When two businesses are brought together through a merger or takeover, it is possible to define the nature and type of integration based on the activities of each business and where they operate in the supply chain of an industry.

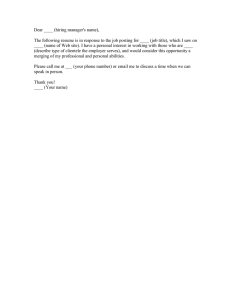

The types of integration are illustrated in the diagram below:

Types of

Integration

The main types of integration are:

Backward vertical integration

This involves acquiring a business operating earlier in the supply chain – e.g. a retailer buys a wholesaler, a brewer buys a hop farm

Conglomerate integration

This involves the combination of firms that are involved in unrelated business activities

Forward vertical integration

This involves acquiring a business further up in the supply chain – e.g. a vehicle manufacturer buys a car parts distributor

Horizontal integration

Here, businesses in the same industry and which operate at the same stage of the production process are combined.

THE GROWTH OF

FIRMS

Topics

Motives for growth

Methods of growth

Methods of integration

Limitations to growth

Motives for growth

Increase profits

Increase market share

Economies of scale

Reduced risk

Survival

To stand up to competition from larger rivals

To be less prone to a takeover by a larger firm

Methods of growth

Organic growth

Definition: (n) growth achieved through the expansion of current business

activities

Internal growth; i.e. does not involve joining with other businesses

Involves a firm increasing its output and selling more in its existing market

or in new markets.

Disadvantage: Relatively slow method of growth

External growth

Involves joining forces with another company

Advantage: Fast (or at least faster than organic growth)

Can be done through a takeover or acquisition of other business, or by

merging

Definition of 'takeover' or 'acquisition:

(n) the purchase of one business by another

Definition of 'merger': (n) the joining together of two or more businesses, usually to make a new one

Methods of integration

There are different types of mergers or integration (listed below).

However, not ever single merger will fit neatly into one of these categories.

Horizontal integration

Definition: (n) the merging of two

firms which are in exactly the same line of business

It could be argued that when firms in the same industry join together the merger is more likely to be a success.

This is because:

There is more common knowledge of the markets in which they operate.

Employees in each firm have similar skills.

Staff are likely to be familiar with each others working practices.

There is also likely to be less disruption.

Vertical integration

Definition: (n) merging with a firm that operates in a different stage of production

Backward vertical integration

Definition: (n) merging with a firm that

operates in the previous stage of production

Example: A petroleum company joining forces with an oil exploration company

Main benefit (of example above):

Guarantee and control supplies of oil

Disadvantage (of example above):

Remove the profit margin enjoyed by the oil exploration company

Forward vertical integration

Definition: (n) merging with a firm that operates in the next stage of

production

Example: A petroleum company joining forces with a chain of petrol retailers

Main benefit (of example above):

Guarantee an outlet for the petroleum company

Disadvantage (of example above):

Remove the profit margin made by retailers

Lateral integration

Definition: (n) the merging of two firms that produce similar goods but are not in competition with each other

Production techniques or distribution channels might be similar.

Example: A care home and a hotel merging

Both offer accommodation but do no compete with each other.

Conglomerate or diversifying mergers

Definition: (n) the merging of firms involved in completely different business activities

Main advantage: If a firm diversifies into new areas it will be able to reduce business risk.

This is because if one product fails it can rely on others in completely different markets for its survival.

However a limitation of success of such a move may be a lack of expertise in the new area.

Limitations to growth (i.e. why a firm may not be able to grow)

Limited market

The market for some goods is small and as a result large firms cannot exist.

Example: A shop supplying a small rural village cannot grow very big because the number of customers is limited. Only if the village expands can the firm grow.

Lack of finance

Owners may not be able to attract enough finance to fund growth.

Financial institutions are often afraid to lend money to small businesses because they are considered too risky.

Aim of the entrepreneur

The owners are already content with the current size of their firm(s) and do not wish for it to grow any further; i.e. some owners are not motivated by growth.

Reasons for this may be:

Owners do not want the responsibility of running a larger business (they may not wish to spend so much effort in their career life).

They may want to avoid VAT registration because of extra administration involved and the need to charge customers more.

They may be content with a modest amount of profit (personal preference).

Low barriers to entry

Set-up costs for some markets are

relatively low so there is very little to discourage new entrants joining the market.

As a result, fierce competition stops any single firm from growing easily .

Examples of such markets may be a grocery, painting and decorating, hairdressing and taxi driving.

Diseconomies of scale

Once a firm reaches a certain size any further growth results in diseconomies of scale.

(Please look at an average cost graph) If a firm expands beyond the minimum efficient scale, average costs

start to rise.

A firm is not likely to grow any further if costs start to rise because it would have to charge more for its output (leading to a potential loss of customers).