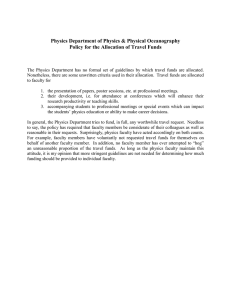

Service Department Cost Allocation: Single & Dual Rate Methods

advertisement

Allocating service departments costs: • Service departments provide support and assist other internal departments (both service and production). • Examples of service departments: - Information System Department - Maintenance Department • There are two methods to allocate service departments costs: 1- Single rate method • no distinction between varaible and fixed costs 2- Dual rate method • Divide the costs of each department into: • - fixed costs • - variable costs Ex: Assume a Company has two production department A and B, and one service department Z provides the following information: - Practical capacity of department Z 12,000 hours - Fixed costs of operating dep. Z was $200,000 - Variable cost per hour of dep. Z was $15 (per hour used) - Budgeted Direct labor usage of dep. Z was 8,000 hours - Department A budgeted usage 6,000 hours of dep. Z services - Department A used 5,000 hours of dep. Z services - Department B budgeted usage 2,000 hours of dep. Z services - Department B used 1,000 hours of dep. Z services Requirement: allocate costs of the company service department to its production department in two cases (based on the demand for services – based on the supply of capacity)using: - Single rate method - Dual rate method Solution: Case 1 based on the demand for services (usage) First: Cost allocation using Single rate method: One combined allocation rate is used, calculated as follows: 1- Determine dep. Z total costs: Dep. Z variable costs = $15 X 8,000 h= $120,000 Dep. Z fixed costs = $200,000 Total costs of dep. Z = (Fixed+ variable) $320,000 2- Determine dep. Z allocation rate: Allocation rate = $320,000 / 8,000 h = $40 per hour used Calculate the cost allocated to each production department: 1- Cost allocated to department A = $40 X 5000 h = $200,00 2- Cost allocated to department B = $40 X 1,000 h = $ 40,000 Total cost allocated $240,000 Note: Under Single rate method allocation rate is calculated based on budgeted cost driver, While production departments are charged with costs based on their actual usage of cost driver (allocation base) Second: Cost allocation using Dual rate method: Calculate allocation rate for each cost pool: Fixed costs allocation rate = $200,000/ 8,000 (budgeted hours) = 25 $/hour Variable costs allocation rate = Variable cost per hour of dep. Z = $15 Calculate the cost allocated to each production department: 1. Department A: Variable Cost allocated to department A = $15 X 5000 h = $75,000 Fixed Cost allocated to department A = $25 X 6,000 h = $ 150,000 Total cost allocated to dep. A $225,000 Department B: Variable Cost allocated to department B = $15 X 1000 h = $15,000 Fixed Cost allocated to department B = $25 X 2,000 h = $ 50,000 Total cost allocated to dep. B Total costs assigned to production departments $65,000 $290,000 + Note: Under Dual rate method allocation rate must be chosen for each cost pool, ✓ allocation rate is calculated based on budgeted cost driver, ✓ While production departments are charged with variable costs based on their actual usage of cost driver (allocation base), ✓ charged with fixed costs based on their budgeted usage of cost driver Note: Under both methods each production division was charged with the same amount of variable cost. Case 2 based on the capacity Practical capacity = 12000 hours Budgeted cost rate per hour = Fixed costs/practical capacity = $200,000 / 12,000 hours = $16.67 + Budgeted variable cost per hour = $15 Budgeted total cost per hour = $31.67 Using the same procedures for the single-rate and dual-rate methods as in the previous section First: Cost allocation using Single rate method: Calculate the cost allocated to each production department: 3- Cost allocated to department A = $31.67 X 5000 (actual hours) = $158,350 4- Cost allocated to department B = $31.67 X 1,000 (actual hours) + = $ 31,670 Total cost allocated to production departments $190,020 5- Fixed Cost of unused (Idle) capacity = (Practical capacity- Capacity used) X Fixed cost allocation rate = (12,000-5,000-1,000) hours X $16.67 = $100,020 Second: Cost allocation using Dual rate method: Calculate the cost allocated to each production department: 2. Department A: Variable Cost allocated to department A = $15 X 5000 (actual hours) = $75,000 Fixed Cost allocated to department A = $16.67 X 6,000 (budgeted hours) = $ 100,020 + Total cost allocated to dep. A $175,020 3. Department B: Variable Cost allocated to department B = $15 X 1000 (actual hours) = $15,000 Fixed Cost allocated to department B = $16.67 X 2,000 (budgeted hours) = $ 33,340 Total cost allocated to dep. B Total costs assigned to production departments $48,340 $223,360 4. Fixed Cost of unused (Idle) capacity = (Practical capacity- budgeted Capacity to be used) X Fixed cost allocation rate = (12,000-6,000-2,000) hours X $16.67 = $66,680 Exercise (1): The power plant serves all manufacturing departments of MidWest Engineering, it has a budget for the coming year, expressed in the following monthly terms: Manufacturing Practical Capacity Average Expected Department Production Level Monthly (Kilowatt-Hours) Usage (Kilowatt-Hours) Rock 10,000 8,000 Peri 20,000 9,000 Hamd 12,000 7,000 + Kan 8,000 6,000 Total 50,000 30,000 The expected monthly costs for operating the power plant during the budget year are $15,000: $6,000 variable and $9,000 fixed. Requirement: What budgeted amounts will be allocated to each manufacturing department if (a) The rate is calculated based on practical capacity, assuming: - single rate method is used. - dual rate method is used. (b) The rate is calculated based on expected monthly usage, assuming: - single rate method is used. - dual rate method is used. Exercise (2): Chocolate Inc. is a producer of premium chocolate based in Cairo. The company has a separate division for each of its two products: dark chocolate and milk chocolate. Chocolate purchases ingredients from WI for its dark chocolate division and from LO for its milk chocolate division. Both locations are the same distance from Cairo plant. Chocolate Inc. operates trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the trucks. The trucks had a practical capacity of 50 round-trips between the plant and the two suppliers The co. recorded the following information. Budgeted Actual Costs of truck Number of round-trips for dark $115,000 $96,750 30 30 20 15 chocolate division (Cairo plant—WI) Number of round-trips for milk chocolate division (Cairo plant—LO) Chocolate Inc. decides to examine the effect of using the dual-rate method for allocating truck costs to each round-trip. At the start of 2018, the budgeted costs were as follows: Variable cost per round-trip $1,350 Fixed costs $47,500 The actual results for the 45 round-trips made in 2018 were as follows: Variable cost $58,500 Fixed costs $38,250 Total $96,750 Required: 1- allocate costs based on round-trips used by each division. 2- allocate costs based on round-trips budgeted for each division.