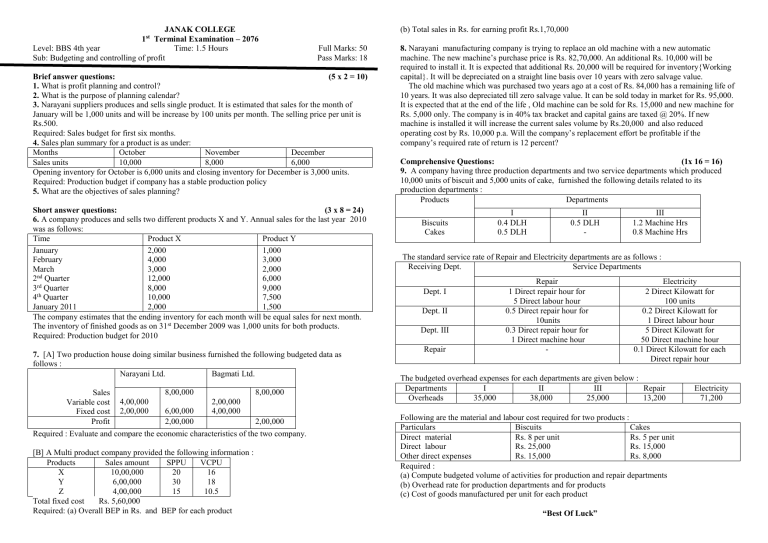

JANAK COLLEGE

1st Terminal Examination – 2076

Level: BBS 4th year

Time: 1.5 Hours

Sub: Budgeting and controlling of profit

(b) Total sales in Rs. for earning profit Rs.1,70,000

Full Marks: 50

Pass Marks: 18

Brief answer questions:

(5 x 2 = 10)

1. What is profit planning and control?

2. What is the purpose of planning calendar?

3. Narayani suppliers produces and sells single product. It is estimated that sales for the month of

January will be 1,000 units and will be increase by 100 units per month. The selling price per unit is

Rs.500.

Required: Sales budget for first six months.

4. Sales plan summary for a product is as under:

Months

October

November

December

Sales units

10,000

8,000

6,000

Opening inventory for October is 6,000 units and closing inventory for December is 3,000 units.

Required: Production budget if company has a stable production policy

5. What are the objectives of sales planning?

Short answer questions:

(3 x 8 = 24)

6. A company produces and sells two different products X and Y. Annual sales for the last year 2010

was as follows:

Time

Product X

Product Y

January

2,000

1,000

February

4,000

3,000

March

3,000

2,000

2nd Quarter

12,000

6,000

3rd Quarter

8,000

9,000

4th Quarter

10,000

7,500

January 2011

2,000

1,500

The company estimates that the ending inventory for each month will be equal sales for next month.

The inventory of finished goods as on 31st December 2009 was 1,000 units for both products.

Required: Production budget for 2010

7. [A] Two production house doing similar business furnished the following budgeted data as

follows :

Narayani Ltd.

Bagmati Ltd.

8,00,000

8,00,000

Sales

2,00,000

Variable cost 4,00,000

6,00,000

4,00,000

Fixed cost 2,00,000

Profit

2,00,000

2,00,000

Required : Evaluate and compare the economic characteristics of the two company.

[B] A Multi product company provided the following information :

Products

Sales amount

SPPU

VCPU

X

10,00,000

20

16

Y

6,00,000

30

18

Z

4,00,000

15

10.5

Total fixed cost

Rs. 5,60,000

Required: (a) Overall BEP in Rs. and BEP for each product

8. Narayani manufacturing company is trying to replace an old machine with a new automatic

machine. The new machine’s purchase price is Rs. 82,70,000. An additional Rs. 10,000 will be

required to install it. It is expected that additional Rs. 20,000 will be required for inventory{Working

capital}. It will be depreciated on a straight line basis over 10 years with zero salvage value.

The old machine which was purchased two years ago at a cost of Rs. 84,000 has a remaining life of

10 years. It was also depreciated till zero salvage value. It can be sold today in market for Rs. 95,000.

It is expected that at the end of the life , Old machine can be sold for Rs. 15,000 and new machine for

Rs. 5,000 only. The company is in 40% tax bracket and capital gains are taxed @ 20%. If new

machine is installed it will increase the current sales volume by Rs.20,000 and also reduced

operating cost by Rs. 10,000 p.a. Will the company’s replacement effort be profitable if the

company’s required rate of return is 12 percent?

Comprehensive Questions:

(1x 16 = 16)

9. A company having three production departments and two service departments which produced

10,000 units of biscuit and 5,000 units of cake, furnished the following details related to its

production departments :

Products

Departments

Biscuits

Cakes

I

0.4 DLH

0.5 DLH

II

0.5 DLH

-

III

1.2 Machine Hrs

0.8 Machine Hrs

The standard service rate of Repair and Electricity departments are as follows :

Receiving Dept.

Service Departments

Dept. I

Dept. II

Dept. III

Repair

Repair

1 Direct repair hour for

5 Direct labour hour

0.5 Direct repair hour for

10units

0.3 Direct repair hour for

1 Direct machine hour

-

Electricity

2 Direct Kilowatt for

100 units

0.2 Direct Kilowatt for

1 Direct labour hour

5 Direct Kilowatt for

50 Direct machine hour

0.1 Direct Kilowatt for each

Direct repair hour

The budgeted overhead expenses for each departments are given below :

Departments

I

II

III

Repair

Overheads

35,000

38,000

25,000

13,200

Following are the material and labour cost required for two products :

Particulars

Biscuits

Cakes

Direct material

Rs. 8 per unit

Rs. 5 per unit

Direct labour

Rs. 25,000

Rs. 15,000

Other direct expenses

Rs. 15,000

Rs. 8,000

Required :

(a) Compute budgeted volume of activities for production and repair departments

(b) Overhead rate for production departments and for products

(c) Cost of goods manufactured per unit for each product

“Best Of Luck”

Electricity

71,200