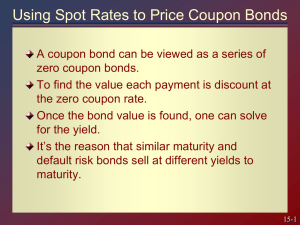

M. Talebian MBA-Finance Program Graduate School of Management and Economics Sharif University of Technology Spring 2019 Corporate Finance Problem Set III Covering: Valuing Bonds Due date is Friday (98/1/2) midnight at 23:55 (not extendable). You should upload a .rar or .zip file in CW containing one Excel and one Word file (a PDF file may be included as well), the names of which should be in the format of “CF-HW#-Student Number”. Score Reduction Policy: You are allowed a maximum of 10 days’ delay (in total) for the submission of all your assignments. Note that the delay will be calculated "daily", not hourly (meaning that a 5-minute delay for a given assignment will be considered as 1 day). If you surpass the threshold, you are subject to a score reduction of 20% per day on ALL of the delayed assignments (assignments uploaded without delay will be secure, and assignments not handed will not be considered in calculating delays). For the questions needing Excel, put the answer to each question in a separate sheet. Also, copy the tables in the Word file as well. Therefore, the Word file will have everything for all questions but the calculations will be in Excel. In other words, the Word file should be a standalone file. Avoid writing the answers on paper and sending the solution with pictures. You are expected to hand in a proper document, with name and student ID, complete solutions to the answers. Proper font, size, and spacing are expected. Courseware (CW) will be used to upload slides and assignments for this course. After the creation of the course in the system, you will be able to upload your files. Please note that (as is the case for many reallife systems) you should make sure to upload your assignments before the deadline. Trying to upload them in the nick of time may result in assignments being uploaded late! Personal integrity is the key to your success in career and life. Any cheating, dishonesty, or plagiarism will NOT be tolerated. If a student is found guilty of academic dishonesty, the student will receive an ‘F’ for the course in addition to any punishment determined by the university. You are allowed to consult with other students in solving the questions. However, all the work including problem sets and exams should reflect your work only. 1) Shortly define the concepts below (no more than one paragraph needed). a. Duration b. Indexed Bonds c. Term structure of interest rate d. Buying long term bonds versus Rolling over 2) Study about Convertible bonds and answer following questions. (attached link may provide a good material for studying1) a. What are the structure and characteristics of convertible bonds, and what is their major difference with ordinary bonds? b. What is the advantage of convertible bonds over ordinary bonds for financing a corporation? 1 https://www.investopedia.com/investing/introduction-convertible-bonds 1 3) Suppose the yield curve on (zero-coupon) treasury strips is as follows: Time to maturity 1-2 3-5 6 7-8 9-10 YTM 4 4.5 5 5.5 6 a. You wish to value a 10-year bond with a coupon rate of 10%, paid annually. Find the price of the 10-year bond expressed above using a spreadsheet program. What are the spot rates? b. Calculate the bond’s yield to maturity and volatility. c. Compare the yield to maturity of the 10-year, 10% coupon bond to that of a 10-year zero coupon bond or Treasury strip. Which is higher? Why does this result make sense given this yield curve? 4) With the help of excel derive the same calculation as the table 3.4 of BMA (11th edition) to calculate the duration and modified duration for following bonds. Which one has the longest duration? (par value is $1,000) a. A 21-year bond with a 10% coupon yielding 10% b. A 20-year bond with a 10% coupon yielding 11% c. A 21-year bond with a 9% coupon yielding 11% d. A 20-year bond with a 11% coupon yielding 10% 5) Suppose that you buy a 1-year maturity bond for $1,000 that will pay you back $1,000 plus a coupon payment of $70 at the end of the year. What real rate of return will you earn if the inflation rate is: a. 2%? b. 4%? c. 6%? d. 8%? Now suppose that the bond in the previous part is a TIPS (inflation-indexed) bond with a coupon rate of 4%. What will the cash flow provided by the bond be for each of the four inflation rates? What will be the real and nominal rates of return on the bond in each scenario? 6) You are offered to buy a 4-year coupon bond in the begging of its 7th month on its 3th year for $963.54. Its face value is $1,000 and its coupon rate is 5.172% per annum, with coupon paid at end of each quarter. Government bond rate is now at 6.9%. a. What is a fair price for the bond? b. Is $963.54 a good price for you to buy it or not? c. What is the yield if you buy it at this price? d. If the Government bond rate suddenly goes down to 4.7%, what will be the new fair value of the bond? 2 7) Download and install “TseClient” through attached link.2 Select three of the actively traded fixed income securities from Iranian market. Calculate daily YTM from historical closing prices for each security. Plot the results and attach the excel file to your report. 8) Prove that the duration of a bond that makes an equal payment each year in perpetuity 1+YTM is . YTM Good Luck 2 http://cdn.tsetmc.com/Site.aspx?ParTree=111A11 3