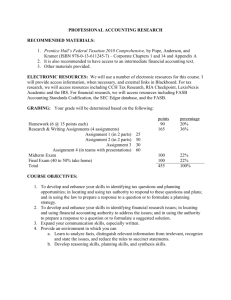

Financial Accounting Solutions Manual, Ch. 1

advertisement