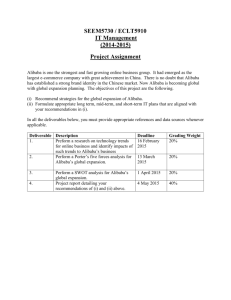

What International Strategy should Alibaba adopt in the e-Commerce industry in Southeast Asia? The international strategies vary in terms of two dimensions-the need for global integration and the need for local responsiveness. (see Figure 1) Alibaba adopts transnational strategy in order to effectively compete on a global scale but still have strong local responsiveness. Figure 1. Source: M. A. Hitt, R. D. Ireland & R. E. Hoskisson. (2017). Strategic management: Competitiveness & globalization: Concepts and cases. New York: Cengage learning. Need for Local Responsiveness With high mobile penetration and fast-growing Internet market, Southeast Asia region contains only 3% online retail penetration. (Lisa Lacy ,2018) Therefore, potential of e-commerce is enormous in Southeast Asia. Due to rising competition in Southeast Asia, the e-commerce market is highly fragmented. Some e-commerce players have already attracted to enter the market by high potential of it. For example, e-commerce giant Amazon entered Singapore market in 2017 and regarded Singapore as the initial entry point of Southeast Asia. Chinese firm JD.com, the largest competitor of Alibaba, also aggressively expanded in the region by developing a new online shopping platform in Thailand, launching a local online retail business JD. id in Indonesia and investing in local-ecommerce firm Tiki.vn in Vietnam. (Zen Soo, Celia Chen, 2018) However, it is still uncertain which player would get the largest chunk of pie in Southeast Asia. Therefore, Alibaba need a strong local responsiveness in a short time in order to increase possibility of grabbing the largest chunk of pie. To acquire important market share in Southeast Asia, Alibaba should put lots of efforts to know about the market in the region and accordingly adapt the product to better meet the taste of local market. In order to more efficiently enter market in the region, Alibaba could acquire control of a well-established platform in the market, such as Lazada. Lazada is one of major e-commerce platforms in six Southeast Asian countries (i.e. Singapore, Malaysia, Indonesia, Thailand, Philippines and Vietnam). Lazada is an existing player who knows well about local market and is more flexible to respond to local condition. Acquisition of well-established player Lazada increases Alibaba’s competitiveness by overcoming lack of knowledge of foreign markets and possessing a strong local responsiveness in the short time. Need for Global Integration Global integration makes use of worldwide resources and amalgamates Alibaba’s business in order to achieve the aim of realizing global economies of scale with cost efficiency. Why does Alibaba want to expand its market to Southeast Asia? One of reason is that high domestic market competition and slow economic growth in China drive Alibaba to look for new opportunities to sustain its development. According to Bartlett and Ghoshal (1998), the need of efficiency serves as the incentive of global integration. Lazada is well-established player that has already built a strong platform ecosystem containing reliable merchants, large customer base and logistic infrastructure across Southeast Asia region. By acquisitioning Lazada, Alibaba could improve performance of Lazada based on Lazada’s existing resource. Alibaba could save money on heavily investment in logistic infrastructure and other investment to build customer base. The lack of efficient logistics and fulfilment is one of factors about slow growth e-commerce in Southeast Asia. User-friendly platforms make customer shop online easily but delivering products to customers in a cost effective and timely manner is still challenging in the region. The lack of familiarity with e-payment is another reason. Alibaba could use its technology in logistics and e-payment to improve this scenario. Alibaba’s mission is to launch business everywhere easily. In order to provide standard service and establish a stronger global grand presence, Alibaba increases the coordination between it with Lazada. As one of the world’s biggest e-commerce company, Alibaba could share its experience and technology with Lazada. Lazada is shifting its business model by increasingly brokering transaction between buyers and merchants rather than directly selling products itself. (Alibaba Bets on Frenchman to Lead High-Stakes Southeast Asia Expansion, 2019) This new business model is same as that of Taobao (owned by Alibaba) in China. Alibaba shares Lazada its successful online sales strategies, technology and resources (e.g. e-payment, logistics, its large data, data analytics technology) to improve the platform by improving payment process, speeding up delivery and targeting customers more precisely. With its outstanding business management, accomplished hypervisor, advanced marketing technique and strong financial position, Alibaba hopes to increase Lazada’s competitiveness but also bring consumers in the region great online shopping experience as consumers in China do. Why does Alibaba need strong global integration? For example, technology companies want to broaden manufacture to a global scope and achieve economies of scale, causing greater levels of standardization of products. Technology firm produces standard product and distribute to customers through the world. Alibaba uses Lazada’s existing resource to provide its excellent services which allow relevant participants in Southeast Asia to take part in commercial activities with Alibaba easily. Founder Jack Ma preaches the statement “Global vision, local win”. Alibaba hopes to provide an effortless experience to its platform users through the world, but also have ability to make decisions strategically according to local environment. These are the reasons why Alibaba adopts transnational strategy to enter market of Southeast Asia. Alibaba hopes to build a shared vision through the world but still meet the taste of local market. Reference Alibaba Bets on Frenchman to Lead High-Stakes Southeast Asia Expansion. (2019, March 03). Retrieved from: https://www.businessoffashion.com/articles/news-analysis/alibaba-bets-onfrenchman-to-lead-high-stakes-southeast-asia-expansion Bartlett, C. A. & Ghoshal, S. (1998) Managing across borders – the transnational solution. 2nd ed. Boston: Havard Business School Press. M. A. Hitt, R. D. Ireland & R. E. Hoskisson. (2017). Strategic management: Competitiveness & globalization: Concepts and cases. New York: Cengage learning. Lisa Lacy (2018, December 3) Why 2018 Was the ‘Year of Ecommerce’ in Southeast Asia. Retrieved from: https://www.adweek.com/digital/why-2018-was-the-year-of-ecommerce-in-southeastasia/ Spandan Sharma (2018, March 19) Alibaba is investing an additional $2.6B in ecommerce in Southeast Asia. Retrieved from: https://yourstory.com/2018/03/alibaba-fresh-2-6-billion-investment-lazada Zen Soo, Celia Chen (2018, June 19) JD.com hastens e-commerce race in Southeast Asia with US$550 million stake sale to Google. Retrieved from: https://www.scmp.com/tech/article/2151282/jdcom-hastens-e-commerce-racesoutheast-asia-us550-million-stake-sale-google