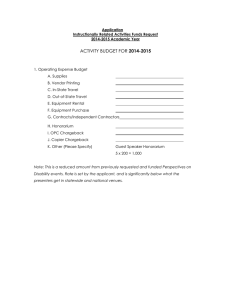

Honorarium Agreement The Honorarium Form is to be completed for non-employees only. Recipients receive a 1099Misc. at the end of the tax year. Instructions: Requestor completes Section I of the Honorarium Payment Request form and attaches supporting documentation such as a copy of the notice to the recipient or similar evidence that supports the reason/purpose for which the award/gift is being given. For example, if a guest speaker is to be paid an honorarium, a copy of the program evidencing the activity would be appropriate. Recipient completes Section II, signs and dates and returns to Kitcheck. Section III must be signed by authorized personnel. Authorized personnel forwards request to Finance for approval to be paid. Submit to Accounts Payable for processing.

![Dear [___________________]: We look forward to your](http://s2.studylib.net/store/data/017905865_1-68bcd706b2a50880c45d6be8a10cf9af-300x300.png)