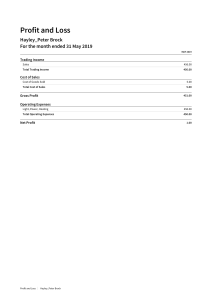

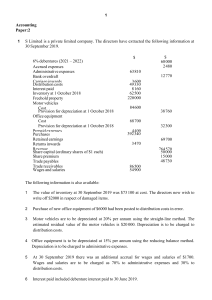

Q.1:- The following is the Trial Balance of Omega Limited as on 31.3.2019(Figures in Rs. ‘000) Particulars Property , Plant & Equipment-Land at cost -Plant and Machinery at cost Trade Receivables Closing Inventory Bank Adjusted Purchases Factory Expenses Administrative Expenses Selling Expenses Debenture Interest Interim Dividend paid Total Debit (Rs.) Particulars Equity Share Capital (Shares of Rs. 10 each) 10% Debentures General Reserve Profit and Loss Account Securities Premium Sales Trade Payables Provision for Depreciation Suspense Account 220 770 96 86 20 320 60 30 30 20 18 1670 Total Credit (Rs.) 300 200 130 72 40 700 52 172 4 1670 Additional Information: 1. The authorised share capital of the company is 40,000 shares of Rs.10 each. 2. The company on the advice of independent valuer wish to revalue the land at Rs. 3,60,000. 3. Declared final dividend @ 10%. 4. Suspense account of Rs. 4,000 represents cash received for the sale of some of the machinery on 1.4.2018. The cost of the machinery was Rs. 10,000 and the accumulated depreciation thereon being Rs. 8,000. 5. Depreciation is to be provided on plant and machinery at 10% on cost. You are required to prepare Omega Limited’s Balance Sheet as on 31.3.2019 and Statement of Profit and Loss with notes to accounts for the year ended 31.3.2019 as per Schedule III. Ignore previous years’ figures & taxation.