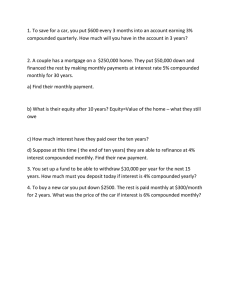

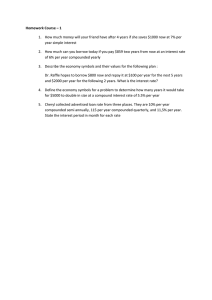

Time Value of Money The time value of money is a very important concept in Finance. This section is aimed at giving you intuitive and hands-on training on how to price securities (e.g., stocks and bonds), figure out your mortgage payments (or your parents’), calculate the payments on your dream car, make the lease versus buy decision, and apply time-value-of-money concepts to a variety of other practical uses. It involves four concepts: 1. Future Value 2. Present Value 3. Future Value of annuity 4. Present Value of annuity All time value of money problems involve comparisons of cash flows at different dates. The idea is trading present dollars for future dollar, or vice versa. Q. Imagine that you have just won the lottery. You are offered two choices: (A) $1 million today, or (B) $50,000 at the end of each of the next 20 years. Which will you take? Why? A. How many would take (A) $1 million today? Why? How many would take (B) $50,000 at the end of each of the next 20 years? Why? Drawing a time line of cash flows is useful to organizing information for time-valueof-money problems. Draw time lines and lay out cash flows. Fact: For an interest rate of 6%, offer (B) is really worth $573,496 in terms of today’s dollars. Intuition: You could put $573,496 in the bank today and have exactly enough to make $50,000 withdrawals at the end of each of the next 20 years. 1 FUTURE VALUE AND COMPOUNDING Definition: The future value is the amount to which an investment will grow after earning interest. Example: You deposit $100 in a bank savings that pays 5% interest compounded annually. How much would you have at the end of 1 year, 2 years, 5 years, and n years? 0 1 100 2 3 4 100(1.05) 105(1.05) 5 n 121.55(1.05) 105 110.25 127.63 100(1.05)1 100(1.05)2 100(1.05)5 FVn = PV(1+k)n Year 1 2 3 4 5 Amount at Beginning of Year, PV $100.00 105.00 110.25 115.76 121.55 x (1 + k) 1.05 1.05 1.05 1.05 1.05 = Amount at End of Year, FVn $105.00 110.25 115.76 121.55 127.63 Interest Earned $5.00 5.25 5.51 5.79 6.08 27.63 Example How much are you able to withdraw five years from today if you deposit $10,000 at a 6% interest rate compounded yearly? Example . You deposit $1,000 in a bank paying 8% interest per year. How much money will you be able to withdraw at the end of 30 years if you leave the account untouched until then? A. 1000(1.08)30 = $10,062 = 1000*FVIF(8%,30) Example . Fifty years ago, your grandfather invested $2,000 at an interest rate of 5% per year. How much is it worth today? A. 2000(1.05)50 = $22,935 = 2000*FVIF(5%,50) 2 PRESENT VALUE AND DISCOUNTING Definition: The present value of a future cash flow is how much it is worth today. Example We have already learned how to take a cash flow today and determine its future value. Can we use this information to take a future cash flow and determine its value today? A. Draw picture of trading rates across time. Derive PV = Fvn/(1+k)n Example How much must be deposited now to be able to withdraw $13,380, five years from today if I=6% compounded yearly? Example . You need $127.63 in 5 years. You can earn 5% per year on your money. How much do you have to put up today? 0 1 2 3 4 5 n We are given that FV = 127.63, n=5, k=5%, but we just learned that FVn = PV(1+k)n Then 127.63 = PV(1.05)5 , PV= 127.63/(1.05)5 = 100 OR F = PV* FVIF(5%,5) Example . How much do we need to invest today at 7% per year to have $1,000 in 5 years? A. 1000/(1.07)5 = $713 = 1000*PVIF(7%,5) Example . What is $1,000 to be received 5 years from now worth today if the interest rate is 8% per year? A. 1000/(1.08)5 = $680.58 = 1000*PVIF(8%,5) 3 Before moving on, let’s try a few more simple examples to build our intuition: Example . What is the value in 5 years of $100 invested now at an interest rate of 7% per year? A. $100(1.07)5 = $140.26 = = 100*FVIF(7%,5) Example In qualitative terms, holding all else equal, what happens to the future value of an investment if the interest rate increases? A. The future value increases as the interest rate increases. Example . Confirming intuition, what is the value in 5 years of $100 invested now at an interest rate of 10% per year? A. $100(1.10)5 = $161.05 = 100*FVIF(10%,5) Example In qualitative terms, holding all else equal, what happens to the future value of an investment if the investment horizon is lengthened? A. The future value increases as the investment horizon increases. Example Confirming intuition, what is the value in 6 years of $100 invested now at an interest rate of 7% per year? A. $100(1.07)6 = $150.07 = = 1000*FVIF(7%,6) Example . What is the value now of $2,000 to be received in 8 years if the annual rate of interest is 9%? A. $2,000* 1 $1,003.73 = 2000*PVIF(9%,8) 1.098 4 Example . In qualitative terms, holding all else equal, what happens to the present value of an investment if the interest rate increases? A. The present value decreases as the interest rate increases. Example . Confirming intuition, what is the value now of $2,000 to be received in 8 years if the annual rate of interest is 12%? A. $2,000* 1 $807.80= 2000*PVIF(12%,8) 1.128 Example In qualitative terms, holding all else equal, what happens to the present value of an investment if the investment horizon is lengthened? A. The present value decreases as the investment horizon increases. Example . A. Confirming intuition, what is the value now of $2,000 to be received in 10 years if the annual rate of interest is 9%? 1 $2,000* $844.80 = 2000*PVIF(9%,10) 1.0910 PERPETUITIES Definition: A perpetuity is a stream of equal payments that lasts forever. Example: You wish to endow a chair in finance at a business school. If the interest rate is 10% per year and your aim is to provide $200,000 a year in perpetuity, how much must be set aside today? The first payment will be made 1 year from today. 0 1 2 3 4 5 n PV (perpetuity) = payment/interest rate = PMT/k ANNUITIES Definition: An ordinary annuity is a series of equal payments at fixed intervals for a specified number of periods. 5 Future Value of an Annuity Example: Deposit (=Payment)=$1,000 per year. k=12%; n=5. 0 1 $1,000 2 $1,000 3 4 $1,000 5 $1,000 $1,000.00 $1,120.00 $1,254.40 $1,404.93 $1,573.52 $6,352.85 Future Value FVn = PV(1+k)n FV of first $1,000: FV = $1,000(1+k)4 = $1,000(1.12)4 = $1,000(1.57352) = $1,573.52 FV of Annuity: FVAn = PMT(1+k)n-1+PMT(1+k)n-2+...+PMT(1+k)0 = PMT[(1+k)n-1+(1+k)n-2+...+(1+k)0] n n (1 k) 1 = PMT (1+k)n-t= PMT k t 1 FV = FVAn = $1,000 (1.12) 1 0.12 5 = $1,000(6.3528) = $1,000 = $6,352.80 OR Let’s define PMT = A = 1000 FV = A[FVIFA(i%,n)] FV = 1000[FVIFA(12%,5)] FV = 1000(6.3598) Example If you are depositing $10000 in the bank at the end of each year for the next four years with a 4% interest rate compounded yearly, how much could you withdraw from the bank in 4 years from now? 6 Present Value of an Annuity Example What is the PV of receiving $20000 at the end of each year for the next 4 years if the interest rate is 4% compounded yearly? or Suppose your parents wish to deposit enough money now to be able to meet your tuition and other payments for the next four years of $20000 per year. The first tuition payment starts a year from today and the interest rate is 4% compounded yearly Example . Suppose you inherit $100,000 and wish to have a steady income over the next 10 years and you plan to deposit it in the savings account paying 5% interest compounded annually, what is your steady income? or Suppose you are shopping for a new car and after all negotiations you make a deal with the dealer for a price of $20000. The interest rate is 12% compounded yearly and the loan is for 5 years. If the first payment occurs at the end of the first year, what is your yearly payment? Example Suppose your uncle is 40 and has a plan to retire at age 60, but his fortune teller told him that he will live for forty more years. If he would like to have a steady income of $150,000 per year after his retirement and the interest rate will be 8% compounded yearly at that time. How much must be set aside each year till his retirement to be able to achieve his goal if the interest rate is now 6% compounded yearly? 7 Example: Payment = $1,000 per year k = 12%; n = 5. 0 1 2 3 4 5 $1,000 $1,000 $1,000 $1,000 $1,000 $892.86 $797.19 $711.78 $635.52 $567.43 $3,604.78 Present Value PV of Annuity t n 1 1 1 PVAn = PMT = PMT n 1 k k k(1 k) t 1 1 1 PV = PVAn = $1,000 5 0.12 0.12(1.12) = $1,000(3.6048) = $3,604.80 Annuity Interpretation: Claim: If you deposit $3604.80 today, you will be able to withdraw $1,000 every year for 5 years. Year 1 Year 2 Year 3 Year 4 Year 5 Beginning Balance $3604.80 $3037.38 $2401.87 $1690.09 $892.00 Interest factor x (1.12) x (1.12) x (1.12) x (1.12) x (1.12) Balance $4037.38 $3401.87 $2690.09 $1892.00 $1000 Withdraw $1000 $1000 $1000 $1000 $1000 Ending Balance $3037.38 $2401.87 $1690.09 $892.00 $0 OR PV = A[PVIFA(i%,n)] = A[PVIFA(12%,5)] = 1000*(3.6048) 8 Example: Which of the following options are more valuable in terms of today’s dollars if all payments are made at the end of the year: a) $400 per year for 10 years at 10%. b) $200 per year for 5 years at 5%. c) $400 per year for 5 years at 0%. A. a) 2457.83 = 400*PVIFA(10%,10) = 400*6.1446 b) 865.90 = 200*PVIFA(5%,5) = 200*4.3295 c) 2000 = 400*PVIFA(0%,5) = 400*5 Example Find the future values of the following options if all payments are made at the end of each year: a) $400 per year for 10 years at 10%. b) $200 per year for 5 years at 5%. c) $400 per year for 5 years at 0%. A. a) 6374.96 = 400*FVIFA(10%,10) = 400*15.937 b) 1105.12 = 200*FVIFA(5%,5) = 200*5.5256 c) 2000 = 400*FVIFA(0%,5) = 400*5 . Determining the Interest Rate: Example Suppose you are able to borrow $100000 right now and pay back $121700 at the end of five years. What is the annual interest rate compounded yearly? Example Suppose you can borrow $27550 right now and repay $10000 annually at t he end of each year for three years. What is the interest rate compounded yearly? Example How long will it take for a sum to double if the interest rate is 10% compounded yearly? 9 Present Value of uneven series: Example How much do you have to set aside now to be able to withdraw $50000 after one year, $20000 after two years, $40000 after three years and $ 10000 after the fourth year if the interest rate is 5% compounded yearly? Example How much are you willing to pay for an investment which is going to bring the following cash flow: $30000 after year one, $20000 after year two, and then 8 annual payments of $10000, when the interest rate is 4% compounded yearly? Example What is the present value of receiving 100 per quarter at the end of each quarter for the next ten years when the interest rate is 12% yearly compounded quarterly? Example Suppose we are borrowing $10000 now and repay $529 at the end of each month for the next two years. What annual interest rate had been charged based on compounding monthly Ordinary Annuity versus Annuity Due Definition: An annuity due is an annuity whose payments occur at the beginning of each period. 0 0 $1,000 1 2 3 4 5 $1,000 $1,000 $1,000 $1,000 $1,000 1 2 3 4 5 $1,000 $1,000 $1,000 $1,000 Example What is the present value of $100 per year for the next ten years with an interest rate of 12% compounded yearly, if each payment were made at the beginning of each year? 10 Example What is the future value of $100 per year for the next ten years if the interest rate is 12% compounded yearly. and if each deposit were made at the beginning of each year? Example How much do you have to set aside now to be able to pay your monthly rent of $435 per month for the next 12 months if the first rent payment is made tomorrow and the annual interest rate on your money is 12% compounded yearly? Examples: To complete your last year in business school and then go through law school, you will need $10,000 per year for 4 years, starting next year. (That is, you will need to make your first withdraw of $10,000 one year from today.) Your rich uncle offers to put you through school. How much does he need to deposit today in a bank paying 7% interest per year to satisfy your schooling expenses? How much will be in the account immediately after you make the first withdrawal? After the last withdrawal? A. a) $33,872.11 = 10,000 * PVIFA(7%,4) =10,000*3.3872 b) $26,243.16 = 10,000*PVIFA(7%,3) = 10,000*2.6243 c) $0 Example. Which of the following options are more valuable in terms of today’s dollars if all payments are made at the beginning of the year? a) $400 per year for 10 years at 10%. b) $200 per year for 5 years at 5%. c) $400 per year for 5 years at 0%. A. a) 2703.62 = 400 + 400*PVIFA(10%,9) b) 909.20 = 200 + 200*PVIFA(5%,4) c) 2000 = 400 + 400*PVIFA(0%,4) = 400*5 11 Example. Find the future value of the following options if all payments are made at the beginning of the year. a) $400 per year for 10 years at 10%. b) $200 per year for 5 years at 5%. c) $400 per year for 5 years at 0%. . a) 7012.46 = 400*FVIFA(10%,10)*FVIF(10%,1) b) 1160.38 = 200*FVIFA(5%,5) *FVIF(5%,1) c) 2000 = 400*FVIFA(0%,5)*FVIF(0%1) AMORTIZED LOAN Example: You have just obtained a 30-year mortgage loan of $200,000. Assume the loan has a 12% annual interest rate, (1% per month) and require equal monthly payments beginning in one month and continuing for 360 months. What will your monthly payments be? How much is the remaining principal after 1 year, 10 years, and 20 years? Payment = $2057.23 => Payment*PVIFA(1%,360) = 200,000 After one year remaining balance = $199,274.24 = 2057.23*PVIFA(1%,360-12) After 10 years remaining balance = $186,836 = 2057.23*PVIFA(1%,360-120) After 20 years remaining balance = $143,390 = 2057.23*PVIFA(1%,360-240) Example Borrow $10000 at 10% to be repaid at the end of each year for the next three years. What is the payment for year two and the principal payment in year three? Example The price of a car is $20000. The term of the lease is 2 years and the interest rate is 12% compounded monthly. What is the monthly payment? 12 COMPOUNDING PERIODS Definition: The effective annual interest rate (EAR) is the annual growth rate of funds (interest rate) allowing for the effects of compounding. When comparing interest rates, use effective annual rates. EAR = (1 + APR/m)m - 1, where m = # of periods per year. Let’s consider table 3.3 from our text, which assumes an APR of 6%: Compounding periods Periods per year Per period interest rate, % Growth factor of invested funds Effective Annual Rate 1 year Semiannually Quarterly Monthly Weekly Daily Continuous 1 2 4 12 52 365 infinite 6 3 1.5 0.5 0.11538 0.01644 - (1.06)1 (1.03)2 (1.015)4 (1.005)12 6.0000 6.0090 6.1364 6.1678 6.1800 6.1831 6.1837 Example: (1.0011538)52 (1.0001644)365 (2.718)0.06 A credit card requiring monthly payments carries an APR of 18%. What is the effective annual interest rate (EAR)? EAR = (1 + 0.18/12)12 - 1 = (1 + 0.015)12 - 1 = 1.1956 - 1 = 19.56% Intuition: If you owe your credit card company $100, they are charging you 1.5% on the outstanding balance every month. Suppose you keep the $100 for one year. You owe at the end of the year = $100 (1.015)12 = $119.56. Example: Which of the following interest rate offers is the best if you are thinking of opening a savings account? Bank A: 7% compounded annually Bank B: 6.9% compounded quarterly Bank C: 6.8% compounded daily Bank D: 6.75% compounded continuously Bank A = 7% Bank B = 7.08% Bank C = 7.04% 13 Additional Problems: Example Determine how much you must deposit today, January 1, to be able to withdraw $100 on July 1, August 1, September 1, and October 1. Assume that the interest rate is 24% per year compounded monthly. Example You just deposited $20000 into a savings account that pays interest of 12% per year, compounded semiannually (every six months). What equal dollar amount can you withdraw from the account semiannually, starting today for a total of twelve withdrawals, such that you have nothing left in the account after the twelfth withdrawal? Example Suppose you are considering purchasing a new car and you have the choice between two cars that are identical in every way except that car A uses gasoline at the rate of 20 miles per gallon and car B uses gasoline at the rate of 40 miles per gallon. Suppose that you drive 10000 miles each year, pay all your gasoline bills at the end of each year, throw the car away at the end of 10 years, and gasoline sells for $1.30 per gallon for ten years. How much extra will you be willing to pay for car B over car A if your opportunity cost is 8%? Example On December 31, XYZ COMPANY buys a building for $60000, payable 15% down and the balance in 20 equal annual installments that are to include principal plus 10% compound interest on the declining balance. What are the approximate equal installments? Example The price of a car is $20000. The term of the lease is 2 years and the interest rate is 12% compounded monthly. What is the monthly payment? 14 Example A recent advertisement in the financial section of a magazine carried the following claim: "Invest your money with us at 14% per year, compounded semiannually, and we guarantee to double your income sooner than you imagine." How long would it take to double your money at 14%, compounded semiannually? We know that FV = PV (1+r)n remember r = periodic interest rates n = # of periods, not # of years Example: A bank agrees to lend you $1,000 today in return for your promise to pay back $2,773 nine years from today. What rate of interest is the bank charging you? FV = PV (1+r)n Example: 0 Suppose now that you remember that no allowance has been made for growth in salaries, which will probably average about 4% a year. Therefore, instead of providing $200,000 a year in perpetuity, you provide $200,000 in year 1, 1.04 x 200,000 in year 2, and so on. In this case, how much do you have to set aside today? (Interest rate is 10%. Refer to page 6 example) 1 2 3 4 5 PV(growing perpetuity) = first payment/(interest rate-growth rate) = PMT1/(k-g) P 15 n