SpiceJet Financial Analysis: Projections & Industry Dynamics

advertisement

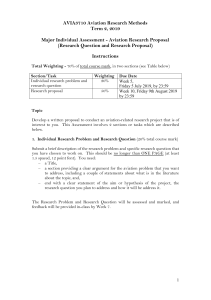

Authors: MUKESH RANJAN PARESH RAHEJA SWAPNIL GUPTA VIKASH CHAUHAN FINANCIAL PROJECTIONS ANALYSIS - SPICEJET LTD Instructor: Dr. NARAYANI RAMACHANDRAN, NMIMS, BENGALURU Table of Contents 1. Introduction : .................................................................................... Ошибка! Закладка не определена. 2. Industry Dynamics : ................................................................................................................................. 2 3. Financial Projections Rationale:............................................................................................................... 2 3.1. Colossal Order for Aircrafts to capitalize industry dynamics: ............................................................... 2 3.2. Spicejet leadership in passenger load factor : ...................................................................................... 3 3.3. Regional Connectivity Scheme (RCS) - UDAN : ..................................................................................... 3 3.4. Improving Balance Sheet and Operating Efficiency: ............................................................................ 3 3.5. Air connectivity through water bodies: ............................................................................................... 4 3.6. Expansion of the Middle Class : ........................................................................................................... 4 4. Appendix 1 - Timeline Projections of Factors affecting the revenue growth of SpiceJet .......................... 4 1. Introduction: This report is prepared as part of a project for estimating the next four years financials (FY 2019-2022) of SpiceJet Ltd. A combination of budgeted and Average percentage of sales method has been taken to arrive at the figures for all the financial items. Budgeted items have been derived from industry research and reports from sources such as IBEF and CAPA (Center for Asia Pacific Aviation). SpiceJet is a low-cost airline headquartered in Gurgaon, India. It is the fourth largest airline in the country by number of domestic passengers carried, with a market share of around 13%. SpiceJet files close to 1.15 million passengers every month on its 408 average daily flights to around 45 domestic and 7 international routes. SpiceJet is the only active participant in the ‘UDAN’, i.e. Regional Connectivity Scheme (RCS) without viability gap funding and has its biggest expansion plan on the cards. It was facing huge losses in 2013-14 and the Company was on the verge of shutting its operations. However, it witnessed a turnaround in 2016 when Ajay Singh, the founder returned and took control of the management. 2. Industry Dynamics: India stands as the second fastest-growing country in the world in terms of domestic passenger growth. Indian domestic air passenger traffic registered a CAGR of 9.89% during 2008-2017 while international passenger traffic grew up by CAGR of 8%. We expect these to grow at around 10%-12% for the next 2-3 years. 3. Financial Projections Rationale: 3.1. Colossal Order for Aircrafts to capitalize industry dynamics: SpiceJet has ordered for 205 aircraft with Boeing. The deal is valued at $22 billion. Out of the 205 aircrafts, 155 are firm orders of Boeing737-8 MAX and includes 40 new Boeing 737-10 and for the rest 50, SpiceJet is having purchase rights which includes the airline’s capability to include long-haul aircrafts. These aircrafts will come into operations from 2018 and will go until 2025. SpiceJet has also signed the largest ever Q400 Turboprop order to increased market share in the regional space and increase its capacity from 10% in the UDAN scheme. With the above-mentioned expansion on the cards, we expect SpiceJet to gain market share in the Indian aviation market. We expect its mkt share to grow steadily from current 12.8% to 18-19% by 2025. Refer Appendix 1 graphs for insight into SpiceJet’s revenue forecasting based on factors like ASK ,RPK and Passneger Carrying capacity growth rates.These aircrafts are brough on 75-25% lease and debt payment ratio.This will also have a significant impact on their depreciation amount.The depreciation amount has been calculated taking into consideration,their current fleet size of 64 (40 Boeing 737 and rest bombardier) having an average aege of 8.1 years (total lifespan of 27years) and the new aircrafts that will be getting delivered in batched upto 2025. Figure 1 3.2. Spicejet leadership in passenger load factor : SpiceJet has flown with the highest passenger load factors in the Indian aviation market for 3 years in a row. PLF for SpiceJet has been in excess of 90% for the last 35 months-an achievement which is unparalleled in the global aviation history. Recently, the company has achieved to clock 95% occupancy even in the traditionally leaner month of March leaving behind the industry leader by market share Indigo by 6-7%. We expect SpiceJet to continue with this trend of having PLF more than 90%. 3.3. Regional Connectivity Scheme (RCS) - UDAN : SpiceJet has been awarded with 17 proposals under the second round of RCS. SpiceJet has announced 20 new non-stop domestic flights, aimed at strengthening its network across South India. The new flights connecting the metro cities with the non-metros will give fresh impetus to the airlines regional connectivity theme and help gain market share. In the first phase, SpiceJet was awarded with 6 routes and it was the only airline that did not seek viable gap funding from the Government. We expect SpiceJet to gain a healthy bite of the pie and continue as market leader in this segment. 3.4. Improving Balance Sheet and Operating Efficiency: In order to clean the balance sheet SpiceJet has repaid its debt to a great extent by bringing it down to around INR9.5 billion in FY18 from around INR17 billion in FY16. Secondly, the company’s focus is on cost optimization and revenue maximization. For FY2017, Cost per Available Seat Kilometer (CASK) ex-fuel was down by 20%. The company has worked upon its Revenue per Available Seat Kilometer (RASK) and increased it to around INR3.76 levels. But due to the huge order size ,we expect it’s loan numbers to almost double in FY 2019 and also the aircraft lease rentals expense to increase by almost 30% in FY19 and subsequent years. 3.5. Air connectivity through water bodies: The Gurgaon-based airline is the only domestic airline to explore air connectivity through water bodies such as rivers and waterways. SpiceJet is working on a cost effective plan to bring into operations small amphibious and land planes. The company is expecting to start its operation commercially by 2019. They are planning to start the operations with around 100 sea-planes. This will bring in the remotest parts of India into the SpiceJet network. Sea-Planes will revolutionize the transport sector in India. 3.6. Expansion of the Middle Class : According to CAPA, India’s annual per capita income has grown at a CAGR of 1.9%, from USD1,497 in FY2012 to USD1,616 in FY2016. India’s growth in per capita income and overall population has caused the rapid expansion in the size of India’s middle class, defined as households with a disposable income of more than USD5,000 per year. This will further fuel the growth in aviation sector in India and we SpiceJet to be a major beneficiary of this growth. 4. Appendix 1 - Timeline Projections of Factors affecting the revenue growth of SpiceJet Figure 2 Available Seat Kilometer 4000 30 3000 20 2000 10 1000 0 0 Passeneger Carried (in Crs) 4 -10 ASK(in crores) 2 Growth rate (%) 0 30 20 10 0 2015 2016 2017 2018 2019 2020 2021 2022 Passenger Carried (in Crs) Revenue Passeneger Kilometers (in Crs) Mkt Share in domestic Ops.(%) 4000 40 20 3000 30 15 2000 20 10 1000 10 0 0 2022 2021 2020 2019 2018 2017 2016 2015 RPK (in Crs) Growth rate(%) Growth rate (%) 5 0 2015 2016 2017 2018 2019 2020 2021 2022 Mkt Share in domestic Ops.(%)