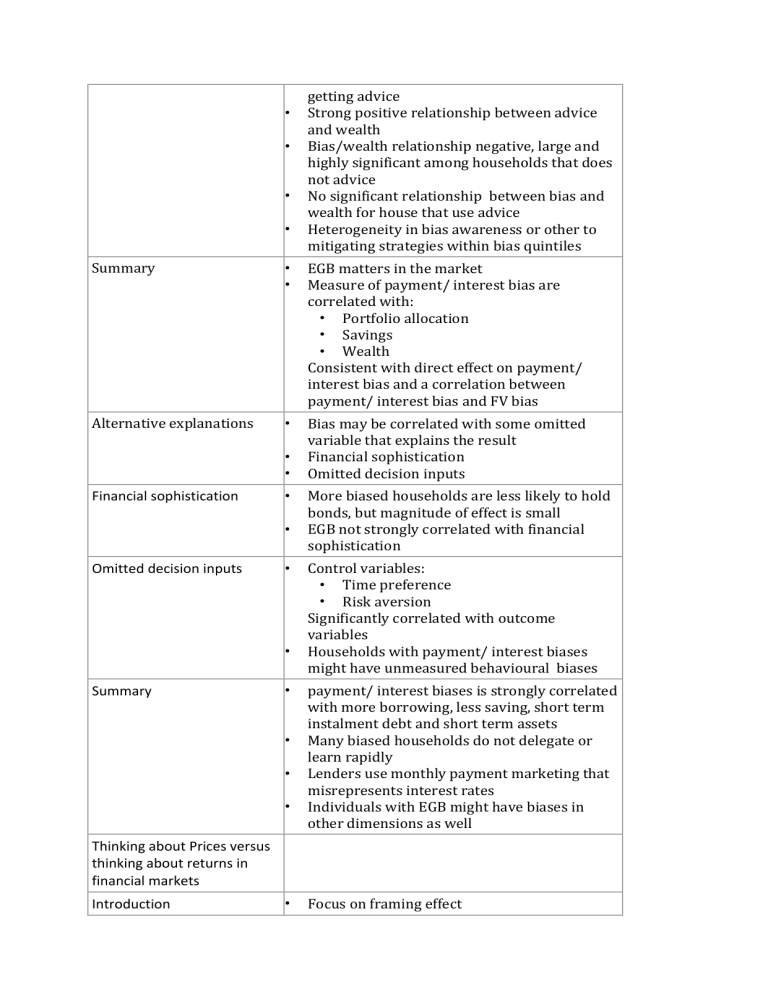

• • • • getting advice Strong positive relationship between advice and wealth Bias/wealth relationship negative, large and highly significant among households that does not advice No significant relationship between bias and wealth for house that use advice Heterogeneity in bias awareness or other to mitigating strategies within bias quintiles Summary • • EGB matters in the market Measure of payment/ interest bias are correlated with: • Portfolio allocation • Savings • Wealth Consistent with direct effect on payment/ interest bias and a correlation between payment/ interest bias and FV bias Alternative explanations • Bias may be correlated with some omitted variable that explains the result Financial sophistication Omitted decision inputs • • Financial sophistication • • Omitted decision inputs • • Summary • • • • More biased households are less likely to hold bonds, but magnitude of effect is small EGB not strongly correlated with financial sophistication Control variables: • Time preference • Risk aversion Significantly correlated with outcome variables Households with payment/ interest biases might have unmeasured behavioural biases payment/ interest biases is strongly correlated with more borrowing, less saving, short term instalment debt and short term assets Many biased households do not delegate or learn rapidly Lenders use monthly payment marketing that misrepresents interest rates Individuals with EGB might have biases in other dimensions as well Thinking about Prices versus thinking about returns in financial markets Introduction • Focus on framing effect • • Neoclassical Theory: • Individual decision invariant to changes in how an information is presented (framing) But price and return estimates may be influenced by framing Motivation and research goals • Research question Do investors understand a chart of a fund´s performance in the same way when the performance chart plots past prices or past returns? And is it the same to ask an analyst to forecast prices or returns? Empirical setup • • • • • Results Financial websites us: • Price charts present development of a market index • Return charts to display development of a passive fund indexed on it Randomize experiments on different framings • Prices vs. Returns Variation of: • Amount of information • Level expertise • Incentive schemes Three experimental studies: • Study 1 baseline, study 2 robustness • Study 3 real word test with financial professionals Study 1&2: • Task price: provide a forecast of future price level of financial instrument next month • Task return: provide a forecast of future return of financial instrument next month Study 3: • Task price: expectation of DAX point level in one month • Task return: expectation of monthly percentage change of DAX return Demographics of participants: • Study 1&2 similar based on almost all demographic variables • Professionals in study 3 are significantly older • Professionals of study 3 are almost exclusively male Main Results: • Asking participants to forecast returns result in higher subjective return • • • • Explaining the effect • • • • Summary • • • • • expectation Showing them return charts result in lower subjective return expectations Very similar effects between study 1&2 Task effect manifests in forecasts of finance professionals even though they have unrestricted access to various information Effect remains by restricting the sample to professionals who act as professional forecasters Processing Theory, two process of thought: • System I: effortless and intuitive thinking • System II: deliberate, reflective and effortful reasoning Role of intuition: • Interaction of treatment dummies with intuitive thinking • Results are not driven by better mathematically skills • Stronger tendency to reflect and deliberately reach a solution and to rely on analytical thinking Negative numbers: • Human brain only equipped with innate intuition for positive numbers • Task price treatment: articulate negative numbers without using negative numbers • Therefore burden to report pessimism is lower than in task return treatment Other explanations: • Results are not driven by anchoring • Main effects cannot be explained by any difference in the selection of prominent chartist strategies Study compares formats of prices and returns in context of financial market expectations based on three laboratory studies • Study 1 baseline study • Study 2 robustness study • Study 3 real world professionals Asking to forecast returns opposed to prices results in higher expectations Showing return charts opposed to price charts results in lower expectations Effects of question and chart formats mediated by involuntary impulses by intuitive thinking Showing price charts of more recent past returns tend to ignorance of more distant past • Showing return bar charts draws their attention to entire available history