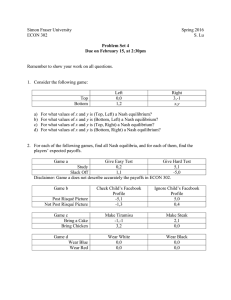

Game Theory Assignment: Nash Equilibria & Strategic Interactions

advertisement

Assignment 1

Assignment 1

Darina Merkulova

8207380

ECO4170

Game Theory with Applications in Corporate Finance

Professor N. V. Quyen

February 12th, 2019

Assignment 1

1

Textbook Problems

3U2.

a. Albus has three pure strategies: SA = {S, E, N}

Minerva has eight pure strategies: SM = {(a, a, a), (a, a, b), (a, b, b), (b, b, b), (b, b, a), (b, a, a),

(a, b, a), (b, a, b)}

b. Albus has four pure strategies: SA = {(S, S), (S, N), (N, S), (N, N)}

Minerva has five pure strategies: SM = {(a, a), (a, b), (b, b), (c, a), (c, b)}

c. Albus has four pure strategies: SA = {(S, S), (S, N), (N, S), (N, N)}

Minerva has four pure strategies: SM = {(a, a), (a, b), (b, a), (b, b)}

Severus has two pure strategies: SS = {X, Y}

3U4

a. Please refer to Annex for tree A.

The President prefers a payoff of 4 over any other payoff, so he chooses B becomes law. When the

President chooses B, Congress receives the highest payoff for A becomes law, so it chooses A.

Thus, the rollback equilibrium is Congress choosing A and President choosing B, and the

President’s choice does not affect the rollback equilibrium, because Congress anticipates the

President to choose B, so it chooses its best response by choosing A.

b. Please refer to Annex for tree B.

The President still chooses B becomes law, but when the President chooses B, Congress chooses

A or B becomes law. Thus, the rollback equilibrium is Congress chooses A or B and President

chooses B.

4U1

a. There are no dominated strategies for Rowena.

But for Colin, playing Right strictly dominates playing Left, so he will play the former. If he plays

Right, Rowena plays Up.

As a result, the game ends in the pure-strategy Nash equilibrium (Up, Right) with payoff (4, 2).

b. There are no dominated strategies for either player.

For Colin, Left dominates Right, so Right can be eliminated. Consequently, for Rowena, Straight

strictly dominates both Up and Down. When Rowena plays straight, Colin will then play Middle.

As a result, through iterative elimination, the pure-strategy Nash equilibrium is (Straight, Middle)

with payoff (9, 2).

c. There are no dominated strategies for either player.

For Colin, Right dominates Middle, so Middle can be eliminated. Consequently, for Rowena,

Straight strictly dominates both Up and Down. When Rowena plays straight, Colin will then play

Middle.

As a result, through iterative elimination, the pure-strategy Nash equilibrium is (Straight, Middle)

with payoff (4, 4).

d. There are no dominated strategies for either player.

For Rowena, Up dominates Down, so Down can be eliminated. Consequently, for Colin, East

dominates North, so North can be eliminated. In turn, Up strictly dominates both High and Low for

Rowena. When she plays Up, Colin then plays East.

As a result, through iterative elimination, the pure-strategy Nash equilibrium is (Up, East) with

payoff (5, 5).

Assignment 1

2

4U2

a. This is a non-zero-sum game, as the gain or loss of utility by Rowena is not matched with a

corresponding or loss of utility by Colin (payoffs in all cells are not equal).

b. This is a non-zero-sum game, as the gain or loss of utility by Rowena is not matched with a

corresponding or loss of utility by Colin (payoffs in all cells are not equal).

c. This is a zero-sum game, as the payoffs in all cells sum to 8.

d. This is a zero-sum game, as the payoffs in all cells sum to 10.

4U5

For Colin, Middle dominates Right, so Right can be eliminated. Elimination of dominated strategies

reduces the strategic-form game to the following:

Colin

Rowena

Up

Down

Left

4, 3

5, 0

Middle

2, 7

5, -1

Consequently, for Rowena, Down strictly dominates Up. When Rowena plays Down, Colin plays

Left. As a result, through iterative elimination, the solution to this game is (Down, Left) with payoff (5, 0).

This solution is a Nash equilibrium because when Rowena plays Down, Colin prefers Left, and when he

plays Left, Rowena also prefers Down.

4U8

a. Game table: (assuming the Japanese have -1 when it they are found, and 1 when not)

Japan

United States

Northern route

Southern route

North

2, -1

1, 1

South

2, 1

3, -1

b. Neither player has a dominant strategy. The Nash equilibrium is (Northern Route, South) with payoff

(2, 1) because it yields the highest expected payoff out of all cells (3).

7U1

a. If Offense Runs, then the Defense Anticipates a Run. If Offense Passes, then the Defense

Anticipates a Pass. In turn, if the Defense Anticipates a Run, the Offense Passes. If the Defense

Anticipates a Pass, the Offense Runs. Therefore, there is no pure strategy that is a best response to

a best response. The game has no pure-strategy Nash equilibrium.

b. Suppose Offense plays Run with probability p and Pass with probability (1-p). Similarly, let

Defense Anticipate a Run with probability q, and Anticipate a Pass with probability (1-q).

Then, (−1)𝑝 − 9(1 − 𝑝) = (−5)𝑝 + 3(1 − 𝑝) 𝑠𝑜 𝑡ℎ𝑎𝑡 16𝑝 = 12 𝑎𝑛𝑑 𝒑 = 𝟑/𝟒.

And (1)𝑞 + 5(1 − 𝑞) = 9𝑞 − 3(1 − 𝑞) 𝑠𝑜 𝑡ℎ𝑎𝑡 10𝑞 = 2 𝑎𝑛𝑑 𝒒 = 𝟏/𝟓.

Assignment 1

3

The mixed-strategy Nash equilibrium is:

- Offense plays (3/4)*(Run) + (1/4)*(Pass)

- Defense plays (1/5)*(Anticipate Run) + (4/5)*(Anticipate Pass)

c. In this game, each player wants to be unpredictable and thus uses a mixed strategy that specifies a

probability distribution over her set of pure strategies, which is why the mixture is different between

the Offense and the Defense.

d. The expected payoff of the Offense is: (1)*(1/5) + (1-1/5)*(5) = 5.25 yards.

7U6

a. Suppose James swerves with probability p and goes straight with probability (1-p). Similarly, let

Dean swerve with probability q, and go straight with probability (1-q).

Then, 0𝑝 − 1(1 − 𝑝) = (1)𝑝 − 2(1 − 𝑝) 𝑠𝑜 𝑡ℎ𝑎𝑡 2𝑝 = 1 𝑎𝑛𝑑 𝒑 = 𝟏/𝟐.

And (0)𝑞 − 1(1 − 𝑞) = 2𝑞 − 2(1 − 𝑞) 𝑠𝑜 𝑡ℎ𝑎𝑡 3𝑞 = 1 𝑎𝑛𝑑 𝒒 = 𝟏/𝟑.

The mixed-strategy Nash equilibrium is:

- James plays (1/2)*(Swerve) + (1/2)*(Straight)

- Dean plays (1/3)*(Swerve) + (2/3)*(Straight)

The expected payoffs for the players are:

- James’s expected payoff = (0)*(1/3) + (-1)*(1-1/3) = -0.667

- Dean’s expected payoff = (0)*(1/2) + (-1)*(1-1/2) = -0.5

b. James’s probability of playing Straight is the same as before, but Dean’s probability of playing

Straight is slightly lower (1/3 < 1/2).

c. The expected payoffs in 4.B are -0.5, so the expected payoffs for the players are now the same for

Dean and worse for James. These are not paradoxical given that Dean changed his strategy whereas

James did not, so James should have a lower payoff given that he is still indifferent between

choosing Swerve and Straight.

7U11

a. Yes, (Sea, Air) and (Land, Sea) are pure-strategy Nash equilibria with payoffs (2, 4).

b. Suppose Patton chooses Air with probability p1, Sea with probability p2, and Land with probability

(1-p1-p2).

Similarly, let Dean play Air with probability q1, Sea with probability q2, and Land with probability

(1-q1-q2).

Macarthur’s payoff from Air is 3𝑝1 + 4𝑝2 + 3(1 − 𝑝1 − 𝑝2 )

His payoff from Sea is 6𝑝2 + 4(1 − 𝑝1 − 𝑝2 )

His payoff from Land is 7𝑝1 + 3(1 − 𝑝1 − 𝑝2 )

From the 2nd payoff, we have that 𝑝1 = 𝑝2 , and substituting into the 2nd and 3rd payoffs:

7𝑝1 + 3(1 − 2𝑝1 ) = 6𝑝1 + 4(1 − 2𝑝1 )

Assignment 1

4

𝑝1 + 3 = 4 − 2𝑝1

3𝑝1 = 1 → 𝒑𝟏 = 𝟏/𝟑

Substituting into (1-p1-p2), we obtain that 𝒑𝟐 = 𝟏/𝟑.

Patton’s payoff from Air is 2𝑞2 + 1(1 − 𝑞1 − 𝑞2 )

His payoff from Sea is 2𝑞1 + 2(1 − 𝑞1 − 𝑞2 )

His payoff from Land is 𝑞1 + 2𝑞2

Therefore, we can set:

2𝑞2 + 1(1 − 𝑞1 − 𝑞2 ) = 2𝑞1 + 2(1 − 𝑞1 − 𝑞2 )

2𝑞2 + 1(1 − 𝑞1 − 𝑞2 ) = 𝑞1 + 2𝑞2

From the first payoff, we obtain 𝑞1 = 3𝑞2 − 1, and substituting into the 2nd condition yields:

2𝑞2 + (1 − (3𝑞2 − 1) − 𝑞2 ) = (3𝑞2 − 1) + 2𝑞2

−2𝑞2 = 5𝑞2 − 1

7𝑞2 = 1 → 𝒒𝟐 = 𝟏/𝟕

Substituting into (1-q1-q2), we obtain that 𝒒 = 𝟏/𝟕.

Non-Textbook Problems

2.a

Each firm seeks to maximize its expected profit in a Cournot duopoly. Since only Firm 1 knows

whether demand is high or low, Firm 1 has two types (H, L) and Firm 2 only has one type. The unique

Bayesian Nash equilibrium in this case is the equilibrium set (q*1H, q*1L, q*2).

If demand Firm 1 knows the demand is high (a = aH), it will then choose q*1H such that:

∗

max(𝑎𝐻 − 𝛾 − 𝑞1𝐻 − 𝑞2∗ )𝑞1𝐻

The FOC gives that:

∗

𝑞1𝐻

𝑎𝐻 − 𝛾 − 𝑞2∗

=

2

If demand Firm 1 knows the demand is low (a = aL), it will then choose q*1L such that:

∗

∗

max 𝑞1𝐿

(𝑎𝐿 − 𝛾 − 𝑞1𝐿 − 𝑞2∗ )𝑞1𝐿

The FOC gives that:

∗

𝑞1𝐿

𝑎𝐿 − 𝛾 − 𝑞2∗

=

2

Firm 2 has incomplete information regarding the demand. All it knows is that it is high with

probability θ and low with probability (1-θ). It will therefore choose q*2 such that:

∗

∗

max 𝜃𝑞2 (𝑎𝐻 − 𝛾 − 𝑞1𝐻

− 𝑞2 ) + (1 − 𝜃)𝑞2 (𝑎𝐿 − 𝛾 − 𝑞1𝐿

− 𝑞2 )

Assignment 1

5

The FOC gives that:

𝑞2∗ =

∗ )

∗ )

𝜃(𝑎𝐻 − 𝛾 − 𝑞1𝐻

+ (1 − 𝜃)(𝑎𝐿 − 𝛾 − 𝑞1𝐿

−𝛾

2

Plugging q*1H and q*1L into q*2, we obtain:

𝑞2∗ =

2𝑞2∗ =

𝜃 (𝑎𝐻 −

𝑎𝐻 − 𝛾 − 𝑞2∗

𝑎 − 𝛾 − 𝑞2∗

(1 − 𝜃) (𝑎𝐿 − 𝐿

)

+

)−𝛾

2

2

2

2𝜃𝑎𝐻 − 𝜃𝑎𝐻 + 𝜃𝛾 + 𝜃𝑞2∗ (1 − 𝜃)(2𝑎𝐿 − 𝑎𝐿 + 𝛾 + 𝑞2∗ )

+

−𝛾

2

2

2𝑞2∗ =

𝜃𝑎𝐻 + 𝑎𝐿 − 𝛾 + 𝑞2∗ − 𝜃𝑎𝐿

2

3𝑞2∗ = 𝜃𝑎𝐻 + (1 − 𝜃)𝑎𝐿 − 𝛾

𝒒∗𝟐 =

𝜽𝒂𝑯 + (𝟏 − 𝜽)𝒂𝑳 − 𝜸

𝟑

Then, replacing q*2 in q*1H and q*1L, we obtain:

𝒒∗𝟏𝑯 =

𝒂𝑯 − 𝜸 𝜽𝒂𝑯 + (𝟏 − 𝜽)𝒂𝑳 − 𝜸

−

𝟐

𝟔

𝒒∗𝟏𝑳 =

𝒂𝑳 − 𝜸 𝜽𝒂𝑯 + (𝟏 − 𝜽)𝒂𝑳 − 𝜸

−

𝟐

𝟔

Therefore, the unique Bayesian Nash equilibrium triplet (q*1H, q*1L, q*2) is:

𝑎𝐻 − 𝛾 𝜃𝑎𝐻 + (1 − 𝜃)𝑎𝐿 − 𝛾

−

2

6

𝑎𝐿 − 𝛾 𝜃𝑎𝐻 + (1 − 𝜃)𝑎𝐿 − 𝛾

=

−

2

6

(1

𝜃𝑎

+

−

𝜃)𝑎

𝐻

𝐿−𝛾

𝑞2∗ =

3

∗

𝑞1𝐻

=

∗

𝑞1𝐿

{

2.b

In a symmetric pure-strategy Bayesian Nash equilibrium of this game, the sensitivity of firm i’s

demand to firm j’s price, and the sensitivity of firm j’s demand to firm i’s price, are equal, so bi = bH = bL.

Firm i has two types (H, L) while firm j only has one type.

For its two types, Firm i sets its price so as to maximize the following profit functions:

max(𝑎 − 𝑝𝑖𝐻 + 𝑏𝐻 (𝜃𝑝𝑗𝐻 + (1 − 𝜃)𝑝𝑗𝐿 )𝑝𝑖𝐻

max(𝑎 − 𝑝𝑖𝐿 + 𝑏𝐿 (𝜃𝑝𝑗𝐿 + (1 − 𝜃)𝑝𝑗𝐻 )𝑝𝑖𝐿

Assignment 1

6

The FOCs give that:

𝑎 − 2𝑝𝑖𝐻 + 𝑏𝐻 (𝜃𝑝𝑗𝐻 + (1 − 𝜃)𝑝𝑗𝐿 ) = 0

𝑎 − 2𝑝𝑖𝐿 + 𝑏𝐿 (𝜃𝑝𝑗𝐿 + (1 − 𝜃)𝑝𝑗𝐻 ) = 0

Solving for p*iH and p*iL, we obtain:

∗

𝑝𝑖𝐻

=

𝑎 + 𝑏𝐻 (𝜃𝑝𝑗𝐻 + (1 − 𝜃)𝑝𝑗𝐿 )

2

∗

𝑝𝑖𝐿

=

𝑎 + 𝑏𝐿 (𝜃𝑝𝑗𝐿 + (1 − 𝜃)𝑝𝑗𝐻 )

2

Then, letting 𝑏 = 𝜃𝑏𝐻 + (1 − 𝜃)𝑏𝐿 , we obtain:

∗

𝑝𝑖𝐻

=

𝑎 𝑎𝑏𝐻 + 𝑏𝑏𝐻 (𝜃𝑝𝑖𝐻 + (1 − 𝜃)𝑝𝑖𝐻 )

+

2

4

∗

𝑝𝑖𝐿

=

𝑎 𝑎𝑏𝐿 + 𝑏𝑏𝐿 (𝜃𝑝𝑖𝐻 + (1 − 𝜃)𝑝𝑖𝐻 )

+

2

4

Replacing, we obtain the following Bayesian Nash equilibrium solution values of p*iH and p*iL:

(1 − 𝜃)

1

𝑎

𝑏𝐻

[ (1 + ) +

𝑎𝑏(𝑏𝐻 − 𝑏𝐿 )]

2

1 − 0.25𝑏 2

2

8

1

𝑎

𝑏𝐿

𝜃

∗

𝑝𝑖𝐿

=

[ (1 + ) + 𝑎𝑏(𝑏𝐻 − 𝑏𝐿 )]

2

1 − 0.25𝑏 2

2

8

∗

𝑝𝑖𝐻

=

{

Assignment 1

7

Annex

Tree A

Tree B