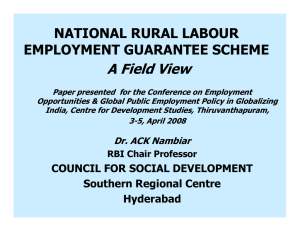

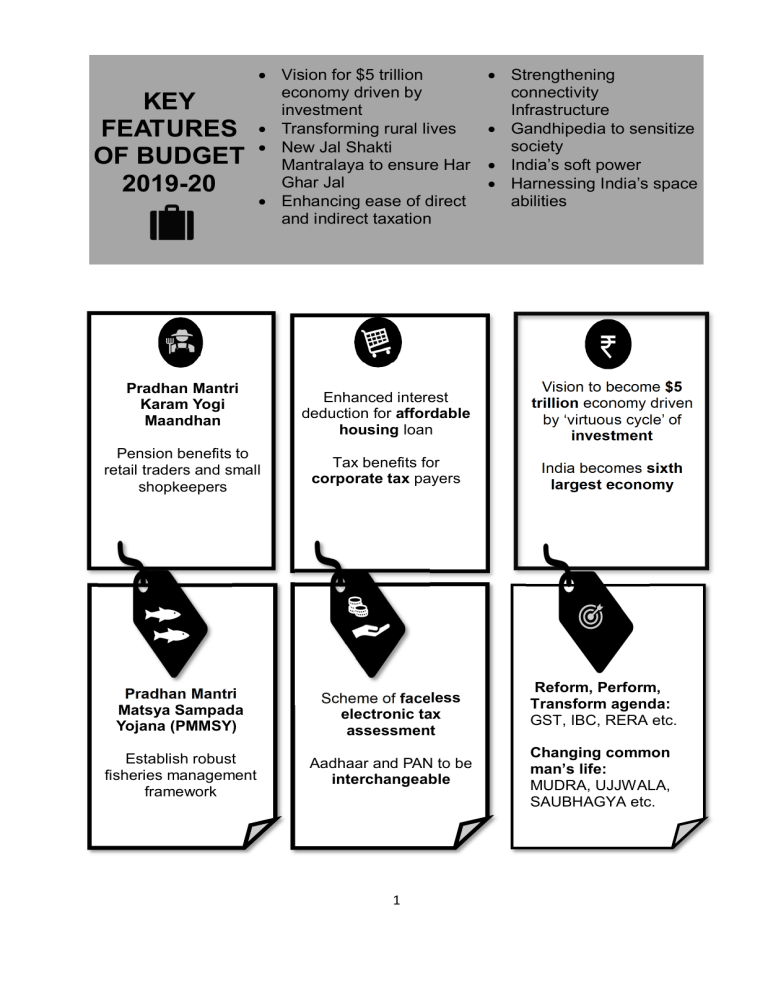

KEY FEATURES OF BUDGET 2019-20 Vision for $5 trillion economy driven by investment Transforming rural lives New Jal Shakti Mantralaya to ensure Har Ghar Jal Enhancing ease of direct and indirect taxation Pradhan Mantri Karam Yogi Maandhan Pension benefits to retail traders and small shopkeepers Strengthening connectivity Infrastructure Gandhipedia to sensitize society India’s soft power Harnessing India’s space abilities Enhanced interest deduction for affordable housing loan Vision to become $5 trillion economy driven by ‘virtuous cycle’ of investment Tax benefits for corporate tax payers India becomes sixth largest economy Pradhan Mantri Matsya Sampada Yojana (PMMSY) Scheme of faceless electronic tax assessment Establish robust fisheries management framework Aadhaar and PAN to be interchangeable 1 Reform, Perform, Transform agenda: GST, IBC, RERA etc. Changing common man’s life: MUDRA, UJJWALA, SAUBHAGYA etc. PUSH TO INVESTMENT: INFRASTRUCTURE DEVELOPMENT Road Bharatmala phase 2 to be launched. State road networks will be developed Air Shipping and Inland waterways World’s third largest domestic aviation market UDAAN: Number of Operational Airports crossed 100 Jal Marg Vikas project and Sagarmala initiatives: improving logistics, reducing transportation cost and increasing competitiveness. Operating Ratio improving Rail PPP in railways infra development 657 km Metro rail network already operational. National Common Mobility Card launched. 98.4 100 96.2 95 96 92 2017-18 2018-19 2019-20 (RE) (BE) 2 PUSH TO INVESTMENT: INFRASTRUCTURE DEVELOPMENT Houses under PMAY-U: Sanctioned: 81 lakh Construction started: 47 lakh Completed: 26 lakh Delivered: 24 lakh Housing Gas grids Water grids Vision for connectivity infrastructure Regional airports I-ways Promotion of rental housing: Model tenancy law to be finalised. Measures for boosting infrastructure financing Credit Guarantee Enhancement Corporation to be set up in 2019-20 Power grids 3 Action plan to deepen long term bonds market To permit transfer of FII/FPI investment in debt securities issued by IDFNBFCs to domestic investors PUSH TO INVESTMENT: INDUSTRIAL DEVELOPMENT Empowering MSMEs and social enterprises Make in India Startups promotion Push to E-vehicles Interest subvention scheme for MSMEs: `350 crore allocated for 2019-20 Payment platform for bill filing for MSMEs to be created: to address delays Social stock exchange for listing social enterprises and voluntary organisations Changes in customs duties to promote Make in India E-verification for establishing investor identity and source of funds to resolve tax issues relating to fund raising Exclusive TV channel for startups FAME Scheme Phase-2 commenced Customs duty exemption on certain e-vehicle parts Income tax deduction of interest on loans for e-vehicle purchase 4 GROWTH & MACRO-ECONOMIC STABILITY: VISION FOR $5 TRILLION ECONOMY GDP CAD Fastest growing major economy in the world 11th largest economy in 2013-14 5.6% of GDP in 2013-14 6th largest economy in 2019-20 CAD as % of GDP GDP Growth rate (%) 8 8.25 7.5 7.4 8.2 6.0 4.3 4.8 5.0 4.0 3.0 1.7 1.3 1.8 2.1 2.0 1.1 0.7 1.0 0.0 7.2 6.8 6.75 6 FDI & FPI 2.1% of GDP in 2018-19 100% FDI to be permitted for Insurance intermediaries India attracted $64.4 bn worth of FDI in 2018-19 Statutory limit for FPI investment in a company increased to sectoral limit Local sourcing norms to be eased for FDI in single brand retail 5 ON THE PATH OF FISCAL CONSOLIDATION AND INFLATION MANAGEMENT Fiscal Deficit (% of GDP) 1,00,045 80,000 1,05,000 Central Govt. Debt (% of 51.6 51.4 GDP) 49.9 49.5 48.4 48 2017-18 (Actuals) 2018-19 (RE) 2019-20 (BE) 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 (Actuals) (RE) (BE) 6 Apr-19 Jan-19 Oct-18 Jul-18 Apr-18 Oct-17 Jan-18 Jul-17 Apr-17 Jan-17 Jul-16 Oct-16 Apr-16 Jan-16 2019-20 2018-19 2017-18 2016-17 2015-16 2014-15 2013-14 2012-13 2011-12 2010-11 2009-10 2008-09 2007-08 2006-07 2005-06 2004-05 2003-04 Disinvestment Receipts (in ₹ crore) Oct-15 3.5 3.5 3.4 3.3 2.6 Jul-15 4.1 3.9 4.9 Apr-15 3.4 4.5 Jan-15 3.9 4 Oct-14 4.9 4.3 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 Jul-14 5.9 Apr-14 6.1 CPI Inflation (in %) 6.6 Also, India’s sovereign external debt to GDP ratio amongst the lowest globally at less than 5%. BUDGET AT A GLANCE Capital Receipts ( in ` crore) Revenue Receipts (in ` crore) 8,23,588 19,62,761 17,25,738 17,29,682 20,00,000 8,00,000 7,06,740 7,16,475 7,27,553 14,35,233 15,00,000 6,00,000 10,00,000 4,00,000 5,00,000 2,00,000 0 0 2017-18 (Actuals) 2018-19 (BE) 2018-19 (RE) 2019-20 (BE) 2017-18 (Actuals) 25,00,000 18,78,833 3,50,000 20,00,000 2,80,000 15,00,000 2,10,000 10,00,000 1,40,000 5,00,000 70,000 0 0 2017-18 (Actuals) 2018-19 (BE) 2018-19 (RE) 2018-19 (RE) 2019-20 (BE) Capital Expenditure (in ` crore) Revenue Expenditure (in ` crore) 21,41,772 21,40,612 24,47,780 2018-19 (BE) 2,63,140 2017-18 (Actuals) 2019-20 (BE) 7 3,00,441 2018-19 (BE) 3,16,623 2018-19 (RE) 3,38,569 2019-20 (BE) BUDGET AT A GLANCE RUPEE COMES FROM 20% Borrowings and Other Liabilities 9%- Non Tax Revenue 21% Corporate Tax 8%-Union Excise Duties 16% Income Tax RUPEE GOES TO 9% Centrally Sponsored Schemes 4% Customs 18% Interest Payments 19% GST 8% Subsidies 9% Defence 23% States’ Share of taxes & Duties 13% Central Sector Schemes 3% Non debt Capital Receipts 8% Other Expenditure 5% Pensions 8 7% Finance Comm. & Transfers s TAX PROPOSALS FACELESS E-ASSESSMENT A scheme of faceless electronic assessment involving no human interface to be launched this year DIRECT TAX REFORMS PAYING OFF Increase in tax collection by 78% from ₹6.4 lakh crore in 2013-14 to ₹11.4 lakh crore in 2018-19 ENHANCING EASE OF TAX PAYERS Aadhaar and PAN to be made interchangeable Threshold for applicability of lower corporate tax rate of 25% increased from ₹250 crore to ₹400 crore. Enhanced interest deduction up to ₹3.5 lakh for purchase of an affordable house. Deposit taking and systemically important non-deposit taking NBFCs can now pay tax in the year they receive interest for certain bad or doubtful debts. TDS of 2% on cash withdrawal exceeding ₹1 crore in a year from a bank account to promote less cash economy. Effective tax rate for individuals having taxable income above ₹2 crore has been increased. No charges or MDR on specified digital mode of payments. These modes are to be compulsorily provided by large businesses. Sabka Vishwas Legacy Dispute Resolution Scheme proposed for quick closure of service tax and excise related litigations. 9 REFORM, PERFORM, TRANSFORM Banking & IBC GST Record Recovery of ₹4 lakh crore in last 4 years due to IBC and other measures Provision coverage ratio of banks highest in 7 years Proposed further recapitalisation of PSBs: ₹70,000 crore 2. Fully automated GST refund module shall be implemented. Average recovery under various recovery regimes (in %) 43 45 35 25 15 5 1. Taxpayers having annual turnover of less than ₹5 crore can now file quarterly returns. 3. An electronic invoice system is proposed that will eventually eliminate the need for a separate e-way bill. 23 DRT, SARFAESI, Realisation by Lok Adalats, etc: Financial Creditors 2007-17 under IBC: 2017-19 Further simplification of GST Processes SWACHH BHARAT More than 95% cities and 5.6 lakh villages declared ODF More than 45,000 public and community toilets uploaded on Google Maps To expand Swachh Bharat Mission to undertake sustainable solid waste management in every village. 10 TRANSFORMING RURAL INDIA Pradhan Mantri Gram Sadak Yojana (PMGSY) Outlay (in ₹ crore) PMAY-G 19000 20000 15500 22.6% jump 15000 1.5 crore rural homes completed 1.95 crore houses proposed for second phase. Average days for completion: 314 (2015-16) 114 (2017-18) PMGSY 10000 5000 0 2018-19(RE) Completion Target advanced 2022 2019 97% of targeted habitations covered 30000 km built using green technology 2019-20(BE) MGNREGA Outlay (in ₹ crore) Rural Electrification 60000 60000 100% Households Electrified 9% jump 58000 55000 56000 UJALA leading to annual cost savings of ₹18,341 crore 54000 52000 2018-19(BE) 11 2019-20(BE) FARMER WELFARE AND WATER SECURITY Boost to agro-rural industries through cluster based development under SFURTI scheme with focus on bamboo, honey and khadi clusters 100 new clusters to be set up to enable 50000 artisans during 2019-20 Pradhan Mantri Matsya Sampada Yojana launched The scheme will address critical gaps in strengthening value chain, including infrastructure, modernisation, production, productivity and quality control 100 Business Incubators to be set up to enable 75000 entrepreneurs under ASPIRE Constitution of Jal Shakti Mantrayala To ensure Har Ghar Jal to all rural households by 2024 under Jal Jeevan Mission 1592 critical and over exploited blocks identified under Jal Shakti Abhiyan Focus on Integrated demand and supply side management at local level, creation of local infrastructure for rainwater harvesting, groundwater recharge and household waste water management 12 WOMEN’S DEVELOPMENT TO WOMEN LED DEVELOPMENT Allocation for ICDS (in ₹ crore) 70% of beneficiaries under MUDRA scheme are Women 2019-20 (BE) 2018-19 (RE) 20,000 More than 7 crore connections already given 27,584 8 Crore free LPG connections to be given under Ujjwala Yojana 23,357 22,000 24,000 26,000 28,000 To expand women SHG interest subvention programme to all districts ₹1 lakh loan under MUDRA scheme for one woman in every SHG 13 LABOUR AND YOUTH WELFARE Pradhan Mantri Laghu Vyapaari Mann-Dhan Yojana (PMLVMY) Pradhan Mantri Shram Yogi Maan Dhan (PM-SYM) About 30 lakh workers have joined the scheme Pension benefits to around 3 crore retail traders and small shopkeepers with annual turnover less than ₹1.5 crore. Rationalising of labour laws into 4 labour codes proposed. National Research Foundation to be established to fund, coordinate and promote R&D National Sports Education Board to be setup under Khelo India. ₹400 crore provided for ‘World Class Institutions’ for FY 2019-20 To prepare youth for new age skills: Artificial Intelligence, IoT, Big Data, 3D Printing, Virtual Reality etc Study in India: to bring foreign students to higher educational institutions 14 VISION FOR THE NEXT DECADE 1 Physical and social infrastructure 2 Digital India 3 Pollution free India 4 5 6 7 8 9 10 Make in India Water management and clean rivers Blue economy Space programmes Self-sufficiency and export of food grains Healthy society Team India with Jan Bhagidari 15