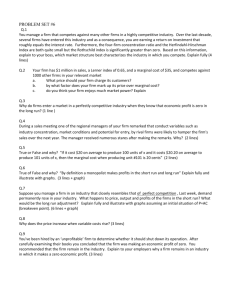

Chapter 7: 1. Evaluate the following statement: “Managers should specialize by acquiring only the tools needed to operate in a particular market structure. That is, managers should specialize in managing either a perfectly competitive, monopoly, monopolistically competitive, or oligopoly firm.” Managers should not specialize in learning to manage a particular type of market structure. Market structure generally evolves over time, and managers must adapt to these changes. 2. Consider a firm that operates in a market that competes aggressively in prices. Due to the high fixed cost of obtaining the technology associated with entering this market, only a limited number of other firms exist. Furthermore, over 70 percent of the products sold in this market are protected by patents for the next eight years. Does this industry conform to an economist’s definition of a perfectly competitive market? No. The conditions for perfect competition include: a. There are many buyers and sellers of products. b. The products are homogenous. c. Consumers and producers have perfect information. d. There is free entry and exit. 3. Based on the information given, indicate whether the following industry is best characterized by the model of perfect competition, monopoly, monopolistic competition, or oligopoly. a. Industry A has a four-firm concentration ratio of 0.005 percent and a HerfindahlHirschman index of 75. A representative firm has a Lerner index of 0.45 and a Rothschild index of 0.34. b. Industry B has a four-firm concentration ratio of 0.0001 percent and HerfindahlHirschman index of 55. A representative firm has a Lerner index of 0.0034 and Rothschild index of 0.00023. c. Industry C has a four-firm concentration ratio of 100 percent and HerfindahlHirschman index of 10,000. A representative firm has a Lerner index of 0.4 and Rothschild index of 1.0. d. Industry D has a four-firm concentration ratio of 100 percent and HerfindahlHirschman index of 5,573. A representative firm has a Lerner index equal to 0.43 and Rothschild index of 0.76. a. Industry A is a monopolistically competitive industry. b. Industry B is a perfectly competitive industry. c. Industry C is a monopoly industry. d. Industry D is an oligopoly industry. 4. The four-firm concentration ratios for industries X and Y are 89 percent and 62 percent, respectively, while the corresponding Herfindahl-Hirschman indexes are 2,600 and 1,200. 2-1 The Dansby-Willig performance index for industry X is 0.6, while that for industry Y is 0.8. Based on this information, which would lead to the greatest increase in social welfare: A slight increase in industry X’s output, or a slight increase in industry Y’s output? A slight increase in output in industry Y will have the greatest impact on increasing social welfare since the Dansby-Willig index is higher in industry Y. 5. Forey, Inc., competes against many other firms in a highly competitive industry. Over the last decade, several firms have entered this industry and, as a consequence, Forey is earning a return on investment that roughly equals the interest rate. Furthermore, the four-firm concentration ratio and the Herfindahl-Hirschman index are both quite small, but the Rothschild index is significantly greater than zero. Based on this information, which market structure best characterizes the industry in which Forey competes? Explain. This industry is most likely monopolistically competitive. Monopolistically competitive industries have concentration measures close to zero, but since each firm’s product is slightly differentiated, the Rothschild index will be greater than zero (unlike perfectly competitive markets). 6. Firms like Papa John’s, Domino’s, and Pizza Hut sell pizza and other products that are differentiated in nature. While numerous pizza chains exist in most locations, the differentiated nature of these firms’ products permits them to charge prices above marginal cost. Given these observations, is the pizza industry most likely a monopoly, perfectly competitive, monopolistically competitive, or an oligopoly industry? Use the causal view of structure, conduct, and performance to explain the role of differentiation in the market for pizza. Then apply the feedback critique to the role of differentiation in the industry. Monopolistically competitive. In a monopolistically competitive market, there are many firms, but each firm produces a differentiated product. According to the causal view, the structure of differentiated products causes firms to capitalize on the absence of close substitutes by charging higher prices and earning higher profit. Thus, structure causes conduct resulting in performance. According to the feedback critique, the conduct of firms may determine the market structure. Firms’ products may be differentiated because of firms’ conduct in the industry. Examples of such conduct include advertising and other behavioral tactics that feedback into demand, causing consumers to view products as differentiated. Thus, it is not at all clear that differentiated products are a structural variable. The willingness of consumers to pay for product variety gives firms an incentive to offer different products (thin-and crispy pizza, pan pizza, pizza delivery, etc.). 7. Recently, the Federal Communications Commission (FCC) implemented “local number portability” rules allowing cellular phone consumers to switch cellular providers within the same geographic area and maintain the same phone number. How would you expect this change to affect the Rothschild index for the cellular service industry? It will decrease. With number portability, the services of the various providers are now closer substitutes to each other. One implication is that the cost to consumers of switching 2-2 service providers is now lower, which increases the likelihood that consumers would switch for small price reductions. These factors make the demand for the individual cellular service providers more elastic (increase the price elasticity of demand). Local number portability, however, is unlikely to affect the elasticity of demand for the industry as a whole. If the elasticity of demand increases for individual firms but remains constant for the industry, the Rothschild index will decrease 8. Use the estimated elasticities in table below to calculate the Rothschild index for each industry. Based on these calculations, which industry most closely resembles perfect competition? Which industry most closely resembles monopoly? Based on the Rothschild indices in the table, wholesale trade most closely resembles a monopoly, while finance most closely resembles perfect competition. 2-3