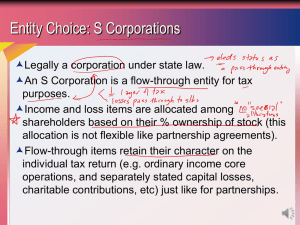

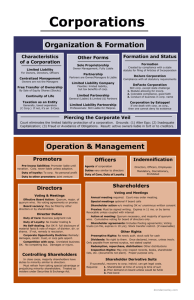

Business Orgs Outline 33 questions for each FL Crim, FL Civ pro, Evidence, (either Wills OR Biz orgs) SOMETIMES dropped evidence biz orgs AND Wills BIZ orgs not tested on essays ( breadth not depth) Timing CHECK SRS FLASHCARDS for FL Business Proxies expire in 11 months Notice to dissenters within 10 days after resolution passed SH annual meetings require at least 10 day notice SH special meetings require at least 10 day notice Orgs!!!!! The notice stated that the meeting was called for the shareholders to vote onBankit’s proposed merger with Spendit Corporation. At least 10 days before the meeting, Bankit must compile a complete list of shareholders entitled to vote at the meeting, and if it fails to do so, any shareholder may demand that the meeting be adjourned. Short form mergers – 80% SH Involuntary Dissolution - 35 SHs Appraisal rights DNA if 2000 shares +10 million outstanding OR traded on national scale 2 day written warning for special director meetings 90 days waiting required after demand on BOD for SH derivative suit 5 business days warning for day of SH inspection of books +GF, directly connected, reasonable particularity Refusal for inspection warranted if in past 2 yrs, person offered a list of SH or etc. Record date may not be > 70 days before meeting SH Annul meetings may not be more than 13 months apart Subscription Agreementin FL-Irrevocable for 6 months unless otherwise stated If no record date is fixed by the board, the close of business on the day before the first notice is delivered to the shareholders is the record date. Makes sense 16b short swing profits provision PRIVATE if you make profits on those shares by a purchase and sale or sale and purchase within 6 months of each other you must give up those profits to the corporation. ) Preemptive right is the right of an existing shareholder to maintain her percentage of ownership by buying stock whenever there is a new issuance of stock for money (cash or equivalent). FLorida does not include sale of treasury stock as Anew issuance.’’ Stock – feely transferrable Florida Business Corps Act (“FBCA”)– requires 2 things on alienation of stock if both satisfied, that limitation on transferability will be ok 1. Reasonable restrictions Complete bar to transferper se unreasonable Right of first refusal (gives the corp the right buy first if you want to sell them (keep the shares within the family)reasonable 2. Conspicuous restriction–restriction runs with the share (person must be put on notice of the restriction on alienation) FL does not recognize de facto corpspersonal liability instead Shareholder List Inspection Rights 4 requirements to get list of shareholders: 1. Person requesting list must be a shareholder (on record) 2. Request must be in writing 3. Making a request during reasonable times (not asking to see records during midnight or a holiday) 4. Request is for a proper purpose, not for mere personal purpose. This method allows shareholders to cast all of their votes for a single nominee for the board of directors when the company has multiple openings on its board. A corp Is considered its own person (a separate entity under FL law) Advantages LL=corps have limited liability meaning you cant go after shareholders unless piercing the corporate veil Centralized management Easy transfer of ownership – shares are % of ownership of that comp that are outstanding Corp can sell shares to make more capital but in effect, dilute the existing ownership C corp – suffers from double taxation. Income is taxed at the personal level and at the business level meaning the corporation is first taxed on its profit because that is income to the corporation. Shareholders are also taxed when they receive distribution (when they receive their share of the profit) because that is income to the shareholders. S corp – single taxation (foregoes double taxation). Here, the shareholders/owners are taxed even if they don't receive the profit in cash, ie the corp chooses to reinvest the profits Duration of corporate existence. As long as you comply with law, corp can exist forever: annual report along with the corresponding fees. These docs are registered with the dsecretary/department of state. Lawful activities: Corps can engage in any lawful activities. Corps are permitted to donate to chairites. Annual report- as part of the notice, you have to appoint a registered agent (someone who is designated to receive service of process). Ultra vires- Ask that is up beyond the corporate charter or unlawful Very limited application today Donate to candidates for federal office How to form a corp: Must file the articles of incorporation. Registered agent + incorporators must sign them and they must be filed with the secretary state. After which time, the corp is filed AOI: (1) corps name (2) # of shares authorized to be released by the corp “ownership interestcan be changed later) + and (3) the distinguishing characteristics (including classes of stock). (4) Preemptive rights if any, (5) corporate address, (6) registered agents name (so we know who to sue-they sign it anyway), (7) name and biz address of incorporators, OPTIONAL: The address of the corporation’s initial registered office in Florida. Required for annual report: same as above generally+(8) address of principal office of the corp (9) date of incorporation (10) federal employment id # NAME - Must end in either corporation, incorporation, company, or abbreviations of those words Cant be misleading name “FB investigators inc.” for an private investigation firm What MAY the AOI include Imposition of personal liability on shareholders Purpose of the corporation # of directors Par value of stock (corp can never sell stock for less than that value) Defective formation: De jure – incorporated in complete compliance with the law De facto – FL DNR de factopersonal liability. incorporated in substantial compliance with the law (although they haven’t complied with everything, they are given a chance to CURE their defects to become a registered corp) No personal liability BUT Quo warranto still p;ossible Quo warranto is a special form of legal action used to resolve a dispute over whether a specific person has the legal right to hold the public office that he or she occupies o Actual knowledge of no incorporation personal liability Corporation by estoppel - neither party knew there was defective incorporation and they acted like it too estopped from suing SHs for personal liability probably + estopped from avoiding contracts (1) a good faith attempt to form a corp, (2) the corp reasonably believes they formed the corp (3) they acted like a corp (4) other party had reason to believe they were not a corp but they treated them like one anyway, they will be estopped from holding the owners liable (they will have to go after corp assets) Amendments Amending AOI: BOTH MAJORITY BOD + SH Amending Bylaws: MAJORITY BOD OR SH Amending AOI BOD AND the shareholders BOTH must approve the amendment by a majority Amending Bylaws BOD OR the shareholders must approve the amendment by a majority Half is typically enough SH voting on Regular issue majority of a quorum present SH voting on Fundamental issue – majority of ALL outstanding shares (not just those at the meeting) Capital structure – Shares - ownership interest issued by the corp Original issuance of share is how corp made money (not the resale of that share) Debt structures – bonds (loans with) layperson buys them and earns interest on them whereafter the corp pays them back after a certain time -NO OWNERSHIP INTEREST Bankruptcy - Bond owners get paid first, shareholders second (increased risk) Preferred stock – a class of stock that typically does not have voting rights in exchange, they usually get paid first or certain amount of money -will be considered voting stock for an issue that would affect these preferred stocks rights -Both classes must approve of this issue by a majority Preemptive right – give a right, but not obligation, to purchase shares for cash in order to maintain their ownership interest in that stock (1) Preemptive right is the right of an existing shareholder to maintain her percentage of ownership by buying stock whenever there is a new issuance of stock for money (cash or equivalent). FLorida does not include sale of treasury stock as Anew issuance. -- S owns 1,000 shares of C Corp. There are 5,000 shares outstanding. C Corp. is planning to issue an additional 3,000 shares. If S has preemptive rights, then S has the right to to buy 600, it is a percentage deal. She initially had 1k of 5k which is 20% so now she is entitled to 20% of the 3,000 newly issued shares which is 600 shares. Traditionally, preemptive rights exist unless the articles provide otherwise. The articles of C Corp. provide for preemptive rights. C Corp. is issuing stock to G to acquire Green Acres from G. Are there preemptive rights? NO. This is not an issuance of momney. Here it is for property Treasury stock. This is stock that was previously issued and has been reacquired by the corporation. The corporation can then resell it. Treat the sale as no par. 1. Who determines the value of consideration received for an issuance? The board of directors. And its valuation is conclusive if it was made in good faith Distribution of shares- giving the profit to shareholders (dividends) BOD has the control over doing this Stock – feely transferrable Florida Business Corps Act (“FBCA”)– requires 2 things on alienation of stock if both satisfied, that limitation on transferability will be ok 3. Reasonable restrictions Complete bar to transferper se unreasonable Right of first refusal (gives the corp the right buy first if you want to sell them (keep the shares within the family)reasonable 4. Conspicuous restriction–restriction runs with the share (person must be put on notice of the restriction on alienation) Shareholder power – vote on BOD + corporate matters (amending AOI, motions, etc.) Valid meetings (annual and special meetings) Annual meetings- elect directors and any other business Special meeting – special notice required!!! Shareholders MUST be notified of both meetings or the act will be null and void Notice + Quorum (majority of common stock shareholders entitled to vote) Can also vote by proxy- they will be counted towards quorum Straight voting (default) (1 share, one vote) Cumulative voting allowed in Florida – allows for minority shareholders to have a voice S*n/d+1 =Shares in vote *directors required /directors to be elected +1 =take answer and add 1 X = # of Ds wanted X # of total shares # of Ds being elected +1 +1 (300* 2/5 +1 )+1 S*n/d+1 Shareholder can vote as many shares as he has times the number of directors being elected, and cast the product among the director candidates. EXAMPLE: 100 Shares X 10 Directors = 1000 cumulative votes Cumulative Voting Formula X > (S*𝑁 / 𝐷+1) +1 X= Number of shares you need to elect N directors S = Total number of shares being voted at the meeting N = Number of directors YOU want to elect to the board from the total of D directors spots open D = The total number of director spots open for election Ex question: 300 shares available (s) 5 directors to be elected (d) 2 directors wanted (n) S*n/d+1 Shares in vote *directors required /directors to be elected +1 (300* 2/5 +1 )+1 =101 votes required to vote in those two directors take answer and add 1 X must be 1 greater than 100 Cumulative Voting Formula 1) How many votes of ALL SH votes are sufficient to elect a specified number of directors? X = a X b +1 X = # of Ds wanted X # of total shares +1 c+1 # of Ds being elected +1 1000 shares ; 2 Directors desired ; 5 positions open =1000 X 2 / 5 + 1 = 2000/6 = 333.33 =should be 334.33? 2) How many directors can one shareholder elect with a given # of shares? X = (n-1)(d+1) X = (# of 1 owner shares -1) (# of Ds being elected + 1) S Total Shares – All Owners 401 shares; 1000 shares voting ; 4 directors (401-1)(4+1) / 1000 = 400X5=2000/1000 = 2 601 shares; 1000 shares voting ; 4 directors (601-1)(4+1) / 1000 = 600X5=3000/1000 = 3 Business judgement rule – directors do not need to pay dividends for this reason BJ rule – moderated by duty of good faith and loyalty Voting trust – a trust where shareholders irrevocably transfer their ownership into the trust -the trustee has the power now (but they must vote those shares in accordance with the trust purpose After transfer of ownership to trust: Trustors have equitable title Trustee has legal title Voting trust certificate entitles you to % of dividends Pooling/voting agreement – a K for voting Must be written and signed Not a trust Lets vote on these people Transfer the share itself Make sure subsequent owners /transferees are bound by this agreement by voting trust certificate (“VTC”) Transferrable from person to person Must be written and signed Duration Share Ownership Pooling Agreement Can be perpetual Shareholders retain both legal and beneficial ownership Voting Trust MBCA: >10 Yrs DGCL: Can be perpetual here too Legal ownership transferred to trustee, shareholders retain beneficial ownerships (VOTING TRUSTORS NO LONGER RETAIN VOTING RIGHTS) Shareholders - No fiduciary duty to corp (act in their own best interest) Exceptions to only act with self interest: Controlling shareholders cannot use that power to defraud or repress minority corp corp with a 100 or fewer SHs Closely held corps corp with a 100 or fewer SHs (corps w/ >100 SH) the duty is ALLLLL SHs must be treated equally FBCA – Florida business corps act --- can dispense with BOD and so, SHs can run the corp by themselves BOD in corp– elect by voting shares (nonvoting shares do not elect BOD) May be ONE or more ADULT NATURAL PERSONS Elected by plurality BOD in not for profit corp– May be THREE or more ADULT NATURAL PERSONS Meetings -- question – was the meeting valid? Directors have no power themselves, they must meet as a body Regular meetings - occur regularly Notice not required because they occur reguarly Special meetings -occur as needed Written Notice at least 2 days before meeting Quorum – set # required for a valid meeting to take place can be as high as you want, but not lower than 1/3 of all BOD that exist (ex. 9 BOD3 is the lowest quorum you can go) once you have a quorum, you need a majority to vote in favor of the act for the act tom be valid after that meeting Board Action/Resolution There are two ways the board can take a valid act: (1) unanimous written consent to act without a meeting, or (2) a meeting (can be held anywhere) that satisfies quorum and voting requirements. What if neither of these is met? must be ratified by any of the above two things or it is VOID Duty of care BJR So long as these judgements are informed, BOD will not have violated duty of care Duty of loyalty Conflicts of interest – BOD cant vote on things if they have a personal stake/interest in them Interested director transaction the proposal will be voted in if EITHER: interest directors discloses their interest to other BOD + interest directors abstains from the vote + as long as majority of disinterested BODs votes in favor of the proposal OR SHs approve the transactionmajority? the proposal will be voted i OR the K was fair and reasonable at the tiome it was approved (the BOP is on the director to show it was fair) If no disclosure, you will be liable to corp for damages If my family is on BOD, they are not disinterested directors (my inrerest is imputed to them) DUTY OF LOYALTY (Burden on Defendant because BJR does not apply in cases involving conflict of interest.) COI Exception Interested director transaction will be set aside UNLESS the director shows: (1) the deal was fair to the corporation when entered, OR (2) full disclosure her interest and the relevant facts were disclosed or known and the deal was approved by either of these: disinterested SHs, BOD, or committee - Special quorum rules: interested directors count toward quorum. interested directors may be counted to meet quorum requirements Business opportunity /usurpation - if director came upon the business opp in the course of your employment with the corp, you have a duty to dsclose and inform that business opp to the corp Corp Denied the opp director can take the opp Corp Accept the opp corp takes the opp Failure to inform (take the opp without telling the corp first) corp can claw back the profits officers – appointed by the BODs -act as AGENTS of the corp (P) *BOD are never agents of the corp PRESIDENTS, CFOs, CEOs, make executive decisions (run the corp day to day activities) Actual vs apparent agency Actual – actually have he authority to bind the corp with your actions Apparent – a person reasonably believes you “ “ “ “ “ The nature/reasonableness of the purchase can also determine if they have apparent authority and thus their actions bind the corp Buying a capital asset/inside the scope of business =what they do day in and day out ( requires BOD approval! (no apparent authority at all) INSIDER TRADING UNFAIR ADVANTAGE 16b 10b5 -broad only one that requires “scienter” Fl’s Blue Sky laws -broad – only one that does not need “nexus to interstate commerce” Promoters- a person who contracts on behalf of a corporation that does not yet exist; Promoters generally are personally liable for actions taken prior to incorporation unless the K waives his personal liability = Generally-Owners cannot claim acting as agents of corporation b/c corp does not yet exist but promoter may look to that corporation for ratification after the fact and indemnification: Promoter’s Liability MBCA 2.04 All persons purporting to act as or on behalf of a corporation, knowing there was no corporation, are jointly and severally liable for all liabilities while so acting. FLORIDA 607.0204 .--All persons purporting to act as or on behalf of a corporation, having actual knowledge that there was no incorporation, are jointly and severally liable for all liabilities created while so acting except for any liability to any person who also had actual knowledge that there was no incorporation. Promoter cannot bind/contract with a corporation that does not exist HOWEVER, promoter is allowed to: (3 Ways To Deal With Pre-Incorporation Contracts): RATIFICATION Make a K that binds himself and then just look to proposed company for ratification and indemnification later OR the K Bind himself (as the promoter) and stipulate in the K that the proposed company will indemnify the promoter NOVATION Make a K that binds himself but2. releasing him from and shifting liability to the corporation once formed Or, after issue arises, corp may bind promoter but hold corp liable instead. TREAT AS OFFER CONTINUING PROPOSAL which corporation may accept when it comes into existence 1) Special Shareholder Meetings any meeting other than the annual meeting the notice must contain a description of meeting’s purpose(s) and the matter to be For special shareholder meetings, notice MUST be given between 10 days and 60 days before + voted upon.=That statute requires that notice for special (i.e. other than annual) shareholder meetings must be at least ten and no more than 60 days in advance of the meeting date. Put in pictures!!! Special Shareholder meeting can be called by: II. MBCA 7.02 Special meeting can be called by: BOD persons authorized in Articles or Bylaw 10% of all SH =In a Model Business and Corporation, as in Fl, 10 percent of the stock company can call a meeting SH Derivative suit 1. Breach of Fiduciary Duty 2. Usurpation of a corporate opportunity 3. Corporate waste claims are derivative, not individual. SH Direct Actions 1. Declare dividends action to compel corp. to give out a dividend, 2. preemptive right suit to enforce preemptive right 3. Appraisal remedy 4. Oppression 5. Dissolution action to compel company to dissolve Derivative Suits =SH sues his corp SH Direct vs Derivative suits derivative suit on behalf of the corporation action is “derivative” because it is brought by one or more shareholders on behalf of the corporation rather than by the corporation itself direct action on behalf of the shareholder Standing Requirements to bring a derivative suit 1. contemporaneous ownership rule You must have been a shareholder at the time of the alleged wrong doing OR 2. continuing wrong doctrine, EXCEPTION: If you acquire your shares, anytime the wrong is ongoing, then you bring a derivative suit and may reap any recovery rewards. AND 3. Must maintain your shareholder status during the entire suit, at least 1 share =Must keep stock until end of litigation II SHAREHOLDER DERIVATIVE SUITS (SHAREHOLDER AS PLAINTIFF) (1) In a derivative suit, a shareholder is suing to enforce the Corporation’s claim, not her own personal claim. To determine if it’s a derivative suit, ask: could the corporation have brought this suit? If so, it is probably a derivative suit. S sues the board of directors of C Corp. for usurping corporate opportunities. Derivative suit? YES duty of loyalty (and care) are owed to corporation. Breach hurts the corp S sues board of directors of C Corp. for issuing new stock without honoring her preemptive rights. Derivative suit? No. this is a direct suit, to vindicate S’s personal claim. (2) What are the consequences of a successful derivative suit? Generally, the recovery in any successful derivative suit goes to the corporation (not to the shareholder (S)) who brought the suit on behalf of the corporation. What does S receive for winning? Costs and attorneys fees, usually from the corporation. After all, the shareholder conferred a benefit on the corporation by suing and winning. What does S receive for losing? NO_attny fees___________________________ -- Is S liable to the people he sued for their costs and attorneys fees? Yes, if he sued without reasonable cause. – - Can other shareholders later sue X on the same transaction? No. res judicata Requirements for a derivative suit: Stock ownership. The person bringing suit must have owned stock at the time the claim arose OR have gotten it by operation of law from someone who did own stock when the claim arose. Acquiring stock by operation of law Inheritance, divorce decree S will adequately represent the interest of the corporation. written demand on directors then wait 90 days that the corporation bring suit. o UNLESS demand would be futile If D are the BOD No demand on BOD for derivative suit is needed the exhaustion of corporate remedies As a predicate of the shareholder making a derivative suit, must make a demand on the board, or the demand must be excused. (and ask it to sue—then if it refuses to sue, then I can sue on its behalf) Exception to demand precondition FutilityA demand on the board is excused when the court is persuaded on the pleadings that the claim is futile (pointless)pleading that a demand would be unavailing, unreasonable, impracticable, or that that corp are the alleged wrongdoers =if the corp BOD leaders made the wrong, you don't have to demand Usually must plead with particularity the efforts to get the corporation to sue or why demand was excused LitigationThe corporation must be joined as a defendant. Even though the suit asserts the corporation's claim, the corporation did not do so, so it is joined initially as a defendant Corporation can move to dismiss the derivative suit based on findings by disinterested directors (or a committee of disinterested directors) that suit is not in the corporation’s best interest (e.g., low chance of success or cost of litigation would exceed recovery). -The court will scrutinize whether the directors making the recommendation are truly disinterested and, if so, dismiss. In some states, the court will also make an independent determination of whether dismissal is in the corporation’s best interest. Record Date For voter eligibility cut-off Determines shareholders entitled to vote at a future meeting by serving as the date on which stock ownership must exist even if SH sells ALL her shares AFTER this time, she is STILL ENTITLED TO VOTE on that future meeting (but not later ones) C Corp. sets its annual meeting for July 7 and record date for June 6. S sells B her C Corp. stock on June 25. Who is entitled to vote the shares at the meeting, S or B? S Exceptions to the general rule that record owner on record date votes. 1. Treasury stock. Suppose the corporation reacquires stock before record date. So the corporation is the record owner on the record date of this treasury stock. Does the corporation vote the treasury stock? _____ NO_________ Short form Merger if parent has 90% (80% in FL) ownership of a subsidiary corp just need parent corp’s BOD approval not SH if parent has 80% ownership of a subsidiary corp, parent can short form merge with that subsidiary without shareholder approval ONLY REQUIRE’S PARENT CORP’S BOD VOTE =Does not require shareholders votes or board of the owned company. Alpha already owns 8% of Beta. Alpha can exercise short form merger of Beta only by Alpha’s board. Defacto Merger Doctrine- the buying/selling was almost the same as a merger (assets and liabilities all came to the other side) This buying/selling gets treated like a merger. Buyer corp’s SHs will assert there was a defacto merger in order to acquire appraiser and/or voting rights of that merger Dissenting Which directors are liable for all the things directors be liable for? Absent directors are not liable Dissenters in writing are not liable Good faith relaince are not liable ??? 1. General rule. A director is presumed to have concurred with Board action unless her dissent or abstention is noted in writing in corporate records. That means (1) in the minutes or (2) in writing to the corporate secretary at the meeting or (3) registered letter to the corporate secretary immediately after the meeting. -- So is an oral dissent effective? Not by itself________ Obviously, you cannot dissent if you voted for the resolution at the meeting. 2. Exceptions. 1. (1) Absent directors are not liable. 2. (2) Good faith reliance on (a) book value of assets or (b) opinion of a competent employee, officer, professional, or committee of which the director relying was not a member, or (c) financial statements by auditors. Must have a reasonable belief in the competence of the persons providing such information. Appraiser Right CLOSE COMPANIES ONLY = right to force corp. to buy your stock =dissenting shareholder can asserts her right of appraisal can compel the corporation to pay her in cash the fair value of her shares as determined by a judicial appraisal process.Appraiser rights DNA to Public Companies! i. Demand that they receive cash equal to the FAIR value of their shares ii. Separate and fair determination of the value of the share 1. Exception- Appraisal remedy does NOT apply a. If the shares are traded on national stock exchange b. Or if you have 2000 stock holders i. Because you can exit by just selling your shares to anyone It’s a way to vote against the merger and to demand cash in the fair amount of their shares and this is a way to allow exit from the transaction. Shareholders of the selling company OR the shareholders of the merged company gets a right of appraisal. Economic loss rule – pure economic losses CANNOT sue for torts instead, sue for contract losses An affiliate is a type of inter-company relationship in which one company owns less than a majority stake in the other company's stoc Affiliate Transaction means any agreement, contract, arrangement or other transaction or series of related transactions (including any purchase, sale, transfer, assignment, lease, license, conveyance or exchange of assets or property, any merger, consolidation or similar transaction or any provision of any service) Affiliate Transaction Transactions with corps that have >10% of ownership in our corp Must be approved by either (1) majority of disinterested directors OR (2) 2/3 disinterested SHs UNLESS consideration is FAIR DNA to corp has under 300 SHs Committees The board can delegate substantial management functions to a committee, but a committee cannot: (1) amend bylaws, (2) declare dividends or (3) recommend a fundamental corporate change to shareholders. Domestic Corp Formation File articles with Secretary of State and pay required fee. Acceptance by Secretary of State is conclusive proof of valid formation. At that point, it is a de jure corporation I. FOREIGN CORPORATIONS . (1) A foreign corporation is one incorporated outside this state. So is a corporation formed in Florida “foreign?” __yes__________________________________________________ Foreign corporations transacting business in this state must qualify (2) Transacting business means the regular course of intrastate (not interstate) business activity Not occasional or sporadic activity. Qualify by: getting a certificate of authority from Secretary of State. Apply by giving information from articles and a certificate of good standing from home state. Must pay fees to state Generally, must appoint registered agent here too. (4) Consequences of foreign corporation transacting business without qualifying: civil fine and the corporation cannot sue in state (but it can be sued). There are no other consequences for the foreign corporation. Unqualifying foreign corp cannot bring an action in any court in Florida, until the corporation obtains authority. However, the corporation is not barred from defending any action in Florida. A foreign corporation that transacts business in Florida without authority is liable to the state in an amount equal to all fees and taxes that would have been imposed for the years in which it failed to qualify. In addition, the corporation must forfeit to the state between $500 and $1,000 for each year it failed to qualify. -- Can the foreign corporation sue once it qualifies and pays fees and fines? __yes______ _____________________________________________________________________ SH Involuntary Dissolution > 35 SHs 1. directors must be in a deadlock, =When the directors are deadlocked in the management of corporate affairs and the shareholders are unable to breach the deadlock. 2. but it must also be shown that the corporation is suffering or threatened with irreparable injury. SH Involuntary Dissolution: closely held corporation having 35 or fewer shareholders can successfully maintain an action to involuntarily dissolve the corporation? The courts have full power to liquidate the assets and business of a corporation in an action by a shareholder or group of shareholders in a corporation having 35 or fewer shareholders when: 1. the corporate assets are being misapplied or wasted, or a causing material injury to the corporation OR 2. the directors or those in control of the corporation have acted, are acting, or are reasonably expected to act in an illegal or fraudulent manner. the shareholders must be deadlocked in voting power and have failed to elect successors to directors whose terms have expired. if the shareholders created the vacancy by removing a director, the shareholders generally must select the replacement. Filling vacancies on the board: MBCA 8.10 If remaining directors less than a quorum, majority of remaining directors may fill vacancies Filling vacancies on the board: Death, resignation, removal, expansion of board. Who can fill a vacancy? SH or the directors can fill the vacancy… whoever acts first. if there was 5 directors… and 3 seats became vacant, the 2 remaining directors they can fill the remaining seats before the SH decides to pick someone (even though there isn’t a quorum) +Once the seat is filled, the other body can’t fill it. !!!!Removal of directors: occurs by vote of the shareholders usually Only at shareholders’ meeting called for that purpose + notice of meeting with that purpose director is entitled to reasonable notice and why his removal is being sought. Anytime you are seeking to remove a director, the director is entitled to corporate Miranda notices… This then allows director to mount his defense as to why they shouldn’t be removed. Common law --high hurdle at common law- a director could only be removed by affirmative showing of cause action that is harmful or wrongful to the corporation, breach of fiduciary duty). Statutes provide that director can be removed without cause, by a majority vote unless bylaws say otherwise. (greatly liberalized) DE!!!!Removal of directors (directors can be removed without cause, by a majority vote) 1 exception TO WITHOUT CAUSE ability Removing directors elected to a staggered boarda SH must have cause =Under Delaware directors elected under staggered voting can only be removed for cause. DE is unique. DE makes it more difficult for SH to remove directors on staggered terms unless the articles of incorporation provided otherwise. MBCA 8.08 !!!!Removal of directors (directors can be removed without case, by a majority vote) 2 exceptions to MAJORITY VOTE requirement: If a director is elected by a voting group of shareholders Only voting group that elected Director can remove him. cumulative voted director If # of NO to removal > director’s # of YES votes that elected him initially NO REMOVAL (everyone who wanted him on the BOD in the first place may still at the corp-) Dissolution: voluntary and involuntary