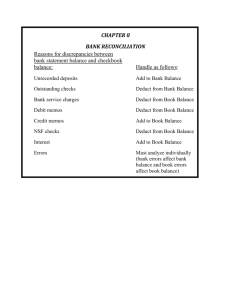

Bank Reconciliation statement Definition Bank reconciliation statement is a statement which is prepared to reconcile the balances of cash ledger and bank statement. Following are the causes of difference between our cash ledger balance and bank statement balance 1. Checks paid into bank but not collected and credited by the bank (Uncollected checks) 2. Checks issued but not presented for payment. (Un presented checks) 3. Direct payment by the customers 4. Interest or dividend on investment 5. Bank charges (service charges) 6. Dishonor of a check (NSF) 7. Checks omitted to be paid into bank. Procedure For Preparing a Bank Reconciliation Statement Bank Reconciliation Per Cash Books (Depositor Ledger) Add increases in cash already recorded by bank but not in books. Deduct decreases in cash already recorded by bank but not in books. Add or deduct errors on books. Bank Reconciliation Per Bank Books (Bank Statement) Deposits in transit Increases in cash recorded on cash book but not in bank book. Checks outstanding Decreases in cash already recorded on cash books but not bank Book. Add or deduct errors by bank Reconciling the Bank Statement Balance per Bank Balance per Depositor + Deposits in Transit + Deposits by Bank (credit memos) - Outstanding Checks - Service Charge - NSF Checks ± Bank Errors ± Book Errors = Adjusted Balance = Adjusted Balance Reconciling the Bank Statement All reconciling items on the book side require an adjusting entry to the cash account. Balance per Depositor + Deposits by Bank (credit memos) - Service Charge - NSF Checks ± Book Errors = Adjusted Balance BANK Bank’s books Beginning balance $3,359.78 Depositor’s records Beginning balance $2,549.99 Power Network prepares to reconcile the monthly bank statement as of July 31, 2006 BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 Depositor’s records Beginning balance 816.20 $4,175.98 A deposit of $816.20 did not appear on the bank statement. $2,549.99 BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Depositor’s records Beginning balance Add note and interest collected by bank The bank collected a note in the amount of $400 and the related interest of $8 for Power Networking $2,549.99 408.00 $2,957.99 BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Depositor’s records Beginning balance $2,549.99 Add note and interest collected by bank 408.00 $2,957.99 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 deposit of $637.02 did not appear ThreeAchecks that were written during the on appear the bankon statement. period did not the bank statement: #812, $1,061; #878, $435.39, #883, $48.60. BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Depositor’s records Beginning balance $2,549.99 Add note and interest collected by bank 408.00 $2,957.99 Deduct check returned because of insufficient funds $300.00 The bank returned an NSF check from one of the firm’s customers, Thomas Ivey, in the amount of $300. This was a payment on account. BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Depositor’s records Beginning balance $2,549.99 Add note and interest collected by bank 408.00 $2,957.99 Deduct check return because of insufficient funds $300.00 Bank service charges 18.00 The bank service charges totaled $18.00. BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Depositor’s records Beginning balance $2,549.99 Add note and interest collected by bank 408.00 $2,957.99 Deduct check return because of insufficient funds $300.00 Bank service charges 18.00 Error recording Check No. 879 9.00 327.00 Check No. 879 for $732.26 to Taylor Co. on account, erroneously recorded in journal as $723.26. BANK Bank’s books Beginning balance Add deposit not recorded by bank $3,359.78 816.20 $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Adjusted balance $2,630.99 Depositor’s records Beginning balance $2,549.99 Add note and interest collected by bank 408.00 $2,957.99 Deduct check return because of insufficient funds $300.00 Bank service charges 18.00 Error recording Check No. 879 9.00 327 Adjusted balance $2,630.99 Now, if desired, we can prepare a formal statement for Power Networking. Power Networking Bank Reconciliation July 31, 2006 Balance per bank statement Add: Deposit not recorded by bank $3,359.78 816.20 $4,175.98 Deduct: Outstanding checks No. 812 No. 878 No. 883 Adjusted balance $1,061.00 435.39 48.60 Balance per depositor’s records Add: Note and interest collected by bank Deduct: NSF check (Thomas Ivey) returned Bank service charges Error in recording Check No. 879 Adjusted balance 1,544.99 $2,630.99 $2,549.99 408.00 $2,957.99 $300.00 18.00 9.00 327.00 $2,630.99 Reconciling the Bank Statement Example Question No 1 Prepare a July 31 bank reconciliation statement and the resulting journal entries for the Simmons Company. The July 31 bank statement indicated a cash balance of $9,610, while the cash ledger account on that date shows a balance of $7,430. Additional information necessary for the reconciliation is shown on the next page. Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $225 received as payment of an account receivable. The bank statement showed $30 interest earned on the bank balance for the month of July. Check 781 for supplies cleared the bank for $268 but was erroneously recorded in our books as $240. A $486 deposit by Acme Company was erroneously credited to our account by the bank. SIMON COMPANY Bank Reconciliation July 31,2001 Balance per bank statement, July 31 Additions: Deposit in transit Deductions: Bank error $ Outstanding checks Adjusted cash balance $ 9,610 500 486 2,417 Balance per depositor's records, July 31 Additions: Interest Deductions: Recording error $ 28 NSF check 225 Adjusted cash balance (2,903) $ 7,207 $ 7,430 30 $ (253) 7,207 Reconciling the Bank Statement Example GENERAL JOURNAL Date Account Titles and Explanation Jul 31 Cash Debit Credit 30 Interest Revenue 31 Supplies Inventory Accounts Receivable Cash 30 28 225 253 Reconciling the Bank Statement Example Question No 2 Prepare a December 31 bank reconciliation statement and the resulting journal entries for the Data Flow Inc . The Dec 31 bank statement indicated a cash balance of $15,981, while the cash ledger account on that date shows a balance of $17,445. Additional information necessary for the reconciliation is shown on the next page. Outstanding checks totaled $3513. A $4353 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $600 received as payment of an account receivable. The bank statement showed $24 Service Charges for the month of dec. DATA FLOW INC Bank Reconciliation December 31,2006 Balance per Bank statement Addition: Deposits in Transit Deduction: Outstanding Checks Adjusted Cash Balance Balance per Depositor’s Record Deductions: Service Charges $24 NSF Check $600 Adjusted Cash Balance $15,981 4,353 (3,513) $16,821 $17,445 $(624) $16,821 GENERAL JOURNAL Date Account Titles and Explanation Debit $ 2006 Dec 31 Bank Service Charges A/R Cash 24 600 Credit $ 624 Reconciling the Bank Statement Example Question No 3 Prepare a July 31 bank reconciliation statement and the resulting journal entries for the Norfleet Farm . The July bank statement indicated a cash balance of $18,928.12, while the cash ledger account on that date shows a balance of $16,766.95. Additional information necessary for the reconciliation is shown on the next page. Outstanding checks totaled $1,802.97. A $4,017.15 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $180 received as payment of an account receivable. The bank statement showed $4,545 Note Receivable collected by the bank for the business. Check 821 for Office Equipment cleared the bank for $835.02 but was erroneously recorded in our books as $853.02. The bank statement showed $7.65 Service Charges for the month of July. NORFLEET FORM Bank Reconciliation July 31,2001 Balance per Bank statement, July 31 $18,928.12 Addition: Deposits in Transit 4017.15 Deduction: Outstanding Checks (1,802.97) Adjusted Cash Balance Balance per Depositor’s Record $16,766.95 Additions: Note Receivable by bank $4,545.00 Book error 18.00 4563.00 Deductions: Service Charges $7.65 NSF Check 180.00 $(187.65) Adjusted Cash Balance $21,142.30 $21,142.30 GENERAL JOURNAL Date Account Titles and Explanation Debit $ 2001 July 31 Cash N/R Office Equipment To record collection by bank of N/R, and correct recorded cost of office equipment 4563 July 31 Bank Service Charges A/R Cash To adjust accounting record for bank service charges and customer check charge back as NSF 7.65 180.00 Credit $ 4545 18 187.65 Reconciling the Bank Statement Example Question No 4 Prepare an October 31, 2006 bank reconciliation statement and the resulting journal entries for the Parkview Company. The October bank statement indicated a cash balance of $5,000.17, while the cash ledger account on that date shows a balance of $4,262.83. Additional information necessary for the reconciliation is shown on the next page. Outstanding checks totaled $717.75. A $410.90 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $50.25 received as payment of an account receivable. The bank statement showed $ 500.00 Note Receivable collected by the bank for the business. Check 875 for Telephone Expense cleared the bank for $85.00 but was erroneously recorded in our books as $58.00. The bank statement showed $17.00 Service Charges for the month of July. The bank statement showed $24.74 interest earned on the bank balance for the month of October. PARKVIEW COMPANY Bank Reconciliation October 31,2006 Balance per Bank statement, July 31 $5,000.17 Addition: Deposits in Transit 410.90 Deduction: Outstanding Checks (717.75) Adjusted Cash Balance $4,693.32 Balance per Depositor’s Record $4,262.83 Additions: Note Receivable by bank $ 500.00 Interest Revenue 24.74 524.74 Deductions: Service Charges $17.00 Book Error 27.00 NSF Check 50.25 $(94.25) Adjusted Cash Balance $4,693.32 GENERAL JOURNAL Date Account Titles and Explanation Debit $ 2006 Oct 31 Cash N/R Interest Revenue To record collections by bank of N/R and Interest Revenue 524.74 Oct 31 Bank Service Charges A/R Telephone Expense Cash To adjust accounting record for bank service charges, customer check charge back as NSF and understatement of cash payment for telephone expense 17.00 50.25 27.00 Credit $ 500.00 24.74 94.25 CLASS ACTIVITY-1 Prepare Bank Reconciliation Statement For DUBAI ENTERPRISES Balance per Depositor’s record $4239.35 Balance per Bank Statement $4581.50 Checks outstanding $694.10 Deposit in transit $362.80 A check for payment of $57 was recorded as $75 in deposit ledger. f) Bank debit memorandum for service charges $7.15. a) b) c) d) e) CLASS ACTIVITY-2 Prepare Bank Reconciliation Statement For DUBAI ENTERPRISES a) Balance per Depositor’s record $5780 b) Balance per Bank Statement $4675 c) Checks outstanding $ 1800 d) Deposit in transit $ 2000 e) Interest on investment collected by the bank $800 f) Bank service charges $30 g) Interest on Notes Payables $175 h) Checks issued and paid by bank omitted to be recorded $ 1500 Financial Assets Cash Short-term Investments Receivables Cash Coins and paper money Bank credit card Cash is Defined as any deposit banks will accept. Travelers’ checks Checks Money orders Accountant define cash as any item that banks will accept for deposits. These items include not only coins and paper money, but also checks, money orders and travelers checks. Banks also accept drafts signed by customers using bank credit cards. Reporting of Cash Cash is listed first in the balance sheet because it is the most liquid of all current assets. For the purpose of Balance Sheet presentation Reporting cash needs special attention of the following: 1.Cash equivalents 2. Restricted cash 3. Lines of credit Cash Equivalents Some short term investments are so liquid that they are termed cash equivalents. To qualify as a cash equivalent ,an investment must be 1. Very safe 2. Have a very stable value 1. 3. Mature within 90 days of acquision . Examples: Treasury bills, money-market funds, commercial paper These assets are considered so similar to cash that they are combined with the amount of cash in Balance Sheet. Therefore the first asset listed in balance sheet often is called Cash and Cash Equivalents. To qualify as a cash equivalent, an investment must be very safe, have a very stable market value and mature within 90 days of the date of acquisition. Short term investments that do not qualify as cash equivalents are listed in the balance sheet as marketable securities, which appear second among the current assets. Reporting Cash in the Balance Sheet Combined with cash on balance sheet Liquid shortterm investments Cash Equivalents Stable market values Matures within 90 days of acquisition Restricted Cash Some banks accounts are restricted as to their use, so they are not available to meet the normal operating needs of the company. For example, a bank account may contain cash specifically kept for the acquisition of Fixed assets. Bank account in some foreign countries are restricted by laws that prohibit transferring the money another country. • Cash that is not available for paying current liabilities should not be viewed as a current asset. Therefore restricted cash should be listed just below the current asset section of the balance sheet in the section entitled “Investment and Funds. Reporting Cash in the Balance Sheet Not available for paying current liabilities “Restricted” Cash Not a current asset Listed as an investment Line of Credit • Many businesses arrange line of credit with their bank. “A line of credit means that the bank has agreed in advance to lend the company any amount of money up to a specified limit”. • The company can borrow this money at any time simply by drawing checks on a special bank account. A liability to the bank arises as soon as money is borrowed that is as soon as a portion of the line of credit is used. The unused portion of the line credit is not an asset nor a liability, it represents only the ability to borrow money quickly and easily and increases the company solvency. Reporting Cash in the Balance Sheet Bank agrees in advance to lend money. Lines of Credit Liability is incurred when line of credit is used. Unused line of credit is disclosed in notes.