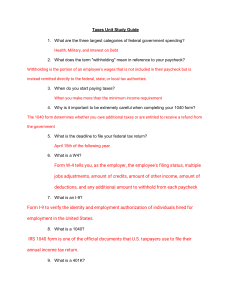

Name_________________________________ Period______ Topic: Paycheck Define the following terms: Income: Expense: Social Security: federal and state taxes: FICA: gross pay: net pay: wage: salary: minimum wage: With this assignment you will: Research reasons why people are paid differently: skills, age, experience, type of job, seasonal, etc. Research minimum wage and tax rates in the three states. 7 PAYCHECK A simple overview of the details that employees would see when they get their paychecks: Everyone who works will receive a W2 paycheck, which is a summary of earnings and deductions. What you earn is not necessarily what you get paid. Your net pay includes the hours worked, multiplied by the rate of pay, minus the deductions. A very basic paycheck showing gross pay, deductions and net pay: What factors could cause pay to be different among people? Choose three different states, with one being California, and create a chart (it can be on the back of this paper) that shows their minimum wage, their state tax rate, and a yes or no if there is a state income tax. Which state would be the best to live in if you only cared about the tax rate and money (don’t forget that income earned could be different in states as well).