THE IMPACT OF EXCHANGE RATES EXPOSURE TOWARD STOCK RETURNS: THE EVIDENCE IN INDONESIAN IMPORT AND EXPORT COMPANIES

advertisement

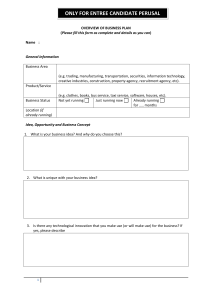

International Journal of Civil Engineering and Technology (IJCIET) Volume 10, Issue 04, April 2019, pp. 1622-1631, Article ID: IJCIET_10_04_169 Available online at http://www.iaeme.com/ijciet/issues.asp?JType=IJCIET&VType=10&IType=04 ISSN Print: 0976-6308 and ISSN Online: 0976-6316 © IAEME Publication Scopus Indexed THE IMPACT OF EXCHANGE RATES EXPOSURE TOWARD STOCK RETURNS: THE EVIDENCE IN INDONESIAN IMPORT AND EXPORT COMPANIES Rizqiyatul Mukhsinah Faculty of Economic and Business, Universitas Airlangga, Indonesia Windijarto* Faculty of Economic and Business, Universitas Airlangga, Indonesia *Corresponding Author ABSTRACT This study investigated the effect of exchange rates exposure toward stock returns in export and import companies in Indonesia. It is crucial because it can give evidence that exchange rate exposure may influence stock return in Indonesian companies. So that, the investor can knows the right time to invest in the import and export companies. This was a quantitative research. The data of this study were 28 export companies and 33 import companies from all export and import companies that listed on the Indonesia Stock Exchange in period 2010-2014. The result of this study showed that exchange rate of the Rupiah per US dollar, Yen and Australian dollar influence the stock return of export companies, while the exchange rate of Rupiah per Euro has no effect. However, in import companies, the exchange rate of Rupiah per US dollar, Euro and Australian dollar influences stock returns, while the exchange rate of Rupiah per Yen has no effect. The results of this study provide an overview of the stock return that investors will receive if there is a change in exchange rate. So that, the investors can predict the right time to invest in the import or export companies. Key words: Stock returns, Exchange rates, Export companies, Import companies Cite this Article: Rizqiyatul Mukhsinah and Windijarto, the Impact of Exchange Rates Exposure toward Stock Returns: The Evidence in Indonesian Import and Export Companies. International Journal of Civil Engineering and Technology, 10(04), 2019, pp. 1622-1631 http://www.iaeme.com/IJCIET/issues.asp?JType=IJCIET&VType=10&IType=04 \http://www.iaeme.com/IJCIET/index.asp 1622 editor@iaeme.com Rizqiyatul Mukhsinah and Windijarto 1. INTRODUCTION The value of a currency is inseparable from its exchange rate in other countries' currencies. The difference in the exchange rate of a country's currency is determined by the amount of demand and supply of the currency [1]. Therefore, the exchange rate plays an important role for the economy of a country. The stable growth of currency value indicates that the country has a relatively good or stable economic condition [2]. As a country with the largest economy in Southeast Asia, Indonesia gets the impact of the continuous changing of exchange rates. When compared to the beginning of 2010, when the level of the rupiah exchange rate per US dollar was still at the level of Rp. 8,000, the figure jumped dramatically to the level of Rp. 12,000 in the last quarter of 2014. This decline in the rupiah exchange rate per US dollar affected to export and import activities. . There are several factors that influence long-term exchange rate movements [3]. First is the level of domestic prices. Second is the tariff and quota. Third is productivity (reflected in GDP / GDP). Fourth is preferences between domestic and foreign goods. In the long term, the increasing demand for domestic goods (exports increase) causes the value of domestic money to appreciate, while the increased demand for foreign goods (imports increase) causes the value of domestic money to depreciate. Changes in exchange rates have their own positive and negative impacts on industries in Indonesia. The rupiah exchange rate per foreign currency has a negative influence on the economy and capital market [4]. In addition, the rupiah exchange rate per foreign currency will result in increased costs of importing raw materials to be used for production and also increasing interest rates. The high cost of imported raw materials as a result of the depreciation of the rupiah has exacerbated the company's balance sheet, especially those that use imported raw materials for the production process and reduce investment activities. This can lead to weakening stock prices. On the other hand, the appreciation of the rupiah also does not always have a good impact on the industry in Indonesia. The appreciation of the rupiah could have a negative impact on companies with sales, most of which came from exports. This is because the foreign currency obtained from the sale will be exchanged for fewer rupiahs. The changes of company income follow the exchange rate of currency that always change, affects to the stock returns received by investors. The changes in one macroeconomic variable have a different impact on stock prices. One stock can be positively affected while the other stocks are negatively affected [5]. The weaker the rupiah value, the lower the company's income. This results in lower stock returns received by investors. In addition, the negative influence of exchange rates can be eliminated by the practice of corporate risk management [6]. Risk management for exchange rate changes is done by hedging. Hedging is an action taken to protect a company from exposure to exchange rates [7]. Exposure to exchange rate fluctuations is the extent of a company can be affected by exchange rate fluctuations. In addition, hedging that carried out by companies can increase the value of the company by reducing various transaction costs [8]. By reducing the volatility of cash flows, the possibility of companies facing financial distress and bankruptcy being lower. Several studies have been conducted to analyze stocks, company returns and currency exchange rates, such as Bhargava (2014), Keith S.K. Lam (2002), and Mahesh D. Pritamani, et al (2003). Bhargava (2014) examined the influence of companies, such as total assets and long-term debt and economic variables, such as the unemployment rate and interest rates on stock prices per quarter in more than 3000 companies in America in 2000-2007. He developed statistical ratios to test hypotheses regarding the influence of macroeconomic variables in the model. From his research it was found that earnings per stock of the company, total assets, http://www.iaeme.com/IJCIET/index.asp 1623 editor@iaeme.com The Impact of Exchange Rates Exposure toward Stock Returns: The Evidence in Indonesian Import and Export Companies long-term debt, dividends per stock, unemployment rate and interest rate significantly influence stock prices [9]. Furthermore, Keith S.K. Lam (2002) investigated the relationship between stock returns and β, size (ME), leverage, book to market equity ratio, and earnings price ratio (E / P) on the Hong Kong stock market using the Fama and French (FF) approach. In his research it was found that β cannot explain the monthly average stock return for the period July 1984 - June 1997. However, three variables, size, book to market equity ratio, and earnings price ratio were able to capture variations in cross-sectional returns on average monthly rates during the period [10]. In addition, Mahesh D. Pritamani, et al (2004) examined the effects of the local economy and foreign markets on companies. The results of this study state that there is no significant residual exposure for exporter companies. The domestic portfolio with the same value is used to reduce the bias that occurs. So that, it is found that exchange rate exposure significantly negatively affects the exporting company and has a positive effect on the importing company [11]. Based on the explanation above and the previous studies, it is crucial to analyze the effect of exchange rate exposure toward stock return of import and export companies in Indonesia. It is because it can give an evidence that exchange rate exposure may influence stock return in Indonesian export and import companies. Furthermore, it can help the investors to predict the right time to invest in the import and export companies they want. Therefore, the purpose of this study is to determine whether the change in exchange rates affect stock returns of import and export companies in Indonesia or not. We supposed that the exchange rates exposure affect stock returns of import and export companies. 1.1. Investment Investment is to spend a certain amount of money or save money on something in the hope that one day it will get financial benefits. Investment can be defined as the capital expenditure or expenditure of planters or companies to buy goods and equipment for the production of capital goods increasing the ability to produce goods and services available in the economy [12]. Investment is the linking of resources in the long run to generate profits in the future. Some investment products are known as securities. For more details, investment products can be securities, stocks / bonds, debt proof (Promissory Notes), interest or participation in collective agreements (mutual funds), rights to buy stocks (rights), guarantee to buy stocks in the future or instruments that can be traded. There are several kinds of investment one of them is stock investment. The companies are expected to benefit from work or research. 1.2. Stock Stock are securities that are a sign of ownership of a person or entity against a company. This definition of stock means securities issued by a company in the form of a Limited Liability Company (PT) or commonly called an issuer. Companies can issue stock certificates for the desired number of stock in accordance with the company's financial capability and the amount of external funds needed by the company. Return is the rate of return on investment invested by investors. Investors invest money from their savings and delay their consumption because of getting a return on their investment [13]. In other words, investors will not invest if there is no return in the future for the investment they invest. Total return consists of capital gain (loss) and yield. Capital gain or capital loss is the difference from the current investment price relative to the price of the past period. If the current price is higher than the investment price of the previous period, there is a http://www.iaeme.com/IJCIET/index.asp 1624 editor@iaeme.com Rizqiyatul Mukhsinah and Windijarto capital gain. On the other hand, if the current price is lower than the investment price of the previous period, there is a capital loss. Investors who want to get a return in the form of dividends or capital gains must be able to analyze the factors that will affect changes in stock returns, both fundamentally and technically. Fundamental factors are the basic factors found in the company's financial data. While technical factors are factors that are reflected in price movements in the market, including taking into account the risk of a stock. Wether the return that investors expect is proportional to the risk borne by the investor or not. 1.3. Exchange Rate Exchange rate is the price of a currency of a country measured or expressed in another currency. The exchange rate is the exchange between two different currencies, it will get a comparison of the value or price between the two currencies. Exchange rates play an important role in spending decisions, because exchange rates allow us to translate prices from various countries into the same language. Therefore, the exchange rate is one of the indicators that affect activities in the stock market and in the money market because investors tend to be careful to make portfolio investments. The cause of exchange rate fluctuations is a change in demand or supply in the foreign exchange market. Whatever shifts the demand curve for a currency to the right or the supply curve to the left invites the appreciation of the currency. Anything that shifts the supply curve to the left will invite depreciation of the currency. 1.4. Exchange Rate Risk Exchange rates can affect a company's performance in terms of cash flows, assets and liabilities. The company experiences asset losses and cash inflows if the foreign currency weakens against the rupiah. Foreign Exchange Exposure is the sensitivity of changes in the value of real assets, liabilities, and operating profits of the company against unexpected changes in exchange rates. Exchange rate exposures consist of three types. Those are transaction exposure, accounting exposure, operation exposure, and economic exposure. According to the explanation above, we supposed that the changes in exchange rates affect stock returns of export and import companies. Figure 1 shows the conceptual framework of this study. Figure 1 Conceptual Framework 2. MATERIAL AND METHOD 2.1. Method and Data This study used quantitative approach. The data of this study were 28 export companies and 33 import companies taken from all of export and import companies listed on the Indonesia Stock http://www.iaeme.com/IJCIET/index.asp 1625 editor@iaeme.com The Impact of Exchange Rates Exposure toward Stock Returns: The Evidence in Indonesian Import and Export Companies Exchange for the period 2010-2014. The data was taken using a purposive sampling technique with several criteria. Those are the companies must publish quarterly financial statements consistently during the period of this study, that is 2010-2014, the companies have complete data as needed in this study, and for export companies, more than 50% of its income must be obtained from exports. 2.2. Variables Identification The variables are used in this study are independent and dependent variables. The dependent variables in this study was company stock returns and the independent variables consisting of the rupiah exchange rate per US dollar (USD), per euro (EUR), per Australian dollar (AUD), and the rupiah exchange rate per Japanese yen (JPY). In addition, there are control variables, namely Firm Size and Earning per stock. 2.3. Model Analysis This study used multiple linear regression analysis techniques. In general, regression analysis is a study of the dependence of one dependent variable with one or more independent variable variables with the aim of estimating and predicting population averages or dependent values based on the values of free variables (independent). Before multiple linear regression analysis is carried out, first the data is analyzed using the classic assumption test. This is done to ensure that the variable used is BLUE (Best Linear Unbiased Estimator). The classic assumption test that was carried out in this study was the autocorrelation test, multicollinearity, heteroscedasticity, and normality. 3. RESULTS AND DISCUSSION 3.1. Description of Export Company Statistics The maximum value (maximum) of the export company return which was the dependent variable was 0.385047189 and the lowest value (minimum) of the return was -0.3928571 with a standard deviation of 0.15651426. The highest USD value was 0.16960419 and the lowest value was -0.0644023. USD shows a change in the exchange rate of the rupiah per US dollar. The average change in the rupiah exchange rate per US dollar during the study period was 0.015188 with a standard deviation of 0.04464159. That is, during the study period, the rupiah exchange rate depreciated against the US dollar by 1.5%. The highest EUR value was 0.207590766 and the lowest value was -0.0957313. EUR showed changes in the rupiah exchange rate per euro. The average change in the rupiah exchange rate per euro during the study period was 0.007039 with a standard deviation of 0.06846636. In other words, during the study period, the rupiah exchange rate depreciated against the euro by 0.7%. Whereas, the highest AUD value was 0.175737587 and the lowest value was -0.09337. AUD showed changes in the rupiah exchange rate per Australian dollar. The average change in the rupiah exchange rate per Australian dollar during the study period was 0.010482 with a standard deviation of 0.06342390. That is, during the study period, the rupiah exchange rate depreciated against the Australian dollar by 1.05%. On the other hand, the highest JPY value was 0.182693132 and the lowest value was 0.0944465. This means the highest depreciation of the rupiah per Japanese yen was 18.2% while the highest appreciation of the rupiah per Japanese yen was 9%. The average change in the rupiah exchange rate per Japanese yen during the study period was 0.001518 with a standard http://www.iaeme.com/IJCIET/index.asp 1626 editor@iaeme.com Rizqiyatul Mukhsinah and Windijarto deviation of 0.06544380. That is, during the study period, the rupiah exchange rate depreciated against the Japanese yen by 0.15%. In addition, firm size was calculated using the natural logarithm of total assets, had the lowest value of 11.556445, the highest value was 18.3321657 and an average of 15.28283. EPS variable which showed net income per stock has the lowest value of -45102.0 and the highest value of 3805.7. The average of the EPS variable was 44.69158 with a standard deviation of 2043,54320. By looking at the value of the standard deviation that was greater than the average it showed the data used the earnings per stock variable had a large distribution. This condition showed a large EPS fluctuation on the Indonesia Stock Exchange (IDX) during the first quarter of 2010 until the last quarter of 2014. 3.2. Description of Import Company Statistics The statistical data was obtained the highest value (maximum) of import company returns which was the dependent variable was 0, 377928 and the lowest (minimum) value of return was -0, 346154 with a standard deviation of 0.139546. The highest USD value was 0.16960419 and the lowest value was -0.0644023. USD showed a change in the exchange rate of the rupiah per US dollar. The average change in the rupiah exchange rate per US dollar during the study period for import companies was 0, 016216 with a standard deviation of 0, 046304. That is, during the study period, the rupiah exchange rate depreciated against the US dollar by 1.6%. The highest EUR value was 0.207590766 and the lowest value was -0.0957313. EUR showed changes in the rupiah exchange rate per euro. The average change in the rupiah exchange rate per euro during the study period was 0.008142 with a standard deviation of 0.070497. In other words, during the study period, the rupiah exchange rate depreciated against the euro by 0.8%. The highest AUD value was 0.175737587 and the lowest value was -0.09337. AUD showed changes in the rupiah exchange rate per Australian dollar. The average change in the rupiah exchange rate per Australian dollar during the study period was 0.010686 with a standard deviation of 0.064619. That is, during the study period, the rupiah exchange rate depreciated against the Australian dollar by 1.06%. The highest JPY value was 0.182693132 and the lowest value was -0.0944465. JPY showed changes in the rupiah exchange rate per Japanese yen. The average change in the rupiah exchange rate per Japanese yen during the study period was 0.002445 with a standard deviation of 0.066592. That is, during the study period, the rupiah exchange rate depreciated against the Japanese yen by 0.2%. Company fundamentals were used as control variables in this study such as firm size and earnings per stock. Firm size was calculated using the natural logarithm of total assets. Its lowest value was 11.55424 while its highest value was 19.28104. In addition, its average was 14.50906. EPS variable which showed the net income per stock has the lowest value of -273.0 and the highest value of 10,320.0. The average of the EPS variable was 258.5942 with a standard deviation of 947,11267. 3.3. Classic assumption analysis The results of the autocorrelation test for export companies show that the Durbin-Watson (DW) value calculated was 1.888. Meanwhile, the value of the Durbin Watson table with the amount of data n = 550 is dL = 1.83794 and dU = 1.88204. The results of the data autocorrelation test for import companies indicated that the calculated Durbin-Watson value was 1.948. Meanwhile, the value of the Durbin Watson table with the amount of data n = 600 is dL = 1.84574 and dU = 1.88612. Because the calculated D-W value was greater than dU and http://www.iaeme.com/IJCIET/index.asp 1627 editor@iaeme.com The Impact of Exchange Rates Exposure toward Stock Returns: The Evidence in Indonesian Import and Export Companies smaller than (4 - dU), there was no autocorrelation in the regression model, both for the sample of export companies and import companies. In addition, for multicollinearity tests for both export and import company data samples, the tolerance values of all independent variables and control variables were obtained more than 0.1. In addition, the VIF values of all independent variables and control variables were also less than 10. This indicated that the regression model is free from multicollinearity problems. Furthermore, based on the results of heteroscedasticity tests, the points in the scatterplot for both export and import companies spread randomly and did not form a specific pattern. These points also spread above and below the number 0 on the Y axis. From these results it can be concluded that there was no heteroscedasticity in the regression model. The results of the normality test shown by the P-P chart plot, data distribution (point), both export and import companies were spread around the diagonal line and followed the direction of the diagonal line. In addition, the results of the normality test were reinforced by the results of the K-S test which showed the significance level of 0.453 for export companies and 0.378 for import companies. Data can be said to be normally distributed in the K-S test if the significance is > 0.05. Therefore, the regression model in this study, both for export companies and import companies had fulfilled the normality test. 3.4. Analysis of the Export Company Model The results of the regression analysis in Table 1 show that the beta value of the rupiah exchange rate per US dollar is -0.499, per Euro is -0.151, and per Japanese yen is -0.334. This shows that the rupiah exchange rate per US dollar, per Euro, and per Japanese yen has a negative effect on the return of export companies. On the other hand, the rupiah exchange rate per Australian dollar has a positive effect on the return of export companies with a beta value of 0.943. However, only the rupiah exchange rate per US dollar, the Australian dollar and the Japanese yen alone has a significant influence on the return of stocks of export companies. This is because the significance value of the rupiah exchange rate per US dollar, the Australian dollar and the Japanese yen is less than 0.05 (p <0.05), which is 0.029, 0.001 and 0.013. In other words, the higher the change in the exchange rate of the rupiah per US dollar and the Japanese yen, the lower the return on stocks of export companies. Table 1 Results of Regression Analysis of Export and Import Companies Variable Import B -0,117 -0,801 -0,531 0,731 -0,042 0,010 2,834E6 Constanta USD EUR AUD JPY TA EPS R 0,335 R Square 0,112 0,103 AdjR Square 1,948 Durbin-Watson Note: *Significance at value of (P<0, 05) http://www.iaeme.com/IJCIET/index.asp Export Sig 0,021 0,002* 0,000* 0,000* 0,722 0,005* 0,627 B -0,015 -0,499 -0,151 0,943 -0,347 0,001 -6,910E-6 Sig 0,803 0,029* 0,331 0,001* 0,013* 0,874 0,033* 0,319 0,102 0,091 1,888 1628 editor@iaeme.com Rizqiyatul Mukhsinah and Windijarto The higher the rupiah exchange rate per Australian dollar, the higher the stock return of the export companies. The effect of the positive size control variable is not significant on stock returns with a significance value of 0.874 (P> 0.05). This shows that the increase or decrease in the size of the company does not affect the increase or decrease in Export Company’s stock return. The effect of negative EPS control variables with the value of its beta is -6,910E-6. In addition, EPS control variables also influence stock returns with a significance value of 0.033 (P <0.05). This shows that the greater the net income per stock of a company, the smaller stock return which is obtained by the company. From table 1 the results of the regression analysis, it can be understood that the R square of export companies value is 0.102. This value indicates that the stock return variation of an export company can be explained by the independent variable in the form of the rupiah exchange rate per US dollar, euro, Australian dollar and Japanese yen and the size and EPS control variable of 0.102 or 10.2%. 3.5. Analysis of the Import Company Model Based on the results of the regression analysis in Table 1, the rupiah exchange rate per US dollar, euro and Japanese yen negatively affects the returns of import companies with beta values of -0.801, -0.531 and -0.042. While the rupiah exchange rate per Australian dollar has a positive effect on stock returns of import companies with a beta value of 0.731. However, only the rupiah exchange rate per US dollar, euro and Australian dollar has a significant influence on the return of import companies with a significance value of 0.002, 0,000 and 0,000 (P <0.05). In other words, the higher the change in the rupiah exchange rate per US dollar and the euro, the lower the return of imported companies. However, the higher the rupiah exchange rate per Australian dollar, the higher the return of import companies will be. In addition, in Table 1 it can be seen that the size control variable has a positive effect on stock returns of import companies with a significance value of 0.005 (P <0.05). So it can be concluded that if the size of the company gets bigger, then the company's stock returns are also higher. The influence of the EPS control variable is not significant to the stock returns of import companies. This is indicated by a significance value of 0.627 (P> 0.05). This shows that the increase or decrease in net income per stock received by the company does not affect the company's stock return. Furthermore, from the results of the regression analysis for import companies, it is known that the R square value is 0.112. This value indicates that the variation of stock returns of import companies can be explained by the independent variables in the form of rupiah exchange rates per US dollar, euro, Australian dollar and Japanese yen and control variable and EPS variables of 0.112 or 11.2%. 3.6. The Impact of Exchange Rates Exposure toward Stock Returns in Indonesian Import and Export Companies We found that changes in exchange rates influenced the stock return of Indonesian companies, both export and import companies. The effect of changes in the rupiah exchange rate per US dollar on export companies was negative. If there is an increase in the exchange rate of the rupiah per US dollar, it will reduce the stocks return of export companies. In America, exchange rate exposures have a significant negative effect on exporter companies [11]. This can be caused by limited research using mining and plantation companies as samples of export companies, so that the company's income is also determined by the price of the company's products. An increase in the rupiah exchange rate causes a decline in stock returns of Export Company, if commodity prices tend to decline. In addition, changes in the rupiah exchange http://www.iaeme.com/IJCIET/index.asp 1629 editor@iaeme.com The Impact of Exchange Rates Exposure toward Stock Returns: The Evidence in Indonesian Import and Export Companies rate per Japanese yen negatively affected export companies. This means that if there is an increase in changes in the rupiah exchange rate per Japanese yen, it will reduce the return of stocks of export companies. Besides, the effect of changes in the exchange rate of the rupiah per US dollar on import companies was also negative. In other words, if there is an increase in the exchange rate of the rupiah per US dollar, it will reduce the return of stocks of imported companies. Currency exchange rates had negative effect on importing companies [11]. Meanwhile, changes in the exchange rate per euro also had negative effect. If there is an increase in changes in the rupiah exchange rate per euro, it will increase the return of stocks of import companies. In addition, changes in the rupiah exchange rate per Australian dollar had positive effect on both import and export companies. The depreciation of the rupiah exchange rate against the Australian dollar has had positive effect for both export and import companies. This can be due to the high interest of Australian investors to invest in companies in Indonesia. Thus, if the rupiah depreciates against the Australian dollar, the investors spend fewer Australian dollars in investment. The high demand for stocks of Australian investors can cause an increase in stock prices and company stock returns. In this study, we also found that firm size control variables had positive value but did not effect significantly in export companies. On the other hand, firm size control had significant positive effect in import companies. That is, the higher the size of a company, the higher the stock return received by the investors. This is due to the assumption of investors that large companies are more profitable than small companies in the same industry. This assumption increases investor confidence in a company and increases the demand for stocks of the company. The not significant positive effect of firm size on stock returns in the sample of export companies can be caused by the formulation of firm size in this study that uses total assets, while to see whether a company is profitable or not is seen from the output produced by the company. In addition, large companies often practice income smoothing so that company profits look more stable. The practice of income smoothing is then used as an excuse by investors to assume that large companies do not necessarily have large stock returns. Company size (size) has no effect on stock returns [14]. Furthermore, EPS control variables have negative effect on export companies. The greater the net income per stock of a company, the smaller the stock return of the company [15]. On the other hand, in import companies, EPS control variable does not affect stock returns. The companies with the high EPS does not consistently have greater stock returns. This can happen because investors are less interested in EPS which can be used as a picture of competition that occurs in the company's industry. In competitive industries, companies tend to have low profits. The results are far different from what happens to companies engaged in industries that tend to be monopolistic. The more companies in the industry, the less market stock they get. In addition, companies that have higher profits than similar companies indicate a firm position in the eyes of consumers, and cost management efficiency. This raises investor’s disinterest in seeing EPS when investing. The high of company’s earning per stock (EPS) does not guarantee that the company is able to provide a better level of welfare to stockholders. So, it does not encourage investors to increase the amount of capital invested in the company's stocks [16]. Therefore, company’s EPS does not influence investors to invest in the company [17]. 4. CONCLUSION The exchanges rate exposure influence stock return both in Indonesian export and import companies. In export companies, the rupiah exchange rate per US dollar and per Japanese yen http://www.iaeme.com/IJCIET/index.asp 1630 editor@iaeme.com Rizqiyatul Mukhsinah and Windijarto has a negative effect on stock returns. While the rupiah exchange rate per Australian dollar has a positive effect on stock returns of export companies. On the other hand, the rupiah exchange rate per euro has no effect. In import companies, the exchange rate of the rupiah per US dollar and per euro has a negative effect on stock returns of import companies. While the rupiah exchange rate per Australian dollar has a positive effect on stock returns of imported companies. On the other hand, the rupiah exchange rate per Japanese yen has no effect. Therefore, investors must consider the exchange rate of the rupiah against the US dollar, Yen and Australian Dollar before investing in export companies in Indonesia. On the other hand, investors must look at the rupiah exchange rate against the US dollar, Euro and Australian Dollar before investing in import companies in Indonesia because it will affect the stock return that they will receive. ACKNOWLEDGEMENTS The authors thank to all parties who had helped this research. REFERENCES [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] Levi MD. Keuangan Internasional Edisi 1. Yogyakarta: Andi; 2001. Dominic S. Ekonomi Internasional. Jakarta: Erlangga. 1997; Mishkin FS. The economics of money, banking, and financial markets. Pearson education; 2007. Nugroho H. Analisis Pengaruh Inflasi, Suku Bunga, Kurs dan Jumlah Uang Beredar terhadap Indeks LQ45 (Studi kasus pada BEI Periode 2002-2007). program Pascasarjana Universitas Diponegoro; 2008. Samsul M. Pasar modal dan manajemen portofolio. Jakarta: Erlangga. 2006; Röthig A, Semmler W, Flaschel P. Hedging speculation, and investment in balance-sheet triggered currency crises. 2006. Madura J. International financial management. Cengage Learning; 2011. Aretz K, Bartram SM, Dufey G. Why hedge? Rationales for corporate hedging and value implications. J Risk Financ. Emerald Group Publishing Limited; 2007;8(5):434–49. Bhargava A. Firms’ fundamentals, macroeconomic variables and quarterly stock prices in the US. J Econom. Elsevier; 2014;183(2):241–50. Lam KSK. The relationship between size, book-to-market equity ratio, earnings–price ratio, and return for the Hong Kong stock market. Glob Financ J. Elsevier; 2002;13(2):163– 79. Pritamani MD, Shome DK, Singal V. Foreign exchange exposure of exporting and importing firms. J Bank Financ. Elsevier; 2004;28(7):1697–710. Sukirno S. Pengantar Teori Mikro Ekonomi, PT. Rajawali Graf Persada, Jakarta. 1997; Reilly FK, Brown KC. Investment analysis and portfolio management. 中信出版社; 2002. Abdullahi IB, Lawal WA, Etudaiye-Muhtar OF. The effects of firm size on risk and return in the Nigerian Stock Market: A sectoral analysis. Br J Econ. 2011;1:2. Zahra HD, Serri EZM, Zare F, Namazi MH. A Comparative Analysis of the Effects of Reducing Prediction Errors of Earnings per Share (EPS) and Dividends per Share (DPS) On the Firms’ Stock Returns. Manag Res Rep. 2014;3(2):1328–35. Bowen RM, Burgstahler D, Daley LA. Evidence on the relationships between earnings and various measures of cash flow. Account Rev. JSTOR; 1986;713–25. Rohmah L. Pengaruh Price Earning Ratio dan Earning Per Share terhadap Return Saham Syari’ah (Studi Kasus di Perusahaan yang Tercatat pada Jakarta Islamic Index Periode Desember 2008–November 2011). IAIN Walisongo; 2012. http://www.iaeme.com/IJCIET/index.asp 1631 editor@iaeme.com