end bonus of $5K. a. Report as GI. 3. Walnut bookcase she bought for < FMV. a. If it’s a bargain purchase, she would only report profit from selling it in GI. b. The presumption is compensation b/c E is getting something in employment context—only sold at < FMV to employees. 4. The $2.5K cost of firm retreat. a. Not income b/c employees have to go & it’s > focused on work than McCann case. 5. $2.5K greenhouse E’s brother built as way of thanking her for legal work she had done for him at no charge. a. Report as GI. Barter purchase, Rev. Rul. 79-24. 6. $10K worth of legal services when E represented herself in lawsuit. a. Not income b/c imputed. viii. F purchases stock in XYZ Corp. in Y1 for $1K. At the end of Y1, stock is worth $1.5K. 1. Not income b/c there is no realization event. a. In Y2 when stock is worth $2K, G offers to buy stock for $2K, but F declines. i. Not income b/c there is no realization event. b. In Y3, when stock is worth $2.5K, F borrows $2K from Bank, pledging the stock as security for the loan. i. Not income b/c obligation to repay. c. In Y4, F repays $2K borrowed. i. Not income b/c nothing changes when loan repaid. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—11 d. In Y5, when the stock is worth $3K, F gives it to the Creditor to satisfy a $3K debt owed to the Creditor. i. ix. This is a realization event. He had $2K of taxable incom e (A/R – A/B). Sort of like Old Colony. H catches record home run baseball. Tax implications for each option: 1. Throw back: a. No income b/c no dominion/control. H disclaimed it. 2. Give back to owner for $0: a. If considered a gift [Duberstein Test], H has taxable income. b. If considered a reward [Rococo], H has taxable income. c. No guidance on timing element, i.e., how long b/w H catching & giving ball back to owner. Possibly no income like returning property. 3. Sell/get something for it: a. Taxable income. b. If H gave the ball back to the team in exchange for season tickets, H will get taxed on FMV of season tickets. c. Christian Lopez got $75K worth of stuff in exchange for A-Rod’s home run ball worth $3M. Miller-Coors paid his tax obligation & Lopez had to pay taxes on that income [Old Colony]. 4. Keep: a. Taxable income once it’s sold. b. Distinction b/w found property [Cesarini] and self-created value. c. Most homerun baseball catchers can argue that it’s self -created property: someone who buys a ticket in a certain area where they are most likely to have a chance to catch the home run ball. Then, there is a realization event when sold. x. TP found a bracelet worth $3K on the sidewalk in Y1. She turned it into the police immediately. In Y2, b/c no one claimed it, she received the bracelet. It was then worth $4.7K. She sold it in Y4 for $4.8K. 1. TP has $4.7K GI in Y2 and $100 in Y4. 2. TP did not have an accession to wealth, clearly realized, until Y2. She did not realize the add’l $100 until she sold the bracelet in Y4. xi. Which of the statements below is correct? 1. If a plumber wins a car worth $25K on a game show in 2016 and sells it in 2018 for $15K, he reports $25K of GI for 2016 and no GI for 2018. a. Plumber has income in 2016. When he sells in 2018, he will have a non -deductible loss. 2. If a client pays his lawyer in property other than $, the lawyer has no GI until he sells the property b/c there has been no sale or other disposition by the lawyer. a. Incorrect b/c income isn’t restricted to cash; it also includes property. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—12 3. If a client pays her dentist in property other than $, the dentist has no GI until she sells the property if she reports using the cash receipts method of accounting. a. Incorrect b/c income isn’t restricted to cash; it also includes property. 4. If a carpenter builds herself a new table, she reports the value of the table as GI when she finishes building it if it is worth > than the cost of the materials she us ed. a. Incorrect b/c imputed income is not taxable. xii. L purchased a table at a garage sale for $78 in Y1. In Dec. of Y3, she learned that it was a valuable antique worth $75K. L immediately began selling tickets for tourists to view the table. She received $24 in Y3, $114 in Y4, and $205 in Y5. 1. L reports GI of $24 in Y3, $114 in Y4, and $205 in Y5. 2. The ticket sales are GI. They are admission fees to see the table, not offsets to its purchase price. 3. She does not report gain until she sells or exchanges the t able. Cesarini should not apply: she purchased a table; they purchased a piano & got both a piano & cash. This was just a bargain purchase. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—13 3. OBLIGATION TO REPAY A. IRC i. § 61(a): Except as otherwise provided in this subtitle, GI means all income from whatever source derived . . . B. Treasury Regulations i. § 1.61-8: Rents and royalties. 1. (b) Advance rentals; cancellation payments. a. GI includes advance rentals, which must be included in income for the yr. of receipt regardless of the period covered or the method of accounting employed by the TP. b. An amount received by a lessor from a lessee for cancelling a lease constitutes GI for the yr. in which it was received, since it is essentially a substitute for rental payments. ii. § 1.61-14: 1. (a) In general a. Illegal gains constitute GI. C. Caselaw i. James (1961): Income illegally obtained. 1. Facts: a. TP failed to report embezzled funds in GI. 2. Held: a. Embezzled money constitutes GI in the yr. in which the funds were misappropriated b/c meets Glenshaw Test. b. Both lawful & unlawful gains were comprehended w/in the term GI. c. If forced to repay, then get a deduction. ii. Indianapolis Power & Light Co. (1990): Advanced Payments = GI/Deposits ≠ GI 1. Facts: a. Customers w/bad credit were required to make deposits to insure prompt payment of future utility bills. b. A customer could obtain a refund of the deposit prior to termination of service by requesting a review & demonstrating acceptable credit. Refund by cash, check, or against future bills. c. IPL’s amended rule: deposits were required under a fixed formula. Deposit was refunded if payments were timely for 9 consecutive mos. or 10/12 consecutive mos. 2. Held: a. Customer deposits paid to IPL were security & did not constitute prepayment of income taxable upon receipt. b. The determination of what constitutes income turned upon nature of rights & obligations that IPL assumed when the payments were made. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—14 c. Court relied upon its “complete dominion” formulation to determine that the deposits did not constitute income. d. IPL did not enjoy complete dominion over customer deposits b/c they were acquired subject to an express obligation to repay them either at the time the customer terminated service or when the customer established good credit. e. IPL’s receipt of the deposits was not accompanied by a guarantee that it would be allowed to keep the money notwithstanding the fact that its use of the funds was unrestrained for a period of time. f. Deposits were not advance payments b/c the customer retained the right to insist upon repayment in cash. 3. Test: Who controls conditions of refund? a. Recipient controls—advance payment i. ii. Income to recipient when received from payor Sufficient dominion/control b. Payor controls—deposit i. Income to recipient only when finalized 4. Economic benefit doctrine: a TP recognizes income as soon as the payor irrevocably sets aside funds for the TP in a manner that prevents the payor’s creditors from being able to reach the amount set aside. D. Examples i. Loan: 1. B purchased investment land for $100K. The land increased in value over time and is now worth $400K. B borrowed $240K using the land as collateral. a. B has no GI no matter what he uses the loan proceeds for. Borrowing is not an economic benefit. The loan proceeds are offset by an obligation to repay the loan. If the debtor does not repay, he is likely to have income from discharge of indebtedness. ii. Claim of Right: 1. In May of Y1, college roommates A & Z devise a new computer program. The program is powerful but unwieldy & is rejected by software distributers. After graduation, A enters law school & loses interest in the program. Z continues to work on the project & eventually manages to make the program user friendly. The program is successfully marketed; Z receives $20K/yr. in royalties during Y3 to Y5 for a total o f $60K. In Y6, A sues Z for 50% of the royalties. In Dec. of Y7, a jury finds for A & rewards her a $30K payment. Advise A on how the $30K she receives from Z should be treated for tax purposes: a. A will include the $30K in Y7, the yr. in which she received the funds under a “claim of right,” despite the fact that she might have to return the $30K to Z if the case were reversed on appeal. 2. Since Jan. Y1, J has been employed as a sales rep for a company selling home security systems. In addition to a base salary of $5K/mo., J is entitled to a commission on every Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—15 security system he sells. J’s employer pays him commissions on a semi -annual basis on Nov. 1 & May 1 each yr. In Nov. Y5, J received a commission check for $25K. 1 mo. later, J’s employer advised him he had mistakenly been credited w/ commissions on 2 sales that had been rescinded by the purchasers. According to the employer, J’s Nov. commission should have been $21K. The company demanded that J repay immediately the $4K difference. J refused, arguing the 2 sales were rescinded only b/c his employer had failed to meet its obligations under the sales Ks. The dispute b/w J & his employer continued until Feb. Y6 when J & his employer reached an agreement whereby J repaid his employer $2K. How should J treat the $25K commission check received in Nov. Y5 and repayment of $2K in Y6? a. J had the money, it was being disputed, but at the end of Y5 he had a good claim of right to it. He would claim the $25K as income in Y5 & then he would deduct the $2K he returned in Y6 [North American Oil]. 3. K is a fitness consultant & personal trainer. She charges her clients $2K, payable in advance, for a month-long diet & exercise regimen designed to lose a pre-determined amount of weight. K promises to refund the $2K fee to anyone who follows the diet & exercise regimen but fails to lose the specified amount of weight. K estimates that she refunds about 5% of the fees on this basis. At the end of Dec. she holds $20K in fees from clients whose mo.-long regimens end in Jan. When must K report these fees? a. Considered GI in yr. in which it is received. Claim of right [North American Oil]. K can do whatever she wants w/ the money when she receives it, even though she may have to refund it at a later point. If she has to repay, she can deduct it. iii. Illegal Income: 1. TP1 sold illegal drugs for $50K; he had nondeductible business expenses of $20K. TP2 sold ice cream for $50K; he had deductible business expenses of $20K. a. TP1 & TP2 have same GI. #1 has more taxable income (b/c no deductions), but the same GI. Even illegal income is GI. iv. Advanced Payments vs. Deposits 1. K owns a number of homes he rents to univ. students. K requires the students to pay a security deposit in the amount of 1 mo. rent. The rental agreement used by K specifically provides that security deposits will be applied (a) to compensate K for any property damage or (b) to cover any unpaid rent. If the tenant complies w/ all terms of the agreement, K must return the security deposit. K neither maintains a separate account for nor pays interest on the security deposits. Whenever a tenant damages the property, K bills the tenant for the full amount of the damages w/o deducting the security deposit. Typically, K’s tenants either ask that the security deposit be applied to the last mo. rent or fail to pay the last mo. rent. In any event, K rarely returns a security deposit to a tenant. How would you advice K to treat the security deposits for tax purposes? a. It is probably a deposit and not included in income until the tenant decides to apply it to the last mo. rent or damages. [Treas. Reg. § 1.61-8(b), IPL]. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—16 4. GAINS FROM PROPERTY A. IRC i. § 61 (a): Except as otherwise provided in this subtitle, GI means all income from whatever source derived, including: 1. (3) Gains derived from dealings in property. ii. § 1001: Determination of amount of and recognition of gain or loss 1. (a) Computation of gain or loss a. Amount Realized (A/R) – Adjusted Basis (A/B) = Realized Gain/Loss 2. (b) Amount Realized a. Sum of money & FMV of anything else received iii. § 1011: Adjusted basis for determining gain or loss 1. (a) General rule a. The A/B for determining the gain or loss from the sale or other disposition of property shall be the basis (determined under § 1012), adjusted as provided in § 1016. iv. § 1012: Basis of property. 1. (a) In general a. Basis of property shall be the cost of such property. 2. Basis in property received is FMV of that property when received (which is the same as A/R) in arm’s-length transaction. v. § 1016: Adjustment to basis 1. (a) Proper adjustment shall be made for capital expenditures, receipts, losses, depreciation, and amortization. a. Note: don’t account for inflation vi. § 7701(g) Clarification of FMV in the case of nonrecourse indebtedness. 1. In determining the amount of gain or loss w/r/t any property, the FMV of such property shall be treated as being not less than the amount of any nonrecourse indebtedness to which such property is subject. B. Treasury Regulations i. §1.1001-1: Computation of gain or loss. 1. (a) General rule. 2. (e) Transfers in part a sale and in part a gift. a. Ex(1). D transfers property to his son for $60K. D’s A/B is $30K (FMV of $90K). D’s gain is $30K ($60K A/R - $30K A/B). He has made a gift of $30K ($90K FMV - $60K A/R). b. Ex(2). E transfers property to his son for $30K. E’s A/B is $60K (FMV of $90K). D has no gain or loss, & has made a gift of $60K ($90K FMV - $30K A/R). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—17 c. Ex(3): F transfers property to his son for $30K. F’s A/B is $30K (FMV of $60K). F has no gain & has made a gift of $30K ($60K FMV - $30K A/R). d. Ex(4): G transfers property to his son for $30K. G’s A/B is $90K (FMV of $60K). G has no loss, and has made a gift of $30K ($60K FMV - $30K A/R). 3. (g) Debt instruments issued in exchange for property. a. Debt incurred by purchaser to acquire property is included in purchaser’s basis. ii. § 1.1001-2: Discharge of liabilities. 1. (a) Inclusion in amount realized. a. Seller’s debt assumed by purchaser is included in seller’s A/R. iii. § 1.1012-1: Basis of property. 1. (a) General rule. a. Basis of property is cost. b. Cost is the amount paid in cash or other property. iv. § 1.1016-2: Items properly chargeable to capital account. 1. (a) The cost or other basis shall be adjusted for any expenditure, receipt, loss, or other item, properly chargeable to capital account, including the cost of improvements & betterments made to property. a. Ex: A purchased property in 1941 for $10K. He subsequently expended $6K for improvements. The A/B of the property is $16K. If A sells the property in 1954 for $20K, his gain is $4K. C. Caselaw i. Philadelphia Park Amusement Co. (Ct. Cl. 1954): 1. Facts: a. TP owned a 50-yr. franchise from the City of Philadelphia to operate a RR to serve an amusement park. b. In conjunction w/ exercise of its rights under this franchise, the TP constructed the Strawberry Bridge across a river. c. Some yrs. later, TP exchanged the bridge w/ the City of Philadelphia for a 10-yr. extension of the TP’s RR franchise. d. TP later abandoned its RR franchise & arranged for a bus co. to give passenger service to amusement park. e. TP claimed a deduction for the unrecovered cost of the franchise & contended that unrecovered cost had to be measured by reference to the undepreciated cost of the bridge which it had given in exchange for the extension of the franchise. 2. Issue: Is property exchange a taxable realization event? If so, how is income calculated? a. Yes. PPA was entitled to use the FMV as the cost basis of the franchise for purposes of determining depreciation & loss. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—18 b. Determination of whether the cost basis of property received is its FMV or the FMV of the property given in exchange therefor, although necessary to the decision of this case, is generally not of great practical significance. c. The value of two properties exchanged in an arms-length transaction are either equal in fact or are presumed to be equal. PPA ii. Bridge: A/B: $50 (assume) A/R: $100 Gain: $50 Franchise: A/B: $100 (FMV) If they go to sell it, then we would look at how much they received (A/R) to determine the gain. City Crane (1947) 1. Facts: a. TP inherited property encumbered by considerable nonrecourse debt. TP claimed depreciation deductions based on the FMV of the property at the time of the decedent’s death. b. Later, TP sold the property for a small amount of cash & the purchaser took the property subject to the outstanding debt. 2. Issue: What was the TP’s basis in the property when she inherited it? a. § 1014(a) provides the basis of inherited property shall be equal to the FMV of the property at the date of the decedent’ b. FMV of property at decedent’s death was its value w/o any adjustment for outstanding liabilities, including nonrecourse liabilities. 3. Issue: What was the A/R? a. Nonrecourse debt taken subject to by the purchaser must be considered part of the A/R. b. If the debt encumbering the property had been recourse debt assumed by the purchaser, the TP would have had to treat the relief from that debt as a benefit constituting part of the A/R. c. Fact that the outstanding debt was nonrecourse made no difference. 4. Nonrecourse vs. Recourse: a. Nonrecourse: not personally liable. i. If you don’t pay your home mortgage, they can come take your home, but they can’t take other property. b. Recourse: personally liable. i. If you don’t pay your home mortgage, they can come take your home & car. c. Treated same way. 5. Two rules: Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—19 a. Liabilities, whether recourse or nonrecourse, assumed, taken subject to or otherwise incurred in the acquisition of property are included in a TP’s basis; and b. The liabilities of a seller, whether recourse or nonrecourse, assumed or taken subject to by a purchaser, are included in the seller’s A/R. iii. Tufts (1983): 1. Facts: a. A general partnership obtained a nonrecourse mortgage loan of $1.852M in order to construct an apartment complex. b. The partnership was not unable to make the payments due on the mortgage, and each partner sold his partnership interest to an unrelated 3P who assumed the nonrecourse mortgage. c. On the date of transfer, the FMV of the property did not exceed $1.4M and the partnership’s A/B in the property was $1.456M. d. Each partner reported the sale on his tax return & indicated that a partnership loss of $55.74K had been sustained. e. Comm’r determined that the sale resulted in a partnership capital gain of approx. $400K on the theory that the partnership had realized the full amount of the nonrecourse obligation. 2. Issue: Should a TP who sells property encumbered by nonrecourse mortgage exceeding the FMV of property sold be required to include unpaid balance of mortgage in computation of A/R on sale? a. Yes. It was irrelevant that there was no economic benefit, since under the IRC, the value of the mortgage was relieved, and thus was a taxable benefit to TPs. b. A TP who sells property encumbered by a nonrecourse mortgage exceeding the FMV of the property sold must include the unpaid balance of the mortgage in the computation of the A/R on sale. D. IRS Administrative Guidance i. Revenue Ruling 91-31: Discharge of Indebtedness 1. Facts: a. In 1988, A borrowed $1M from C and signed a note payable to C for $1M. A had no personal liability w/r/t the note, which was secured by an office bldg. valued at $1M that A acquired from B w/ the proceeds of the nonrecourse financing. b. In 1989, when the value of the office bldg. was $800K and the outstanding principal on the note was $1M, C agreed to modify the terms of the note by reducing the note’s principal amount to $800K. c. No bankruptcy or insolvency is involved. 2. Issue: a. If the principal amount of an undersecured nonrecourse debt is reduced by the holder of the debt who was not the seller of property securing the debt, do es this debt Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—20 reduction result in the realization of discharge of indebtedness income for the yr. of the reduction under § 61(a)(12) or in the reduction of the basis in the property securing the debt? 3. Held: a. The reduction of the principal amount of an undersecured nonrecourse debt by the holder of a debt who was not the seller of the property securing the debt results in the realization of discharge of indebtedness income under § 61(a)(12). b. A realizes $200K of discharge of indebtedness income in 1989 as a re sult of the modification of A’s note payable to C. 4. Discharge of indebtedness (even if nonrecourse) by 3P lender is income to the borrower. E. Examples i. A purchased a 5-acre tract of land 10 yrs. ago for $100K. A sold the entire tract of land this yr. for $300K. How much income must A report? 1. $300K (A/R) – $100K (A/B) = $200K gain 2. What if he subdivides the tract into five 1-acre parcels and sells each parcel for $75K? a. $375K (A/R) – $100K (A/B) = $275K gain ii. B purchased a home for $500K. B used $100K of her own funds & borrowed the other $400K from a bank, giving the bank a mortgage on the home. 1. What basis will B have in the home? a. $500K. b. During the 5 yrs. following the purchase of the home, B paid $100 on the principal balance owing the bank under the original mortgage. She thus reduced the amount of the mortgage to $300K. How, if at all, will the $100K in principal payments affect B’s basis in the home? i. No effect. Basis is still $500K. c. B reduced the mortgage balance to $200K. B refinanced the home. As part of the refinancing of the home, B borrowed an add’l $250K from the bank, thus increasing her mortgage to $450K. B used the refinancing proceeds as follows: $75K to remodel the summer home; $125K to purchase a tract of land she will hold for investment; and $50K to pay for a European vacation for her family. What impact will refinancing have on B’s basis in the home? What basis will B have in the tract of land she purchased for investment? i. ii. Tract: $125K. House: $575K ($500K original basis + $75K improvement). d. 2 yrs. after remodeling the home, B, who had never used the home as her PR, sold it. The purchaser paid B $300K in cash and assumed the balance of $400K which B then owed on the mortgage encumbering the home. How much gain, if any, will B realize on the sale of the home? What basis will the purchaser (P) take in the home? i. B: $700K (A/R) – $575K (A/B) = $125K gain Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—21 ii. iii. P’s basis: $700K L purchases one of C’s paintings for $6K. C then uses the $6K to pay the legal fees owed to L. 5 yrs. later when the painting has significantly increased in value, L sells the painting for $10K. 1. L: $10K (A/R) – $6K (A/B) = $4K gain in Y5 2. C: $6K (A/R) – $0 (A/B) = $6K gain in Y1 a. Alternatively, assume L, instead of paying C $6K for the painting, agrees to accept it as payment in full of the legal fees C’ owes L. Assume, as before, that L sells the painting for $10K 5 yrs. later. i. ii. iv. L: $6K = ordinary income in Y1 L: $10K (A/R) – $6K (A/B) = $4K gain in Y5 K owns an undeveloped 5-acre tract of land in Phoenix, AZ. K’s Phoenix land has a FMV of $750K and her A/B is $450K. K transfers her Phoenix land to P in exchange for a tract of undeveloped lakefront property P owns at Lake Tahoe. K plans to build a home for herself on the Lake Tahoe property. Assume P’s Lake Tahoe property has a FMV of $750K and he has an A/B of $100K. 1. What are the tax consequences to K & P on the exchange? a. K (Phx): $750K (A/R assumed FMV) – $450K (A/B) = $300K gain b. P (LT): $750K (A/R assumed FMV) – $100K (A/B) = $650K gain c. K’s basis in LT = $750K d. P’s basis in Phx = $750K 2. K’s Phoenix land had a FMV of $800K and P transferred his Lake Tahoe p roperty plus $50K in cash in exchange for the land? a. K (Phx): $800K (A/R assumed FMV) – $450K = $350K gain b. P (LT): $800K (A/R assumed FMV) – $150K (A/B+cash) = $650K gain c. K’s basis in LT = $750K d. P’s basis in Phx: $800K v. R purchased undeveloped land for $25K in Y1. In Y2, he borrowed $200K & used the loan proceeds to build a vacation home. The addition of a home increased the property’s value to $480K. R’s A/B is now: 1. The vacation home was an improvement to his property & increases his $25K original basis to $225K. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—22 5. CAPITAL GAINS AND LOSSES A. IRC i. § 61(a): Except as otherwise provided in this subtitle, GI means all income from whatever source derived, including: 1. (3) Gains derived from dealings in property. ii. § 1001: Determination of amount of and recognition of gain or loss. iii. § 1221: Capital asset defined. 1. (a) In general. a. Capital asset means property held by the TP (whether or not connected w/ his trade or business), but does not include: i. (1) Stock in trade of the TP or other property of a kind which would properly be included in the inventory of the TP, or property held by the TP primarily for sale to customers in the ordinary course of his trade or business; ii. (3) A patent, invention, model, or design, a secret formula or process, a copyright, a literary, musical, or artistic composition, a letter or memo, or similar property, held by 1. A TP whose personal efforts created such property [aka self-created property]. a. (b)(3) Sale or exchange of self-created musical works. i. iv. At the election of the TP, (a)(1) and (a)(3) shall not apply to musical compositions or copyrights in musical works sold or exchanged by a TP described in (a)(3). § 1222: Short-term versus long-term capital gain/loss. a. If held more than 1 year = long-term, otherwise short-term b. Capital gain ONLY IF sale or exchange v. § 165: Losses 1. (a) General rule. a. There shall be allowed as a deduction any loss sustained during the taxable yr. & not compensated for by insurance or otherwise. 2. (c) Limitation on losses of individuals. a. The deduction under (a) shall be limited to: i. ii. iii. Losses incurred in a trade or business; Losses incurred in any transaction entered into for profit, though not connected w/ a trade or business; and Losses of property not connected w/ a trade or business or a transaction entered into for profit, if such loses arise from fire, storm, shipwreck, or other casualty, or from theft. 3. (f) Capital losses. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—23 a. Losses from sales or exchanges of capital assets shall be allowed only to the extent allowed in §§ 1211 and 1212. vi. § 1211: Limitation on capital losses. 1. (b) Other TPs. a. Losses from sales or exchanges of capital assets shall be allowed only to the extent of the gains from such sales or exchanges, plus (if such losses exceed such gains) the lower of: i. ii. vii. $3K/yr. to offset ordinary income (carryover provision ); or the excess of such losses over such gains. § 1212. Capital loss carrybacks and carryovers. 1. (b) Other TPs. a. (1) In general. i. Offset STCG w/ STCL ii. Offset LTCG w/ LTCL iii. If excess STCL, offset LTCG w/ STCL iv. If excess LTCL, offset STCG w/ LTCL v. If you have LT & ST gain, preferential treatment on LT & ordinary income on ST. b. (2) Treatments of amounts allowed under § 1211(b)(1) or (2): i. viii. Non-utilized capital losses can be carried forward 1. Carryover loss retains initial characterization as either LT or ST LT ST Y1 CG $5K $5K Y1 CL ($8K) ($12K) Y1 Net ($3K) ($7K) Y1 Offset (deducted) ($3K) Leftover loss for Y2 (3K) ($4K) Y2 CG $0 $10K Y2 CL (carryover) ($3K) ($4K) Y2 Net ($3K) $6K Y2 Offset (STCG) $3K § 1(h) Maximum capital gains rate. 1. Short term is lumped in like ordinary income 2. (1)(B)–(D) Long term capital gains: 20%, 15%, or 0% a. Depends on TP’s ordinary income tax bracket (marginal rate) b. To fund Obamacare, there is an add’l 3.8% added to the 20% people who make over $200K. 3. (4), (5) Collectibles gain and loss: 28% a. Any work of art, any rug or antique, any metal or gem, any stamp or coin, any alcoholic beverage. § 408(m)(2). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—24 4. (11) Qualified dividends: 20%, 15%, or 0% a. Calculate separately from capital asset gain/loss b. Not capital assets (even though they’re w/in the same rate structure). c. A dividend is a distribution by a corporation to its shareholders of a share of the earnings of the corporation. B. Treasury Regulations i. § 1.1221-1 Meaning of terms. 1. (a) In determining whether a property is a “capital asset,” the period for which held is immaterial. 2. (c)(1) For the purposes of § 1222(a)(3), the phrase “similar property” includes for ex., such property as a theatrical production, a radio program, a newspaper cartoon strip, or any other property eligible for copyright. Protection, but does not include a patent or an invention, or a design which may be protected only under the patent law and not under the copyright law. 3. (c)(3) For purposes of § 1222(a)(3), property is created in whole or in part by the personal efforts of a TP if such TP performs literary, theatrical, musical, artistic, or other creative or productive work which affirmatively contributes to the creation of the property, or if such TP directs & guides others in the performance of such work. C. Explanation for the Treatment of Capital Gain & Loss i. Capital gain should be taxed at a lower rate b/c the gain included in the yr. in which the asset is sold may throw the TP into a higher tax bracket than the TP would have been in had the gain been taxed over a # of yrs. 1. However, allowing income averaging would be a much more precise way to solve the bunching problem for TPs who are generally taxed at lower rates. ii. TP owns 4 stocks: A (LTCG $5K); B (STCG $5K); C (LTCL $5K); and D (STCL $5K). Which two should TP sell? 1. If TP sells A&B: a. End up w/ net gain of $10K ($5K taxed at preferential rate & $5K taxed at ordinary rate). b. Not the best option: Might not be able to generate enough cash to pay for tax from selling stocks. 2. If TP sells B&C: a. End up w/ net of $0 and pay no tax. b. Ok option. 3. If TP sells C&D: end up w/ net loss of $10K. $3K of STCL can be deducted from ordinary income. 4. Left w/ $7K loss in next yr. ($5K LTCL and $2K STCL). 5. Best option to generate income. iii. If client asks for tax implications of selling 10 shares of stock, ask: Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—25 1. Is this a capital asset? Yes, stocks are capital assets. 2. Did you sell it as a gain or loss? [A/R – A/B] a. Sold it at a gain: How long have you had it for? What rate does the gain fall in? b. Sold it as a loss: Is it allowable or personal? For personal, don’t get anything. Stocks are assumed to be allowable, so ask: i. How long have you had it for? [capital loss netting]. D. Examples i. Determine which of the following are capital assets for T&M who own all stock of Friendly Car Dealership (FCD): 1. Sedan FCD received from manuf. & has been placed in sales showroom. a. Not capital asset: § 1221(a)(1). 2. Van FCD uses to transport customers to & from its service dep’t. a. Not capital asset: § 1221(a)(2). 3. The new station wagon T&M have just purchased as their family car: a. Capital asset. 4. The land and building FCD owns and uses in the car dealership. a. Not capital asset: § 1221(a)(2). 5. Vacant land T&M purchased as an investment. a. Capital asset. 6. Promissory note FCD received on the sale of new car. a. Not capital asset. 7. T&M’s home. a. Capital asset. 8. A painting M’s mother painted & gave to M shortly before mother died. a. Not a capital asset; self-created property characterization. b. Same basis & holding period as mother. 9. 2nd painting by M’s mother, which M received as heir to mother’s estate. a. Capital asset. b. No carryover b/c of death. 10. Manuscript for a book T&M wrote re: history of FCD. a. Not capital asset: § 1221(a)(3). 11. M’s wedding ring. a. Capital asset. 12. T&M’s stock in FCD. a. Capital asset: not stock in the trade b/c it’s not inventory. 13. Computer which FCD formerly owned & used in the dealership, but which T&M now own & use to manage their investments. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—26 a. Capital asset. ii. S hired by State Univ. as head basketball coach. Under the 5-yr. K b/w Steve & State Univ., the Univ. agreed to pay S $250K/yr. After 3 losing seasons, the Univ. bought out the remainder of S’s 5-yr. K for $400K. S believes he should report the $400K as LTCG b/c he, in effect, is selling property, i.e., his K rights, which he has held for > 12 mos. 1. The $400K is treated as wages. iii. D became aware of rapid appreciation in value of certain rec. properties located near a major nat’l park. He purchased the properties anticipating they would appreciate in value & intending to resell them when he could make a satisfactory profit. Over a 3-yr. period, D purchased 15 tracts. He subdivided some of the tracts, made surveys, obtained some rights of way, installed some drainage facilities & extinguished easements on the land. He did not otherwise add any structures of facilities to the land purchased. The demand for large tracts of unimproved property like that owned by D became so great that he did not have to advertise—prospective buyers using public records identified him as the owner & contacted him. D sold 10 parcels of land this yr. In each instance, the sale was initiated by the purchaser. D never listed any properties w/ a real estate broker & realized gain of $150K on the 10 parcels. What is the character of his gain? 1. Look at activities: a. Probably inventory: subdividing, frequency. b. Probably capital asset: no advertising. iv. H & N (married) file joint tax return. 1. H&N sold their summer home for $240K. They purchased the home 4 yrs. ago for $170K & never used the home as their PR. a. Capital asset ($70K LTCG, preferential treatment). 2. H sold a painting for $130K. H purchased the painting as an investment 6 yrs. ago for $50K. a. Capital asset ($80K gain, collectible treatment). 3. N sold 100 shares of stock in Z corp. for $70K. She had purchased the stock as an investment 8 mos. ago for $60K. a. Capital asset. ($10K STCG, ordinary income treatment). 4. H&N received $10K in qualified dividend income w/in meaning of § 1(h)(11)(B). a. Not included in CG; receives preferential treatment (same as LTCG). 5. H&N earned $275K in compensation. How much GI will H&N have? a. $275K (ordinary income) + $10K (Qdiv) + $70K (LTCG) + $10K (STCG) = $445K. 6. How much NCG? $160K. 7. H&N sold some land which they had purchased 11 mos. previously & held for investment. They paid $150K and sold it for $90K. How much loss may H&N deduct? a. Land is capital asset b/c purchased as investment. b. Short-term: $10K + ($60K) = ($50K) Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—27 c. Long-term: $70K + $80K (collectible) i. ii. If excess STCL, offset LTCG w/ STCL BUT STCL offset against collectible first. iii. $80K + ($50K) = $30K (collectible treatment, 28%) iv. $70K LTCG receives preferential treatment. 8. Instead, H&N held the land for 13 mos. before selling it. a. Short-term: $10K (ordinary income treatment) b. Long-term: $70K + ($60K) = $10K LTCG (preferential treatment); $80K (collec tible 28%). 9. Instead, H&N paid $250K for the land they held for 11 mos. Also, H&N sold Y stock which they held for 15 mos. at $30K loss. a. $90K (A/R) – $250K (A/B) = ($160K) b. Short-term: $10K + ($160K) = ($150K) c. Long-term: $70K + ($30K) = $40K LTCG + $80K collectible d. Net: ($30K) STCL e. Carryover: ($27K) STCL E. Opportunity Zones i. § 1400Z-1 1. (a) The term “qualified opportunity zone” means a population census tract that is a low income community that is designated as a QOZ. 2. Provides the procedural rules for designating QOZ and related definitions. ii. § 1400Z-2 1. Provides two main tax incentives to encourage investment in QOZ. a. It allows for deferral of inclusion in GI of certain gain to the extent that a TP elects to invest a corresponding amount in a QOF. i. Additionally, w/r/t deferral of inclusion in GI certain gain invested in a QOF, § 1400Z-2 permanently excludes a portion of such deferred gain if the corresponding investment in the QOF is held for 5 or 7 yrs. b. It allows for the TP to elect to exclude from GI the post-acquisition of gain on investments in the QOF held for at least 10 yrs. iii. Goal: to encourage TPs to sell appreciated assets, and then make long-term investment in low income areas w/ the gain. iv. Benefits include gain deferral/elimination for TPS who roll over CG into a QOF: 1. Specifically, if an investor: a. Recognizes CG from the sale of an asset to an unrelated person; b. Invests an amount equal to all or part of the CG in a QOF w/in 180 days of the date the gain is recognized; and c. Makes an election (on IRS Form 8949) to treat the investment as a QOZ investment; Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—28 2. The investor is eligible for QOZ benefits. Four (huge) benefits include: a. For CG invested in QOF, tax deferred until earlier of sale of QOF investment or 2026; b. Basis of CG invested is increased (and thus tax decreased) by 10% of invested amount if QOF held for 5 yrs., and an add’l 5% if held for 7 yrs.; c. Amount recognized when QOF sold or 2026 is lesser of CG invested or current FMV in QOF investment; and d. If QOF investment held for ≥ 10 yrs., any gain in QOF investment is tax free. v. QOF requirements: 1. 90% or more of its assets (on avg.) are comprised of: a. QOZ Business Property (QOZBP); and/or b. Interests in a partnership or corporation that qualifies as a QOZBP. 2. QOZBP is tangible property: a. Acquired after 12/31/17, by purchase from unrelated person; b. The original use of which in the QOZ commences w/ the QOF or QOZB; or which the QOF or QOZB substantially improves; and c. Substantially all of the use of which is in a QOZ during substantially all the time it is held by the QOF or QOZB. vi. QOZB must be a partnership or corporation for fed. Income tax purposes that satisfies a variety of tests including: 1. At least 70% of tangible property it owns/leases is QOZBP; and 2. It is not a “sin business.” vii. QOF Investor Guidance 1. An investor is eligible for QOZ benefits if, w/in 180 days after recognizing CG from the sale of property to an unrelated person, the investor invests an amount equal to all or part of that CG in a QOF. 2. Upon a QOF investor’s sale or exchange of its QOF interest , the QOF investor will not recognize gain provided that the QOF investor held its interest in the QOF for ≥ 10 yrs. & the QOF investor disposes of its QOF interest on or before 12/31/47. a. Gain is eliminated by allowing QOF investor to elect to step up its tax basis for its QOF interest to its FMV immediately before the sale. viii. Answer to Essay Q about QOF: 1. J was approached by the shady real estate developer who purchased her vacant land promising a “once in a generation” tax opportunity & wants her to invest in this new project (he can tell from public records that she made a good amount of money on the sale). The real estate venture is a QOF, & J is asking you if there really are tax advantages to investing (& to what extent). 2. If J invested in the QOF w/in 180 days of selling the capital assets, she would be able to defer her CG from selling the capital assets until she sold the QOF or until the yr. 2026. If she held the QOF for 5 yrs., her basis would be increased (& thus tax decreased) by 10%. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—29 If she held the QOF for 7 yrs., her basis would be increased (& thus tax decreased) by an add’l 5%. The CG in the property are not recognized until the QOF investment is sold or the FMV is determined in the yr. 2026, whichever comes first. If the QOF investment is held for at ≥ 10 yrs., any gain in QOF investment is tax free. a. Define QOZ & QOF b. CG this yr.: Initial basis is $0. Basis stepped up by 15% form holding property for 7 yrs. by 2026. c. Investment: $80K (vacant lot) $10K (Brady football card): If they hold it for 7 yrs., the basis goes up 15% of $80K and 15% of $10K. ix. Example: bought property for $500K in 2012. Sold in 2019 for $2.5M. Compared A/R Basis Gain Rate Tax No Opportunity Zone $2.5M $500K $2M 20% $400K Opportunity Zone $2M (amount invested) $300K (15% of A/R) $1.7M 20% $340K Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—30 EXCLUSIONS FROM INCOME 6. SALE OF PRINCIPAL RESIDENCE (PR) A. IRC i. § 61(a)(3) Except as otherwise provided in this subtitle, GI means all income from whatever source derived, including (but not limited to) the following items: 1. Gains derived from dealings in property. ii. § 121: Exclusion of gain from sale of PR. 1. (a) Exclusion. a. GI shall not include gain from the sale/exchange of property if, during the 5 -yr. period ending on the date of the sale/exchange, such property has been owned & used by the TP as the TP’s PR for periods aggregating 2+ yrs. 2. (b) Limitations. a. (1) The amount of gain excluded from GI shall not exceed $250K. b. (2) In the case of a husband & wife filing jointly: i. (A) Para. (1) shall be applied by substituting $500K if: 1. Either spouse meets the ownership requirements; 2. Both spouses meet the use requirements; and 3. Neither spouse claimed a deduction in past 2 yrs. c. (3) Sub. (a) shall not apply if TP claimed deduction in past 2 yrs. d. (5) Exclusion of gain allocated to nonqualified use. i. ii. (A) sub (a) does not apply to the gain from the sale/exchange of property allocated to periods of nonqualified use. (B) Gain shall be allocated to periods of nonqualified use based on the ration to which: 1. Aggregate periods of nonqualified use during the period such property was owned by the TP, bears to 2. The period such property was owned by the TP. iii. (C) Period of nonqualified use. 1. The term nonqualified use means any period (other than the portion before 1/1/09) during which the property is not used as the PR of the TP or TP’s spouse/former spouse. 2. Exceptions: The term nonqualified use does not include a. Any portion of the 5-yr. period described in sub (a) which is after the last date property was used as PR. b. Any period (not to exceed an aggregate period of 10 yrs.) during which the TP was serving in military or temporarily absent due to change of employment, health conditions. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—31 3. (c) Exclusions for TPs failing to meet certain requirements. a. The ownership & use requirements of (a) and (b)(3) shall not apply; but the dollar limitation under (b)(1) or (2) shall be equal to: i. The amount which bears the same ratio to such limitation as: 1. The shorter of a. The aggregate periods, during the 5-yr. period ending on the date of sale/exchange, such property has been owned & used by the TP as the TP’s PR; or b. The period after the date of the most recent prior sale/exchange that TP claimed deduction, bears to 2. 2 years. b. This subsection shall apply to any sale/exchange if: i. TP would not be able to exclude gain by reason of: 1. Failure to meet ownership & use requirements, or 2. Used exclusion in previous 2 yrs., and ii. Sale/exchange is by reason of a change in place of em ployment, health, or unforeseen circumstances. B. Treasury Regulations i. § 1.121-1 1. (a) In general. 2. (b) Residence a. (1) Whether property is used by the TP as the TP’s residence depends upon all the facts & circumstances. b. (2) If TP uses >1 property as a residence, whether property is used by TP as the TP’s PR depends upon all the facts & circumstances. Relevant factors: i. ii. TP’s place of employment; Principal place of abode of TP’s family members; iii. Address listed on TP’s tax returns, DL, car registration, & voter registration; iv. TP’s mailing address for bills & correspondence; v. vi. Location of TP’s banks; and Location of religious orgs & rec clubs. c. (3)(i) Vacant land. Generally, sale/exchange of vacant land is not a sale/exchange of TP’s PR unless: i. ii. Vacant land is adjacent to land containing the dwelling unit of the TP’s PR; TP owned & used the vacant land as part of TP’s PR; Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—32 iii. TP sells/exchanges dwelling unit in sale/exchange that meets the requirements of § 121 w/in 2 yrs. before or 2 yrs. after date of sale/exchange of vacant land; and iv. § 121 requirements otherwise met w/r/t vacant land. d. (3)(ii) Sale/exchange of dwelling unit & vacant land are treated as one sale/exchange. Only one max. limitation amount of $250K (or $500K) applies to the combined sales/exchanges of vacant land & dwelling unit. 3. (c) Ownership and use requirements. a. (1) In general, requirement of ownership & use for periods aggregating. 2 yrs. or > maybe satisfied by establishing ownership & use for 24 full mos. or 730 days. i. (2) Use: Occupancy of the residence is required. However, short temporary absences, such as for vacation or other seasonal absence (although accompanied w/ rental of the residence), are counted as periods of use. ii. § 1.121-2: Limitations iii. § 1.121-3: Reduced maximum exclusion for TPs failing to meet certain requirements. 1. (b) In order for TP to claim a reduced max. exclusion under § 121(c), the sale/exchange must be by reason of a change in place of employment, health, or unforeseen circumstances. 2. (c) Sale or exchange by reason of a change in place of employment. a. Change in place of employment occurs during TP’s ownership & use of property as TP’s PR; and b. Qualified individual’s new place of employment is ≥ 5o mi. from residence sold/exchanged than was former place of employment, or, if there was no former place of employment, distance b/q new place of employment & residence sold/exchanged is ≥ 5o mi. i. Qualified individual: TP, TP’s spouse; co-owner of residence; a person whose principal place of abode is in the same househ old as TP. 3. (g) Computation of reduced maximum exclusion. a. Computed by multiplying the max. $ limitation by a fraction. b. Numerator: shortest period of time the TP owned the property during 5 -yr. period; the period of time that the TP used the property as the TP’s PR during the 5-yr. period; or period of time b/w date of a prior sale/exchange of property for which TP excluded gain under § 121 & date of current sale/exchange. c. Denominator: 730 days or 24 mo. (depending on measure of time in numerator). d. Ex(1): TP A purchases a house that she uses as her PR. 12 mos. after the purchase, A sells the house due to a change in place of her employment. A has not excluded gain under § 121 on a prior sale/exchange of property w/in. last 2 yrs. A is eligible to exclude up to $125K of the gain from the sale of her house (12/24 x $250K). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—33 e. Ex(2): TP H owns a house that he has used as his PR since 1996. On 01/15/99, H & W marry & W begins to use H’s house as her PR. On 01/15/00, H sells the house due to a change in W’s place of employment. Neither H nor W has excluded gain under § 121 on a prior sale/exchange of property w/in the last 2 yrs. i. B/c H & W have not each used the house as their PR for at least 2 yrs. during the 5-yr. period preceding its sale, the maximum dollar limitation amount that may be claimed by H & W will not be $500K, but the sum of each spouse’s limitation amount determined on a separate basis as if they had not been married. See § 1.121-2(a)(3)(ii). ii. H is eligible to exclude up to $250K of gain b/c he meets the requirements of § 121. W is not eligible to exclude the maximum dollar limitation amount. Instead, b/c the sale of the house is due to a change in place of employment, W is eligible to claim a reduced maximum exclusion of up to $125K of the gain (365/720 x $250K). therefore, H & W are eligible to exclude up to $375K of gain ($250K + $125K) from the sale of the house. C. Caselaw i. Guinan (D. Ariz. 2003): Did they use residence as principal residence? 1. Facts: a. TPs excluded gain realized from a sale of their residence in WI. During the 5 -yr. period, TPs also owned residences in GA & AZ. b. It was undisputed that the TPs occupied their WI residence on more days in total during the relevant period than either of the other residences. This was not determinative for purposes of § 121(a) since the governing regulation referred to the time spent in a residence during a single tax yr. c. TPs spent > time in WI house only during the 1st yr. of the 5 -yr. period. 2. Held: a. While time spent in a residence was a major factor, if not the most important factor, in determining whether it was the principal residence, other factors were also relevant. b. In this case, those other factors, taken as a whole, do not establish that the WI house was TP’s PR during the relevant time period. c. Yr. by yr. determination: can only have 1 PR per yr. ii. Gates (T.C. 2010): Remodel vs. Rebuild 1. Facts: a. TPs lived in a house on the property for 2 yrs. and, after discovering that enlarging & remodeling the house was not feasible, TPs demolished the house & constructed a new house on the property, which was never used by the TPs as a residence. b. TPs contended that the real property was the TPs’ PR for 2 of the 5 yrs. prior to the sale of the property. 2. Held: Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—34 a. The TPs could not exclude from their income the gain on the sale of the new house since the new house was never used as the TPs’ PR.. b. Although TPs resided on the real property for the resided on the real property for the requisite period, a sale of property meant a sale of a house or other dwelling unit which the TPs used as their PR, together w/ the real property. c. When the TPs sold the new house in which they never resided, they did not sell a dwelling unit which was their PR. D. Examples i. J owned a home in G-ville for 4 yrs. She moved to Orlando but let her son P stay in the G-ville home while he finished his Ph.D. studies. J sold the home 3 yrs. after she moved out & realized a gain of $140K. She still owns the Orlando home. 1. J can exclude her entire $140K gain. Her gain did not exceed $250K; she satisfied the ownership & use requirements; use after she moved out is not unqualified use; purchase of a new home does not matter on these facts. ii. One year after G purchased & moved into his 1st home, the city took the home by eminent domain. It needed the land to expand a city park. G received compensation from the city that was $210K greater than the cost for the home. G does not plan to buy another home. 1. Greg has GI of $85K. G qualifies for a reduced exclusion b/c of unforeseen circumstances. His maximum exclusion is 12/24 of $250K ($125K). His GI is $210K – $125K = $85K. iii. J bought his 1st home for $100K. He occupies the house as his PR until he sells it for $150K b/c he has to move to another city to take a new job. His gain is $50K. 1. J owned & occupied the home for 3 yrs. a. Since this is the first property J has ever owned, he has not used the § 121 exclusion w/in the last 2 yrs. He satisfies the eligibility requirements for § 121 b/c he has owned & occupied the property as his PR for at least 2 of the previous 5 yrs. He can permanently exclude the entire $50K of gain. 2. J owned the property for 3 yrs. but occupied the property for only the first 3 mos. a. J moved b/c of a change of employment, so he is eligible to exclude a portion of his gain even though he occupied the home for < 2 of the previous 5 yrs. He can exclude $31,250 ($250K x 3 months/24 months). He will include in income $18,750 of gain ($50K gain realized – $31,250 excluded under § 121). iv. Did S own & use her LA home as her PR for the requisite time for § 121 purposes? 1. Timeline: a. 01/01/13: Purchased LA home b. 09/01/14 to 12/31/14: temp. 4 mo. assignment in NYC c. 01/01/15 to 08/31/15: alternated b/w LA & NYC d. 09/01/15: sold LA home 2. S owned & used her LA home as her PR. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—35 a. She only had one PR (LA) from 01/01/13 to 12/31/14 (2 yrs.). Even though she was not using her LA home for 4 mo. temp. position, the regs say temp. absences will cout as use. b. When she alternated b/w LA & NYC for 8 mos., Guinan says since it’s 50/50, we look at all the factors. This problem doesn’t give those factors to determine whether she satisfied use, but assuming she still had ties to LA we can count this as 4 mos. use. 3. Assume S’s LA home was situated on 2 city lots. Her house was on one of the lots. She used the other lot for her vegetable & flower gardens. Assume the LA home constituted her PR. On 09/01/15, S sold the house & the lot on which it was located to A. On the same day, she sold the other lot to E. S realized $125K gain on each sale. May she take advantage of § 121 w/r/t each sale? a. As long as it’s next to our touching the main property & she’s using it for something, then she will likely be able to take advantage of § 121. b. A PR may include land surrounding the dwelling. Gates; § 1.121-1(b)(3)(A). v. B&J (husband/wife) purchased a home in Seattle in 2006 for $350K & held title to the home as joint tenants w/ right of survivorship. The home was their PR until 05/2014 when they moved to a town in northern Idaho where they purchased a home for $250K. On 01/2015, B&J finally sold their Seattle home. The purchaser paid B&J $750K in cash & assumed a $250K mortgage encumbering the property. B&J added an add’l room to the Seattle home, and, as a result, had an A/B in that home of $400K. 1. A/R – A/B = gain/loss: $1M – $400K = $600K gain. 2. 2006 to 05/2014: owned & used Seattle home as PR 3. 05/2014 to 01/2015: did not own & use Seattle home; not a non -qualified use b/c it isn’t being rented. However, even if it was, it doesn’t affect the outcome here. 4. Can exclude up to $500K gain. vi. On 05/01/15, T&C married & moved into a new home they purchased in MIA. Prior to their marriage, T owned his home in Ft. L.; C owned her home in MIA. T sold his Ft. L home on 03/01/15 for $550K. T had owned & used that home as his PR since 2005. He had an A/B in the home of $400K. C never lived in T’s Ft. L. home. C sold her home in MIA in 12/2015. She had owned & used the home in MIA as her PR since 2002. She had a $300K A/B in the home & sold it for $800K. T never lived in C’s MIA home. Neither T nor C had ever taken advantage of § 121. 1. Assume T&C file a joint return for 2015. a. T’s Ft. L. home: $550K – $400K = $150K (gain). b. C’s MIA home: $800K – $300K = $500K (gain). c. B/c T&C have not both used each home as their PR for at least 2 yrs. during the 5 yr. period preceding the sale of their respective homes, the max. amount they may claim will be the sum of each spouse’s limitation amount determined as if they had not been married. d. They can exclude $150K as a result of the sale of T’s home. e. They can exclude $250K as a result of the sale of C’s home. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—36 f. In total, they can exclude $400K. 2. Had T&C consulted you before they sold their respective homes, what advice might you have given them re: a way to maximize benefits provided by § 121? a. Sell T’s home & live together in C’s home for 2 yrs. before selling it. Th at would maximize their exclusion ($500K). vii. A, who is single, worked in NYC where, until her retirement in 08/2011, she lived in a rented apartment. On 01/01/06, A purchased a home in E. Hampton which, prior to her retirement, she used only on weekends. On 01/01/12, A gave up her NYC apartment & made the E. Hampton home her principal residence until 01/01/15 when she moved out & put the E. Hampton home on the market. She sold the E. Hampton home on 01/01/16 and realized $300K of gain on the sale. Assuming A has never previously taken advantage of § 121, how much of the $300K of realized gain may she exclude under § 121. 1. She doesn’t get to exclude the whole $300K b/c there is a cap of $250K. 2. 01/01/05 to 01/01/09 (not considered non-qualified use b/c provision did not start until 01/2009). B/w 01/01/09 and 01/01/12, there were 3 yrs. of non -qualified use at beginning of ownership. 3. Numerator is 3 (yrs. of non-qualified use). Denominator is 10 (total yrs. of ownership): 3/10 = 30%. 4. Only multiply by the cap if didn’t own & use as PR for past 2/5 yrs. Here, multiply by total gain to find out what is not excludable. 5. $300K x 30% = $90K can’t be excluded; $210K is excludable. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—37 7. GIFTS A. IRC i. § 102: Gifts and inheritances. 1. (a) General rule. Gross income does not include the value of property acquired by gift, bequest, device, or inheritance. 2. (c). Employee gifts. a. Sub (a) shall not exclude from GI any amount transferred by or for an employer to, or for the benefit of, an employee. ii. § 1014: Basis of property acquired from a decedent. 1. (a) In general. Basis of property in hands of a person acquiring property from a decedent shall, if not sold/exchanged/disposed of before the decedent’s death by such person, be a. The FMV of property at the date of decedent’s death. 2. (b)(1) Sub (a) applies to property acquired by bequest, devise, or inheritance. 3. (e) Appreciated property acquired by decedent by gift w/in 1 yr. of death. (1) If i. Appreciated property was acquired by the decedent by gift during t he 1-yr. period ending on the date of the decedent’s death, and ii. Such property is acquired from the decedent by the donor of such property (or the spouse of such donor), a. The basis of such property in the hands of such donor (or spouse) shall be the A/B of such property in the hands of the decedent immediately before the decedent’s death. b. (2) Definitions for subparagraph (1): i. iii. Appreciated property means any property if the FMV of such property on the day it was transferred to the decedent by gift exceeds it’ s A/B. § 1015: Basis of property acquired by gifts and transfers in trust. 1. (a) If the property was acquired by gift, the basis shall be the same as it would be in the hands of the donor or the last preceding owner by whom it was not acquired by gift, except that if such basis is greater than the FMV of the property at the time of the gift, then for purposes of determining loss the basis shall be such FMV. FMV ≥ Donor’s A/B at time of gift FMV < Donor’s A/B at time of gift Donee’s Basis for Computing GAIN Donor’s A/B Donor’s A/B Donee’s Basis for Computing Loss Donor’s A/B FMV (loss does not carryover) 2. Donee sells b/w Donor’s A/B and FMV: no gain/loss. Treas. Reg. § 1.1015-1 (example). iv. § 1223: Holding Period of Property 1. (2) In determining period for which TP has held property however acquired there shall be included the period for which such property was held by any other person, if such property has, for the purpose of determining gain/loss from a sale/exchange, the same basis in whole or in part in his hands as it would have in the hands of such other person. 2. (9) In the case of a person acquiring property from a decedent, if i. The basis of such property is determined under § 1014, and Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—38 ii. Such property is sold by such person w/in 1 yr. after decedent’s death, a. Then such person shall be considered to have held such property for > 1 yr. B. Treasury Regulations i. § 1.102-1: Gifts and inheritances. 1. (a) Property received as a gift, or received under a will, is not includable in GI, although the income from such property is includable in GI. 2. Proposed, published 1-9-89 a. (f) Exclusions i. (1) § 102 does not apply to 1. prizes & awards (including employee achievement awards (see § 74); 2. certain de minimis fringe benefits (see § 132); 3. any amount transferred by or for an employer to, or for the benefit of, an employee (see § 102(c)); or 4. qualified scholarships (see § 117). ii. (2) For purposes of § 102(c), extraordinary transfers to the natural subjects of an employer’s bounty will not be considered transfers to, or for the benefit of, an employee if the employee can show that the transfer was not made in recognition of the employee’s employment. 1. § 102(c) shall not apply to amounts transferred b/w related parties (e.g., father & son) if purpose of transfer can be substantially attributed to familial relationship of parties & not to circumstances of their employment. ii. § 1.1014-1: Basis of property acquired from a decedent. 1. (a) The general rule is that the basis of property acquired from a decedent is the FMV of such property at the date of the decedent’s death. 2. The general rule governing basis of property acquired form a decedent shall have no application if the property is sold, exchanged, or otherwise disposed of before the decedent’s death by the person who acquired the property from the decedent. iii. § 1.1014-2: Property acquired from a decedent. iv. § 1.1015-1: Basis of property acquired by gift. 1. Ex: A acquires by gift income-producing property which has an A/B of $100K at the date of the gift. The FMV of the property at the date of the gift is $90K. A later sells the property for $95K. In such case there is neither gain nor loss. The basis for determining loss is $90K; therefore, there is no loss. Furthermore, there is no gain, since the basis for determining gain is $100K. v. § 1.1015-4: Transfers in part gift and in part sale. 1. (a) Where a transfer of property is in part a sale and in part a gift, the unadjusted basis of the property in the hands of the transferee is: a. Whichever of the following is greater: i. Amount paid by the transferee for the property, or Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—39 ii. Transferor’s A/B. b. For determining loss, the unadjusted basis of the property in the hands of the transferee shall not be > FMV of property at time of transfer. c. For determining loss of transferor, see § 1.1001-1(e). 2. Examples: a. If A transfers property to his son (S) for $30K, and at the time of transfer A has an A/B of $30K (and a FMV of $60K), S’s basis is $30K. b. If A transfers property to S for $60K, and at the time of transfer A has an A/B of $30K (and a FMV of $90K), S’s basis is $60K. c. If A transfers property to S for $30K, and at the time of transfer A has an A/B of $60K (and a FMV of $90K), S’s basis is $60K. d. If A transfers property to S for $30K, and at the time of transfer A has an A/B of $90K (and a FMV of $60K), S’s basis is $90K. However, since A’s A/B at the time of transfer was > the FMV at that time, for the purpose of determining any loss on a later sale or other disposition of the property by S, S’s A/B is $60K. C. Caselaw i. Duberstein (1960: Test for “gift” characterization. 1. Facts: a. TP regularly provided a list of potential customers to a metal manufacturer. The manufacturer provided the taxpayer w/ a new Cadillac. The Cadillac was unsolicited and, apparently, unexpected. 2. Held: a. Cadillac was not a gift. b. A gift proceeds from a detached and disinterested generosity, out of affection, respect, admiration, charity, or like impulses. c. The most critical consideration is the transferor’s intent. ii. Wolder (2d Cir. 1974): Client’s will. 1. Facts: a. Pursuant to a written agreement, TP, an attorney, provided legal services at no charge to his client who bequeathed her stock to TP upon her death. b. TP received the stock & cash 1 yr. after client’s death, when its value had considerably increased. 2. Held: a. Gift is not excludable under § 102 b/c the contract was, in effect, one for the postponed payment of legal services rather than for a gift. b. True test of whether income is exempt from taxation under § 102 is whether in actuality the gift is a bona fide gift or simply a method for paying compensation. c. Question is resolved by an examination of parties’ intent, the reasons for the transfer, & the parties’ performance in accordance w/ their intentions. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—40 iii. Olk (9th Cir. 1976): Tokes. 1. Facts: a. TP was employed as a craps dealer. Dealers are forbidden to fraternize or engage in unnecessary conversation w/ the casino patrons, & must remain in separate areas while on their breaks. Dealers must treat all patrons equally & any attempt to provide special service to a patron is grounds for termination. b. At times, players will give money (tokes) to dealers. Tokes are combined and split equally b/w dealers at a particular table at the end of each shift so that a dealer will get his share of the tokes received even while he is taking a break. 2. Held: a. Giving of tokes was not an act of a detached or disinterested generosity. b. Receipts by TPs engaged in rendering services contributed by those with whom the TPs had some personal or functional contact in the course of the performance of the services were taxable income when in conformity w/ the practices of the area & easily valued. Tokes, like tips, met those conditions. iv. Goodwin (8th Cir. 1995): special occasion “gifts” from congregation to Rev. Goodwin. 1. Facts: a. Rev. Goodwin headed a church congregation. Over the yrs., the congregation’s anonymous cash gifts to the Rev. increased substantially. b. Congregation funds the church, and that includes Rev. Goodwin’s salary; “special occasion” gifts were substantial compared to his salary; and congregation knew that, w/o the gifts, it wouldn’t be able to keep its popular & successful minister at the relatively low salary it was paying. 2. Held: a. Regular, sizable payments made by people to whom the TP provides services are customarily regarded as compensation & may be treated as taxable income. This add’l compensation is: i. ii. v. Routine, structured, & institutionalized Coming from the congregation as a whole, not individualized. Felton (T.C. 2018): recent decision similar to Goodwin 1. Facts: a. Congregants used white envelopes for the normal contributions that sustain the church; these envelopes included a line marked “pastoral,” where the congregant could contribute directly to Rev. Felton’s income. b. Blue envelope was created so that congregants could ensure their donations would be considered a gift (they did not want to get a tax deduction for these gifts). Blue envelopes weren’t passed out by ushers unless requested by congregants & Rev. Felton did not preach about making personal donations to him in blue envelopes. 2. Applicable law: a. § 61(a)(1): GI includes compensation for services. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—41 b. Glenshaw Glass: GI is undeniable accessions to wealth, clearly realized, and over which the TP has complete dominion and control. c. § 102 excludes from income the value of property acquired by gift. 3. Analysis: What is a gift? No bright-line test. a. Proceeds from a detached & disinterested generosity, out of affection, respect, admiration, charity or like impulses. b. Most critical consideration is transferor’s intent, but transferor’s characterization of his intention is not determinative. There must be an objective inquiry as to whether what is called a gift amounts to it in reality. 4. Caselaw on donations to clergy indicate how to distinguish b/w taxable payments & gifts: a. Whether donations are objectively provided in exchange for services. b. Whether cleric (or other church authorities) requested personal donations. c. Whether donations were part of a routinized, highly structured program, and given by individual church members or congregation as a whole. d. Whether cleric receives a separate salary from the church & the amount of that salary in comparison to the personal donations. 5. Conclusion: a. When comparatively so much money flows to a person from people for whom he provides services (even intangible ones), and to whom he expects to provide services in the future, we find it to be income & not gifts. D. Examples & Explanations i. To determine basis, ask: How did TP acquire the property? 1. TP bought property § 1012 (cost) 2. TP acquired the property for free, but not a gift § 1012 (FMV) 3. TP acquired by gift § 1015(a) (carryover basis: donee’s A/B is = donor’s A/B) a. EXCEPTION: If FMV < donor’s A/B at time of gift & donee sells for loss basis is FMV 4. TP inherited property § 1014 (stepped up (or down) to FMV on date of death). a. Date-of-death basis rule: i. ii. Means that the appreciation of the property during decedent’s lifetime will never be taxed. Encourages individuals to retain appreciated property until their death, but to sell before death any property that has declined in value. ii. Gifts are generally included in the donor’s tax base (that is, the donor generally cannot deduct the gift) & excluded from the donee’s base. iii. M owns piece of property. She paid $20 for the property so that is her property under § 1012. M gives D property after it has appreciated in value to $50. At the time of the gift, the property has “built-in gain” of $30 (b/c the $50 FMV of property exceeds M’s $20 basis by $30). iv. Father devises property to Son: FMV $100 and A/B $200. Son’s A/B is $100 (FMV). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—42 1. v. “Locked in loss”: for property that is depreciated, it is often times better selling it as opposed to devising it through a will b/c son gets stepped-down basis. Father devised Blackacre to Daughter in his will. Father paid $50K for Blackacre several yrs. ago. When he died, it was worth $48K. 1. D’s basis for Blackacre is $48K for computing both gain & loss. Basis for property received from a decedent is FMV (generally at the decedent’s death). If D had received the property as an inter vivos gift, she would use F’s $50K basis if she sold it at a gain and the FMV on the date of the gift ($48K) if she sold it at a loss. vi. Son bought stock for $10 (A/B); now FMV $1K. 1. Gives stock to dying father (while still alive). What are tax results? a. Father’s A/B is $10 (carryover basis). FMV > A/B, so don’t have to go into rules. b. What if father then gives stock back to son in a will? What is the son’s basis? i. ii. If father died > 1 yr. after son gave stock to him, son’s A/B is $1K. If son were to sell the next day, $0 gain. If father died < 1 yr. after son gave stock to him, A/B would carryover from father ($10). § 1014(e). If son were to sell next day, $990 gain. c. What about holding period? i. If the basis is going to be the same as the basis in the other person’s hands, then the holding period is going to be the same. 1. Doesn’t apply to devised gifts. If it is going to be a stepped-up or stepped-down basis & the property is sold w/in 1 yr. of decedent’s death, then such property shall be considered to have been held for > 1 yr. vii. C gives D a parcel of land. The parcel has a basis in C’s hands of $50K; the FMV is $40K. 1. D sells the parcel the next yr. for $60K. a. For the purpose of determining gain, D inherits C’s basis of $50K. D r ealizes & recognizes $10K of gain. §§ 1001, 1015(a). 2. D sells the parcel the next yr. for $35K. a. D’s $35K A/R is < D’s $50K basis in the property, so there is no gain. b. $40K FMV was < $50K basis at time of transfer, so (for purpose of determining loss), D has a basis = FMV at time of transfer ($40K). D realizes & recognizes $5K loss. §§ 1001, 1015(a). 3. D sells parcel next yr. for $45K. a. D’s $45K A/R is < D’s $50K basis in the property, so there is no gain. b. $40K FMV was < $50K basis at time of transfer, so (for purpose of determining loss) D has basis = FMV at time of transfer ($45K). Property was sold for $45K, so no loss. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—43 8. LIFE INSURANCE/DAMAGES A. IRC i. § 101: Certain death benefits. 1. GI does not include amounts received (whether in single sum or otherwise) under a life insurance contract, if such amounts are paid by reason of the death of the insured. 2. (g) permits a terminally ill or chronically ill TP to exclude amounts paid to her, during her life, pursuant to a life insurance contract. ii. § 61(a)(4): Gross income includes interest earned on damages received. iii. § 104: Compensation for injuries or sickness. 1. (a)GI does not include a. (1) $ received under workmen’s comp as compensation for personal injuries or sickness. b. (2) the amount of any damages received (other than punitive damages) on account of personal physical injuries or physical sickness. i. ii. Can be lump sums or periodic payments. Can be by suit or agreement. B. Treasury Regulations i. § 1.61-10: Income from life insurance and endowment contracts. 1. (a) In general. Income from life insurance contracts constitute GI, unless excluded. ii. § 1.101-1: Exclusion from GI of proceeds of life insurance contracts payable by reason of death. iii. § 1.101-4: Payment of life insurance proceeds at a date later than death. iv. § 1.104-1: Compensation for injuries or sickness. 1. (c) Damages received on account of physical injuries or physical sickness. a. Emotional distress is not considered a physical injury or physical sickness. b. Damages for emotional distress attributable to a physical injury or physical sickness are excluded from income under § 104(a)(2). c. § 104(a)(2) also excludes damages not in excess of the amount paid for medical care for emotional distress. 2. (d) Accident or health insurance. a. § 104(a)(3) excludes from GI amounts received through accident/health insurance for PI or sickness through a policy that the individual purchases with his own funds. C. Explanations for Life Insurance i. Life insurance policies may be divided into 2 broad categories: term and whole life. 1. Term insurance: provides protection for a specific term, almost always 1 yr. If the insured dies w/in the yr., the policy pays a specified amount to the designated beneficiary. If the insured does not die during the yr., the insurer retains the premium, or policy cost. a. Represents a gamble, which is “won” by the purchaser only if the insured dies. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—44 b. An individual who purchases a policy on her own life & lives out the term of the policy is not allowed to deduct the cost of the policy as a loss. c. No tax is levied on the “profit” from a policy. Instead, under § 101, the beneficiary receives the insurance proceeds tax-free. 2. Whole life insurance: provides protection for entire life of insured. Generally, requires annual premiums. The amount of the annual premium in a whole life policy does not increase w/ age of insured. a. Represents a form of savings: the amounts paid to beneficiaries always exceed the expected premiums received by the insurance co. That is b/c, if the insured lives to life expectancy, the insurance co. will be able to invest the premiums paid in early yrs. & earn interest form the investment. b. In the cases which the insured lives exactly to the life expectancy, there is no mortality gain/loss, so the excess of the amounts paid to the beneficiaries over the premiums paid by the insured represents interest income. c. Even though its savings component distinguishes a whole life policy from a term policy, proceeds of a whole life policy qualify for same exclusion under § 101 as proceeds of a term policy. Makes whole life policy a tax-favored form of investment. i. Individual who places $2K/yr. in a savings acct. & gives that sum, together w/ interest, to her children upon her death will pay tax on annual interest. ii. Same individual who purchases whole life policy & lives to life expectancy earns, in effect, the same interest, but is not taxed. D. Caselaw for Damages i. Test to determine type of damages. a. Business/property damages: In lieu of what were the damages awarded? Raytheon (1st Cir. 1944). b. Personal injury: What is the nature of the claim that is the basis for payment? Amos (T.C. Memo 2003-329). ii. Schleier (1995): Age Discrimination 1. Facts: a. Half of TP’s settlement award under the Age Discrimination in Employment Act was attributed to backpay and half to liquidated damages. 2. Held: a. TP’s settlement award is not excludable from GI. b. TP must show that damages were received on account of personal injuries or sickness. Neither TP’s birthday nor his discharge can fairly be described as a personal injury or sickness. c. Although TP’s unlawful termination may have caused some psychological/personal injury, no part of his recovery of back wages was attributable to that injury. d. Note: based on old language of § 104(a)(2) that did not include “physical.” Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—45 iii. Domeny (U.S. Tax Ct. 2010): Pacific Autism Center for Education (PACE) 1. Facts: a. TP diagnosed with multiple sclerosis. TP had a strained relationship w/ her supervisor. By 2004, TP’s concerns & conditions in TP’s workplace caused her MS symptoms to flare up. TP advised her superiors on several occasions of her unhealthful work environment, including her stress from the embezzlement & PACE’s failure to take any action. b. On 03/07/05, TP’s Dr. determined she was too ill, b/c of her MS symptoms, to return to work. TP notified PACE of Dr.’s instructions not to return to work until after 03/21/05, and then she was fired. c. B/c of these circumstances, TP hired a lawyer & eventually received a settlement agreement from PACE. The $33,308 settlement was segregated into 3 separate & distinct payments. The amount in dispute is $16,933, which PACE paid to TP w/o withholding deductions & issued a Form 1099-MISC reflecting that the amount was “Non-employee compensation.” 2. Held: a. The differing tax & reporting treatments used for the 3 payments showed that the employer was aware that at least part of the TP’s recovery may not have been subject to tax; i.e., was due to physical illness. b. TP showed that her work environment exacerbated her existing physical illness. c. TP’s condition & her MS flare-up caused by her working conditions was intense & long lasting. The TP was physically unable to work until > 1 yr. after termination. d. Employer intended to compensate TP for her acute physical illness caused by her hostile & stressful work environment. e. TP showed that only reason for $16,933 payment was to compensate for her physical injuries. It was excludable from GI under § 104(a)(2). iv. Perez (U.S. Tax Ct. 2015): Unfertilized eggs for transfer. 1. Facts: a. TP received $20K under contracts that she signed w/ a clinic before she under went a prolonged series of painful injections & operations to retrieve her unfertilized eggs for transfer to infertile couples. Contracts said she was being pain in compensation for pain & suffering. 2. Issue: Code says that damages for pain & suffering are not taxable. Was the $20K TP received “damages”? 3. Held: a. Payment that TP received as compensation for undergoing procedures to donate her eggs to infertile couples was not damages under § 104(a)(2) b/c the pain & suffering she endured was w/in scope of the medical procedures to which she consented, and therefore the payment had to be included in GI under § 61(a)(1). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—46 b. Her physical pain was a byproduct of performing a service contract, and the payments were made not to compensate her for some unwanted invasio n against her bodily integrity but to compensate her for services rendered. v. Bollea v. Gawker (2016): Hulk Hogan 1. Received punitive damages, which are never excludable under § 104. E. IRS Administrative Guidance for Damages i. PLR 200041022 1. Direct unwanted/uninvited physical contacts resulting in observable bodily harms such as bruises, cuts, swelling, & bleeding are personal physical injuries under § 104(a)(2). F. Examples & Explanations i. Life Insurance: 1. Assume you invest $100 in a 1 yr. term life insurance policy. If you die w/in the yr., how will the proceeds be taxed to your beneficiaries? If the policy does not pay off (b/c you do not die), can you take a loss on the $100 you invested in the policy? a. If you die, the proceeds will be tax-free to your beneficiaries under § 101. b. You are not permitted to deduct the cost of the policy if you live. ii. Damages Summary: 1. Damages for personal physical injury EXCLUDED 2. Damages for emotional distress TAXABLE (unless attributable to injury) 3. Lost profits, wages, or income TAXABLE (unless attributable to injury) 4. Recovery of lost capital EXCLUDED 5. Punitive damages TAXABLE (even if attributable to injury) 6. Employment discrimination TAXABLE iii. Damages Ex: L assaulted D. D sustained a broken arm & filed a civil suit against L. After a trial, D is awarded $10K for pain & suffering, $10K for medical expenses, $12K for lost wages, and $25K for punitive damages. What portion, if any, of his recovery is excludable? 1. Damages received for pain & suffering, lost wages, and medical expenses on account of personal physical injury or sickness are all excludable under § 104. Thus, D can exclude the $10K award for pain & suffering, the $10K award for medical expenses, and the $12K award for lost wages. Punitive damages are not excludable under § 104, so D will include the $25K in income. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—47 9. DIVORCE A. IRC i. § 61(a)(8) (pre-TCJA) 1. GI means all income from whatever source derived, including alimony & separate maintenance payments [for divorce instrument executed before 01/01/19]. a. Post-TCJA: Alimony is not deductible by the payor & is not included by the payee. ii. § 71: Alimony and separate maintenance payments (pre-TCJA) 1. (a) GI includes amounts received as alimony or separate maintenance payments. 2. (b) Definitions. a. (1) Alimony or separate maintenance payment means payment in cash if i. (A) Such payment is received by (or on behalf of) spouse under a divorce or separation instrument, ii. (B) Divorce or separation instrument does not designate such payment as a payment which is not includable in GI under this § & not allowable as a deduction under § 215, iii. (C) Payor & payee must live in separate households , and iv. (D) Payment obligation must not continue after death of payee spouse . 3. (c) Payments to support children. a. (1) Alimony payment must not be for child support. Child support payments are not deductible by the payor or includible by the payee. i. (2) Any payments that end when a child dies or reaches a certain age will be characterized as child support payments. 4. (f) Payments are treated as alimony only to the extent that they are substantially = in 1st 3 yrs. in which alimony payments are made. iii. § 215: Alimony, etc., payments (pre-TCJA) 1. (a) General rule. Deduction allowed for alimony paid during individual’s taxable yr. iv. § 1041: Transfers of property b/w spouses or incident to divorce. 1. (a) General rule. No gain or loss shall be recognized on a transfer of property from an individual to (or in trust for the benefit of) a. A spouse, or b. A former spouse, but only if the transfer is incident to the divorce. 2. (b) Transfer treated as gift; transferee has transferor’s basis. 3. (c) Incident to divorce. A transfer of property is incident to the divorce if such transfer a. Occurs w/in 1 yr. after date on which marriage ceases, or b. Is related to the cessation of the marriage. B. Treasury Regulations i. § 1.1041-1T: Treatment of transfer of property between spouses or incident to divorce. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—48 1. Ex(1): A & B are married and file a joint return. A is the sole owner of a condo unit. A sale or gift of the condo from A to B is a transfer which is subject to the rules of § 1041. 2. Ex(2): A & B are married & file separate returns. A is the owner of an independent sole proprietorship, X Co. In the ordinary course of business, X Co. makes a sale of property to B. The sale is a transfer of property b/w spouses & is subject to the rules of § 1041. 3. Ex(3): Assume same facts as (2), except that X Co. is a corporation who lly owned by A. This sale is not a sale b/q spouses subject to the rules of § 1041. C. Caselaw i. Gilmore (1963): Characterization of litigation costs. 1. Facts: a. TP claimed an income tax deduction for legal expenses incurred in successfully resisting his former wife’s claims that certain of his assets were community property under California law. 2. Held: a. Since the wife’s claims stemmed entirely from the marital relationship and not under any tenable view of things from income-producing activity, the expenses were not business expenses deductible under § 23(a)(2). Instead, they were nondeductible personal expenses under § 24(a)(1). b. Under the origin-of-the-claim test, legal expenses in connection w/ a divorce will generally be nondeductible D. IRS Administrative Guidance i. Revenue Ruling 2002-22 1. Application of assignment of income doctrine is generally inappropriate in the context of divorce. ii. Revenue Ruling 2013-17 1. The terms “spouse,” “husband and wife,” “husband,” and “wife” include an individual married to a person of the same sex if the individuals are lawfully married under state law, & the term “marriage” includes such a marriage b/w individuals of the same sex. 2. The terms “spouse,” “husband and wife,” “husband,” and “wife” do not include individuals (whether of the opposite sex or the same sex) who have entered into a registered domestic partnership, civil union, or other similar formal relationship recognized under state law that is not denominated as a marriage under the laws of that state, and the term “marriage” does not include such formal relationships. E. Examples and Explanations i. Pre-2019: 1. Alimony is income to the recipient; there is deduction (above-the-line) for payor under IRC § 215. a. Several requirements to qualify as alimony under IRC § 71. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—49 b. Allowed divorcing spouse to shift income from high-bracket payor to a low-bracket payee. ii. 2019-Forward: 1. Alimony is not income to the recipient; there is no deduction for the payor. a. Much simpler, but removed income shifting benefit. 2. Dependency Exemptions. a. Deductions for personal exemptions are suspended for taxable yrs. beginning after 12/31/17 and before 01/01/26. iii. C gives D stock w/ a basis of $5K & a FMV of $50K. State tax consequences: 1. Stock was held by C&D as community property & is given to D incident to a divorce. a. D does not recognize any gain on the receipt of the stock & C cannot deduct the stock transferred. D’s basis in the stock is $5K. § 1041. 2. The stock was held by C as separate property & is given to D as part of an antenuptial agreement. In return, D waives any rights to alimony or property upon divorce. a. § 1041 provides for a nonrecognition of gain upon transfer to either (i) a spouse or (ii) a former spouse, incident to divorce. If the property is transferred after marriage, § 1041 applies. However, if the property is transferred prior to marriage, § 1041 would not apply. The transaction would probably be treated as a sale in which appreciated property was used to acquire marital rights. The purchaser of the rights (here, C) would be treated as if the stock were sold & the sale of the proceeds used to acquire the marital rights D gave up in the agreement. D would then have a basis in the stock equal to its value on the date of the transfer, $50K. iv. Which of the following characteristics will prevent a series of payments from being characterized as alimony? 1. The payments are equal but only last 3 yrs. a. Under § 71(f), payments that would otherwise qualify as alimony but are too “front loaded” are recharacterized as property settlements. A payment t hat is substantially equal during the first 3 yrs. will not run afoul of § 71(f). Thus, the condition described here will not prevent alimony treatment. 2. Payments are made under a separate maintenance agreement prior to divorce. a. The condition described here will not prevent alimony treatment. Parties need not be divorced so long as there is a written agreement as to separate maintenance and the other requirements of § 71 are met. 3. Upon the death of the payee spouse, the payments continue & so may be passed by will to the payee’s beneficiaries. a. This condition will prevent alimony treatment. § 71(b)(1)(D). Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—50 10. FRINGE BENEFITS A. IRC i. § 119: Meals or lodging furnished for the convenience of the employer. 1. (a) Meals and lodging furnished to employee, his spouse, and his dependents, pursuant to employment. a. Exclusion of value of meals/lodging furnished to employee, his spouse, or any of his dependents by or on behalf of his employer for the convenience of the employer , but only if: i. Meals: 1. Meals are furnished on the business premises of employer. ii. Lodging: 1. Employee is required to accept such lodging as condition of employment; and 2. Lodging is on the business premises of employer. ii. § 132: Certain fringe benefits 1. (b) No-add’l-cost service defined. a. Provided by employer b. To employee (check definition!), for their use c. Offered for sale to customers in ordinary course of business d. Employer incurs no substantial add’l cost (or foregone revenue) e. Non-discrimination rule applies 2. (c) Qualified employee discount defined. a. Provided by employer b. To employee (check definition!), for their use c. Offered for sale to customers in ordinary course of business d. Discount must not exceed: i. ii. For property, the gross profit % of the price offered to customers (i.e., must be at least wholesale cost); For services, 20% of the price at which services are offered to customers. e. Non-discrimination rule applies. 3. (d) Working condition fringe defined. a. Provided by employer b. Tot employee (check definition!) c. Employee would have been able to deduct it as a business expense 4. (e) De minimis fringe defined. a. Catchall category b. Any property or service the value of which is (after taking into account the frequency w/ which similar fringes are provided by the employer to the employees) so small as to make accounting for it unreasonable or administratively impracticable. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—51 c. Most popular: On-Site Cafeteria, special rule § 132(e)(2) i. Excluded from income if: 1. On or near employer premises 2. Food provided at cost or above ii. Non-discrimination special rule. 5. (f) Qualified transportation fringe. a. Provided by employer b. To employee (check definition!) c. Shuttles, transit passes, parking, bike commute reimbursement i. Bike benefit suspended until 2025 d. Cash reimbursement fine, but limit for transit passes e. Employer can no longer deduct f. Qualified parking is defined as parking provided to an employee on or near the business premises of employer. 6. (j) Special rules. a. (1) Exclusions under (a)(1) and (2) apply to officers, etc., only if no discrimination. b. No-add’l-cost service & qualified employee discount. c. Cannot provide better fringe benefits for “highly compensated” employees. i. iii. If rule is violated, employee can’t deduct benefit. § 414(q) Highly compensated employee 1. Means any employee who had compensation from the employer in excess of $80K, and was in top paid group of employees for preceding year. 2. Top paid group of employees is group consisting of top 20% of employees when ranked on the basis of compensation. B. Treasury Regulations i. § 1.61-21: Taxation of fringe benefits. ii. § 1.119-1: Meals and lodging furnished for the convenience of the employer iii. § 1.132-1: Exclusion from gross income certain fringe benefits. 1. (b) Definition of employee a. (1) No-add’l-cost services and qualified employee discounts. b. (2) Working condition fringes. c. (4) De minimis fringes. iv. § 1.132-2: No-add’l-cost services. v. § 1.132-3: Qualified employee discounts. vi. § 1.132-4: Line of business limitation. vii. § 1.132-5: Working condition fringes. viii. § 1.132-6: De minimis fringes. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—52 ix. § 1.132-7: Employer-operated eating facilities [de minimis]. x. § 1.132-8: Fringe benefit nondiscrimination rules. C. Caselaw i. Bengalia (U.S. B.T.A. 1937): start of convenience of employer doctrine; before § 132. 1. Facts: a. TP employed as manager in full charge of several hotels in Honolulu. TP was constantly on duty, and, for the proper performance of his duties & entirely for the convenience of his employer, he and his wife occupied a suite of rooms in the Royal Hawaiian Hotel & received their meals at and from the hotel. b. TP’s salary was fixed w/o reference to his meals & lodging. Neither TP nor his employer ever regarded the meals & lodging as part of his compensation. 2. Held: a. Under such circumstances, the value of meals & lodging is not income to the employee. b. From the evidence, there is no doubt that TP’s residence at the hote l was solely b/c he could not otherwise perform services required of him. His residence at the hotel was necessary. He would not consider undertaking the job & the owners of the hotel would not consider employing a manager unless he lived there. ii. Gotcher (5th Cir. 1968): Germany trip; prospective business partner. 1. Facts: a. Mr. & Mrs. Gotcher took a 12-day expense-paid trip to Germany to tour the VW facilities. The tip cost $1,372.30. His employer, Economy Motors, paid $343.73, and VW of Germany and VW of America shared the remaining $1,023.53. b. The trip was made when VW was attempting to expand its local dealerships in the U.S. The officials of VW decided the best way to remove apprehension of their product was to take the dealer to Germany & have him see his investment. 2. Held: a. The economic benefit was taxable to the recipient only when expens es paid served no legitimate corporate purpose. b. The personal benefits & pleasure TP husband received was incidental to the dominant purpose of marketing & cultivating investors. c. When the direct economic gain was subordinate to an overall business purpose , the recipient was not taxed. d. The dominant purpose of the trip was a critical inquiry w/ some pleasurable features did not negate the finding of an overall business purpose. e. For TP husband: trip was primarily business. TP wife: trip was primarily a vaca tion, and thus not deductible from income. f. Didn’t use fringe benefits exclusion b/c no employee relationship. D. Examples & Explanations Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—53 i. IRS Nat’l Office Technical Advice Memo 1. Is the value of meals furnished to employees excludable from GI under § 132(e)(2) and the corresponding Treas. Reg. § 1.132-7? a. The snack areas & employees’ desks at which meals were provided & consumed did not qualify as eating facilities under § 132(e)(2) b/c these areas were not set aside only for meals & no services were provided in the facilities relating to preparing & serving food. 2. Is the value of snacks furnished to TP’s employees for the same business reasons provided for furnishing meals excludable from GI under § 119 as furnished for the convenience of the employer? a. The snacks that TP provides its employees in designated snack areas are not meals prepared for the consumption at meal time & therefore do not qualify as meals provided for the convenience of the employer under § 119. ii. Meals & Lodging for Employees 1. Specifically, value of meals excluded from income if: a. Employer furnishes meals to an employee, her spouse, or her dependents; b. Meals are provided for the convenience of the employer; and c. Meals are provided on the business premises of the employer. 2. Specifically, the value of lodging is excluded from income if: a. It is furnished on the business premises by the employer to an employee, her spouse, or her dependents; b. It is provided for the convenience of the employer; and c. The employee is required to accept the lodging as a condition of employment. 3. Caveats: a. If provided to an employee’s SO, who is not the employee’s spouse or dependent, the employee (not the SO) is required to include in GI the value of the non -excludable meals & lodging provided to SO. b. Dependent is defined in § 152, but a simplified definition is a member of the TP’s family (including a child, grandchild, parent, sibling, aunt, uncle, niece, or nephew) or household can qualify as the TP’s dependent if he/she: i. ii. Has little income & is supported by the TP; or Is young, lives w/ the TP for > ½ the yr., & does not support himself. c. Covers meals “furnished” by employer. Does not cover amounts reimbursed for meals. d. “Convenience of the employer” requirement: i. Generally, a TP can establish that the meals & lodging were prov ided for the convenience of the employer by showing that the employee is required to be on-call even when the employee is not working 4. Examples: Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—54 a. A is the manager of the Travel Motel. As a condition of her employment, TM requires her to live in a home, owned by the motel, which is located ½ mile from the motel so that she will be close enough to arrive quickly in an emergency. A is on -call 24 hrs. a day. TM can contact her at any time by calling her cell phone. The value of the lodging is $10K/yr. is A entitled to exclude the value of the lodging under § 119? i. Probably not, unless A conducts motel business in the home. An employee can exclude the value of lodging under § 119 only if the employee is required to accept such lodging on the “business premises” of her employer. § 119(a)(2). It is unlikely that a home ½ mile from the motel would be considered on the business premises of the motel. b. J is the president & sole share-holder of the Rustic Inn, Inc., a motel located alongside I-80. RI consists of 80 motel rooms and an adjoining house where J & his wife & young kids live. Th phone line & doorbell to the motel ring in J’s house so that he can answer calls & welcome guests 24 hrs./day. Most other motels the size of RI have fulltime managers who are required to live on the premises. However, most managers of comparable motels are not given accommodations as nice as the house in which J & his family live. The motel deducts all expenses associated w/ the adjoining house, including those (such as utilities) that clearly would be nondeductible for ordinary homeowners. Is J entitled to exclude the value of the lodging from is GI under § 119? i. J is both an employee of the corporation & its owner. Does that dual role prevent him from qualifying for the § 119 exclusion? Probably not. ii. J can establish that his residence on the business premises is for the convenience of the employer b/c he is on-call 24 hrs./day & comparable motels require that their managers live on the motel pr emises. iii. iii. However, potential for abuse of § 119 is great here b/c J can set conditions of his own employment, as owner of RI, & his accommodations are nicer than accommodations motels generally give their managers. Courts & the IRS may carefully scrutinize such potentially abusive arrangements. On these facts J can probably qualify for the § 119 exclusion. No Add’l Cost Service 1. Employee: Retired & disabled employees and surviving spouse of employees are treated as employee. W/r/t a line of business of an employer, the employee includes: a. Any individual who was formerly employed by such employer in such line of business and who separated from service w/ such employer in such line of business by reason of retirement or disability, and b. Any widow or widower of any individual who died while employed by such employer in such line of business or while an employee w/in the meaning of (a). 2. Spouses and dependent children. a. In general: Any use by the spouse or a dependent child of the employee shall be treated as use by the employee. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—55 b. Dependent child: For purposes of (a., the term “dependent child” means any child (as defined in § 152(f)(1) of the employee i. ii. Who is a dependent of the employee, or Both of whose parents are deceased & who is under 25. Any child to whom § 152(e) applies shall be treated as the dependent child of both parents. 3. Non-discrimination rule: § 132(j)(1). a. Generally requires that the benefit be made available to a wide cross section of employees, including non-highly compensated employees. i. ii. § 132(j)(6) and Reg. § 132-8(f)(1) provide that the term highly compensated employee is defined by reference to § 414(q) (although the reg. provides the formula for determining whether an employee is a “highly compensated employee,” the formula in the reg. is outdated b/c it has not been amended to reflect changes in § 414(q). As amended, § 414(q) defines “highly compensated employee” as any employee who: 1. Was a 5% owner during the year, or the preceding year, or 2. For the preceding year a. Was paid > $120K, and b. Was in the top-paid (top 20%) group of employees. 4. Examples: a. A hotel might allow employees free use of otherwise unused hotel rooms. b. Due to line of business limitation, a manufacturer could not offer its employees, as a tax-free benefit, hotel rooms it was not using but for which it had paid. c. Services provided pursuant to reciprocal written agreements among employers operating similar businesses can qualify for the § 132 no -add’l-cost service exclusion so long as no employer incurs any substantial add’l cost in providing the service. § 132(i). i. Such reciprocal agreements, for example, might permit an employee of one airline to fly (on a standby basis) on another airline at no charge. d. D, an airline reservation clerk for Friendly Airlines, is allowed to fly free of charge on FA flights. D is required to fly on a stand-by basis and is permitted to board only when there otherwise would be unoccupied seats. Is the flight taxable to D? i. Flight is not taxable to D. Under § 132(a)(1), an employee may exclude from GI a fringe benefit that qualifies as a no -add’l-cost service. § 132(b) defines a no-add’l-cost service as a service provided by an employer to an employee if such service is offered for sale to customers “in the ordinary course of the line of business of the employer in which the employee is performing services” and if the employer incurs no substantial add’l cost (including foregone revenue) in providing such services to the employee. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—56 ii. D meets all of these tests. His employer the airline, is providing the service, is in the business of selling flights to the public , and will incur no add’l costs in providing D with the seat on the plane since the seat would not otherwise be occupied by a paying customer. If, on the other hand, D were permitted to reserve a seat on the flight, he would be taxed on its value b/c he might displace a paying customer. Reg. § 1.132 -2(c). e. S works as a proofreader for J. Books, Inc., a successful publishing comp any. J. Books owns a jet that can carry 20 passengers. When the jet makes a business trip, there is often add’l space on board. The company usually permits employees who are on vacation to “hitch a ride” on the jet if there is extra space available. J. Boo ks flies several of its employees to NY for a business convention and S “hitches a ride” on the flight in order to visit friends. What amount, if any, does S have to include in income as a result of the flight to NY? i. The flight does not qualify for the § 132 no-add’l-cost service exclusion. Although the company will not incur an add’l expense by allowing S to “hitch a ride,” the flight is not a § 132 no-add’l-cost service b/c J. Books does not offer airline service for sale to customers in the ordinary cour se of its business. § 132(b)(1). How much does S have to include in income? 1. Reg. § 1.61-21(g)(12) provides a special valuation rule where most passengers on a company airplane are traveling for business and an employee “hitches a ride” on the plane. This special valuation rule may permit S to exclude the value of the flight. The regulation provides that if at least ½ of the seats on the employer’s airline are occupied by employees traveling primarily for the employer’s business, the value of the flight to the employee traveling for personal reasons will be deemed to be zero. iv. Qualified Employee Discount 1. § 132(h) Employee definition. a. Retired & disabled employees and surviving spouse of employees are treated as employee. W/r/t a line of business of an employer, the employee includes: Any i. Individual who was formerly employed by such employer in such line of business and who separated from service w/ such employer in such line of business by reason of retirement or disability, and ii. Widow(er) of any individual who died while employed by such employer in such line of business or while an employee w/in meaning of (i). b. Spouses and dependent children. i. In general: Any use by the spouse or a dependent child of the employee shall be treated as use by the employee. ii. Dependent child: For purposes of (i), the term “dependent child” means any child (as defined in § 152(f)(1) of the employee 1. Who is a dependent of the employee, or Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—57 2. Both of whose parents are deceased and who is under 25. Any child to whom § 152(e) applies shall be treated as the dependent child of both parents. 2. Discount must not exceed: a. Wholesale cost for property. b. 20% discount for services. 3. Non-discrimination rule applies. § 132(j)(1). 4. Note: If the parent is getting a discount b/c their child is an employee, then the discount is taxable to the employee. v. Working Condition 1. § 1.132-1(b)(2) Employee definition. a. Any individual who is currently employed by the employer; b. Any partner who performs services for the partnership; c. Any director of the employer; and d. Any independent contractor who performs services for the employer. 2. Requirement: employee would have been able to deduct as a business expense: a. “Ordinary and necessary” expenses paid or incurred during the taxable year in carrying on any trade or business. b. If an employer provides a professional journal to an employee, free of charge, the employee can exclude the value of the journal b/c the employee’s purchase of the journal would constitute an unreimbursed employee business expense. 3. Example: J is an associate for a large law firm. a. J travels to NY to take a deposition. Firm pays for her travel, meals & lodging. i. Payment of expenses of NY trip is excludable as a working condition fringe under § 132(a)(3). Working condition fringes are defined in § 132(e) as property or services provided to an employee to the extent that the employee would have been able to take a § 162 trade or business deduction of § 167 depreciation deduction had the employee paid for the services or property. If J had paid for these travel expenses herself, she would have been able to deduct the expenses under § 162, as ordinary and necessary business expenses, so payment of items by her employer will be considered a working condition fringe. b. Each day firm hires a caterer to provide sandwiches & soft drinks for all employees who wish to eat in their offices. J takes advantage of this free lunch 2 /3x a wk. i. Free meals do not qualify as a § 132(d) working condition fringe b/c an employee buying her own lunches would not be able to deduct the cost of lunches under these circumstances. However, if the law firm provides the free meals so that the lawyers in the firm work through lunch & bill > hrs., the meals may be provided “for the convenience of the employer,” so J may be able to exclude the value of the meals under § 119. c. Firm provides J w/ free parking in the office building housing the law firm. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—58 i. vi. J would not be able to deduct the cost of parking if she purchased it herself, so the payment would not be excludable as a working condition fringe. The value of free parking would be De Minimis 1. Catchall category. 2. How does this interact w/ § 119? a. Doesn’t have to be for the convenience of the employer. 3. Limited to employees? a. § 1.132-1(b)(4): For purposes of § 132(a)(4) (relating to de minimis fringes), the term “employee” means any recipient of a fringe benefit. 4. Is there a non-discrimination rule? a. The anti-discrimination rule for no-add’l-cost service & employee discount doesn’t apply. However, there is a special rule for treatment of certain eating facilities. i. Can’t discriminate for eating facilities, i.e., no executive cafeteria & low level employee cafeteria. 5. Value of de minimis fringe provided to employee is excluded from GI. 6. Reg. § 1.132-6(e) lists following items as examples of de minimis fringe benefits: a. Occasional parties; b. Occasional theater or sporting event tickets; c. Coffee, doughnuts, soft drinks; d. Local telephone calls. 7. Example: E works at a small rural law firm. Her employer pays for her dinners, which are delivered to the firm on those occasional evenings when she has to work late. a. E is not taxed on the value of the dinners. If the meals furnished to E at the firm are provided for the convenience of the employer (so that E will work late), the meals qualify for a § 119 exclusion. In the alternative, E can exclude the meals as a § 132(e) de minimis fringe b/c the meals are provided only occasionally & allow her to extend her normal work hours. § 1.132-6(d)(2). vii. Non-discrimination rule: 1. § 132(j) for no-add’l-cost service & qualified employee discount. 2. Separate rule in § 132(e)(2) for de minimis. 3. Cannot provide better fringe benefits for “highly compensated employees” a. Highly compensated § 414(q) b. Compare w/ § 1.132-8(f)(1) c. Top 20% of employees. 4. If rule violated? a. TP doesn’t get to deduct. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—59 11. DISCHARGE OF INDEBTEDNESS A. IRC i. § 61(a)(12): GI includes income from discharge of indebtedness. ii. § 108. Income from discharge of indebtedness 1. (a) Exclusion from gross income. GI does not include amount which (but for this sub§) would be includable in GI by reason of discharge of indebtedness of the TP if: a. Discharge occurs b/c of bankruptcy case; b. Discharge occurs when TP is insolvent; 2. (d) Meaning of terms; special rules relating to certain provisions. a. Indebtedness of TP means any indebtedness i. ii. For which the TP is liable, or Subject to which the TP holds property. b. Insolvent means the excess of liabilities over the FMV of assets. B. Treasury Regulations i. § 1.61-12: Income from discharge of indebtedness. 1. (a) General rule. If an individual performs services for a creditor, who in consideration thereof cancels the debt, the debtor realizes income in the amount of the debt as compensation for his services. a. A TP may realize income by the payment or purchase of his obligations at less than their face value. ii. § 1.108-2: Acquisition of indebtedness by person related to the debtor. 1. (a) General rules. 2. (b) Direct acquisition. iii. § 1.1001-2: Discharge of liabilities. 1. (a) Inclusion in A/R. a. (1) In general. b. (2) Discharge of indebtedness. c. (3) Liability incurred on acquisition. d. (4) Special rules. (i)–(iii). 2. Ex(8): In 1980, F transfers to a creditor an asset w/ a FMV of $6K and the creditor discharges $7.5K of indebtedness for which F is personally liable. The A/R on the disposition of the asset is its FMV ($6K). In addition, F has income from the discharge of indebtedness of $1.5K ($7.5K – $6K). C. Caselaw i. Kirby Lumber (1931) 1. Discharge or reduction of indebtedness for less than the amount due = income. 2. Company was essentially buying its own indebtedness. A bond is a debt, a loan. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—60 3. If company offered bond of $100. At the end of the term, they give buyer back $100. In this case, they paid back $90 and retired obligation. 4. Court found that only paying $90 instead of $100 constituted income. ii. Gehl (8th Cir. 1995): § 108 and bifurcation. D. IRS Administrative Guidance i. Revenue Ruling 84-176 E. Examples & Explanations: i. Loan Proceeds: 1. General rule—NOT INCOME ii. Discharge of Indebtedness: 1. General rule—INCOME iii. Contested liability: 1. If a lender and borrower disagree about the amount owed & the borrower ultimately pays the lender less than the amount that the lender said was owed, the difference b/w the amount the lender said was owed & the amount the borrower pays does not have to be included in income. iv. If a TP is relieved of a nonrecourse liability in. connection w/ the disposition of encumbered property, the consequences are not determined under §§ 61(a)(12) § 108; instead, the debt relief is included in the TP’s A/R for the purpose of computing her gain or loss realized in the property transaction. 1. In the case of nonrecourse debt incurred to acquire or improve the property, the rationale for this rule is as follows: a. The debt relief is included in the TP’s A/R b/c the debt will have been included in the TP’s basis for the property when the TP acquired the property. Crane v. Comm’r, Reg. § 1.1001-2(a). b. The A/R includes the debt relief even if the encumbered property is worth less than. The amount of debt at the time the TP disposes of the property. Comm’r v. Tufts. v. If the debt encumbering TP’s depreciable property is a recourse liability, the tax consequences of a disposition of the property are determined using a “bifurcated” approach: 1. The debt discharge is included in the A/R, up to the FMV of the property; and 2. Any add’l debt discharge is treated as § 61(a)(12) debt discharge (income). Reg. §§ 1.1001-2(a), 1.1001-2(c) Example 8. 3. Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—61 OVERVIEW 12. PERSONAL INCOME TAX COMPUTATION A. Calculation GROSS INCOME [§ 61 — Exclusions §§ 101–140] - ABOVE-THE-LINE DEDUCTIONS [§ 62(a)] ADJUSTED GROSS INCOME - STANDARD [§ 63(c)] or ITEMIZED DEDUCTIONS [§ 63(d)] TAXABLE INCOME x TAXE RATE [§ 1(c) or § 1(h)] GROSS TAX LIABILITY - TAX CREDITS NET TAX LIABILITY Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—62 13. INCOME RECAP A. What is Income? Income • Glenshaw Glass Test • (1) accession to wealth • (2) clearly realized • (3) complete dominion and control Specific Items of Income •Treasure Trove/Claim of Right [Cesarini; 1.61-14(a); N.A. Oil] •Deemed Receipts [Old Colony] •Barter Exchanges [Rev. Rul. 79-24] •Non-Cash (FMV) [McCann] •Reward (Qui Tam) [Rococo] •Illegal Income [James] •Advance Payments [Indy Power] •Gains from Property [§ 1001] •Capital Gains/Losses [§ 1211] •Alimony [pre-2019] •Discharge of Indebtedness [Kirby] Not Income • Unrealized appreciation in value (income only upon realization/sale) • Imputed Income • Bargain Purchases [Pellar] • Loan Proceeds • Deposits/Escrow [Indy Power] • Opp. Zones [§ 1400Z-2] • Principal Residence [§ 121] • Gifts & Bequests [§ 102] • Damages for Physical Injury or Sickness [§ 104(a)(2)] • Alimony [2019-Forward] • Property Transfers B/w Spouses [§ 1041] • Meals & Lodging for Employees [§ 119] • Certain Fringe Benefits [§ 132] • Discharge of Indebtedness: Insolvent [§ 108] Ошибка! Используйте вкладку "Главная" для применения Heading 1 к тексту, который должен здесь отображаться.: Ошибка! Используйте вкладку "Главная" для применения Heading 2 к тексту, который должен здесь отображаться.—63