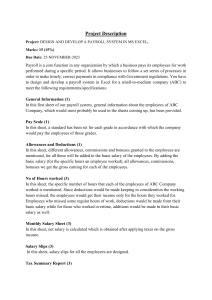

Excel Assignment (15%): TO DEVELOP PAYROLL SYSTEM (3 to 6 month Data) Payroll consists of a process by which a business pays its employees for work performed during a specific period. It allows businesses to follow a set series of processes in order to make timely, correct payments in compliance with Government regulations. You have to design a payroll system for company ABC (in Excel) following a specific set series of processes/excel worksheet as mentioned below: General Information: In this first sheet of our payroll system, general information about the employees of ABC Company, which would most probably be used in the sheets coming up, has been provided. ”NEW” is written in brackets in front of the names of the new recruits of the company. Pay Scale: In this sheet, a standard has been set for each grade in accordance with which the company would pay the employees of those grades. Allowances and Deductions: In this sheet, different allowances, commissions and bonuses granted to the employees are mentioned, for all these will be added to the basic salary of the employees. Here the retroactive pay that is the pay that the company owes its employees from a prior period is zero since the company does not owe any amount to its employees from any prior period. By adding the basic salary (for the specific hours an employee worked), all allowances, commissions, bonuses we get the gross earning for each of the employees. No of Hours worked: In this sheet, the specific number of hours that each of the employees of ABC Company worked is mentioned. Since deductions would be made keeping in consideration the working hours missed, the employees would get their income only for the hours they worked for. Employees who missed some regular hours of work, deductions would be made from their basic salary while for those who worked overtime, additions would be made in their basic salary as well. Monthly Salary Sheet: In this sheet, net salary is calculated which is obtained after applying taxes on the gross income. Salary Slips: In this sheet, salary slips for all the employees are designed. Tax Summary Report: This sheet contains the annual tax details that are applied on the income of all the employees and the annual basic income as well as the annual tax. Submitted By Member names BBA - 2K18 Section