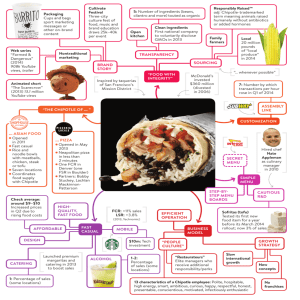

! CONTACT: John Amirsakis iSENTIUM, LLC jamirsakis@isentium.com +1 (917) 293-5870 The iSENTIUM Chipotle Report Executive Summary iSentium has tracked consumer sentiment on Chipotle Mexican Grill, Inc (CMG: NYSE) since the first E. coli reports emerged in October 2015. Since Chipotle’s key driver of brand loyalty is its ‘food with integrity’ and ‘fresh, high-quality ingredients’ approach, the repercussions of the E. coli reports and the subsequent Norovirus outbreaks crushed their sales numbers in Q4 2015 and Q1 2016. As consumer confidence declined, Chipotle moved quickly to comply with CDC investigations, implement an enhanced food safety plan, and recover brand loyalty by introducing free burrito coupons. Our natural language sentiment computation engine has analyzed millions of Chipotle product and ticker tweets to map consumer confidence in the fast casual Mexican themed restaurant. We picked up prolonged negative social sentiment during the E. coli scare, which highlighted public fear of eating at Chipotle. As 2016 progressed and Chipotle rolled out customer incentive plans, tweets on ‘free burrito’ (and similar free products) indicated an increase in consumer confidence in the brand. This report documents the downturn and recovery in consumer social sentiment, and supports a duel thesis of strengthening Chipotle revenues and bullishness in its near term stock price. We have found that: ! There is a clear positive correlation between Chipotle ticker sentiment and share price changes. Negative sentiments arising from reported E. coli outbreaks and succeeding events is associated with falling price action. Likewise, positive sentiment during the free burrito incentive is associated with increasing price action. ! Decreasing consumer confidence, as evidenced by an upsurge in negative tweets, led to a drop in Chipotle sales. Now that the scare has abated and sentiment is recovering, we predict an increase in Q2 2016 revenue over the prior quarter. ! Facts and Trends Since October 2015, tweets on Chipotle products (Fig. 1a) have been extremely active with an average of over 10,000 tweets a day. Moreover, such activities have been stable since we began tracking these tweets. This enormous amount of tweets and their consistent frequency gives us confidence in the robustness and predictability of our data. a b Fig. 1 The outbreak of E. coli was captured in tweets from November 2015 to February 2016 (Fig. 1a). During these months, our engine ingested a build-up of negative consumer sentiment related to the outbreak (Fig. 1b). This sentiment spread like wildfire across Twitter and general social media through re-tweets, increased tweet activities, etc. The public consensus was to avoid the restaurant. Messages before E. coli scare: (Twitter) “really really really really reaaaaally want chipotle” (iSENTIUM Score1: 31) 2:13pm Oct 13, 2015 (Twitter) “I want chipotle right now ugh why isn't chipotle open im about to go there and sleep in front of the stor e until it opens tomorrow” (iSENTIUM Score: 10) 12:05am Oct 28, 2015 (Twitter) “Im eating chipotle right now and I'm very fucking happy ! ” (iSENTIUM Score: 4.5) 12:09am Oct 28, 20 15 Messages during E. coli scare: (Twitter) “#health #news Chipotle-Linked E. Coli Outbreak: 'Jump in Cases' Expected N https://t.co/VOGRDBIeeM https://t.co/rJaVYP5wwI” (iSENTIUM Score: -10) 12:01pm Nov 2, 2015 (Twitter) “I swear I be craving chipotle so much but that ecoli outbreak fucking shit up "#” (iSENTIUM Score:-30) 12:06pm Dec 7, 2015 (Twitter) “If ya'll wonna eat chipotle get ready to have the most painful tummy ache and the most watery poop in y our life” (iSENTIUM Score: -32) 12:44pm Jan 15, 2016 (Facebook): “http://www.msn.com/en-us/foodanddrink/restaurantsandnews/the-25-best-fast-food-chains-inamerica/ss-BBsOtVj?ocid=mailsignout#image=26 anybody who claims to confuse chipotle and qdoba is a liar. the !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 1 The iSENTIUM Score is a number combining polarity and strength. Positive polarity is unmarked, and negative polarity is marked by ''-''. The number itself is the sentiment strength. ! 2 ! food at qdoba is 1000 percent better than chipotle. i ate at chipotle once while i lived in colorado and i will never go back. at the time i only knew about freebirds2 but i knew that freebirds food was superior to chipotle. and who really wants to get sick eating at chipotle? their locations are closed at least once a month for e-coli infestations. they can't figure out food safety or how to prevent food diseases there. eat there at your own risk. rant over.” (iSENTIUM Score: -47.5) After the conclusion of the CDC investigation in early February, Chipotle scrambled to salvage its image through the ‘free burrito’ initiative. Interestingly enough, this ‘free burritos’ sentiment period can be easily separated from the E. coli episode sentiments by our engine (Fig. 2). The burrito giveaways appeared to be helpful in regaining the consumer confidence lost in the E. coli scare - note that negative consumer sentiment curved back towards zero by late February 2016. Fig. 2 Messages during ‘Free Burrito’ period: (Twitter) “Chipotle is patiently earning back my trust with free lunch. Click the link to grab a free burrito https://t.c o/0pnLsEmaTi .” (iSENTIUM Score: 11) 12:23pm Feb 8, 2016 (Twitter) “The best text I've gotten all day is my free burrito text from chipotle” (iSENTIUM Score:10.5) 3:35pm Feb 10, 2016 (Twitter) “Genius idea to get people back into Chipotle (including myself): FREE GUACAMOLE!! #guacamole @Ch ipotleTweets https://t.co/Kccu1LHK5a'” (iSENTIUM Score: 10) 10:32am Feb 15, 2016 Current Messages: (Twitter) “Finally had the chance to try Chipotle for the first time!\U0001f60d New I would love it\U0001f4aa\n#chipotle#gains#goals#diet#food#fo\u2026 https://t.co/vF9C6cijSj” (iSENTIUM Score: 20) 9:43am May 6, 2016 (Twitter) “I've been craving chipotle man lol” (iSENTIUM Score: 6) 3:14pm May 11, 2016 (Facebook) “need sumthing to eat this day going crazy thinking bout getting sum chipotle” (iSENTIUM Score: 12) (Facebook) “sweet! i just scored a free lunch at chipotle. perfect timing, because up until then the highlight of my day had been finding a cool pair of dress socks hiding in my sock drawer.” (iSENTIUM Score: 6.5) !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 2 ! Freebirds is a fast casual burrito chain – a competitor to Chipotle 3 ! Analysis: The Sentiment-Price Relationship Now, let us examine the real-time effect of the CMG ticker sentiment on share price. As shown in Fig. 3, the E. coli outbreak and each succeeding event are immediately tweeted about, leading to a surge in tweet activity, which is then reflected in stock price behavior. We see a clear positive correlation between sentiments and changes in prices -- negative sentiments are associated with falling prices and positive sentiments with rising prices. This is due to the ‘mob effect’. As the volume of tweets increases in either the positive or negative direction, the trading public feels greater exhilaration or fear, respectively, and makes decisions which drive prices in accordance with the current overwhelming sentiment. Note the tremendous sea of red sentiment during the E. coli episode and the resulting plunge in share price. Fig. 3 ! 4 ! Analysis: The Sentiment-Revenue Relationship In addition to the effect on ticker price, we find that consumer sentiment is positively correlated with quarterly revenues (Fig. 4). Average consumer sentiment decreased in November, December and January, by as much as 96% from pre E. coli values. This was accompanied by a 161% increase in negative tweets about Chipotle extending into February. As shown earlier, this growth signified amplifying public skepticism and fear of Chipotle products, indicating that the restaurant was losing its customer base. Indeed, data from FourSquare[1] corroborates this – Chipotle suffered up to a 60% foot traffic loss in the Nov 2015 – Feb 2016 time period. Thus, the negative consumer tweet sentiments directly measured the pulse of the “marginal” consumer who had a decrease in appetite for Chipotle products. Such a shift in demand resulted in a significant decrease in sales in Q4 2015 and Q1 2016. Fig. 4 ! 5 ! Revenue Change Prediction and Conclusion However, there appears to be very good news on the horizon for Chipotle. The average sentiment reached a low in November 2015 of 0.07, and recently has recovered to 1.78 in April of 2016. The current sentiment level is comparable to the average sentiment in October 2015 of 1.88, just prior to the E. coli episode. Chipotle has successfully convinced the tweeting consumer that things are back on track and we believe their revenues will continue to be strong, adding back +$225M[5] in sales in the current quarter. Value-based investors should keep a watchful eye on Chipotle’s social sentiments since the next big event may be even worse than the E. coli episode. References [1] “Foursquare Predicts Chipotle’s Q1 Sales Down Nearly 30%; Foot Traffic Reveals the Start of a Mixed Recovery” Jeff Glueck, https://medium.com/foursquare-direct/foursquare-predicts-chipotle-s-q1-sales-down-nearly-30-foottraffic-reveals-the-start-of-a-mixed-78515b2389af#.unw4fgn7i [2] http://ir.chipotle.com/phoenix.zhtml?c=194775&p=irol-newsArticle&ID=2134993 [3]!http://ir.chipotle.com/phoenix.zhtml?c=194775&p=irol-newsArticle&ID=2098750 [4] http://ir.chipotle.com/phoenix.zhtml?c=194775&p=irol-newsArticle&ID=2161714 [5] https://www.earningswhispers.com/stocks/cmg About Founded in 2008, iSENTIUM, LLC. is in the business of extracting sentiment from galactic amounts of unstructured social content and transforming it into highly actionable indicators in diverse fields such as Finance, Brand Management and Politics. iSENTIUM’s management team brings a wealth of experience from both industry and academia with skills ranging from Big Data, finance, linguistics and signal processing. Our world-class team comprised of linguists, quants and computer scientists has collectively published over 200 papers and 18 books. iSENTIUM, LLC is not an investment advisor, broker or dealer and therefore does not participate in the offer, sale or !distribution of securities, nor does it provide any investment advice. © 2011-2016 iSENTIUM, LLC. All Rights Reserved 6