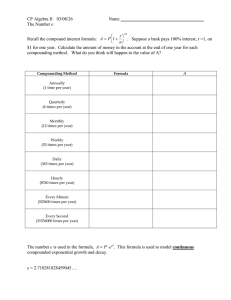

SP 2018 Principles of Finance Exam 1 Dr. Leo Chan Student Name: Part I: Multiple Choice Problems (1 to 10 are worth 2 points each.) Instructions: Please write down your answer to the MC problems at the space provided at the end of the MC section. 1. Which of the following is(are) considered unethical behavior(s)? I. Management pushed for more profit/revenue sources that are against the law II. Employees act against company rules (but not established laws) to seek profit/bonus opportunities III. Employee observes management and/or other employees commits unethical or unlawful behaviors and failed to report them a. I and II only b. III only c. I, and II only d. I, II, and III 2. Which of the following is the least desirable asset? a. cash b. inventory c. goodwill d. long term investment e. plant, property and equipment 3. Higher fixed asset level will result in: a. higher total asset turnover b. higher fixed asset turnover c. higher return on assets d. higher depreciation expenses e. higher shareholders equity. 4. When economic condition creates challenging time for sales, which of the following indicates that a company might be in trouble? a. low ROE b. low total debt ratio c. low time interest earned ratio d. low P/E ratio e. low ROA 5. All else being equal, operating cash flow can be negatively impacted by a. increases in depreciation expenses. b. tax rate decreases. c. interest paid decreases. d. revenues increases. e. decreases in gross margin. 6. Which one of the following will cause a reduction in average tax rate? a. Higher taxable income in a progressive tax system. b. Higher taxable income in a regressive tax system. c. Lower taxable income in a progressive tax system. d. Lower taxable income in a regressive system. e. both b and c. 1 7. Which of the following would result in the biggest change in effective interest rate? a. From monthly compounding to weekly compounding. b. From monthly compounding to daily compounding. c. From annual compounding to monthly compounding. d. From annual compounding to weekly compounding. e. not enough information provided. 8. Chan’s Inc. has positive operating cash flow last year. Given this, you can assume the: a. gross profit is also positive. b. NWC is also positive. c. free cash flow is also positive. d. net income is also positive. e. EBIT is also positive. 9. Company A has much higher total asset turnover ratio than company B, and both company has the same profit margin and debt to equity ratio. Which of the following must be true? a. Company B has higher ROA. b. Company A has higher ROE. c. Company A has higher equity multiplier.. d. Company B has higher inventory. e. .both B and C 10. All else being equal, which of the following would result in higher free cash flows? a. Higher fixed assets to total asset ratio. b. Higher return on fixed assets. c. Lower return on fixed assets. d. Higher level of net working capital requirement. e. Higher tax rate. MC answer 1 _____ 2 _____ 3 _____ 4 ____ 5 ____ 6 _____ 7_____ 8_____ 9_____10____ Part II: Short answer problems. 4 points for 1 – 6, and 6 points for 7 -12. 1. You have a 300,000 mortgage, with fixed 30-year term and 5.75% interest, what is your monthly mortgage payment? 2. Kidd’s Kitchen has a marginal tax rate of 28 percent and an average tax rate of 22 percent. If the restaurant earns $189,500 in taxable income, how much will it owe in taxes? 2 3. The Tasty Yogurts Shop has total assets of $8,800, fixed assets of $7,100, current liabilities of $1,500, and longterm liabilities of $4,600. What is the net working capital of the firm? 4. Community Bank Corp has total assets of $2,480 million and an equity multiplier of 8. What is the amount of equity the bank has? 5. Chan, Inc. has sales of $329,000, cost of goods sold of $204,000, SG&A of $25,000, depreciation of $5,900, and interest expense of $15,100. The tax rate is 31 percent. What is the time interest earned ratio? 6. Arnold, Inc. has sales of $124,700, cost of goods sold of $102,500, net profit of $9,800, fixed assets of $84,200, and current assets of $8,100. What is the total asset turnover ratio? 7. You won a lottery that has a payout of $30,000,000. Would you take a lump sum payment of $12,000,000 today rather than an equal payment of $1,000,000 over 30 years if you can earn 8.2% return on investment? 8. Your credit card carries a 24% APR. You have $10,000 balance. If you pay $200 each month, how long would it take you to pay off the balance? 3 9. When you were born, your parents opened college fund account in your name and deposited $3,000 into the account. The account has earned an average annual rate of return of 11 percent. Today, the account is valued at $21,790. How old are you? 10. You have $5,000 today and want to have $20,000 in 12 years. What interest rate must you earn? 11. You quit your job and started a company last year. The company has sales of $198,400. The costs of goods sold are $95,000 and the other costs are $17,000. Depreciation is $20,000 and the tax rate is 32 percent. What is the operating cash flow of the company? 12. Garner, Inc. has a return on equity of 16 percent, an equity multiplier of 1.5, and a total asset turnover of 2. What is the profit margin? Part II. Short Answer problems: you must show your work to get full credits. 1. (8 points) You want to have $150,000 a year for retirement spending. If you’re expected to live for 27 years after retirement and you can earn 6.5% on retirement savings, how much you have to have before you can retire? 4 2. (8 points) You want to have $1,500,000 million dollar before you retire. You can put aside $5,000 a year for retirement investments. You plan to work for another 38 years. What is the return on investment do you have to earn in the account? 3. (10 points) The Best Pet Supply Co. has EBIT of $534 million last year. The company has no debt and an average tax rate of 30%. Increase in net working capital is $5 million and a net increase in fixed assets of $30 million (including $35 million in depreciation). What is the free cash flow for the company? 4. (10 points) Auto-mart has total assets of $842,000. There are 80,000 shares of stock outstanding with a market value of $25 a share. The firm has a profit margin of 5.4 percent and a total asset turnover of 1.6. What is the priceearnings ratio? Bonus (2 points): How long did the gorilla appears in the basketball passing exercise? 5