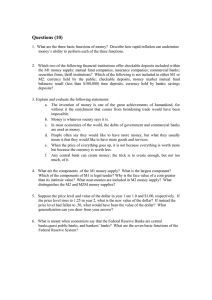

Money and Banking Ch. 3 Measures of Money Central Bank balance Sheet Prof. Anwar M. El Nakeeb Learning Objectives Measures of Money (M0, M1 and M2) Egypt, Case Study The Central Bank’s Balance Sheet/Assets The Central Bank’s Balance Sheet/liabilities Balance Sheet of the Federal Reserve/USA- case Study Balance Sheet, Central Bank Of Egypt-case Study Measures of Money Measuring Money The total quantity of money in the economy at any one time is called the money supply. The money supply measures reflect the different degrees of liquidity—or spendability—that different types of money have. Economists measure the money supply because it affects economic activity. What should be included in the money supply? We want to include as part of the money supply those things that serve as media of exchange. However, the items that provide this function have varied over time. Money IS: - M0, M1, M2, and M3 M 0: currency (notes and coins) in circulation and in bank vaults. M0: is usually called the monetary base - the base from which other forms of money are created - and is traditionally the most liquid measure of the money supply Measures of Money M1 is the narrowest and most liquid measure of the money supply. It includes financial assets that are immediately available for spending on goods and services. M1 includes: Currency: Minted coins and paper currency not deposited in financial institutions Travelers’ Checks: Financial instruments purchased from a bank or a nonbanking organization and signed during purchase that can be used as cash upon a second signature by the purchaser Demand Deposits (checking accounts): Deposits are also money because they can be converted into currency and are used to settle debts. Any deposits in a thrift institution or a commercial bank on which a check may be written or debit card used Other Checkable Deposits (interest-bearing checking) Demand Deposits and Checkable Deposits are called transactions accounts—these are checking accounts that can be drawn upon to make payments. Measures of Money/ Defining Money M2/Near Moneys The liquidity approach: M2 is equal to M1 plus Time Deposit: A deposit in a financial institution that requires notice of intent to withdraw or must be left for an agreed period. Early withdrawal may result in a penalty CD (Certificate of Deposit): Time deposit with fixed maturity Money Market Deposit Accounts (MMDAs): Accounts issued by banks yielding a market rate of interest with a minimum balance requirement and a limit on transactions, They have no minimum maturity Money Market Mutual Funds: Funds obtained from the public that investment companies hold in common-Funds used to acquire short-maturity credit instruments - CD’s, U.S. government securities Example Egypt, Case Study June 2013 Reserve Money (M0) Currency in circulation 260,849 outside the CBE Banks' deposits in local 57,095 currency with the CBE Reserve Money (M0) 317,944 Domestic Liquidity (1+2) (M2) Money Supply (1) (M1) 344,100 Currency in circulation outside the banking 241,011 system Demand deposits in local 103,089 currency Quasi-Money (2) 951,986 Local currency time & saving deposits Foreign currency demand deposits Foreign currency time & saving deposits++ Domestic Liquidity (1+2) (M2) 2014 2015 2016 2017 2018 288,651 313,468 368,459 439,366 485,235 75,822 172,408 109,617 206,987 233,768 364,473 485,876 478,076 646,353 719,003 410,554 499,065 572,935 737,469 823,268 270,856 292,699 346,853 407,802 441,551 139,698 206,366 226,082 329,667 381,717 1,106,047 1,266,427 1,521,565 2,465,188 2,633,747 727,778 869,976 1,003,432 1,197,746 1,786,179 1,916,789 55,152 62,214 68,631 75,910 135,790 149,769 169,056 173,857 194,364 247,909 543,219 567,189 1,765,492 2,094,500 3,202,657 3,457,015 1,296,086 1,516,601 There are numerous financial transactions leading to changes in the central bank’s balance sheet. The structure of the balance sheet gives us a window through which we can study how the institution operates. • Figure 1 shows the major assets and liabilities that appear in every central bank’s balance sheet in one form or another. • We divide the these assets and liabilities up between the role the central bank plays: the government’s bank or the banker’s bank. Figure 1 1. Securities are the primary asset of most central banks. – Traditionally, the Fed exclusively held Treasury securities, which are virtually free of default risk. – The quantity of securities it holds is controlled through purchases and sales known as open market operations. 2. Foreign exchange reserves: are the central bank’s and government’s balances of foreign currency. – These are held in the form of bonds issued by foreign governments. – These reserves are used in foreign exchange interventions, when officials attempt to change the market values of various currencies. 3. Loans are usually extended to commercial banks. • Central bank can provide reserve to the banking system by making loans to banks. The loans are refereed to as “Discount loans” . • Discount loans are the loans the Fed makes when commercial banks need short-term cash. 1. Currency. Nearly all central banks have a monopoly on the issuance of the currency used in everyday transactions. Currency circulating in the hands of the nonbank public is the central bank’s principal liability. 2. Government’s account. Governments need a bank account like the rest of us. – The central bank provides the government with an account into which the government deposits funds (mostly tax revenue) and from which the government makes payments. 3. Commercial Bank accounts (reserves). Commercial bank reserves are the sum of two parts: • Deposits at the central bank, plus • The cash in the bank’s own vault. • Vault cash is part of reserves. There are two types of reserves. • Required reserves that banks must hold, and • Excess reserves, which banks hold voluntarily. Assets Liabilities and Equity Gold and foreign exchange SDR certificates Treasury currency Federal Reserve Float FR loans to domestic banks Security repurchase agreements U.S. Treasury securities U.S. government securities Miscellaneous assets $ 25.5 2.2 33.2 0.0 0.0 50.3 551..7 0.0 20.3 Depository institution reserves $ 17.5 Vault cash of commercial banks 47.3 Deposits due to federal government 7.1 Deposits due to rest of the world 0.1 Currency outside banks 596.2 Miscellaneous liabilities 7.8 FR Bank stock 7.2 Total assets $683.2 Total liabilities and equity $683.2 A successful central bank must be: 1. Independent of political pressure: A successful central bank needs to be independent from politics, policy makers and outside influence, Central bank independence refers to the freedom of monetary policymakers from direct political or governmental influence in the conduct of policy. 2. Accountable to the public: A central bank has to be accountable for its policies and decisions, 3. Transparent in its policy actions: It has to be transparent with its policies to maintain credibility., 4. Clear in its communications with financial markets and the public: A central bank has to be clear in communicating with financial markets & the public. This helps build trust with the public.. 13 Questions Discussion