Working Capital Management: Strategies & Analysis

advertisement

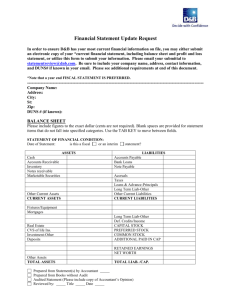

Working Capital Management Management need to understand the management of working capital so that management can efficiently manage current assets and decide whether to finance the firm’s funds requirements aggressively or conservatively. ABC Company Balance Sheet As of December 31, 19xx Assets: Liabilities & Equity: Current Assets Current Liabilities Cash & M.S. Accounts payable Accounts receivable Notes Payable Inventory Total Current Assets Fixed Assets: Gross fixed assets Total Current Liabilities Long-Term Liabilities Total Liabilities Equity: Less: Accumulated dep. Common Stock Goodw ill Paid-in-capital Other long-term assets Retained Earnings Total Fixed Assets Total Assets Total Equity Total Liabilities & Equity Current assets & Current liabilities: • Current assets, commonly called working capital, represent the portion of investment that circulates from one to another in the ordinary conduct of business. • Current liabilities represent the firm’s shortterm financing, because they include all debts of the firm that come due (must be paid) in 1 year or less. Working Capital • Working Capital includes a firm’s current assets, which consist of cash and marketable securities in addition to accounts receivable and inventories. It also consists of current liabilities, including accounts payable (trade credit), notes payable (bank loans), and accrued liabilities. • Net Working Capital is defined as total current assets less total current liabilities. Often called working capital. Short-term financial management In U.S. manufaturing firms, current assets account for about 40 percent of total assets; current liabilities represent about 26 percent of total financing. Therefore, it should not be surprising to learn that short-term financial management – managing current assets and current liabilities - is one of the financial manager’s most important and timeconsuming activities. The goal of short-term financial management is to manage each of the firm’s current assets and current liabilities to achieve a balance between profitability and risk that contributes positively to the firm’s value. Net Working Capital Current Assets - Current Liabilities. Gross Working Capital The firm’s investment in current assets. Working Capital Management The administration of the firm’s current assets and the financing needed to support current assets. Significance of Working Capital Management: • In a typical manufacturing firm, current assets exceed one-half of total assets. • Excessive levels can result in a substandard Return on Investment (ROI). • Current liabilities are the principal source of external financing for small firms. • Requires continuous, day-to-day managerial supervision. • Working capital management affects the company’s risk, return, and share price. Alternative Current Asset Investment Policies: 1. Relaxed Current Asset Investment Policy 2. Moderate Current Asset Investment Policy 3. Restricted Current Asset Investment Policy Optimal Amount (Level) of Current Assets ASSET LEVEL ($) Policy A Policy B Policy C Current Assets 0 25,000 50,000 Liquidity Analysis Policy Liquidity • A High • B Average • C Low Greater current asset levels generate more liquidity; all other factors held constant. Profitability Analysis Return on Investment = Net Profit Total Assets Current Assets = (Cash + Rec. + Inv.) Return on Investment = Net Profit Current + Fixed Assets Policy Profitability • A Low • B Average • C High As current asset levels decline, total assets will decline and the ROI will rise. The trade-off between profitability and risk • Profitability The relationship between revenues and costs generated by using the firm’s assets- both current and fixed assets- in productive activities. • Risk (of technical insolvency) The probability that a firm will be unable to pay its bills they come due. Impact on Risk • Decreasing cash reduces the firm’s ability to meet its financial obligations. More risk! • Stricter credit policies reduce receivables and possibly lose sales and customers. More risk! • Lower inventory levels increase stockouts and lost sales. More risk! Policy Risk • A Low • B Average • C High Risk increases as the level of current assets are reduced. Summary of the Optimal Amount of Current Assets Policy A B C Liquidity High Average Low Profitability Risk Low Low Average Average High High The Tradeoff Between Profitability & Risk • Positive Net Working Capital (low return and low risk) low return Current Assets Net Working Capital > 0 Current Liabilities Long-Term Debt low cost high cost high return Fixed Assets Equity highest cost Negative Net Working Capital (high return and high risk) low return Current Assets high return Fixed Assets Current Liabilities Net Working Capital < 0 low cost Long-Term Debt high cost Equity highest cost The Tradeoff Between Profitability & Risk (cont.) Cash Conversion Cycle Central to short-term financial management is an understanding of the firm’s cash conversion cycle. The Operating Cycle (OC) is the time from beginning of thr production process to collection of cash from the sale of finished products. The Cash Conversion Cycle (CCC) measures the length of time required a company to convert cash invested in its operations to cash received as a result of its operations. • Operating Cycle (OC) = AAI + ACP • Cash Conversion Cycle (CCC) = OC - APP CCC : (inventory period + accounts receivable period) – accounts payable period. Inventory period = average inventory annual CGS/365 A/R period = average A/R annual credit sales/365 A/P period = average A/P annual credit purchases/365 A/R turn over = 365 A/R period Average A/R = credit Sales : A/R turn over A/P turn over = 365 A/P period Average A/P = credit purchases : A/P turn over Gitman & Zutter (2012:604) In 2007, IBM had annual revenues of $ 98,786 million, cost of revenue of $ 57,057 millon, and accounts payable of $ 8,054 million. IBM has an average age of inventory (AAI) of 17.5 days, an average collection period (ACP) of 44.8 days, and an average payment period (APP) of 51.2 days (IBM purchases were $ 57,416 million). Thus CCC for IBM was 11.1 days. The resources IBM had invested in this CCC were: Inventory, $ 57,057 millon x (17.5/365) = $ 2,735,610 A/R, $ 98,786 million x (44.8/365) = 12,124,967 A/P, $ 57,416 million x (51.2/365) = 8,053,970 $ 6,806,607 $ 6,8 billion committed to working capital. • The end of 2009, IBM has lowered its ACP to 24.9 days. This dramatical increase in working capital efficiency . It would shorten the CCC and reduce the amount of resources IBM has invested in operations. • CCC = - 7.6 days Strategies for Managing the CCC 1. Turn over inventory as quickly as possible without stock outs that result in lost sales. 2. Collect accounts receivable as quickly as possible without losing sales from high-pressure collection techniques. 3. Manage, mail, processing, and clearing time to reduce them when collecting from customers and to increase them when paying suppliers. 4. Pay accounts payable as slowly as possible without damaging the firm’s credit rating. Funding Requirements of the CCC • permanent funding requirement, a constant investment in operating assets resulting from constant sales over time. • seasonal funding requirement, an investment in operating assets that varies over time as result of cyclic sales. Kebutuhan Modal (Rp) Temporary current assets Permanent current assets Waktu Permanent vs. Seasonal Funding Needs Nicholson Company holds, on average, $50,000 in cash and marketable securities, $1,250,000 in inventory, and $750,000 in accounts receivable. Nicholson’s business is very stable over time, so its operating assets can be viewed as permanent. In addition, Nicholson’s accounts payable of $425,000 are stable over time. Nicholson has a permanent investment in operating assets of $1,625,000 ($50,000 + $1,250,000 + $750,000 - $425,000). This amount would also equal the company’s permanent funding requirement. In contrast, Semper Pump Company has seasonal sales, with its peak sales driven by purchases of bicycle pumps. Semper holds, at minimum, $25,000 in cash and marketable securities, $100,000 in inventory, and $60,000 in accounts receivable. At peak times, Semper’s inventory increases to $750,000 and its accounts receivable increase to $400,000. To capture production efficiencies, Semper produces pumps at a constant rate throughout the year. Thus, accounts payable remain at $50,000 throughout the year. Semper has a permanent funding requirement for its minimum level of operating assets of $135,000 ($25,000 + $100,000 + $60,000 $50,000) and peak seasonal funding requirements of $990,000 [($25,000 + $750,000 + $400,000 - $50,000) - $135,000]. Semper’s total funding requirements for operating assets vary from a minimum of $135,000 (permanent) to a seasonal peak of $1,125,000 ($135,000 + $990,000) as shown in Figure 15.3. Aggressive versus Conservative Seasonal Funding Strategies Semper Pump has a permanent funding requirement of $135,000 and seasonal requirements that vary between $0 and $990,000 and average $101,250 (calculated from data not shown). If Semper can borrow short-term funds at 6.25% and long term funds at 8%, and can earn 5% on any invested surplus, then the annual cost of the aggressive strategy would be: • Alternatively, Semper can choose a conservative strategy under which surplus cash balances are fully invested, this surplus would be the difference between the peak need of $1,125,000 and the total need, which varies between $135,000 and $1,125,000 during the year. The aggressive strategy’s heavy reliance on short-term financing makes it riskier than the conservative strategy because of interest rate swings and possible difficulties in obtaining needed funds quickly when the seasonal peaks occur. The conservative strategy avoids these risks through the locked-in interest rate and longterm financing, but is more costly. The final decision is left to management. P15-4 The forecast of total funds requirements for coming year: Month Amount Month Amount January $ 2,000,000 July $ 12,000,000 February $ 2,000,000 August $ 14,000,000 March $ 2,000,000 September $ 9,000,000 April $ 4,000,000 October $ 5,000,000 May $ 6,000,000 November $ 4,000,000 June $ 9,000,000 December $ 3,000,000 • Permanent component $ 2,000,000 • Seasonal component, 0 - $ 12,000,000 average $ 4,000,000 per month Accounts Receivable Management The objective for managing accounts receivable is to collect accounts receivable as quickly as possible without losing sales from highpressure collection techniques. Topics of Accounts Receivable Management: • Credit Selection and Standards: Five C’s of credit; credit scoring; credit standard. • Credit Terms: cash discount; cash discount period; credit period. • Credit monitoring: average collection period; aging of accounts reveivable; collection techniques. Numerical Credit Scoring categories: – The customer’s character – The customer’s capacity to pay – The customer’s capital – The collateral provided by the customer – The condition of the customer’s business Changing Credit Standards A company is currently selling a product for $10 per unit. Sales (all on credit) for last year were 60,000 units. The variable cost per unit is $6 and total fixed costs are $120,000. A company is currently contemplating a relaxation of credit standards that is anticipated to increase sales 5% to 63,000 units. It is also anticipated that the Average Collection Period will increase from 30 to 45 days, and that bad debt expenses will increase from 1% of sales to 2% of sales. The opportunity cost of tying funds up in receivables is 15%. Should a company relax its credit standards? Contribution margin A/R turn over Total variable costs present $ 240,000 12.2 x $ 360,000 proposed $ 252,000 8.1 x $ 378,000 Investment in A/R Cost of fund Bad debt expenses $ 29,508 $ 4,426 $ 6,000 $ 46,667 $ 7,000 $ 12,600 Credit Terms • Credit terms: the terms of sale for customers who have been extended credit by the firm. • Cash discount: a percentage deduction from the purchase price; available to the credit customer who pays its account within a sepcified period. • Cash discount period: the number of days after the beginning of the credit period during which the cash discount is available. Gitman & Zutter (2012:620-621) MAX Company has an average collection period of 40 days, A/R turnover = 365/40 = 9.1. MAX is considering initiating a cash discount by changing its credit terms from net 30 to 2/10 net 30. The firm expects this change to reduce an average collection period to 25 days, A/R turnover = 365/25 = 14.6. • • • • Harga jual $ 3,000 per unit Biaya variabel $ 2,300 per unit Opportunity cost of funds = 14% Volume penjualan 1.100 unit dan akan naik menjadi 1.150 unit • Konsumen yang akan menggunakan kesempatan cash discount sebanyak 80%