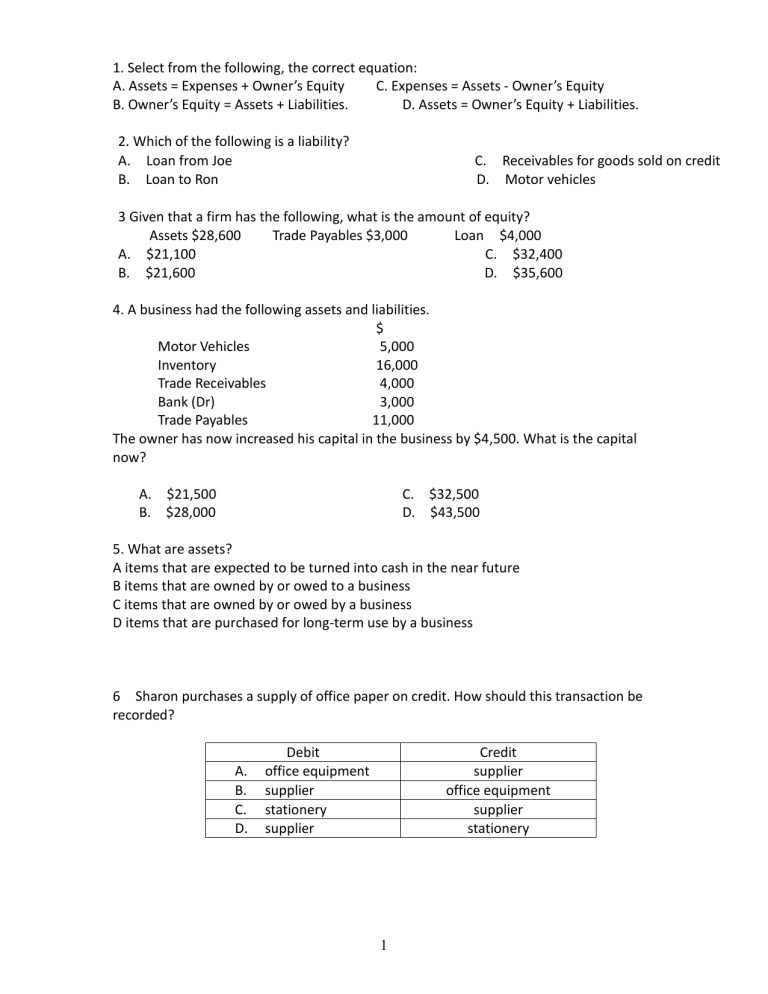

1. Select from the following, the correct equation: A. Assets = Expenses + Owner’s Equity C. Expenses = Assets - Owner’s Equity B. Owner’s Equity = Assets + Liabilities. D. Assets = Owner’s Equity + Liabilities. 2. Which of the following is a liability? A. Loan from Joe B. Loan to Ron C. Receivables for goods sold on credit D. Motor vehicles 3 Given that a firm has the following, what is the amount of equity? Assets $28,600 Trade Payables $3,000 Loan $4,000 A. $21,100 C. $32,400 B. $21,600 D. $35,600 4. A business had the following assets and liabilities. $ Motor Vehicles 5,000 Inventory 16,000 Trade Receivables 4,000 Bank (Dr) 3,000 Trade Payables 11,000 The owner has now increased his capital in the business by $4,500. What is the capital now? A. $21,500 B. $28,000 C. $32,500 D. $43,500 5. What are assets? A items that are expected to be turned into cash in the near future B items that are owned by or owed to a business C items that are owned by or owed by a business D items that are purchased for long-term use by a business 6 Sharon purchases a supply of office paper on credit. How should this transaction be recorded? A. B. C. D. Debit office equipment supplier stationery supplier Credit supplier office equipment supplier stationery 1 7. Why is a trial balance prepared? A to calculate net profit B to check the amount of the owner’s capital C to check the arithmetical accuracy of the double entry D to find out how much is owed to creditors 8. The following balances have been taken from a trader's books. $ Inventory 20,000 Equipment 80,000 Account Receivables 60,000 Account Payable 35,000 Long term-loan from bank 20,000 Cash at bank 5,000 What is the total of the current assets? A. $80,000 B. $85,000 C. $165,000 D. $220,000 9. Amal started a business introducing furniture worth RM100,000 and RM300,000 in cash. Which of the following would be the correct accounting equation after incorporating this transaction? Assets = Capital + Liabilities (1) 300,000 = 300,000 - 0 (2) 400,000 = 400,000 - 0 (3) 100,000 = 400,000 - 300,000 (4) 400,000 = 300,000 + 100,000 10. A business purchases a motor vehicle on credit. What is the effect of this? A It increases fixed assets. B It increases owner’s capital. C It reduces net profit. D It reduces the bank balance. 2 Question 1 Indicate each category of the following for Anna who owns a general store. 1) Fittings 2) Loan at HSBC bank 3) Inventory of Goods 4) Trade Payables 5) Land & Building 6) Carriage Outwards 7) Bank Overdraft 8) Stationery 9) Petty Cash 10) Rent received 11) Discount Allowed 12) Light & Heat 13) Carriage Inwards 14) Machinery 15) Discount Received Question 2 The following details were taken from Carol’s business as at Jan 2019 a) Complete the following table showing which accounts to be debited & credited Date Jan 1 2 3 4 9 10 21 22 25 27 28 29 31 Particulars Started firm with capital in bank of RM5,000 Transferred RM2,000 from bank to the cash Bought goods on credit from Rachel RM750 Sold goods on credit to Debby RM1500 Bought a printer for RM200 direct debit We return goods to Rachel RM50 Debby return some goods worth RM25 Received commission via credit transfer RM100 Bought goods by cash RM1000 Bought display shelf on credit from Courts Mammoth RM450 Paid electric bill(TNB) via direct debit RM50 Debby paid us RM400 by giro credit We paid Rachel the balance outstanding by internet transfer b) Prepare the ledgers for all the necessary accounts (Do in your own ledger book) c) Prepare the Trial Balance as at that date 3 Debit Credit