Utah's 10-Year Strategic Energy Plan: Initiatives & Imperatives

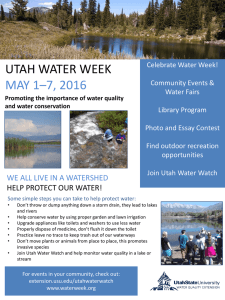

advertisement