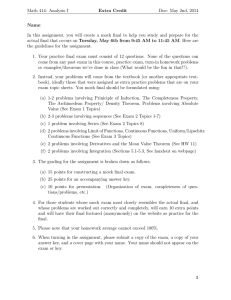

CFA Level I Mock Exam: Practice Questions & Time Allocation

advertisement