Lecture 2:

Comparing GDP over Time

September 2, 2014

Prof. Wyatt Brooks

MEASURING A NATION’S INCOME 0

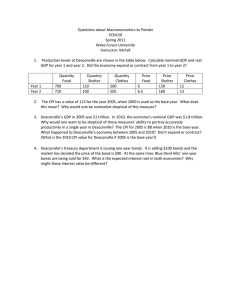

US GDP per capita: 1929-2012

51200

25600

12800

6400

3200

1600

Bread, Chicago

1929: 10¢

800

400

1929 1949

MEASURING THE COST OF LIVING

1969 1989

Bread, Chicago

2012: $3.55

2009

1

Real versus Nominal GDP

Inflation is the reduction in the purchasing power of the currency over time

Inflation can distort economic variables like GDP, so we have two versions of GDP:

One is corrected for inflation, the other is not.

Nominal GDP values output using current prices.

It is not corrected for inflation.

Real GDP values output using the prices of a base year . Real GDP is corrected for inflation.

MEASURING A NATION’S INCOME 2

The GDP Deflator

The GDP deflator is a measure of the overall level of prices.

Definition:

GDP deflator = 100 x nominal GDP real GDP

One way to measure the economy’s inflation rate is to compute the percentage increase in the GDP deflator from one year to the next.

MEASURING A NATION’S INCOME 3

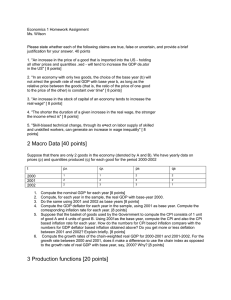

A C T I V E L E A R N I N G 1

Computing GDP

2007 (base yr) 2008 2009

P Q P Q P Q

Good A $30 900 $31 1,000 $36 1050

Good B $100 192 $102 200 $100 205

Use the above data to solve these problems:

A. Compute nominal GDP in 2007.

B. Compute real GDP in 2008.

C. Compute the GDP deflator in 2009.

4

A C T I V E L E A R N I N G 1

Answers

2007 (base yr) 2008 2009

P Q P Q P Q

Good A $30 900 $31 1,000 $36 1050

Good B $100 192 $102 200 $100 205

A. Compute nominal GDP in 2007.

$30 x 900 + $100 x 192 = $46,200

B. Compute real GDP in 2008.

$30 x 1000 + $100 x 200 = $50,000

5

A C T I V E L E A R N I N G 1

Answers

2007 (base yr) 2008 2009

P Q P Q P Q

Good A $30 900 $31 1,000 $36 1050

Good B $100 192 $102 200 $100 205

C. Compute the GDP deflator in 2009.

Nom GDP = $36 x 1050 + $100 x 205 = $58,300

Real GDP = $30 x 1050 + $100 x 205 = $52,000

GDP deflator = 100 x (Nom GDP)/(Real GDP)

= 100 x ($58,300)/($52,000) = 112.1

6

The Consumer Price Index (CPI)

GDP Deflator includes the effect of investment goods, imports, exports and so on…

Not closely tied to the prices that consumers face

Use the Consumer Price Index

A measure of how much it costs to maintain your standard of living

the basis of cost of living adjustments (COLAs) in many contracts and in Social Security

MEASURING THE COST OF LIVING 7

How the CPI Is Calculated

1.

Fix the “basket.”

The Bureau of Labor Statistics (BLS) surveys consumers to determine what’s in the typical consumer’s “shopping basket.”

2.

Find the prices.

The BLS collects data on the prices of all the goods in the basket.

3.

Compute the basket’s cost.

Use the prices to compute the total cost of the basket.

MEASURING THE COST OF LIVING 8

How the CPI Is Calculated

4.

Choose a base year and compute the index.

The CPI in any year equals

100 x cost of basket in current year cost of basket in base year

5.

Compute the inflation rate.

The percentage change in the CPI from the preceding period.

Inflation rate

=

CPI this year – CPI last year

CPI last year x

100%

MEASURING THE COST OF LIVING 9

What’s in the CPI Basket?

Housing

3.7%

3.5%

Transportation

6.4%

6.5%

6.5%

42.0%

Food & Beverages

Medical care

Recreation

14.8%

16.7%

Education and communication

Apparel

Other

MEASURING THE COST OF LIVING 10

Two Measures of Inflation

, 1950-2010

MEASURING THE COST OF LIVING 11

Producer Price Index (PPI)

The equivalent of CPI, but the basket of goods is based on what firms purchase

Because costs are passed on, CPI and PPI

15.00% move together

PPI

10.00%

CPI

5.00%

0.00%

1948 1956 1964 1972

-5.00%

MEASURING THE COST OF LIVING

1980 1988 1996 2004 2012

12

Correcting Variables for Inflation:

Comparing Dollar Figures from Different Times

Amount in today’s dollars

=

Amount in year T dollars x

Price level today

Price level in year T

MEASURING THE COST OF LIVING 13

Correcting Variables for Inflation:

Comparing Dollar Figures from Different Times

Inflation makes it harder to compare dollar amounts from different times.

Example: the minimum wage

$1.15 in Dec 1964

$5.85 in Dec 2007

Did minimum wage have more purchasing power in Dec 1964 or Dec 2007?

MEASURING THE COST OF LIVING 14

The U.S. Minimum Wage in Current Dollars and 2009 Dollars, 1938-2010

A C T I V E L E A R N I N G 4

Converting to “today’s dollars”

Annual tuition and fees, average of all public fouryear colleges & universities in the U.S.

1986-87: $1,414 (1986 CPI = 109.6)

2006-07: $5,834 (2006 CPI = 203.8)

After adjusting for inflation, did students pay more for college in 1986 or in 2006? Convert the 1986 figure to 2006 dollars and compare.

16

A C T I V E L E A R N I N G 4

Answers

Annual tuition and fees, average of all public fouryear colleges & universities in the U.S.

1986-87: $1,414 (1986 CPI = 109.6)

2006-07: $5,834 (2006 CPI = 203.8)

Solution

Convert 1986 figure into “today’s dollars”

$1,414 x (203.8/109.6) = $2,629

Even after correcting for inflation, tuition and fees were much lower in 1986 than in 2006!

17

Correcting Variables for Inflation:

Indexation

A dollar amount is indexed for inflation if it is automatically corrected for inflation by law or in a contract.

For example, the increase in the CPI automatically determines

the COLA in many multi-year labor contracts

the adjustments in Social Security payments

(since 1975) and federal income tax brackets

(since 1985)

MEASURING THE COST OF LIVING 18

Correcting Variables for Inflation:

Cost of Living Adjustments (COLA)

MEASURING THE COST OF LIVING 19

Problems with the CPI:

Substitution Bias

Over time, some prices rise faster than others, hence relative prices change.

Consumers substitute toward goods that become relatively cheaper.

The CPI misses this substitution because it uses a fixed basket of goods.

Thus, the CPI overstates increases in the cost of living.

MEASURING THE COST OF LIVING 20

Problems with the CPI:

Introduction of New Goods

The introduction of new goods increases variety, allows consumers to find products that more closely meet their needs.

In effect, dollars become more valuable.

The CPI misses this effect because it uses a fixed basket of goods.

Thus, the CPI overstates increases in the cost of living.

MEASURING THE COST OF LIVING 21

Problems with the CPI:

Unmeasured Quality Change

Improvements in the quality of goods in the basket increase the value of each dollar.

The BLS tries to account for quality changes but probably misses some, as quality is hard to measure.

Thus, the CPI overstates increases in the cost of living.

MEASURING THE COST OF LIVING 22

Problems with the CPI

Each of these problems causes the CPI to overstate cost of living increases.

The BLS has made technical adjustments, but the CPI probably still overstates inflation by about 0.5 percent per year .

This is important because Social Security payments and many contracts have COLAs tied to the CPI.

MEASURING THE COST OF LIVING 23

Correcting Variables for Inflation:

Real vs. Nominal Interest Rate

The nominal interest rate:

the interest rate not corrected for inflation

the rate of growth in the dollar value of a deposit or debt

The real interest rate:

corrected for inflation

the rate of growth in the purchasing power of a deposit or debt

Real interest rate

= (nominal interest rate) – (inflation rate)

MEASURING THE COST OF LIVING 24

Correcting Variables for Inflation:

Real vs. Nominal Interest Rate

Example:

Deposit $1,000 for one year.

Nominal interest rate is 9%.

During that year, inflation is 3.5%.

Real interest rate

= Nominal interest rate – Inflation

= 9.0% – 3.5% = 5.5%

The purchasing power of the $1000 deposit has grown 5.5%.

MEASURING THE COST OF LIVING 25

Real and Nominal Interest Rates in the U.S.,

1950-2010

MEASURING THE COST OF LIVING 26

Quick Intro to the Federal Reserve Bank

The Federal Reserve Bank of the United States is the monetary authority of the USA.

Monetary Authority: Government body responsible to determining how much money is in the economy

Examples: US Federal Reserve ($), European

Central Bank ( €), Bank of England (£), People’s

Bank of China ( 元 ), Bank of Japan (¥)

One goal of the Federal Reserve: price stability

The Federal Reserve was created on

December 23, 1913

MEASURING THE COST OF LIVING 27

2500%

US Price Level (CPI) relative to 1913

2000%

1500%

1000%

500%

0%

1913 1923 1933 1943 1953 1963 1973 1983 1993 2003 2013

MEASURING THE COST OF LIVING 28

40.00%

30.00%

20.00%

10.00%

0.00%

1912

-10.00%

-20.00%

CPI Annual Changes over Time

1932 1952 1972 1992 2012

-30.00%

-40.00%

MEASURING THE COST OF LIVING 29

40.00%

30.00%

20.00%

10.00%

0.00%

1701

-10.00%

-20.00%

-30.00%

Inflation Measure: 1701-1914

1751 1801 1851 1901

-40.00%

Source: John McCusker, “How Much is That in Real Money?”,

Proceedings of the American Antiquarian Society (2001)

MEASURING THE COST OF LIVING 30

Next Class

Growth over the long run

Read Mankiw chapter 12

Make sure to do the first two sections of the homework based on the lectures

MEASURING THE COST OF LIVING 31