Accounting & Finance Career Paths: Skills & Job Roles

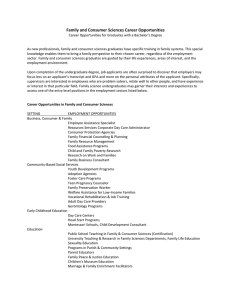

advertisement

Employability skills Studying within the Accounting and Finance department you will have the opportunity to develop specific subject knowledge alongside a set of highly valuable and transferable employability skills, including: Business and commercial awareness: a first-rate understanding of business procedure and the nature and functionality of organizations and the commercial world Strong numerical skills: the ability to understand, manipulate and interpret complex numerical and statistical data Advanced analytical thinking and problem-solving skills: applying a methodical approach to analyse information critically, assessing all aspects of a situation and evaluating possible solutions. Organizational skills: learning to think logically, pay attention to detail and organise your time and work efficiently. Excellent communications skills: enabling you to present complex data verbally and in writing http://www.lse.ac.uk/collections/graduateDestinations/accountingAndFinance/whatdo .htm#generated-subheading3 Further study options Many Accounting graduates go on to pursue further study via on-the-job training or part-time study. In particularly large numbers of graduates go on to complete professional qualifications, including the ACA, ACCA, ATT, CFA and CIMA qualifications. A few graduates also choose to undertake the Graduate Diploma in Law in order to convert to a career in law. Others have chosen to undertake postgraduate courses, for example: MSc courses in Economics, Accounting & Finance and Real Estate Economics & Finance at LSE MSc in Management at HEC Paris MSc in Information Systems Management at the University of Warwick Business School MPhil courses in Management Studies and Geostate Finance at the University of Cambridge MPhil in Economics at the University of Oxford http://www.lse.ac.uk/collections/graduateDestinations/accountingAndFinance/undergr aduatecareers.htm In recent years undergraduates from the Accounting department at LSE have pursued a range of careers six months after graduation, including: Employers Typical Job Roles ABN AMRO Analyst Accenture Accountant Anderson Young Auditor Barclays Capital Financial Analyst Bloomberg Graduate Trainee Citigroup Tax Administrator Conde Nast Intern Deloitte Auditor Ernst & Young Trainee Chartered Accountant Flag Telecom Treasury Assistant General Electric Financial Analyst Goldman Sachs International Financial Analyst/ Business Analyst Gortons Graduate Trainee Accountant Grant Thornton Trainee Accountant/ Tax Assistant HBOS Treasury Services Graduate Analyst Inland Revenue Revenue Assistant JP Morgan Chase Analyst KPMG Audit Assistant/ Trainee Chartered Accountant Lazard Financial Analyst Lehman Brothers Research Assistant M & G Investments Tax and Compliance Administrator Macquarie Bank Business Analyst Morgan Stanley Analyst National Audit Office Assistant Auditor Price Waterhouse Coopers Associate/ Auditor/ Assistant Consultant Royal Bank of Scotland Portfolio Finance Manager Shell Oil Business Analyst Signet Investment Analyst Smith & Williamson Trainee Tax Assistant SVB Holdings Assistant Group Internal Auditor Torch Partners Research Analyst In our experience many employers look favorably on students who can demonstrate their abilities in more than one field. Newcastle graduates will have acquired the ability to research, evaluate and communicate information, alongside developing specialist subject knowledge, practical and technical skills. This provides graduates with a range of educational and career opportunities, especially if the skills you have developed during your degree have been further enhanced by work experience. Many of our students go on to pursue careers in a scientific field. Past students have entered fields such as scientific research, scientific publishing or journalism, sales or laboratory work. Graduates who wish to pursue a career in teaching will find that they are suitably qualified to study for a PGCE in either discipline. Those graduates who enter employment outside their discipline find a flexible degree of this nature is highly valued in professions such as IT, management, commerce and the civil service. Mathematicians and statisticians have always been highly valued by employers for their general analytical and problem-solving skills and their ability to think logically and quantitatively. Our courses and university life also provide many opportunities for you to develop skills such as communication, team work, planning and organising, all of which are essential for the employment market. There are some careers for which a degree in mathematics is usually specified, for example, teaching mathematics, statistical work, actuarial work, some types of research and development, and some areas of computing. Mathematics graduates are also strong candidates for other job sectors such as management consultancy, finance, accountancy, information technology, logistics and transportation. Industry too is always looking out for specialists with an interest in the applications of mathematics to engineering. In short, Mathematics graduates can be found in a very wide crosssection of careers, and in both the private and public sectors. Approximately 60% of graduate jobs advertised in the UK do not specify any particular degree subject. Many employers are more interested in the skills and personal qualities you have acquired at university than in the degree course you have studied. The University has very good links with employers. Many companies come on campus to give presentations, attend job fairs and carry out interviews. Some of them are specifically targeting mathematicians. Examples of some of the well-known companies that our recent graduates have gone into are, Ernst and Young, Barclays, Halifax, NHS, Civil Service, BAE Systems, Northern Rock, Watson Wyatt. We enjoy a good reputation for producing highly employable graduates. In addition to technical skills, we teach our students to use their initiative and be self-reliant. We also develop the key skills employers are looking for, such as communication skills, the ability to work in a team, computer literacy and numeracy.Knowledge of accounting, finance, economics and law, together with the analytical and interpersonal skills that you will acquire while studying at Newcastle, provide you with a good foundation for the future. There is a clear difference between the Business Accounting and Finance programme and the Accounting and Finance degree, in that the former offers a fast track to one particular destination, qualification as a Chartered Accountant, whereas the latter leaves your options much more open and could lead to different sorts of accounting traineeships (such as public sector, management accounting, Certified Accountant), as well as to finance, financial services and careers in business. Graduates in accounting and finance do not have to become accountants, although in practice many of our graduates do. There are different types of accountant and within accounting firms there are a number of specialisms which you can choose, such as audit and assurance, taxation, and sometimes insolvency and corporate finance. Some students also choose to undertake further study, often here in Newcastle. It is worth stressing that a professional accounting qualification can open the door to a wide range of senior positions. A significant proportion of those accountants who train in a professional firm later work in industry, commerce and finance, some in the finance area, but many in general management. For example, a high proportion of the chief executive officers of FTSE-100 companies are accountants by training. http://www.ncl.ac.uk/undergraduate/course/NG43/employability Alternative careers There are many other occupations which Accounting and Finance graduates can enter: over 40% of graduate vacancies are open to graduates in any degree discipline. A further 10% may specify a numerate or business-related degree, increasing your opportunities still further. Some careers open to graduates in any subject, where Accounting and Finance graduates may be able to successfully apply the skills mentioned earlier, include: Advertising Civil Service Computing Law Library and Information work Management Services Market Research Personnel Retail Management Purchasing. In the longer term, qualified accountants can and do move into many areas of business, management, finance, sport, media and the public sector. For further information on careers for Accounting and Finance graduates, see Prospects.ac.uk www.prospects.ac.uk/links/AccountFinDeg Specific skills which you may develop include: knowledge and awareness of business organizations, including how they operate and are managed. This enhances your commercial awareness, particularly if the course involves a work placement or case studies; understanding the technical language and practices of accountancy and finance; gaining an insight into the contemporary theories and the practice of financial institutions; numerical and quantitative skills - developed from understanding, recording and evaluating figures within a business context; problem-solving and analytical ability - developed from the numerical aspects of your studies and from exercises and project work; oral and written communication skills - from producing reports and assignments on business issues; working on group topics and discussing business problems will enhance your ability to argue your case and negotiate with others; knowledge of global business issues and language skills, particularly if you study European or international finance; Entrepreneurship - particularly if your course includes mock exercises in self-employment. Consider the skills developed on your course as well as through your other activities, such as paid work, volunteering, family responsibilities, sport, membership of societies, leadership roles, etc. Think about how these can be used as evidence of your skills and personal attributes. Then you can start to market and sell who you really are, identify what you may be lacking and consider how to improve your profile. Take a look at applications, CVs and interviews for some useful tips. http://www.prospects.ac.uk/cms/ShowPage/Home_page/Options_with_your_subject/ Your_degree_in_accountancy_and_finance/Your_skills/p!ecdXfei Postgraduate Study The percentage of Accounting and Finance graduates continuing into full-time postgraduate study is under 10% - about half of the figure for graduates overall. Most will study for a professional accountancy qualification through part-time study while working rather than a Masters degree. Higher degrees in Accounting and Finance tend to be academic rather than vocational, although there are exceptions such as the MSc in International Securities, Investment and Banking at the University of Reading. Graduates who do not wish to follow a finance-related career may consider a general postgraduate business degree, such as the MBA; however, as noted above, many graduate employers are happy to recruit Accounting & Finance graduates into general business functions straight from their first degree. http://www.kent.ac.uk/careers/accountancy.htm