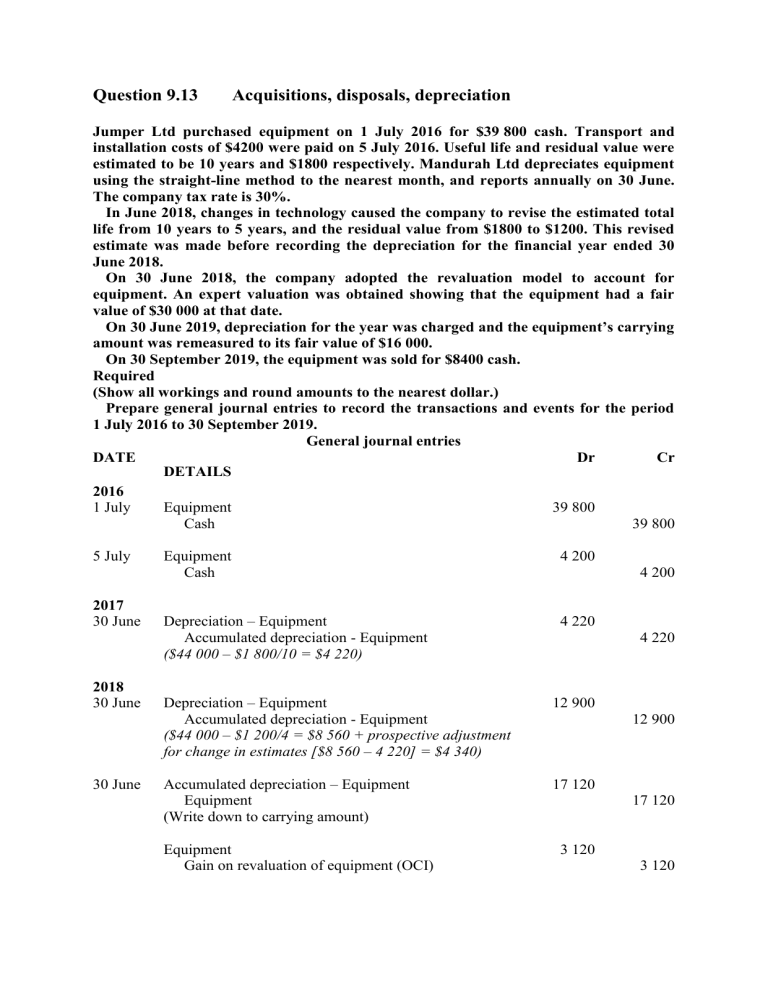

Question 9.13 Acquisitions, disposals, depreciation Jumper Ltd purchased equipment on 1 July 2016 for $39 800 cash. Transport and installation costs of $4200 were paid on 5 July 2016. Useful life and residual value were estimated to be 10 years and $1800 respectively. Mandurah Ltd depreciates equipment using the straight-line method to the nearest month, and reports annually on 30 June. The company tax rate is 30%. In June 2018, changes in technology caused the company to revise the estimated total life from 10 years to 5 years, and the residual value from $1800 to $1200. This revised estimate was made before recording the depreciation for the financial year ended 30 June 2018. On 30 June 2018, the company adopted the revaluation model to account for equipment. An expert valuation was obtained showing that the equipment had a fair value of $30 000 at that date. On 30 June 2019, depreciation for the year was charged and the equipment’s carrying amount was remeasured to its fair value of $16 000. On 30 September 2019, the equipment was sold for $8400 cash. Required (Show all workings and round amounts to the nearest dollar.) Prepare general journal entries to record the transactions and events for the period 1 July 2016 to 30 September 2019. General journal entries DATE Dr Cr DETAILS 2016 1 July Equipment 39 800 Cash 39 800 5 July 2017 30 June 2018 30 June 30 June Equipment Cash 4 200 Depreciation – Equipment Accumulated depreciation - Equipment ($44 000 – $1 800/10 = $4 220) 4 220 4 200 4 220 Depreciation – Equipment Accumulated depreciation - Equipment ($44 000 – $1 200/4 = $8 560 + prospective adjustment for change in estimates [$8 560 – 4 220] = $4 340) 12 900 Accumulated depreciation – Equipment Equipment (Write down to carrying amount) 17 120 Equipment Gain on revaluation of equipment (OCI) 12 900 17 120 3 120 3 120 (Fair value $30 000; Carrying amount $26 880; Revaluation increase $3 120) Income tax expense (OCI) Depreciation – Equipment 936 9 600 30 June Accumulated depreciation – Equipment ($30 000 – $1 200/3 = $9 600) 30 June Accumulated depreciation – Equipment Equipment (Write down to carrying amount) 9 600 Loss on revaluation of plant (OCI) Loss on revaluation of plant (P&L) Equipment (Fair value $16 000; Carrying amount $20 400; Revaluation decrease $4 400) 3 120 1 280 Deferred tax liability Income tax expense (OCI) (Tax effect on decrement relating to prior increment) 2019 30 Sept 9 600 9 600 4 400 936 936 Asset revaluation surplus Income tax expense (OCI) Loss on revaluation of plant (OCI) (Reduction in accumulated equity due to devaluation of plant) 2 184 936 Depreciation expense – Equipment Accumulated depreciation - Equipment (3/12[$16 000 – $1 200/2]) 1 850 Accumulated depreciation – Equipment Carrying amount of Equipment Equipment Cash Proceeds on sale – Equipment 3 120 1 850 1 850 14 150 16 000 8 400 8 400