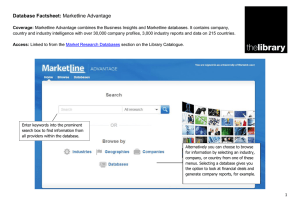

A Progressive Digital Media business MarketLine Industry Profile Fragrances in China March 2019 Reference Code: 0099-0703 Publication Date: March 2019 WWW.MARKETLINE.COM MARKETLINE. THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 1 EXECUTIVE SUMMARY Market value The Chinese fragrances market grew by 2.2% in 2018 to reach a value of $859.2 million. Market value forecast In 2023, the Chinese fragrances market is forecast to have a value of $1,011.2 million, an increase of 17.7% since 2018. Market volume The Chinese fragrances market grew by 0.2% in 2018 to reach a volume of 15.5 million units. Market volume forecast In 2023, the Chinese fragrances market is forecast to have a volume of 15.9 million units, an increase of 2.5% since 2018. Category segmentation Female fragrances is the largest segment of the fragrances market in China, accounting for 83.9% of the market's total value. Geography segmentation China accounts for 21.6% of the Asia-Pacific fragrances market value. Market share Chanel S.A. is the leading player in the Chinese fragrances market, generating a 20.4% share of the market's value. Market rivalry Many of the leading players are highly diversified companies, both in terms of products and geography, ameliorating rivalry within the market. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 2 TABLE OF CONTENTS Executive Summary......................................................................................................................................................... 2 Market value ................................................................................................................................................................ 2 Market value forecast .................................................................................................................................................. 2 Market volume ............................................................................................................................................................. 2 Market volume forecast ............................................................................................................................................... 2 Category segmentation ............................................................................................................................................... 2 Geography segmentation ............................................................................................................................................ 2 Market share................................................................................................................................................................ 2 Market rivalry ............................................................................................................................................................... 2 Market Overview.............................................................................................................................................................. 7 Market definition .......................................................................................................................................................... 7 Market analysis............................................................................................................................................................ 7 Market Data ..................................................................................................................................................................... 9 Market value ................................................................................................................................................................ 9 Market volume ........................................................................................................................................................... 10 Market Segmentation .................................................................................................................................................... 11 Category segmentation ............................................................................................................................................. 11 Geography segmentation .......................................................................................................................................... 12 Market share.............................................................................................................................................................. 13 Market distribution ..................................................................................................................................................... 14 Market Outlook .............................................................................................................................................................. 15 Market value forecast ................................................................................................................................................ 15 Market volume forecast ............................................................................................................................................. 16 Five Forces Analysis ..................................................................................................................................................... 17 Summary ................................................................................................................................................................... 17 Buyer power .............................................................................................................................................................. 18 Supplier power........................................................................................................................................................... 19 New entrants ............................................................................................................................................................. 20 Threat of substitutes .................................................................................................................................................. 21 Degree of rivalry ........................................................................................................................................................ 22 Leading Companies....................................................................................................................................................... 23 China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 3 Chanel S.A. ............................................................................................................................................................... 23 Coty Inc. .................................................................................................................................................................... 24 L'Oreal SA ................................................................................................................................................................. 27 LVMH Moet Hennessy Louis Vuitton SA ...................................................................................................................30 Macroeconomic Indicators............................................................................................................................................. 34 Country data .............................................................................................................................................................. 34 Methodology .................................................................................................................................................................. 36 Industry associations ................................................................................................................................................. 37 Related MarketLine research .................................................................................................................................... 37 Appendix........................................................................................................................................................................ 38 About MarketLine ...................................................................................................................................................... 38 China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 4 LIST OF TABLES Table 1: China fragrances market value: $ million, 2014–18 ..........................................................................................9 Table 2: China fragrances market volume: million units, 2014–18................................................................................10 Table 3: China fragrances market category segmentation: $ million, 2018...................................................................11 Table 4: China fragrances market geography segmentation: $ million, 2018 ...............................................................12 Table 5: China fragrances market share: % share, by value, 2018...............................................................................13 Table 6: China fragrances market distribution: % share, by value, 2018 ......................................................................14 Table 7: China fragrances market value forecast: $ million, 2018–23...........................................................................15 Table 8: China fragrances market volume forecast: million units, 2018–23 ..................................................................16 Table 9: Chanel S.A.: key facts ..................................................................................................................................... 23 Table 10: Coty Inc.: key facts ........................................................................................................................................ 24 Table 11: Coty Inc.: key financials ($) ........................................................................................................................... 25 Table 12: Coty Inc.: key financial ratios......................................................................................................................... 25 Table 13: L'Oreal SA: key facts ..................................................................................................................................... 27 Table 14: L'Oreal SA: key financials ($) ........................................................................................................................28 Table 15: L'Oreal SA: key financials (€) ........................................................................................................................28 Table 16: L'Oreal SA: key financial ratios......................................................................................................................28 Table 17: LVMH Moet Hennessy Louis Vuitton SA: key facts.......................................................................................30 Table 18: LVMH Moet Hennessy Louis Vuitton SA: key financials ($) ..........................................................................31 Table 19: LVMH Moet Hennessy Louis Vuitton SA: key financials (€) ..........................................................................31 Table 20: LVMH Moet Hennessy Louis Vuitton SA: key financial ratios .......................................................................32 Table 21: China size of population (million), 2014–18...................................................................................................34 Table 22: China gdp (constant 2005 prices, $ billion), 2014–18 ...................................................................................34 Table 23: China gdp (current prices, $ billion), 2014–18...............................................................................................34 Table 24: China inflation, 2014–18................................................................................................................................ 35 Table 25: China consumer price index (absolute), 2014–18 .........................................................................................35 Table 26: China exchange rate, 2014–18 .....................................................................................................................35 China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 5 LIST OF FIGURES Figure 1: China fragrances market value: $ million, 2014–18 .........................................................................................9 Figure 2: China fragrances market volume: million units, 2014–18...............................................................................10 Figure 3: China fragrances market category segmentation: % share, by value, 2018 ..................................................11 Figure 4: China fragrances market geography segmentation: % share, by value, 2018...............................................12 Figure 5: China fragrances market share: % share, by value, 2018 .............................................................................13 Figure 6: China fragrances market distribution: % share, by value, 2018 .....................................................................14 Figure 7: China fragrances market value forecast: $ million, 2018–23 .........................................................................15 Figure 8: China fragrances market volume forecast: million units, 2018–23.................................................................16 Figure 9: Forces driving competition in the fragrances market in China, 2018 .............................................................17 Figure 10: Drivers of buyer power in the fragrances market in China, 2018 .................................................................18 Figure 11: Drivers of supplier power in the fragrances market in China, 2018..............................................................19 Figure 12: Factors influencing the likelihood of new entrants in the fragrances market in China, 2018........................20 Figure 13: Factors influencing the threat of substitutes in the fragrances market in China, 2018.................................21 Figure 14: Drivers of degree of rivalry in the fragrances market in China, 2018 ...........................................................22 Figure 15: Coty Inc.: revenues & profitability.................................................................................................................25 Figure 16: Coty Inc.: assets & liabilities......................................................................................................................... 26 Figure 17: L'Oreal SA: revenues & profitability..............................................................................................................29 Figure 18: L'Oreal SA: assets & liabilities......................................................................................................................29 Figure 19: LVMH Moet Hennessy Louis Vuitton SA: revenues & profitability ...............................................................32 Figure 20: LVMH Moet Hennessy Louis Vuitton SA: assets & liabilities .......................................................................33 China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 6 MARKET OVERVIEW Market definition The fragrances market consists of the retail sale of female fragrances, male fragrances and unisex fragrances. The female fragrances segment consists of mass female fragrances and premium female fragrances. The male fragrances segment consists of mass male fragrances and premium male fragrances. The unisex fragrances segment consists of mass unisex fragrances and premium unisex fragrances. The market is valued according to retail selling price (RSP) and includes any applicable taxes. All currency conversions used in the creation of this report have been calculated using constant annual average 2018 exchange rates. For the purpose of this report, the global figure comprises North America, South America, Europe, Asia-Pacific, the Middle East, and South Africa. The Americas comprises Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru and the United States. North America comprises Canada, Mexico, and the United States. South America comprises Argentina, Brazil, Chile, Colombia and Peru. Europe comprises Austria, Belgium, Bulgaria, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Romania, Russia, Slovakia, Spain, Sweden, Turkey, Ukraine, and the United Kingdom. Scandinavia comprises Denmark, Finland, Norway, and Sweden. Asia-Pacific comprises Australia, China, Japan, Indonesia, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Hong Kong, Taiwan, and Thailand. The Middle East comprises Saudi Arabia, Egypt, Israel and the United Arab Emirates. Market analysis The Chinese fragrances market recorded moderate growth during the review period (2014-2018). The growth of the market is expected to accelerate over the forecast period (2018-2023). The Chinese fragrances market contributed 21.6% of the overall Asia-Pacific fragrances market value in 2018. The market is quite mature; therefore manufacturers are focusing more on promotional activities and celebrity endorsements to retain their market share. Sales were also supported by increasing disposable income and awareness about personal hygiene. Furthermore, the rising popularity of fragrances appealing to the niche population, who indulge in niche brands rather than mass brands, is also contributing to the market’s growth. The Chinese fragrances market had total revenues of $859.2m in 2018, representing a compound annual growth rate (CAGR) of 2.5% between 2014 and 2018. In comparison, the Singaporean and Indian markets grew with CAGRs of 3.0% and 22.1% respectively, over the same period, to reach respective values of $111.4m and $580.4m in 2018. Market consumption volume increased with a CAGR of 0.4% between 2014 and 2018, to reach a total of 15.5 million units in 2018. The market's volume is expected to rise to 15.9 million units by the end of 2023, representing a CAGR of 0.5% for the 2018-2023 period. Female fragrances accounted for the highest value in the Chinese fragrances market in 2018, with total sales of $720.6m, equivalent to 83.9% of the market's overall value. In comparison, sales of male fragrances reached a value of $124.7m in 2018, equating to 14.5% of the total market value. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 7 The performance of the market is forecast to accelerate, with an anticipated CAGR of 3.3% for the five-year period 2018 - 2023, which is expected to drive the market to a value of $1,011.2m by the end of 2023. Comparatively, the Singaporean and Indian markets will grow with CAGRs of 2.7% and 19.6% respectively, over the same period, to reach respective values of $127.3m and $1,423.1m in 2023. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 8 MARKET DATA Market value The Chinese fragrances market grew by 2.2% in 2018 to reach a value of $859.2 million. The compound annual growth rate of the market in the period 2014–18 was 2.5%. Table 1: China fragrances market value: $ million, 2014–18 Year $ million CNY million € million % Growth 2014 779.4 5,159.7 660.7 2015 799.8 5,294.7 678.0 2.6% 2016 821.0 5,435.2 695.9 2.7% 2017 840.5 5,563.8 712.4 2.4% 2018 859.2 5,688.1 728.3 2.2% CAGR: 2014–18 2.5% SOURCE: MARKETLINE MARKETLINE Figure 1: China fragrances market value: $ million, 2014–18 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 9 Market volume The Chinese fragrances market grew by 0.2% in 2018 to reach a volume of 15.5 million units. The compound annual growth rate of the market in the period 2014–18 was 0.4%. Table 2: China fragrances market volume: million units, 2014–18 Year million units % Growth 2014 15.2 2015 15.3 0.6% 2016 15.3 0.4% 2017 15.4 0.6% 2018 15.5 0.2% CAGR: 2014–18 0.4% SOURCE: MARKETLINE MARKETLINE Figure 2: China fragrances market volume: million units, 2014–18 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 10 MARKET SEGMENTATION Category segmentation Female fragrances is the largest segment of the fragrances market in China, accounting for 83.9% of the market's total value. The Male fragrances segment accounts for a further 14.5% of the market. Table 3: China fragrances market category segmentation: $ million, 2018 Category 2018 % Female fragrances 720.6 83.9% Male fragrances 124.7 14.5% 13.9 1.6% 859.2 100% Unisex fragrances Total SOURCE: MARKETLINE MARKETLINE Figure 3: China fragrances market category segmentation: % share, by value, 2018 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 11 Geography segmentation China accounts for 21.6% of the Asia-Pacific fragrances market value. India accounts for a further 14.6% of the Asia-Pacific market. Table 4: China fragrances market geography segmentation: $ million, 2018 Geography 2018 % China 859.2 21.6 India 580.4 14.6 South Korea 541.4 13.6 Japan 306.5 7.7 Singapore 111.4 2.8 Rest of Asia-Pacific 1,578.5 39.7 Total 3,977.4 100% SOURCE: MARKETLINE MARKETLINE Figure 4: China fragrances market geography segmentation: % share, by value, 2018 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 12 Market share Chanel S.A. is the leading player in the Chinese fragrances market, generating a 20.4% share of the market's value. Coty, Inc. accounts for a further 16.5% of the market. Table 5: China fragrances market share: % share, by value, 2018 Company % Share Chanel S.A. 20.4% Coty, Inc. 16.5% LVMH Moet Hennessy - Louis Vuitton 15.2% L`Oreal S.A. 3.9% Other 44.0% Total 100% SOURCE: MARKETLINE MARKETLINE Figure 5: China fragrances market share: % share, by value, 2018 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 13 Market distribution eRetailers form the leading distribution channel in the Chinese fragrances market, accounting for a 26.9% share of the total market's value. Health & Beauty Stores accounts for a further 22.9% of the market. Table 6: China fragrances market distribution: % share, by value, 2018 Channel % Share eRetailers 26.9% Health & Beauty Stores 22.9% Hypermarkets & Supermarkets 19.0% Department Stores 18.0% Other 13.2% Total 100% SOURCE: MARKETLINE MARKETLINE Figure 6: China fragrances market distribution: % share, by value, 2018 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 14 MARKET OUTLOOK Market value forecast In 2023, the Chinese fragrances market is forecast to have a value of $1,011.2 million, an increase of 17.7% since 2018. The compound annual growth rate of the market in the period 2018–23 is predicted to be 3.3%. Table 7: China fragrances market value forecast: $ million, 2018–23 Year $ million CNY million € million % Growth 2018 859.2 5,688.1 728.3 2.2% 2019 887.8 5,877.4 752.6 3.3% 2020 915.5 6,060.4 776.0 3.1% 2021 945.5 6,259.2 801.4 3.3% 2022 977.2 6,469.1 828.3 3.4% 2023 1,011.2 6,693.7 857.1 3.5% CAGR: 2018–23 3.3% SOURCE: MARKETLINE MARKETLINE Figure 7: China fragrances market value forecast: $ million, 2018–23 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 15 Market volume forecast In 2023, the Chinese fragrances market is forecast to have a volume of 15.9 million units, an increase of 2.5% since 2018. The compound annual growth rate of the market in the period 2018–23 is predicted to be 0.5%. Table 8: China fragrances market volume forecast: million units, 2018–23 Year million units % Growth 2018 15.5 0.2% 2019 15.6 0.6% 2020 15.6 0.5% 2021 15.7 0.5% 2022 15.8 0.5% 2023 15.9 0.5% CAGR: 2018–23 0.5% SOURCE: MARKETLINE MARKETLINE Figure 8: China fragrances market volume forecast: million units, 2018–23 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 16 FIVE FORCES ANALYSIS The fragrances market will be analyzed taking personal care products manufacturers and large fashion houses as players. The key buyers will be taken as retailers, and manufacturers of chemicals, packaging, and manufacturing equipment as the key suppliers. Summary Figure 9: Forces driving competition in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE Many of the leading players are highly diversified companies, both in terms of products and geography, ameliorating rivalry within the market. The large size of the typical buyers in this market allows them to negotiate favorable contracts with manufacturers, thereby enhancing buyer power. On the other hand, strong branding is utilized to build loyalty towards manufacturers, which works to undermine buyers’ power. This factor becomes even more important in a market where end users have no switching costs. For some ingredients, there are no substitutes, augmenting supplier power, but suppliers are often small in scale compared to the large manufacturers, causing asymmetric bargaining positions. Chemicals used for manufacturing consumer products must adhere to environmental and safety standards and established players have developed and acquired extensive portfolios of well-known brands, backed by large marketing and advertising budgets. These trends pose significant barriers to new entrants. One method of establishing a new brand is through celebrity endorsement, but this can prove very costly for new players. Some personal hygiene products can be used as substitutes to products in this market. The low price of such products compared to those of many fragrances increases the threat of this. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 17 Buyer power Figure 10: Drivers of buyer power in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE The main distribution channel for the Chinese fragrances market is e-retailers, which account for 26.9% of the market value in 2018, followed by health and beauty stores with 22.9%. Advertising plays a crucial role in this market, with the transmission of a fragrances’ smell not always feasible. Strong branding is utilized to build loyalty towards manufacturers, which works to undermine buyers’ power. This factor becomes even more important in a market where end users have negligible switching costs. Celebrity endorsement of marketing campaigns or the celebrity developing their own fragrance is becoming more prominent. This reduces buyer power, as most retailers must stock popular brands in order to maintain their own sales volumes, with little option regarding alternatives. Moreover, end users in this market are quick to abandon old products in return for the novelty of a new fragrance. This behavior reduces buyer power by forcing retailers to follow trends closely in order to attract new clients. Retailers often occupy a strong position in the supply chain in this industry, which allows them to negotiate favorable contracts with manufacturers, thereby enhancing buyer power. That said, direct selling is also possible in the fragrances market: for example, manufacturer Avon uses a direct sales force to bypass the retail distribution channels. Overall, buyer power in the fragrances market is assessed as moderate. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 18 Supplier power Figure 11: Drivers of supplier power in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE The quality of raw materials is of great importance in the fragrances market. Chemicals used for manufacturing consumer products must adhere to safety regulations and standards. For some ingredients, there are no substitutes, augmenting supplier power. This is particularly true with the regards to fragrances’ essence. Suppliers are often small in scale compared to the large manufacturers, causing asymmetric bargaining positions. However, this factor is counterbalanced by the fact that chemical producers generate revenues from a wide variety of sources, reducing their dependence on fragrance product manufacturers. Overall, supplier power is assessed as moderate. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 19 New entrants Figure 12: Factors influencing the likelihood of new entrants in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE The fragrances market is primarily monitored by the International Fragrance Association (IFRA), which is mainly responsible for regulating worldwide legislative trends and keeping track of health problems related to fragrance usage, such as allergies or asthma. Fragrance formulas are treated as "trade secrets" and manufactures are not obliged to reveal them, even to regulatory agencies. However, products must meet environmental and safety standards. This presents a barrier to new entrants. Established players have developed and acquired extensive portfolios of such products, backed by large marketing and advertising budgets. New entrants have to contend with these formidable barriers, as branding has a heavy influence on consumer purchasing choices in this market. Additionally, substantial funds are necessary to start up a business in this market, with capital required for investment in production, distribution, and also advertising, which is crucial to success. One potential method of establishing a new brand is through celebrity endorsements, but this too can be very costly for new players. China has the largest population in the world; however, its fragrance market's value sales are considerably lower that its western counterparts. Although the concept of perfume is relatively new to its consumers, China is slowly opening up to Western fragrance standards among its affluent Chinese consumers. This means that while China has a low penetration level and is still developing, there is huge potential for growth, attracting newcomers. The moderate rate of growth during the review period makes the Chinese fragrances market attractive to prospective entrants. Overall, the threat of new entrants is assessed as moderate. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 20 Threat of substitutes Figure 13: Factors influencing the threat of substitutes in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE Fragrances, perfumes in particular, used to be considered luxury products. This trend is changing, however, with these products increasingly being sold at prices affordable to the general public. To a certain extent, many personal hygiene products provide a fragrance, and these traits are often used by manufacturers to differentiate their product lines. The low price of such products compared to that of fine fragrances increases the threat of substitution. Counterfeit goods cause a great threat to the fragrance industry and cost the industry billions in lost revenues. Clear imitations of a particular fragrance can make it hard to differentiate between the two. EBay poses a great problem when it comes to filtering between genuine and counter goods; there is no guarantee that the picture you see on an eBay auction is an actual picture of the fragrance bottle. In addition to this, flea markets, street strands and bargain stores are also rife with fake perfume. The problem with identifying counterfeit fragrances is that it may smell similar to the original fragrance. Overall, the threat of substitutes is moderate. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 21 Degree of rivalry Figure 14: Drivers of degree of rivalry in the fragrances market in China, 2018 SOURCE: MARKETLINE MARKETLINE The Chinese fragrances market is relatively consolidated, with the top four players, Chanel, Coty, LVMH and L`Oreal, accounting for 56.0% of the total market value in 2018; Chanel leads the market with a 20.4% share. Many of the leading players are highly diversified companies, both in terms of products and geography, ameliorating rivalry within the market. Fixed costs are high in this market, as most companies own large production facilities. The need to divest such assets upon exiting the market constitutes an exit barrier, enhancing rivalry. There is some collaboration between players, as certain fragrance products can be sold and manufactured under license via other companies, granting better access to different geographies and benefitting both parties. Many players are very similar, and feature a broad array of well-known brands in their portfolio. The Chinese fragrance market is an untapped market and one in which many fragrance companies can experience exceptional growth. The Chinese fragrance industry is expected to consolidate as international players increase their presence and competition intensifies. The advantage international players have in China is that domestic players do not hold a strong presence, allowing these companies to establish themselves as fragrance leaders. Furthermore, the fragrance industry is well known for using the flanking marketing strategy; companies diversify their products and services to reach a greater number of consumers. Demand for a product gives rise to companies introducing new products or innovations, but they may also be able to reposition an existing product for the target market. There are many perfumes that have the same name as the previous release, however, with an evocation word or two added. Flankers are a way for manufacturers to double down on a scent's success; an example of this is Chanel Coco versus Coco Mademoiselle. This further increases rivalry. However, moderate market growth during the review period will alleviate the rivalry to an extent. Overall, rivalry in the Chinese fragrances market is assessed as moderate. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 22 LEADING COMPANIES Chanel S.A. Table 9: Chanel S.A.: key facts Head office: 135 Avenue Charles de Gaulle, Cedex, 92200 Neuilly Sur Seine, FRA Telephone: 33 146 434 000 Fax: 33 147 476 034 Website: www.chanel.com SOURCE: COMPANY WEBSITE MARKETLINE Chanel S.A. (Chanel) is engaged in operating boutiques. The company offers designer apparel, footwear, watches, jewellery, leather goods, perfumes and eyewear. Chanel also offers beauty care products such as bases, foundations, powders, micro liquid essence, nail colors, mascara, eyeshadows, pencils and liners, lipsticks, brushes, and other accessories. Its product portfolio also includes shoes, small leather goods, costume jewellery, scarves, camellias, belts and various other accessories. The company also offers services such as the maintenance of its products, such as watches. Chanel is headquartered in Paris, France. Key Metrics As a privately held company, Chanel S.A. is not obliged to publish its financial statements. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 23 Coty Inc. Table 10: Coty Inc.: key facts Head office: 350 Fifth Avenue, New York, New York, USA Telephone: Telephone: 1 212 389 7300 Coty Prestige Shanghai Ltd., 8F Room C, No. 666 Fuzhou Road, Shanghai, CHN 86 216 391 7979 Website: www.coty.com Financial year-end: June Ticker: COTY Stock exchange: NYSE Local office: SOURCE: COMPANY WEBSITE MARKETLINE Coty Inc (Coty or ‘the company’) is a multi-segment beauty company that offers a wide range of beauty products, including fragrances, color cosmetics, and skin and body care products. The company operates in more than 46 countries and markets, sells and distributes its products in over 150 countries and territories across the Americas, EMEA and Asia-Pacific. The company operates 14 manufacturing facilities across the US, Europe, and Brazil. Coty operates through three business segments: Luxury, Consumer Beauty, and Professional Beauty. The company markets its products through 75 brands including Lacoste, Jil Sander, Clairol Professional, Mexx, Enrique, Beyonce, Adidas, Beckham, and Monange, among others. Under the Consumer Beauty segment, the company offers mass fragrances, color cosmetics, retail hair coloring and styling products, and body care products through supermarkets, hypermarkets, drug stores and pharmacies, traditional food and drug retailers, and mid-tier department stores. As of June 2018, the company operates five manufacturing facilities to carry out its Consumer Beauty business. In FY2018, the segment reported revenue of US$4,268.1m, which accounted for 45.4% of the company’s revenue. Under the Luxury segment, Coty offers prestige fragrances, premium cosmetics, and premium skincare through prestige retailers, including perfumeries, duty-free shops, and department stores. As of June 2018, the company operates five manufacturing facilities to carry out its Luxury business. In FY2018, the segment reported revenue of US$3,210.5m, which accounted for 34.2% of the company’s revenue. Under the Professional Beauty segment, the company offers hair and nail care products for salon professionals. The segment markets its products to nail and hair professionals, nail and hair salons, and professional stores. In FY2018, the segment reported revenue of US$1,919.4m, which accounted for 20.4% of the company’s revenue. Geographically, the company classifies its operations into three regions: North America, Europe, and ALMEA (Asia, Latin America, the Middle East, Africa and Australia). In FY2018, the Europe segment accounted for 44.7% of the company's revenue; followed by North America (31.6%) and ALMEA (23.7%). In China, the company sells its products under Adidas, Davidoff, Hugo Boss and other brand names. Key Metrics The company recorded revenues of $9,398 million in the fiscal year ending June 2018, an increase of 22.8% compared to fiscal 2017. Its net loss was $169 million in fiscal 2018, compared to a net loss of $422 million in the preceding year. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 24 Table 11: Coty Inc.: key financials ($) $ million 2014 2015 2016 2017 2018 4,551.6 4,395.2 4,349.1 7,650.3 9,398.0 (97.4) 232.5 156.9 (422.2) (168.8) Total assets 6,592.5 6,018.9 7,035.6 22,548.2 22,630.2 Total liabilities 5,748.7 5,049.1 6,675.4 13,233.5 13,780.5 Revenues Net income (loss) SOURCE: COMPANY FILINGS MARKETLINE Table 12: Coty Inc.: key financial ratios Ratio 2014 2015 2016 2017 2018 Profit margin (2.1%) 5.3% 3.6% (5.5%) (1.8%) Revenue growth (2.1%) (3.4%) (1.0%) 75.9% 22.8% 1.9% (8.7%) 16.9% 220.5% 0.4% 15.5% (12.2%) 32.2% 98.2% 4.1% Debt/asset ratio 87.2% 83.9% 94.9% 58.7% 60.9% Return on assets (1.5%) 3.7% 2.4% (2.9%) (0.7%) Asset growth Liabilities growth SOURCE: COMPANY FILINGS MARKETLINE Figure 15: Coty Inc.: revenues & profitability SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 25 Figure 16: Coty Inc.: assets & liabilities SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 26 L'Oreal SA Table 13: L'Oreal SA: key facts Head office: 41 rue Martre, Clichy, FRA Telephone: Telephone: 33 147 567 000 L'Oreal (China) Co., Ltd., 25F, Park Place, 1601 West Nanjing Road, Jingan, Shanghai, CHN 86 216 272 1988 Fax: 86 216 272 9553 Website: www.loreal.com Financial year-end: December Ticker: OR Stock exchange: Euronext Local office: SOURCE: COMPANY WEBSITE MARKETLINE L'Oreal SA (L'Oreal), a French company, is engaged in the production and marketing of a range of perfumes, make-up, coloring, hair and skin care products. The company classifies its business operations into four reportable segments: Professional Products, Consumer Products, L’Oreal Luxe, and Active Cosmetics. L’Oreal’s research and development activities focus on skin, haircare, color cosmetics, beauty, and sun protection, among others. The company's Professional Products segment sells haircare, coloring and styling products to hair salons and beauty institutes under the L'Oreal Professionnel, Kerastase, Redken, Matrix, Pureology, Shu Uemura Art of Hair, Carita, Mizani, Essie and Decleor brands. The Consumer Products segment sells coloring products, hair care, make-up and skin care products through massmarket retailing channels under the L'Oreal Paris, Garnier, Maybelline New York, Softsheen-Carson, Essie and NYX brands. Under the LOreal Luxe segment, the company sells skin care, make-up and perfume products through department stores, perfumeries, travel retail shops, the company’s own boutiques and certain e-commerce websites. Major brands in this division include Lancome, Giorgio Armani, Yves Saint Laurent, Biotherm, Kiehl's, Ralph Lauren, Shu Uemura, Cacharel, Helena Rubinstein, Clarisonic, and Diesel, among others. The Active Cosmetics segment sells dermo-cosmetic skin care products through healthcare channels such as pharmacies, drugstores, parapharmacies, and medi-spas. The brands in this division include Vichy, La Roche-Posay, Roger & Gallet, Sanoflore and SkinCeuticals. In China, the company sells its products under Diesel, Lancôme, Giorgio Armani and other brand names. Key Metrics The company recorded revenues of $31,783 million in the fiscal year ending December 2018, an increase of 3.5% compared to fiscal 2017. Its net income was $4,596 million in fiscal 2018, compared to a net income of $4,226 million in the preceding year. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 27 Table 14: L'Oreal SA: key financials ($) $ million 2014 2015 2016 2017 2018 26,585.1 28,659.6 29,398.3 30,704.9 31,783.0 5,793.5 3,890.7 3,664.4 4,225.6 4,596.1 Total assets 37,825.7 39,775.4 42,039.5 41,696.0 45,375.4 Total liabilities 13,999.9 11,913.8 13,130.1 12,416.4 13,603.0 Revenues Net income (loss) SOURCE: COMPANY FILINGS MARKETLINE Table 15: L'Oreal SA: key financials (€) € million 2014 2015 2016 2017 2018 22,532.0 24,290.2 24,916.3 26,023.7 26,937.4 4,910.2 3,297.5 3,105.7 3,581.4 3,895.4 Total assets 32,058.8 33,711.3 35,630.2 35,339.1 38,457.5 Total liabilities 11,865.5 10,097.4 11,128.3 10,523.4 11,529.1 Revenues Net income (loss) SOURCE: COMPANY FILINGS MARKETLINE Table 16: L'Oreal SA: key financial ratios Ratio 2014 2015 2016 2017 2018 21.8% 13.6% 12.5% 13.8% 14.5% Revenue growth 1.8% 7.8% 2.6% 4.4% 3.5% Asset growth 3.8% 5.2% 5.7% (0.8%) 8.8% Liabilities growth 44.0% (14.9%) 10.2% (5.4%) 9.6% Debt/asset ratio 37.0% 30.0% 31.2% 29.8% 30.0% Return on assets 15.6% 10.0% 9.0% 10.1% 10.6% Profit margin SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 28 Figure 17: L'Oreal SA: revenues & profitability SOURCE: COMPANY FILINGS MARKETLINE Figure 18: L'Oreal SA: assets & liabilities SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 29 LVMH Moet Hennessy Louis Vuitton SA Table 17: LVMH Moet Hennessy Louis Vuitton SA: key facts Head office: 22, Avenue Montaigne, Paris, FRA Telephone: 33 144 132 222 Fax: 33 144 132 223 Website: www.lvmh.fr Financial year-end: December Ticker: MC Stock exchange: Euronext SOURCE: COMPANY WEBSITE MARKETLINE LVMH Moet Hennessy Louis Vuitton SE (LVMH) is a luxury goods company that manufactures and sells wines, spirits, perfumes, cosmetics, watches, jewelry, and fashion and leather products. The company operates through six business segments: Fashion and Leather Goods; Selective Retailing; Wines and Spirits; Perfumes and Cosmetics; Watches and Jewelry; and Other Activities and Holding Companies. The Fashion and Leather Goods segment includes the following brands: Louis Vuitton, Fendi, Christian Dior Couture, Loewe, Marc Jacobs, Celine, Kenzo, Givenchy, Thomas Pink, Emilio Pucci, Berluti, Loro Piana, Rimowa, and Nicholas Kirkwood. Louis Vuitton brand offers a range of products, including leather goods, ready-to-wear for men and women, shoes and accessories, watches and jewelry. Fendi specializes in furs, and also offers leather goods, accessories and ready-to-wear products. Donna Karan offers a ready-to-wear line, DKNY. Loewe specializes in leather goods and readyto-wear, and Marc Jacobs specializes in fashion for men and women. Celine develops a ready-to-wear line, leather goods, shoes and accessories; Kenzo operates in the areas of ready-to-wear for men and women, fashion accessories, leather goods and home furnishings. Givenchy is known for its collections of men and women's ready-to-wear and its fashion accessories. Thomas Pink specializes in high-end shirts in the UK, and Emilio Pucci in casual fashion in luxury ready-to-wear. Berluti designs and markets men's shoes, a line of leather goods, and a ready-to-wear line for men. Loro Piana creates luxury fabrics and products, particularly from cashmere. Nicholas Kirkwood manufactures luxury footwear. The Selective Retailing segment operates through two divisions: travel retail and selective retail. The travel retail division includes the Duty Free Shoppers (DFS) and Starboard Cruise Services businesses, both of which sell luxury products to international travelers. The Sephora and Le Bon Marche banners represent selective retail business. Sephora is a selective fragrance and cosmetics retail chain. Le Bon Marche consists of two activities: department store (Le Bon Marche Rive Gauche in Paris) and food stores (La Grande Epicerie de Paris and Franck et Fils located on rue de Passy). These companies operate in Europe, the Americas, Asia and the Middle East. The Wines and Spirits segment operates through two divisions: champagne and wines, and cognac and spirits. The champagne and wines division markets champagne brands such as Moet & Chandon, Dom Perignon, Veuve Clicquot Ponsardin, Krug, Mercier and Ruinart. It also develops and distributes high-end still and sparkling wines from France, Spain, California, Argentina, Brazil, Australia, New Zealand, India and China. These wines are sold under brands such as Chateau d'Yquem, Cloudy Bay, Cape Mentelle, Newton, Cheval des Andes and Terrazas de los Andes. The cognac and spirits division sells cognac under the Hennessy brand and vodka under the Belvedere brand. It also sells single malt whisky brands Glenmorangie and Ardbeg, and white liquor under the Wen Jun Spirits brand. The Perfumes and Cosmetics segment offers a portfolio of brands including Christian Dior, Guerlain, Givenchy, Kenzo, Benefit Cosmetics, Fresh, Acqua di Parma, Loewe, Maison Francis Kurkdjian, Fenty Beauty by Rihanna, Kat Von D, Marc Jacobs Beauty and Make Up For Ever. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 30 The Watches and Jewelry segment operates in two segments: jewelry and high jewelry with Bvlgari, Chaumet and Fred; and high-end watchmaking with TAG Heuer, Hublot, Zenith, and Dior Montres. The Other activities segment includes the media business managed by the Les Echos group; Royal Van Lent; and Cheval Blanc's hotel operations. The Les Echos group includes Les Echos, a financial newspaper in France; LesEchos.fr, a business and financial website in France; the business magazine, Enjeux-Les Echos; as well as other specialized business services. Les Echos group also holds several other financial and cultural media titles that were previously owned by LVMH: Investir - Le Journal des Finances; Connaissance des Arts; and the French radio station, Radio Classique. Les Echos group also publishes trade journals, with titles produced by SID Presse, and is active in the business-to-business segment through Les Echos Formation and Les Echos Conferences, the trade show Le Salon des Entrepreneurs, and Eurostaf market studies. La Samaritaine is a real estate complex located in Paris, France. Royal Van Lent designs and builds luxury yachts and markets them under the Feadship brand. Cheval Blanc handles the development of the LVMH group's hotel businesses. Geographically, the company classifies its business into six regions: Asia (excluding Japan), the US, Europe (excluding France), France, Japan and Other Markets. Key Metrics The company recorded revenues of $55,249 million in the fiscal year ending December 2018, an increase of 9.8% compared to fiscal 2017. Its net income was $7,497 million in fiscal 2018, compared to a net income of $6,330 million in the preceding year. Table 18: LVMH Moet Hennessy Louis Vuitton SA: key financials ($) $ million Revenues Net income (loss) 2014 2015 2016 2017 2018 36,149.3 42,079.4 44,363.6 50,305.5 55,249.2 6,664.0 4,215.7 4,797.4 6,330.1 7,497.0 Total assets 62,961.0 67,962.5 70,340.0 82,302.8 87,665.4 Total liabilities 37,283.2 39,245.3 39,205.2 48,122.7 49,563.4 SOURCE: COMPANY FILINGS MARKETLINE Table 19: LVMH Moet Hennessy Louis Vuitton SA: key financials (€) € million Revenues Net income (loss) 2014 2015 2016 2017 2018 30,638.0 35,664.0 37,600.0 42,636.0 46,826.0 5,648.0 3,573.0 4,066.0 5,365.0 6,354.0 Total assets 53,362.0 57,601.0 59,616.0 69,755.0 74,300.0 Total liabilities 31,599.0 33,262.0 33,228.0 40,786.0 42,007.0 SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 31 Table 20: LVMH Moet Hennessy Louis Vuitton SA: key financial ratios Ratio 2014 2015 2016 2017 2018 18.4% 10.0% 10.8% 12.6% 13.6% 5.6% 16.4% 5.4% 13.4% 9.8% (5.0%) 7.9% 3.5% 17.0% 6.5% Liabilities growth 7.9% 5.3% (0.1%) 22.7% 3.0% Debt/asset ratio 59.2% 57.7% 55.7% 58.5% 56.5% Return on assets 10.3% 6.4% 6.9% 8.3% 8.8% Profit margin Revenue growth Asset growth SOURCE: COMPANY FILINGS MARKETLINE Figure 19: LVMH Moet Hennessy Louis Vuitton SA: revenues & profitability SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 32 Figure 20: LVMH Moet Hennessy Louis Vuitton SA: assets & liabilities SOURCE: COMPANY FILINGS China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 33 MACROECONOMIC INDICATORS Country data Table 21: China size of population (million), 2014–18 Year Population (million) % Growth 2014 1,366.6 0.5% 2015 1,372.5 0.4% 2016 1,378.0 0.4% 2017 1,383.1 0.4% 2018 1,387.8 0.3% SOURCE: MARKETLINE MARKETLINE Table 22: China gdp (constant 2005 prices, $ billion), 2014–18 Year Constant 2005 Prices, $ billion % Growth 2014 5,224.3 7.4% 2015 5,597.6 7.1% 2016 5,987.8 7.0% 2017 6,390.7 6.7% 2018 6,805.2 6.5% SOURCE: MARKETLINE MARKETLINE Table 23: China gdp (current prices, $ billion), 2014–18 Year Current Prices, $ billion % Growth 2014 10,033.4 9.3% 2015 11,072.8 10.4% 2016 12,241.0 10.5% 2017 13,438.5 9.8% 2018 14,639.6 8.9% SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 34 Table 24: China inflation, 2014–18 Year Inflation Rate (%) 2014 2.2% 2015 2.9% 2016 3.1% 2017 3.3% 2018 3.4% SOURCE: MARKETLINE MARKETLINE Table 25: China consumer price index (absolute), 2014–18 Year Consumer Price Index (2005 = 100) 2014 131.1 2015 134.9 2016 139.1 2017 143.7 2018 148.5 SOURCE: MARKETLINE MARKETLINE Table 26: China exchange rate, 2014–18 Year Exchange rate ($/CNY) Exchange rate (€/CNY) 2014 6.1456 8.1643 2015 6.2288 6.9109 2016 6.6441 7.3513 2017 6.7514 7.6363 2018 6.6199 7.8098 SOURCE: MARKETLINE China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED MARKETLINE 0099 - 0703 - 2018 Page | 35 METHODOLOGY MarketLine Industry Profiles draw on extensive primary and secondary research, all aggregated, analyzed, crosschecked and presented in a consistent and accessible style. Review of in-house databases – Created using 250,000+ industry interviews and consumer surveys and supported by analysis from industry experts using highly complex modeling & forecasting tools, MarketLine’s in-house databases provide the foundation for all related industry profiles Preparatory research – We also maintain extensive in-house databases of news, analyst commentary, company profiles and macroeconomic & demographic information, which enable our researchers to build an accurate market overview Definitions – Market definitions are standardized to allow comparison from country to country. The parameters of each definition are carefully reviewed at the start of the research process to ensure they match the requirements of both the market and our clients Extensive secondary research activities ensure we are always fully up-to-date with the latest industry events and trends MarketLine aggregates and analyzes a number of secondary information sources, including: - National/Governmental statistics - International data (official international sources) - National and International trade associations - Broker and analyst reports - Company Annual Reports - Business information libraries and databases Modeling & forecasting tools – MarketLine has developed powerful tools that allow quantitative and qualitative data to be combined with related macroeconomic and demographic drivers to create market models and forecasts, which can then be refined according to specific competitive, regulatory and demand-related factors Continuous quality control ensures that our processes and profiles remain focused, accurate and up-to-date China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 36 Industry associations International Fragrance Association Avenue des Arts, 6 1210, Brussels, BEL Tel.: 32 2 214 20 60 Fax: 32 2 214 20 69 www.ifraorg.org China Association of Fragrance Flavor and Cosmetic Industries Room 507 508, Building No2 Jiaye Plaza, No.21 Songzhuang Rd Shunsan tiao, Fengtai District, Beijing 100079, CHN Tel.: 86 10 67663110 Fax: 86 10 67663114 www.caffci.org Related MarketLine research Industry Profile Global Fragrances Fragrances in Australia Fragrances in Japan Fragrances in India Fragrances in Singapore China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 37 APPENDIX About MarketLine In an information-rich world, finding facts you can rely upon isn’t always easy. MarketLine is the solution. We make it our job to sort through the data and deliver accurate, up-to-date information on companies, industries and countries across the world. No other business information company comes close to matching our sheer breadth of coverage. And unlike many of our competitors, we cut the ‘data padding’ and present information in easy-to-digest formats, so you can absorb key facts in minutes, not hours. What we do Profiling all major companies, industries and geographies, MarketLine is one of the most prolific publishers of business information today. Our dedicated research professionals aggregate, analyze, and cross-check facts in line with our strict research methodology, ensuring a constant stream of new and accurate information is added to MarketLine every day. With stringent checks and controls to capture and validate the accuracy of our data, you can be confident in MarketLine to deliver quality data in an instant. For further information about our products and services see more at: http://www.marketline.com/overview/ Disclaimer All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, MarketLine. The facts of this report are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that MarketLine delivers will be based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such MarketLine can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. China - Fragrances © MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED 0099 - 0703 - 2018 Page | 38 MarketLine | John Carpenter House, John Carpenter Street | London, United Kingdom, EC4Y 0AN T: +44(0)203 377 3042, F: +44 (0) 870 134 4371 E: reachus@marketline.com