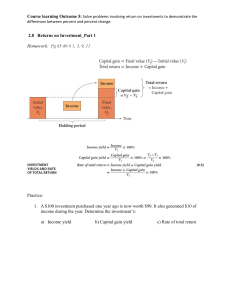

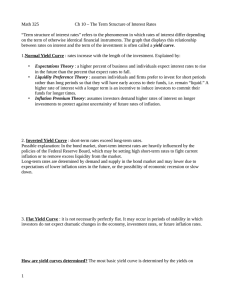

presentation GROUP2 MAI THI QUYEN – MAMAIU16049 NGUYEN THANH KHANG – MAMAIU16036 THIEU THI THUY VAN – MAMAIU16059 Presentation overview 4.1 The yield curve 4.2 The term structure 4.3 Forward rates 4.4 Term structure explanations 4.5 Expectations dynamics 4.6 Running present value 4.7 Floating rate bonds 4.8 Duration 4.9 Immunization 4.1 YIELD CURVE: a plot of the interest rates ( yield to maturity ) for particular types of bond with different terms to maturity, but the same risk, liquidity and tax treatments _Yield curve are classified in terms of their shapes and are used to explain the condition in financial markets and the economy Theyieldcurve TYPES OF YIELD CURVE _Normal yield curve _Steep yield curve _ Flat yield curve _ Inverted yield curve Different shapes appear under different economic condition 4.2 the term structu re SPOT RATE, DISCOUNT FACTOR, PRESENT VALUE. Spot rate is the rate of interest , expressed in yearly term, charged for money held from the present time (t=0) until time t. KEY TAKEAWAYS: *The spot rate reflects current market supply and demand for an asset. *The spot rates for particular currency pairs and commodities are widely publicized and followed. *Contracts for delivery will often reference the spot rate at the time of signing. Spot rate DISCOUNT FACTOR and PRESENT VALUE Once the spot rates has been determined , it is natural to defined the corresponding discount factor dt for each time point. These are the factors by which future cash flows must be multiplied to obtain an equivalent present value. For the various compouding conventions, they are defined as follow: Discount factor Using the spot rate curve of figure below, let us find the value of an 8% bond maturing in 10 years example Using the spot rate curve of figure below, let us find the value of an 8% bond maturing in 10 years example 4.3 FORWARD RATE Forward rates -The forward rate between time t1 and t2 with t1< t2 is denoted by f(t1,t2). It is the rate of interest charged for borrowing money at time t1, which is to be repaid ( with interest) at time t2 _ Forward rates are calculated from the spot rate. _In the context of bonds, forward rates are calculated to determine future values. 4.4 TERM STRUCTURE_ EXPLANATIONS THE EXPECTATION THEORY LIQUIDITY PREFERENCE THEORY MARKET SEGMENTATION THEORY Term Structure Theories Any study of the term structure is incomplete without its background theories. They are pertinent in understanding why and how are the yield curves so shaped. #1 – The Expectations Theory/ Pure Expectations Theory This theory states that current long-term rates can be used to predict short term rates of future. It simplifies the return of one bond as a combination of the return of other bonds. For example: a 3-year bond would yield approximately the same return as three 1-year bonds. Term Structure Theories (cont) Any study of the term structure is incomplete without its background theories. They are pertinent in understanding why and how are the yield curves so shaped. .#2 – Liquidity Preference Theory This theory perfects the more commonly accepted understanding of liquidity preferences of investors. Investors have a general bias towards short term securities which have higher liquidity as compared to the long term securities which get one’s money tied up for long. Key points of this theory are: • Price change for a long term debt security is more than that for a short term debt security. • Liquidity restrictions on long term bonds prevent the investor from selling it whenever he wants. • The investor requires an incentive to compensate for the various risks he is exposed to, primaril price risk and liquidity risk. • Less liquidity leads to an increase in yields while more liquidity leads to falling yields, thus defining the shape of upward and downward slope curves. Term Structure Theories (cont) Any study of the term structure is incomplete without its background theories. They are pertinent in understanding why and how are the yield curves so shaped. #3 – Market Segmentation Theory This theory related to the supply-demand dynamics of a market. The yield curve shape is governed by the following aspects: • Preferences of investors for short term and long term securities. • An investor tries to match the maturities of his’ assets and liabilities. Any mismatch can lead to capital loss or income loss. • Securities with varying maturities form a number of different supply and demand curves which then eventually inspire the final yield curve. • Low supply and high demand lead to an increase in interest rates.. a. Spot rate forecasts 4.5EXPECTATION_ DYNAMICS Expectation theory forms the basis of the concept of expectation dynamics, which is a particular model of how spot rates might change with time. Expectation Dynamic is only a model, and future rates will most likely deviate from the values its delivers; but it provides a logical simple prediction of future rate. a. Spot rate forecasts 4.5EXPECTATION_ DYNAMICS b. Discount factor SIMPLE YOUR C R E AT I V I T Y SIMPLE YOUR C R E AT I V I T Y C. Short rates SIMPLE YOUR C R E AT I V I T Y SIMPLE YOUR C R E AT I V I T Y SIMPLE YOUR C R E AT I V I T Y CONTINUE… d. Invariance As a special case, if the current spot rate is flat say, at 12% then according to expectation dynamic, the spot rate curve next year will also be flat at 12%. The invariance theorem states that if spot rate evolve according to expectations dynamics, the interest rate market for several years is independent of how those funds are invested 4.6 RUNNING PRESENT VALUE _Present value can be calculated by the running method, which states from the final cash flow and works backward toward the first cash flow. ._At any stage k of the process, the present value is calculated by discounting the next period’s present value using the short rate at time k that is implied by the term structure. _This backward moving method of evaluation is fundamental to advance methods of calculation in various areas of investment science. EXAMPLE 4.6 RUNNING PRESENT VALUE 4.7 FLOATING RATE BONDS •A floating rate note or bond has a fixed face value and fixed maturity. •But its coupon payments are tied to current ( short) rates of interest. •It has interest rates are varied by period. The interest rate adjustment period can be 6 months, 1 year, 1 and a half years, ... clearly agreed on the bond, while the interest rate changes depends on the average indicators in the market at the time. This interest rate change is prescribed by the issuing company FLOATING BOND •Consider, a floating rate bond that makes coupon payments every 6 months. When the bond is issued, the coupon rate for the first 6 months is set equal to the current 6-month interest rate. At the end of 6 months a coupon payment at that rate is paid. •The coupon is the rate times the face value divided by 2 (because of the 6-month schedule). Then, after that payment, the rate is reset.The process continues until maturity •Clearly, the exact values of future coupon payments are uncertain until 6 months before they are due. Therefore, that it may be difficult to assess the value of such a bond In fact at the reset times, the value is easy to deduce-it is equal to par. FLOATING BOND 4.8 DURATION •Given the spot rates s1, s2,… imagine that these rates all change together by an additive amount λ. Then the new spot rates are s1 + λ, s2 + λ …, for the new spot rates are for the same periods as before. This parallel shift of the spot rate curve generalizes a change in the yield because if the spot rate curve were flat, all spot rates would be equal to the common value of yield 90% 4.8 DURATION 90% 4.8 DURATION 90% 4.8 DURATION 90% 4.8 DURATION 90% 4.9 IMMUNIZATION 90% 4.9 IMMUNIZATION 4.9 IMMUNIZATION THANK YOU !