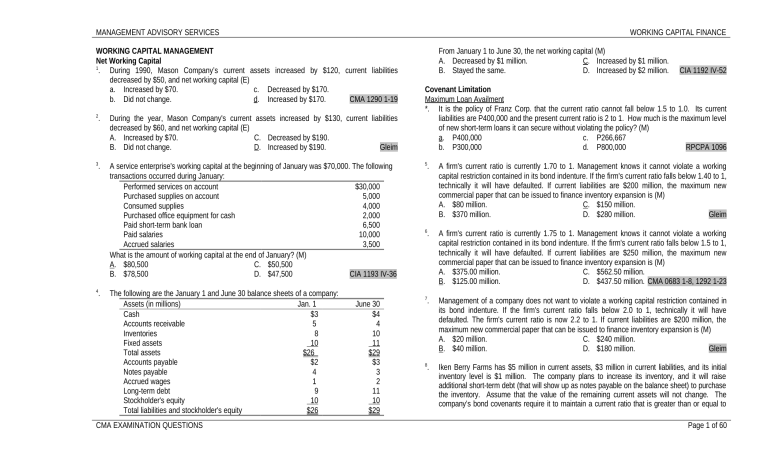

MANAGEMENT ADVISORY SERVICES

WORKING CAPITAL FINANCE

WORKING CAPITAL MANAGEMENT

Net Working Capital

1

. During 1990, Mason Company’s current assets increased by $120, current liabilities

decreased by $50, and net working capital (E)

a. Increased by $70.

c. Decreased by $170.

b. Did not change.

d. Increased by $170.

CMA 1290 1-19

2

During the year, Mason Company's current assets increased by $130, current liabilities

decreased by $60, and net working capital (E)

A. Increased by $70.

C. Decreased by $190.

B. Did not change.

D. Increased by $190.

Gleim

3

A service enterprise's working capital at the beginning of January was $70,000. The following

transactions occurred during January:

Performed services on account

$30,000

Purchased supplies on account

5,000

Consumed supplies

4,000

Purchased office equipment for cash

2,000

Paid short-term bank loan

6,500

Paid salaries

10,000

Accrued salaries

3,500

What is the amount of working capital at the end of January? (M)

A. $80,500

C. $50,500

B. $78,500

D. $47,500

CIA 1193 IV-36

.

.

4

.

The following are the January 1 and June 30 balance sheets of a company:

Assets (in millions)

Jan. 1

Cash

$3

Accounts receivable

5

Inventories

8

Fixed assets

10

Total assets

$26

Accounts payable

$2

Notes payable

4

Accrued wages

1

Long-term debt

9

Stockholder's equity

10

Total liabilities and stockholder's equity

$26

CMA EXAMINATION QUESTIONS

June 30

$4

4

10

11

$29

$3

3

2

11

10

$29

From January 1 to June 30, the net working capital (M)

A. Decreased by $1 million.

C. Increased by $1 million.

B. Stayed the same.

D. Increased by $2 million.

CIA 1192 IV-52

Covenant Limitation

Maximum Loan Availment

*. It is the policy of Franz Corp. that the current ratio cannot fall below 1.5 to 1.0. Its current

liabilities are P400,000 and the present current ratio is 2 to 1. How much is the maximum level

of new short-term loans it can secure without violating the policy? (M)

a. P400,000

c. P266,667

b. P300,000

d. P800,000

RPCPA 1096

5

A firm's current ratio is currently 1.70 to 1. Management knows it cannot violate a working

capital restriction contained in its bond indenture. If the firm's current ratio falls below 1.40 to 1,

technically it will have defaulted. If current liabilities are $200 million, the maximum new

commercial paper that can be issued to finance inventory expansion is (M)

A. $80 million.

C. $150 million.

B. $370 million.

D. $280 million.

Gleim

6

A firm's current ratio is currently 1.75 to 1. Management knows it cannot violate a working

capital restriction contained in its bond indenture. If the firm's current ratio falls below 1.5 to 1,

technically it will have defaulted. If current liabilities are $250 million, the maximum new

commercial paper that can be issued to finance inventory expansion is (M)

A. $375.00 million.

C. $562.50 million.

B. $125.00 million.

D. $437.50 million. CMA 0683 1-8, 1292 1-23

7

Management of a company does not want to violate a working capital restriction contained in

its bond indenture. If the firm's current ratio falls below 2.0 to 1, technically it will have

defaulted. The firm's current ratio is now 2.2 to 1. If current liabilities are $200 million, the

maximum new commercial paper that can be issued to finance inventory expansion is (M)

A. $20 million.

C. $240 million.

B. $40 million.

D. $180 million.

Gleim

8

Iken Berry Farms has $5 million in current assets, $3 million in current liabilities, and its initial

inventory level is $1 million. The company plans to increase its inventory, and it will raise

additional short-term debt (that will show up as notes payable on the balance sheet) to purchase

the inventory. Assume that the value of the remaining current assets will not change. The

company’s bond covenants require it to maintain a current ratio that is greater than or equal to

.

.

.

.

Page 1 of 60

MANAGEMENT ADVISORY SERVICES

WORKING CAPITAL FINANCE

1.5. What is the maximum amount that the company can increase its inventory before it is

restricted by these covenants?

a. $0.50 million

d. $1.66 million

b. $1.00 million

e. $2.33 million

c. $1.33 million

Brigham

Maximum Cash Dividend

9

. MFC Corporation has 100,000 shares of stock outstanding. Below is part of MFC’s Statement

of Financial Position for the last fiscal year.

MFC Corporation

Statement of Financial Position – Selected Items

December 31, 1996

Cash

Accounts receivable

Inventory

Prepaid assets

$455,000

900,000

650,000

45,000

Accrued liabilities

285,000

Accounts payable

550,000

Current portion, long-term notes payable

65,000

What is the maximum amount MFC can pay in cash dividends per share and maintain a

minimum current ratio of 2 to 1? Assume that all accounts other than cash remain unchanged.

(M)

a. $2.05

c. $3.35

b. $2.50

d. $3.80

CMA 0697 1-16

Effect of Plant Expansion on Working Capital

10

. Shaw Corporation is considering a plant expansion that will increase its sales and net income.

The following data represent management’s estimate of the impact the proposal will have on

the company:

Current

Proposal

Cash

$ 100,000

$ 120,000

Accounts payable

350,000

430,000

Accounts receivable

400,000

500,000

Inventory

380,000

460,000

Marketable securities

200,000

200,000

Mortgage payable (current)

175,000

325,000

CMA EXAMINATION QUESTIONS

Fixed assets

2,500,000

Net income

500,000

The effect of the plant expansion of Shaw’s working capital will be a(n) (M)

a. Decrease of $150,000.

c. Increase of $30,000.

b. Decrease of $30,000.

d. Increase of $120,000.

3,500,000

650,000

CMA 1292 1-22

11

. Finan Corporation's management is considering a plant expansion that will increase its sales

and have commensurate impact on its net working capital position. The following information

presents management's estimate of the impact the proposal will have on Finan.

Current

Proposal

Cash

$ 100,000

$ 110,000

Accounts payable

400,000

470,000

Accounts receivable

560,000

690,000

Inventory

350,000

380,000

Marketable securities

200,000

200,000

Fixed assets

2,500,000

3,500,000

Net income

500,000

650,000

The impact of the plant expansion on Finan's working capital would be (M)

A. A decrease of $100,000.

C. An increase of $100,000.

B. A decrease of $950,000.

D. An increase of $950,000. CMA 1286 1-29

. The Herb Salter Corporation is considering a plant expansion that will increase its sales and

net income. The following data represent management's estimate of the impact the proposal

will have on the company:

Current

Proposed

Cash

$ 120,000

$ 140,000

Accounts payable

360,000

450,000

Accounts receivable

400,000

550,000

Inventory

360,000

420,000

Marketable securities

180,000

180,000

Mortgage payable (current)

160,000

310,000

Fixed assets

2,300,000

3,200,000

Net income

400,000

550,000

The effect of the plant expansion on Salter's working capital will be a(n) (M)

A. Increase of $240,000

C. Increase of $230,000

B. Decrease of $10,000

D. Increase of $10,000

Gleim

12

Page 2 of 60

MANAGEMENT ADVISORY SERVICES

WORKING CAPITAL FINANCING POLICY

Moderate

13

. Wildthing Amusement Company’s total assets fluctuate between $320,000 and $410,000,

while its fixed assets remain constant at $260,000. If the firm follows a maturity matching or

moderate working capital financing policy, what is the likely level of its long-term financing? (E)

a. $ 90,000

d. $410,000

b. $260,000

e. $320,000

c. $350,000

Brigham

Conservative

23. Great Company has P8,000,000 in current assets, P3,500,000 of which are considered

permanent current assets. In addition, the firm has P6,000,000 invested in fixed assets. Great

Company wishes to finance all fixed assets and permanent current assets plus half of its

temporary current assets with long-term financing costing 15%. Short-term financing currently

costs 10%. Great Company’s earnings before interest and taxes are P2,200,000. Income tax

rate is 40%.

How much would Real Company’s earnings after taxes be under this financing plan?

A. P112,500

C. P225,000

B. P127,500

D. P85,000

Pol Bobadilla

Aggressive

49. Normal Company has total fixed assets of P100,000 and no current liabilities. The table below

displays its wide variation in current asset components:

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Cash

P 20,000

P 10,000

P 15,000

P 20,000

Accounts receivable

66,000

25,000

47,000

88,000

Inventory

20,000

65,000

59,000

10,000

Total

P106,000

P100,000

P121,000

P118,000

If Normal’s policy is to finance all fixed assets and half the permanent current assets with longterm financing and the rest with short-term financing, what is the level of long-term financing?

(D)

A. P68,000

C. P150,000

B. P100,000

D. P155,625

Pol Bobadilla

Working Capital Policy Options

14

. Mason Company's board of directors has determined 4 options to increase working capital

next year. Option 1 is to increase current assets by $120 and decrease current liabilities by

$50. Option 2 is to increase current assets by $180 and increase current liabilities by $30.

CMA EXAMINATION QUESTIONS

WORKING CAPITAL FINANCE

Option 3 is to decrease current assets by $140 and increase current liabilities by $20. Option 4

is to decrease current assets by $100 and decrease current liabilities by $75. Which option

should Mason choose to maximize net working capital?

A. Option 1.

C. Option 3.

B. Option 2.

D. Option 4.

Gleim

15

. Jarrett Enterprises is considering whether to pursue a restricted or relaxed current asset

investment policy. The firm’s annual sales are $400,000; its fixed assets are $100,000; debt

and equity are each 50 percent of total assets. EBIT is $36,000, the interest rate on the firm’s

debt is 10 percent, and the firm’s tax rate is 40 percent. With a restricted policy, current assets

will be 15 percent of sales. Under a relaxed policy, current assets will be 25 percent of sales.

What is the difference in the projected ROEs between the restricted and relaxed policies? (M)

a. 0.0%

d. 1.6%

b. 6.2%

e. 3.8%

c. 5.4%

Brigham

Comprehensive

Questions 56 thru 61 are based on the following information.

Gitman

Irish Air Services has determined several factors relative to its asset and financing mix.

The firm earns 10 percent annually on its current assets.

The firm earns 20 percent annually on its fixed assets.

The firm pays 13 percent annually on current liabilities.

The firm pays 17 percent annually on long-term funds.

The firm's monthly current, fixed and total asset requirements for the previous year are

summarized in the table below:

Month

Current Assets

Fixed Assets

Total Assets

January

$45,000

$100,000

$145,000

February

40,000

100,000

140,000

March

50,000

100,000

150,000

April

55,000

100,000

155,000

May

60,000

100,000

160,000

June

75,000

100,000

175,000

July

75,000

100,000

175,000

August

75,000

100,000

175,000

September

60,000

100,000

160,000

October

55,000

100,000

155,000

November

50,000

100,000

150,000

December

50,000

100,000

150,000

Page 3 of 60

MANAGEMENT ADVISORY SERVICES

WORKING CAPITAL FINANCE

B. 3:1

56. The firm's monthly average permanent funds requirement is (E)

A. $100,000.

C. $140,000.

B. $57,500.

D. $157,500.

63. The firm's initial net working capital is

A. -$ 5,000.

B. $13,000.

57. The firm's monthly average seasonal funds requirement is (M)

A. $17,500.

C. $40,000.

B. $57,500.

D. $157,500.

65. If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital

would _____, the annual profits on total assets would _____, and the risk of technical

insolvency would _____, respectively.

A. increase; decrease; increase

C. increase; decrease; decrease

B. decrease; increase; decrease

D. decrease; increase; increase

59. The firm's annual financing costs of conservative financing strategy is (M)

A. $22,775.

C. $29,750.

B. $26,075.

D. $21,175.

60. The firm's annual profits on total assets for the previous year was (M)

A. $20,000.

C. $23,625.

B. $21,500.

D. $25,750.

61. If the firm's current liabilities in December were $40,000, the net working capital was (E)

A. $140,000.

C. $10,000.

B. $60,000.

D. -$10,000.

Assets

Current assets

Fixed assets

Gitman

Liabilities & Equity

$10,000

Current Liabilities

$ 5,000

20,000

Long-term debt

12,000

Equity

13,000

Total

$30,000 Total

$30,000

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current

liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

62. The firm's initial ratio of current to total asset is _____.

A. 1:3

C. 2:3

CMA EXAMINATION QUESTIONS

C. $ 5,000.

D. $10,000.

64. The firm's initial annual profits on total assets is

A. $2,500.

C. $3,000.

B. $3,500.

D. $4,500.

58. The firm's annual financing costs of the aggressive financing strategy is (M)

A. $21,175.

C. $24,475.

B. $26,075.

D. $22,775.

Questions 62 thru 68 are based on the following information.

Flum Packages, Inc.

D. 3:2

66. If the firm was to shift $7,000 of fixed assets to current assets, the firm's net working capital

would _____, the annual profits on total assets would _____, and the risk of not being able to

meet current obligations would _____, respectively.

A. increase; decrease; increase

C. increase; decrease; decrease

B. decrease; increase; decrease

D. decrease; increase; increase

67. If the firm was to shift $2,000 of current liabilities to long-term funds, the firm's net working

capital would _____, the annual cost of financing would _____, and the risk of technical

insolvency would _____, respectively.

A. decrease; decrease; increase

C. decrease; increase; decrease

B. increase; increase; decrease

D. increase; decrease; decrease

68. The firm would like to increase its current ratio. This goal would be accomplished most

profitably by

A. increasing current liabilities.

C. increasing current assets.

B. decreasing current liabilities.

D. decreasing current assets.

CASH MANAGEMENT

Cash Conversion Cycle

29. A firm has an average age of inventory of 60 days, an average collection period of 45 days,

and an average payment period of 30 days. The firm's cash conversion cycle is ______ days.

(E)

Page 4 of 60

MANAGEMENT ADVISORY SERVICES

A. 15

B. 45

WORKING CAPITAL FINANCE

C. 75

D. 135

34. A firm has an average age of inventory of 101 days, an average collection period of 49 days,

and an average payment period of 60 days. The firm's cash conversion cycle is (E)

A. 150 days.

C. 112 days.

B. 90 days.

D. 8 days

Gitman

37. A firm has an average age of inventory of 20 days, an average collection period of 30 days,

and an average payment period of 60 days. The firm's cash conversion cycle is _____ days.

(E)

A. 70

C. -10

B. 50

D. 110

Gitman

16

. If the average age of inventory is 60 days, the average age of the accounts payable is 30

days, and the average age of accounts receivable is 45 days, the number of days in the cash

flow cycle is (E)

A. 135 days.

C. 75 days.

B. 90 days.

D. 105 days.

Gleim

17

. If the average days of inventory is 90 days, the average age of accounts payable is 60 days,

and the average age of accounts receivable is 65 days, the number of days in the cash flow

cycle is (E)

a. 215 days

c. 95 days

b. 150 days

d. 85 days

CMA 1284 1-20, RPCPA 1096

18

. For the Cook County Company, the average age of accounts receivable is 60 days, the

average age of accounts payable is 45 days, and the average age of inventory is 72 days.

Assuming a 360-day year, what is the length of the firm’s cash conversion cycle? (E)

a. 87 days

d. 48 days

b. 90 days

e. 66 days

c. 65 days

Brigham

19

. A growing company is assessing current working capital requirements. An average of 58 days

is required to convert raw materials into finished goods and to sell them. Then an average of

32 days is required to collect on receivables. If the average time the company takes to pay for

its raw materials is 15 days after they are received, then the total cash conversion cycle for this

company is (E)

CMA EXAMINATION QUESTIONS

A. 11 days.

B. 41 days.

Gitman

20.

C. 75 days.

D. 90 days.

CIA 0596 IV-53

Spartan Sporting Goods has $5 million in inventory and $2 million in accounts receivable. Its average daily sales are $100,000. The company’s payables deferral

period (accounts payable divided by daily purchases) is 30 days. What is the length of the company’s cash conversion cycle?

a. 100 days

b. 60 days

c. 50 days

d.

e.

(E)

40 days

33 days

Brigham

31. A firm purchased raw materials on account and paid for them within 30 days. The raw

materials were used in manufacturing a finished good sold on account 100 days after the raw

materials were purchased. The customer paid for the finished good 60 days later. The firm's

cash conversion cycle is ______ days. (M)

A. 10

C. 130

B. 70

D. 190

Gitman

87. A firm with a cash conversion cycle of 175 days can stretch its average payment period from

30 days to 45 days. This will result in a(n) _____ in the cash conversion cycle of _____ days.

(M)

A. increase, 15

C. increase, 45

B. decrease, 15

D. decrease, 45

Gitman

21

. Porta Stadium Inc. has annual sales of $40,000,000 and keeps average inventory of

$10,000,000. On average, the firm has accounts receivable of $8,000,000. The firm buys all

raw materials on credit, its trade credit terms are net 30 days, and it pays on time. The firm’s

managers are searching for ways to shorten the cash conversion cycle. If sales can be

maintained at existing levels but inventory can be lowered by $2,000,000 and accounts

receivable lowered by $1,000,000, what will be the net change in the cash conversion cycle?

Use a 360-day year. (M)

a. +105 days

d. -27 days

b. -105 days

e. -3 days

c. +27 days

Brigham

22

. Bully Corporation purchases raw materials on July 1. It converts the raw materials into

inventory by September 30. However, Bully pays for the materials on July 20. On October 31,

it sells the finished goods inventory. Then, the firm collects cash from the sale 1 month later on

November 30. If this sequence accurately represents the average working capital cycle, what

is the firm's cash conversion cycle in days? (D)

Page 5 of 60

MANAGEMENT ADVISORY SERVICES

A. 92 days.

B. 133 days.

WORKING CAPITAL FINANCE

C. 123 days.

D. 153 days.

c. -13 days

Brigham

Gleim

26

23

. You have recently been hired to improve the performance of Multiplex Corporation, which has

been experiencing a severe cash shortage. As one part of your analysis, you want to

determine the firm’s cash conversion cycle. Using the following information and a 360-day

year, what is your estimate of the firm’s current cash conversion cycle? (M)

Current inventory = $120,000.

Annual sales = $600,000.

Accounts receivable = $160,000.

Accounts payable = $25,000.

Total annual purchases = $360,000.

Purchases credit terms: net 30 days.

Receivables credit terms: net 50 days.

a. 49 days

d. 168 days

b. 193 days

e. 143 days

c. 100 days

Brigham

24

. Gaston Piston Corp. has annual sales of $50,000,000 and maintains an average inventory

level of $15,000,000. The average accounts receivable balance outstanding is $10,000,000.

The company makes all purchases on credit and has always paid on the 30th day. The

company is now going to take full advantage of trade credit and pay its suppliers on the 40th

day. If sales can be maintained at existing levels but inventory can be lowered by $2,000,000

and accounts receivable lowered by $2,000,000, what will be the net change in the cash

conversion cycle? (Assume there are 360 days in the year.) (M)

a. -14.4 days

d. -25.6 days

b. -18.8 days

e. -38.8 days

c. -28.8 days

Brigham

25

. Kolan Inc. has annual sales of $36,500,000 ($100,000 a day on a 365-day basis). On average,

the company has $12,000,000 in inventory and $8,000,000 in accounts receivable. The company

is looking for ways to shorten its cash conversion cycle, which is calculated on a 365-day basis.

Its CFO has proposed new policies that would result in a 20 percent reduction in both average

inventories and accounts receivables. The company anticipates that these policies will also

reduce sales by 10 percent. Accounts payable will remain unchanged. What effect would these

policies have on the company’s cash conversion cycle? (M)

a. -40 days

d. +22 days

b. -22 days

e. +40 days

CMA EXAMINATION QUESTIONS

. Jordan Air Inc. has average inventory of $1,000,000. Its estimated annual sales are 12 million and

the firm estimates its receivables conversion period to be twice as long as its inventory conversion

period. The firm pays its trade credit on time; its terms are net 30. The firm wants to decrease its

cash conversion cycle by 10 days. It believes that it can reduce its average inventory to $900,000.

Assume a 360-day year and that sales will not change. By how much must the firm also reduce its

accounts receivable to meet its goal of a 10-day reduction? (D)

a. $ 101,900

d. $ 333,520

b. $1,000,000

e. $

0

c. $ 233,333

Brigham

209.A firm has arranged for a lockbox system to reduce collection time of accounts receivable.

Currently the firm has an average collection period of 43 days, an average age of inventory of

50 days, and an average payment period of 10 days. The lockbox system will reduce the

average collection period by 3 days by reducing processing, mail, and clearing float. The

firm's cash conversion cycle _____. (E)

A. increases by 3 days

C. will not change

B. decreases by 3 days

D. is 93 days

Annual Savings

81. A firm has annual operating outlays of $1,800,000 and a cash conversion cycle of 60 days. If

the firm currently pays 12 percent for negotiated financing and reduces its cash conversion

cycle to 50 days, the annual savings is

A. $ 50,000

C. $ 6,000.

B. $200,000

D. $216,000.

Gitman

82. A firm has a cash conversion cycle of 60 days. Annual outlays are $12 million and the cost of

negotiated financing is 12 percent. If the firm reduces its average age of inventory by 10 days,

the annual savings is ______.

A. $104,000

C. $ 28,800

B. $144,000

D. $40,000

Gitman

Cash Flow

27

. FLF Corporation had income before taxes of $50,000. Included in the calculation of this

amount was depreciation of $6,000, a charge of $7,000 for the amortization of bond discounts,

and $5,000 for interest paid. The estimated pretax cash flow for the period is (M)

A. $50,000

C. $37,000

Page 6 of 60

MANAGEMENT ADVISORY SERVICES

B. $57,000

WORKING CAPITAL FINANCE

D. $63,000

Gleim

28

. RLF Corporation had income before taxes of $60,000 for the year 1991. Included in this

amount was depreciation of $5,000, a charge of $6,000 for amortization of bond discounts,

and $4,000 for interest expense. The estimated cash flow for the period is (M)

a. $60,000.

c. $49,000.

b. $66,000.

d. $71,000.

CMA 0692 1-26

Q

5. Suppose that the interest rate on Treasury bills is 6%, and every sale of bills costs $60. You

pay out cash at a rate of $800,000 a year. According to Baumol's model of cash balances,

what is Q?

A. $17,376

D. $50,000

B. $20,000

E. $40,000

C. $10,000

B&M

29

. Shown below is a forecast of sales for Cooper Inc. for the first 4 months of the year (all

amounts are in thousands of dollars).

January

February

March

April

Cash sales

$ 15

$ 24

$18

$14

Sales on credit

100

120

90

70

On average, 50% of credit sales are paid for in the month of sale, 30% in the month following

the sale, and the remainder is paid 2 months after the month of sale. Assuming there are no

bad debts, the expected cash inflow for Cooper in March is (M)

A. $138,000

C. $119,000

B. $122,000

D. $108,000

CMA 1295 1-8

Baumol’s Model of Cash Balances

Number of Conversions

7. Suppose that the interest rate on Treasury bills is 6%, and every sale of bills costs $20. You

pay out cash at a rate of $400,000 a month. According to Baumol's model of cash balances,

how many times a month should you sell bills?

A. 30

C. 7

B. 20

D. 4

B&M

6. Suppose that the interest rate on Treasury bills is 4%, and every sale of bills costs $40. You

pay out cash at a rate of $1,000,000 a quarter. According to Baumol's model of cash

balances, how many times a quarter should you sell bills? (Approximately.)

A. 20

C. 12

B. 22

D. 11

B&M

4. Suppose that the interest rate on Treasury bills is 6%, and every sale of bills costs $60. You

pay out cash at a rate of $800,000 a year. According to Baumol's model of cash balances,

how many times a year should you sell bills?

A. 20

C. 50

B. 35

D. 15

B&M

CMA EXAMINATION QUESTIONS

8. Suppose that the interest rate on Treasury bills is 6%, and every sale of bills costs $20. You

pay out cash at a rate of $400,000 a month. According to Baumol's model of cash balances,

what is Q?

A. $16,000

D. $43,000

B. $24,000

E. $57,000

C. $31,000

B&M

Float

Availability Float

18. On an average day, a company writes checks totaling $1,500. These checks take 7 days to

clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The

cost of debt is 9%. What is the firm's availability float?

A. $10,500

C. $1,800

B. $7,200

D. None of the above

B&M

Disbursement Float

17. On an average day, a company writes checks totaling $1,500. These checks take 7 days to

clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The

cost of debt is 9%. What is the firm's disbursement float?

A. $10,500

C. $1,800

B. $1,500

D. None of the above

B&M

20. H. Pottamus, Inc., has $2 million on deposit with the bank. It now writes checks for $100,000

and $200,000 and deposits a check for $80,000. Two weeks later it learns that the $200,000

check and $80,000 check have cleared. What is the company's disbursement float?

A. $300,000

C. $100,000

B. $220,000

D. -$100,000

B&M

Net Float

Page 7 of 60

MANAGEMENT ADVISORY SERVICES

19. On an average day, a company writes checks totaling $1,500. These checks take 7 days to

clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The

cost of debt is 9%. What is the firm's net float?

A. $300

C. $2,100

B. $3,300

D. $1,200

B&M

WORKING CAPITAL FINANCE

B. $350

D. $40,000

Gleim

Questions 2 and 3 are based on the following information.

CIA 0595 IV-45 & 46

A company has a 10% cost of borrowing and incurs fixed costs of $500 for obtaining a loan. It has

stable, predictable cash flows, and the estimated total amount of net new cash needed for

transactions for the year is $175,000. The company does not hold safety stocks of cash.

30

. Assume that each day a company writes and receives checks totaling $10,000. If it takes 5

days for the checks to clear and be deducted from the company's account, and only 4 days for

the deposits to clear, what is the float? (E)

A. $10,000

C. $(10,000)

B. $0

D. $50,000

CMA 0694 1-24

31

. Average daily collection of checks for a firm is $40,000. The firm also writes on the average

$35,000 of checks daily. If the collection period for checks is 5 days, calculate the net float. (E)

A. $25,000

C. $175,000

B. $40,000

D. $200,000

Gleim

32

. Jumpdisk Company writes checks averaging $15,000 a day, and it takes five days for these

checks to clear. The firm also receives checks in the amount of $17,000 per day, but the firm

loses three days while its receipts are being deposited and cleared. What is the firm’s net float

in dollars? (E)

a. $126,000

d. $ 24,000

b. $ 75,000

e. $ 16,000

c. $ 32,000

Brigham

Annual Savings

12. As part of a union negotiation agreement, the United Clerical Workers Union conceded to be

paid every two weeks instead of every week. A major firm employing hundreds of clerical

workers had a weekly payroll of $1,000,000 and the cost of short-term funds was 12 percent.

The effect of this concession was to delay clearing time by one week. Due to the concession,

the firm

A. realized an annual loss of $120,000.

C. increased its cash cycle.

B. realized an annual savings of $120,000. D. decreased its cash turnover.

Gitman

Opportunity Cost

33

. What is the opportunity cost of keeping a cash balance of $2 million, if the daily interest rate is

0.02% and the average transaction cost of investing money overnight is $50? (E)

A. $50

C. $400

CMA EXAMINATION QUESTIONS

34

. When the average cash balance of the company is higher, the <List A> the cash balance is

<List B>.

List A

List B

A.

Opportunity cost of holding

Higher

B.

Total transactions costs associated with obtaining

Higher

C.

Opportunity cost of holding

Lower

D.

Total costs of holding

Lower

35

. If the average cash balance for the company during the year is $20,916.50, the opportunity

cost of holding cash for the year will be

A. $2,091.65

C. $8,750.00

B. $4,183.30

D. $17,500.00

Lock Box Service

Increase in Average Cash Balance

36

. CMR is a retail mail order firm that currently uses a central collection system that requires all

checks to be sent to its Boston headquarters. An average of 5 days is required for mailed

checks to be received, 4 days for CMR to process them and 1½ days for the checks to clear

through its bank. A proposed lockbox system would reduce the mail and process time to 3

days and the check clearing time to 1 day. CMR has an average daily collection of $100,000. If

CMR should adopt the lockbox system, its average cash balance would increase by (E)

a. $250,000.

c. $650,000.

b. $400,000.

d. $800,000.

CMA 1286 1-30

37

. DLF is a retail mail order firm that currently uses a central collection system that requires all

checks to be sent to its Boston headquarters. An average of 6 days is required for mailed

checks to be received, 3 days for DLF to process them, and 2 days for the checks to clear

through its bank. A proposed lockbox system would reduce the mailing and processing time to

2 days and the check clearing time to 1 day. DLF has an average daily collection of $150,000.

If DLF adopts the lockbox system, its average cash balance will increase by (E)

A. $1,200,000

C. $600,000

Page 8 of 60

MANAGEMENT ADVISORY SERVICES

B. $750,000

WORKING CAPITAL FINANCE

D. $450,000

Gleim

Daily Income (Loss)

24. Assume that the average number of daily payments to a lock-box is 200, the average size of

the payment is $1,000, the rate of interest per day is 0.02% (i.e., 0.0002), the savings in mail

time is 2 days, and the savings in processing time is 1 day. What is the daily return from

operating the lock-box?

A. $80

C. $120

B. $100

D. $130

B&M

Increase in Annual Income (Loss)

38

. What are the expected annual savings from a lockbox system that collects 200 checks per day

averaging $500 each, and reduces mailing and processing times by 2.0 and 0.5 days,

respectively, if the annual interest rate is 6%? (E)

A. $250,000

C. $6,000

B. $12,000

D. $15,000

Gleim

39

. A firm has daily cash receipts of $300,000. A bank has offered to provide a lockbox service

that will reduce the collection time by 3 days. The bank requires a monthly fee of $2,000 for

providing this service. If money market rates are expected to average 6% during the year, the

additional annual income (loss) of using the lockbox service is (E)

A. ($24,000)

C. $30,000

B. $12,000

D. $54,000

Gleim

40

. Foster Inc. is considering implementing a lock box collection system at a cost of $80,000 per

year. Annual sales are $90 million, and the lockbox system will reduce collection time by 3

days. If Foster can invest funds at 8%, should it use the lockbox system? Assume a 360-day

year. (E)

a. Yes, producing savings of $140,000 per year.

b. Yes, producing savings of $60,000 per year.

c. No, producing a loss of $20,000 per year.

d. No, producing a loss of $60,000 per year.

CMA 1295 1-14

41

. Cross Collectibles currently fills mail orders from all over the U. S. and receipts come in to

headquarters in Little Rock, Arkansas. The firm’s average accounts receivable (A/R) is $2.5

million and is financed by a bank loan with 11 percent annual interest. Cross is considering a

regional lockbox system to speed up collections that it believes will reduce A/R by 20 percent.

The annual cost of the system is $15,000. What is the estimated net annual savings to the firm

from implementing the lockbox system? (M)

a. $500,000

d. $ 55,000

b. $ 30,000

e. $ 40,000

c. $ 60,000

Brigham

42

. A company has daily cash receipts of $150,000. The treasurer of the company has

investigated a lock box service whereby the bank that offers this service will reduce the

company’s collection time by four days at a monthly fee of $2,500. If money market rates

average 4% during the year, the additional annual income (loss) from using the lock box

service would be (E)

a. $6,000.

c. $12,000.

b. $(6,000).

d. $(12,000).

CMA 0694 1-19

43

. A banker has offered to set up and operate a lock box system for your company. Details are

given below. Estimate the annual savings.

Average number of daily payments

325

Average size of payments

$1,250

Daily interest rate

0.021%

Saving in mailing time

1.3 days

Saving in processing time

0.9 days

Bank charges

$0.30

Assume 250 processing days per year. (M)

A. $3,273

C. $23,500

B. $22,675

D. $47,000

Gleim

44

. Cleveland Masks and Costumes Inc. (CMC) has a majority of its customers located in the

states of California and Nevada. Keystone National Bank, a major west coast bank, has

agreed to provide a lockbox system to CMC at a fixed fee of $50,000 per year and a variable

fee of $0.50 for each payment processed by the bank. On average, CMC receives 50

payments per day, each averaging $20,000. With the lockbox system, the company's

collection float will decrease by 2 days. The annual interest rate on money market securities is

6%. If CMC makes use of the lockbox system, what would be the net benefit to the company?

Use 365 days per year. (M)

A. $59,125

C. $50,000

B. $60,875

D. $120,000

CMA Samp Q1-6

Optimal Lock-Box Alternative

CMA EXAMINATION QUESTIONS

Page 9 of 60

MANAGEMENT ADVISORY SERVICES

WORKING CAPITAL FINANCE

45

. Newman Products has received proposals from several banks to establish a lockbox system to

speed up receipts. Newman receives an average of 700 checks per day averaging $1,800

each, and its cost of short-term funds is 7% per year. Assuming that all proposals will produce

equivalent processing results and using a 360-day year, which one of the following proposals

is optimal for Newman? (M)

CMA 0697 1-13

a. A $0.50 fee per check.

c. A fee of 0.03% of the amount collected.

b. A flat fee of $125,000 per year.

d. A compensating balance of $1,750,000

46

. A firm has daily cash receipts of $300,000 and is interested in acquiring a lockbox service in

order to reduce collection time.

Bank 1's lockbox service costs $3,000 per month and will reduce collection time by 3

days.

Bank 2's lockbox service costs $5,000 per month and will reduce collection time by 4

days.

Bank 3's lockbox service costs $500 per month and will reduce collection time by 1 day.

Bank 4's lockbox service costs $1,000 per month and will reduce collection time by 2

days.

If money market rates are expected to average 6% during the year, and the firm wishes to

maximize income, which bank should the firm choose? (M)

A. Bank 1.

C. Bank 3.

B. Bank 2.

D. Bank 4.

Gleim

Other Cash Management Systems

Change in Profit (Loss)

*. QRS makes large cash payments averaging P17,000 daily. The company changed from using

checks to sight drafts which will permit it to hold unto its cash for one extra day. If QRS can

use the extra cash to earn 14% annually, what annual peso return will it earn? (E)

a. P652.10

c. P6.52

b. P6,521.00

d. P2,380

RPCPA 1097

47

. What is the benefit for a firm with daily sales of $15,000 to be able to reduce the collection

period by 2 days, given an 8% annual opportunity cost of funds? (M)

A. $2,400 annual benefit.

C. $600 annual benefit.

B. $1,200 annual benefit.

D. $7,500 annual benefit.

Gleim

48

. A firm has daily cash receipts of $100,000 and collection time of 2 days. A bank has offered to

decrease the collection time on the firm’s deposits by two days for a monthly fee of $500. If

CMA EXAMINATION QUESTIONS

money market rates are expected to average 6% during the year, the net annual benefit loss)

from having this service is (M)

a. $3,000

c. $0

b. $12,000

d. $6,000

CMA 0696 1-12

49

. A firm has daily cash receipts of $200,000. A commercial bank has offered to reduce the

collection time by 3 days. The bank requires a monthly fee of $4,000 for providing this service.

If money market rates will average 12% during the year, the additional annual income (loss) of

having the service is (M)

A. $(24,000).

C. $66,240.

B. $24,000.

D. $68,000.

CMA 0683 1-7

50

. A firm has daily cash receipts of $300,000. A commercial bank has offered to reduce the

collection time by 2 days. The bank requires a monthly fee of $3,000 for providing this service.

If the money market rates will average 11% during the year, the annual pretax income (loss)

from using the service is (M)

A. $(30,000)

C. $66,000

B. $30,000

D. $63,000

Gleim

Point of Indifference

51

. Average daily cash outflows are $3 million for Farms Inc. A new cash management system

can add 2 days to the disbursement schedule. Assuming Farms earns 10% on excess funds,

how much should the firm be willing to pay per year for the cash management system. (E)

a. $6,000,000.

c. $1,500,000.

b. $3,000,000.

d. $600,000.

CMA 1295 1-3

52

. Troy Toys is a retailer operating in several cities. Its individual store managers deposit daily

collections at a local bank in a noninterest-bearing checking account. Twice per week, the

local bank issues a depository transfer check (DTC) to the central bank at headquarters. The

controller of the company is considering using a wire transfer instead. The additional cost of

each transfer would be $25; collections would be accelerated by two days; and an annual

interest rate paid by the central bank is 7.2% (0.02% per day). At what amount of dollars

transferred would it be economically feasible to use a wire transfer instead of the DTC?

Assume a 360-day year. (M)

CMA 1294 1-17

a. It would never be economically feasible. c. Any amount greater than $173.

b. $125,000 or above.

d. Any amount greater than $62,500

Page 10 of 60

MANAGEMENT ADVISORY SERVICES

53

. Best Computers believes that its collection costs could be reduced through modification of

collection procedures. This action is expected to result in a lengthening of the average

collection period from 28 days to 34 days; however, there will be no change in uncollectible

accounts. The company's budgeted credit sales for the coming year are $27,000,000, and

short-term interest rates are expected to average 8%. To make the changes in collection

procedures cost beneficial, the minimum savings in collection costs (using a 360-day year) for

the coming year would have to be (M)

A. $30,000.

C. $180,000.

B. $360,000.

D. $36,000.

CMA 1292 1-20

54

. Best Computers believes that its collection costs could be reduced through modification of

collection procedures. This action is expected to result in a lengthening of the average

collection period from 30 to 35 days; however, there will be no change in uncollectible

accounts, or in total credit sales. Furthermore, the variable cost ratio is 60%, the opportunity

cost of a longer collection period is assumed to be negligible, the company's budgeted credit

sales for the coming year are $45,000,000, and the required rate of return is 6%. To justify

changes in collection procedures, the minimum annual reduction of costs (using a 360-day

year and ignoring taxes) must be (M)

A. $375,000

C. $125,000

B. $37,500

D. $22,500

Gleim

Checking Accounts

55

. Kemple is a newly established janitorial firm, and the owner is deciding what type of checking

account to open. Kemple is planning to keep a $500 minimum balance in the account for

emergencies and plans to write roughly 80 checks per month. The bank charges $10 per

month plus a $0.10 per check charge for a standard business checking account with no

minimum balance. Kemple also has the option of a premium business checking account that

requires a $2,500 minimum balance but has no monthly fees or per check charges. If

Kemple’s cost of funds is 10%, which account should Kemple choose?

a. Standard account, because the savings is $34 per year.

b. Premium account, because the savings is $34 per year.

c. Standard account, because the savings is $16 per year.

d. Premium account, because the savings is $16 per year.

CMA 0697 1-20

Economic Conversion Quantity (ECQ)

Optimum Conversion Size

WORKING CAPITAL FINANCE

47. Gear Inc.. has a total annual cash requirement of P9,075,000 which are to be paid uniformly.

Gear has the opportunity to invest the money at 24% per annum. The company spends, on the

average, P40 for every cash conversion to marketable securities.

What is the optimal cash conversion size?

a. P60,000

c. P55,000

b. P45,000

d. P72,500

Pol Bobadilla

Average Cash Balance

56

. A company uses the following formula in determining its optimal level of cash.

2bt

C*=

i

If b = fixed cost per transaction

i = interest rate on marketable securities

t = total demand for cash over a period of time

This formula is a modification of the economic order quantity (EOQ) formula used for inventory

management. Assume that the fixed cost of selling marketable securities is $10 per

transaction and the interest rate of marketable securities is 6% per year. The company

estimates that it will make cash payments of $12,000 over a one-month period. What is the

average cash balance (rounded to the nearest dollar)? (E)

a. $1,000

c. $3,464

b. $2,000

d. $6,928

CMA 0696 1-10

47. Mott Co. has a total annual cash requirement of P9,075,000 which are to be paid uniformly.

Mott has the opportunity to invest the money at 24% per annum. The company spends, on the

average, P40 for every cash conversion to marketable securities.

What is the optimum average cash balance?

a. P60,000

c. P45,000

b. P55,000

d. P27,500

Pol Bobadilla

MARKETABLE SECURITIES

Current Price

57

. Assuming a 360 day year, the current price of its $100 U.S. Treasury bill due in 180 days on a

6% discount basis is (E)

a. $97.00

c. $100.00

b. $94.00

d. $93.00

CMA 0694 1-26

. Hendrix, Inc. is interested in purchasing a $100 U.S. Treasury bill and was presented with the

following options:

58

CMA EXAMINATION QUESTIONS

Page 11 of 60

MANAGEMENT ADVISORY SERVICES

Due Date

Discount Rate

Option 1

180 days

6%

Option 2

360 days

3.5%

Option 3

120 days

8%

Option 4

240 days

4.5%

If Hendrix wishes to buy the Treasury bill at the lowest purchasing price, which option should

be chosen, assuming a 360-day year? (M)

A. Option 1.

C. Option 3.

B. Option 2.

D. Option 4.

Gleim

Annually Compounded Rate of Return

4. The discount on a 91-Treasury bill is 5.2%. What is the annually compounded rate of return?

A. 4.8%

C. 5.4%

B. 5.2%

B&M

5. The discount on a 91-Treasury bill is 5.65%. What is the annually compounded rate of return?

A. 5.2%

C. 5.6%

B. 5.9%

D. 5.5%

B&M

6. The discount on a 91-Treasury bill is 4.83%. What is the annually compounded rate of return?

A. 4.83%

D. 5.13%

B. 4.78%

E. 5.0%

C. 1.22%

B&M

Economic Conversion Quantity

Questions 98 and 99 are based on the following information.

Gleim

Snobiz, Inc. has $2 million invested in Treasury bills yielding 8% per annum; this investment will

satisfy the firm's need for funds during the coming year.

. If it costs $50 to sell these bills, regardless of the amount, how much should be withdrawn at a

time? (E)

A. $50,000

C. $250,000

B. $100,000

D. $500,000

59

. If Snobiz, Inc. needs $167,000 a month, how frequently should the CFO sell off Treasury bills?

(M)

A. About every 3 days.

C. About every 15 days.

B. About every 9 days.

D. About every 18 days.

WORKING CAPITAL FINANCE

Yield on Floating-rate Preferred Stock

18. If the short-term commercial paper rate is 10% and the corporate tax rate is 35%, what yield

would a corporation require on an investment in floating-rate preferred stock? Assume the

default risk is the same as for commercial paper.

A. 15.2%

C. 7.3%

B. 10.0%

D. 6.6%

B&M

19. If the short-term commercial paper rate is 6% and the corporate tax rate is 35%, what yield

would a corporation require on an investment in floating-rate preferred stock? Assume the

default risk is the same as for commercial paper.

A. 6.0%

C. 9.2%

B. 39%

D. 4.4%

B&M

20. If the short-term commercial paper rate is 8% and the corporate tax rate is 35%, what yield

would a corporation require on an investment in floating-rate preferred stock? Assume the

default risk is the same as for commercial paper.

A. 5.8%

C. 4.6%

B. 5.3%

D. 4.4%

B&M

RECEIVABLES MANAGEMENT

Accounts Receivable Balance

*. JBJ Company’s account balance at June 30, 1987 for account receivables and related

allowances for doubtful accounts were P600,000 and P3,000 respectively. Aging of accounts

receivable indicated that P48,000 of the June 30, 1987 receivable may be uncollectible. Net

realizable value of accounts receivable were: (E)

a. P597,000

c. P539,000

b. P552,000

d. none of these

RPCPA 1087

61

. The Irwin Corporation has $3 million per year in credit sales. The company's average day's

sales outstanding is 40 days. Assuming a 360-day year, what is Irwin's average amount of

accounts receivable outstanding? (E)

A. $500,000

C. $250,000

B. $333,333

D. $75,000

Gleim

60

CMA EXAMINATION QUESTIONS

49. A company has sales of $1,800,000 (70% are credit), a gross profit ratio of 55%, an accounts

receivable turnover of 12 times, and an inventory turnover of 4 times. The average accounts

receivable balance is

Page 12 of 60

MANAGEMENT ADVISORY SERVICES

a. $202,500

b. $247,500

*.

WORKING CAPITAL FINANCE

c. $315,000

d. $450,000 ($105,000)

L&H

Ten Q’s Inc. has an inventory conversion period of 60 days, a receivable conversion period of

35 days, and a payment cycle of 26 days. If its sales for the period just ended amounted to

P972,000, what is the investment in accounts receivable? (Assume 360 days a year.) (E)

a. P85,200

c. P94,500

b. P72,450

d. P79,600

RPCPA 0595

62

. For the Flesher Company, the average age of accounts receivable is 48 days, the average age

of accounts payable is 32 days, and the average age of inventory is 59 days. Assume a 360day year. If McIntyre's annual sales are $2,050,200, what is the firm's investment in accounts

receivable? (E)

A. $96,000

C. $182,240

B. $336,005

D. $273,360

Gleim

95. Collectrite Company sells on terms 3/10, net 30. Total sales for the year are P900,000. Forty

percent of the customers pay on the tenth day and take discounts, the other 60 percent pay,

on average, 45 days after their purchases.

What is the average amount of receivables?

A. P70,000

C. P77,200

B. P77,500

D. P67,500

Pol Bobadilla

66

. A firm averages $4,000 in sales per day and is paid on an average, within 30 days of the sale.

After they receive their invoice, 55% of the customers pay in cash while the remaining 45%

pay by credit card. Approximately how much would the company have in accounts receivable

on its balance sheet on a given date? (M)

a. $4,000

c. $48,000

b. $120,000

d. $54,000

CMA 1294 1-22

*.

63

. For the Fratzie Company, the average age of accounts receivable is 48 days, the average age

of accounts payable is 32 days, and the average age of inventory is 60 days. Assume a 360day year. If Fratzie's annual sales are $2,870,280, what is the firm's investment in accounts

receivable? (E)

A. $127,567

C. $478,381

B. $382,704

D. $637,839

Gleim

Simba Corp., whose gross sales amounted to P1,200,000 sold on terms of 3/10, net 30. The

collections manager estimated that 30% of the customers pay on the 10th day and take

discounts; 40% on the 30th day; and the remaining 30% pay, on the average, 40 days after the

purchase. If management would toughen on its collection policy and require that all nondiscount customers pay on the 30th day, how much would be the receivables balance? (M)

a. P60,000

c. P70,000

b. P80,000

d. Zero

RPCPA 0595

67

64

. The company sells 10,000 units at a unit selling price of 66 annually. Assume that the average

collection period is 25 days. After the credit policy is well established, what is the expected

average accounts receivable balance for the company at any moment in time, assuming a

365-day year? (E)

A. 684.93

C. 27,123.30

B. 1,808.22

D. 45,205.48

CIA 0594 IV-36

65

. Jackson Distributors sells to retail stores on credit terms of 2/10, net/30. Daily sales average

150 units at a price of $300 each. Assuming that all sales are on credit and 60% of customers

take the discount and pay on day 10 while the rest of the customers pay on day 30. The

amount of Jackson’s account receivable is (D)

a. $1,350,000.

c. $900,000.

b. $990,000.

d. $810,000.

CMA 1295 1-6

CMA EXAMINATION QUESTIONS

. Ruth Company currently has $1,000,000 in accounts receivable. Its days sales outstanding

(DSO) is 48 days. The company wants to reduce its DSO to the industry average of 32 days

by pressuring more of its customers to pay their bills on time. The company’s CFO estimates

that if this policy is adopted the company’s average sales will fall by 10 percent. Assuming that

the company adopts this change and succeeds in reducing its DSO to 32 days and does lose

10 percent of its sales, what will be the level of accounts receivable following the change?

Assume a 360-day year. (M)

a. $600,000

d. $900,000

b. $666,667

e. $966,667

c. $750,000

Brigham

Days Receivable

68

. An organization offers its customers credit terms of 5/10 net 20. One-third of the customers

take the cash discount and the remaining customers pay on day 20. On average, 20 units are

sold per day, priced at $10,000 each. The rate of sales is uniform throughout the year. Using a

360-day year, the organization has days sales outstanding, to the nearest full day, of

Page 13 of 60

MANAGEMENT ADVISORY SERVICES

A. 13 days.

B. 15 days.

*.

WORKING CAPITAL FINANCE

C. 17 days.

D. 20 days.

CIA 1195 IV-7

Hakuna Inc. sells on terms of 3/10, net 30 days. Gross sales for the year are P2,400,000 and

the collections department estimates that 30% of the customers pay on the 10th day and take

discounts; 40% pay on the 30th day; and the remaining 30% pay, on the average, 40 days

after the purchase. Assuming 360 days per year, what is the average collection period. (M)

a. 40 days.

c. 20 days

b. 15 days.

d. 27 days.

RPCPA 0595

69

. Clauson, Inc. grants credit terms of 1/15, net 30 and projects gross sales for next year of

$2,000,000. The credit manager estimates that 40% of their customers pay on the discount

date, 40% on the net due date, and 20% pay 15 days after the net due date. Assuming

uniform sales and a 360-day year, what is the projected days’ sales outstanding rounded to

the nearest whole day? (M)

a. 20 days.

c. 27 days.

b. 24 days.

d. 30 days.

CMA 0697 1-9

Carrying Cost on Accounts Receivable

94. The Tempo Company has an inventory conversion period of 60 days, a receivable conversion

period of 30 days, and a payable payment period of 45 days. The Tempo’s variable cost is

60% and annual fixed costs of P600,000. The current cost of capital for Tempo is 12%.

If Tempo’s annual sales are P3,375,000 and all sales are on credit, what is the firm’s carrying

cost on accounts receivable, using 360 days year?

A. P281,250

C. P20,250

B. P168,750

D. P56,250

Pol Bobadilla

Days Receivable & Average Accounts Receivable Balance

70

. Sixty percent of Baco's annual sales of $900,000 is on credit. If its year-end receivables

turnover is 4.5, what is the average collection period and the year-end receivables,

respectively (assume a 365-day year)? (M)

A. 81 days and $120,000.

C. 73 days and $108,000.

B. 73 days and $120,000.

D. 81 days and $200,000.

Gleim

Questions 48 and 49 are based on the following information.

CIA 0594 IV-35 & 36

A company sells 10,000 skateboards a year at $66 each. All sales are on credit, with terms of 3/10,

net 30, that is, a 3% discount if payment is made within 10 days; otherwise full payment is due at

the end of 30 days. One half of the customers are expected to take advantage of the discount and

CMA EXAMINATION QUESTIONS

pay on day 10. The other half are expected to pay on day 30. Sales are expected to be uniform

throughout the year for both types of customers.

71

. A company sells 10,000 skateboards a year at $66 each. All sales are on credit, with terms of

3/10, net 30, which means three percent discount if payment is made within 10 days;

otherwise full payment is due at the end of 30 days. One half of the customers are expected to

take advantage of the discount and pay on day 10. The other half are expected to pay on day

30. Sales are expected to be uniform throughout the year for both types of customers. What is

the expected average collection period for the company?

A. 10 days.

C. 20 days.

B. 15 days.

D. 30 days.

72

. Assume that the average collection period is 25 days. After the credit policy is well established,

what is the expected average accounts receivable balance for the company at any point in

time, assuming a 365-day year? (E)

A. $684.93

C. $27,123.30

B. $1,808.22

D. $45,205.48

Collection Efficiency

28. A firm has annual sales of $365 million. Currently, customers take an average of 60 days to

pay. If the collection period can be permanently reduced by one day and the cost of capital is

10%, what is the increase in company value?

A. Zero

C. $500,000

B. $100,000

D. $1 million

B&M

Aging of Accounts Receivable

Questions 160 & 161 are based on the following information.

Gitman

A breakdown of Teffan, Inc.'s outstanding accounts receivable dated June 30, 2003 on the basis of

the month in which the credit sale was initially made follows. The firm extends 30-day credit terms.

Month of Credit Sale

Accounts Receivable

June, 2003

$ 410,000

May, 2003

340,000

April, 2003

270,000

March, 2003

200,000

February, 2003 or before

100,000

Total

$1,320,000

160.Accounts receivable over 90 days total

Page 14 of 60

MANAGEMENT ADVISORY SERVICES

A. $200,000.

B. $470,000.

WORKING CAPITAL FINANCE

C. $300,000.

D. $100,000.

161.An evaluation of the firm's collection efforts based on the aging schedule would suggest

A. poor credit management.

C. superior credit management.

B. satisfactory credit management.

D. overzealous collection efforts.

Customer Default

29. The default rate of Demurrage Associates' new customers has been running at 10%. The

average sale for each new customer amounts to $800, generating a profit of $100 and a 40%

chance of a repeat order next year. The default rate on repeat orders is only 2%. If the

interest rate is 9%, what is the expected profit from each new customer?

A. $88.70

D. $43.25

B. $47.75

E. $50.83

C. $101.00

B&M

30. The default rate of Don's new customers has been running at 20%. The average sale for each

new customer amounts to $500, generating a profit of $200 and a 30% chance of a repeat

order next year. The default rate on repeat orders is only 5%. If the interest rate is 6%, what

is the expected profit from each new customer?

A. $152.50

C. $275.00

B. $149.53

D. $100.00

B&M

Seasonal Dating

Questions 10 and 11 are based on the following information.

CIA 1194 IV-29 & 30

Effective September 1, a company initiates seasonal dating as a component of its credit policy,

allowing wholesale customers to make purchases early but not requiring payment until the retail

selling season begins. Sales occur as follows:

Date of Sale

Quantity Sold

September 1

300 units

October 1

100 units

November 1

100 units

December 1

150 units

January 1

50 units

Each unit has a selling price of $10, regardless of the date of sale.

The terms of sale are 2/10 net 30, January 1 dating.

All sales are on credit.

All customers take the discount and abide by the terms of the discount policy.

CMA EXAMINATION QUESTIONS

All customers take advantage of the new seasonal dating policy.

The peak selling season for all customers is mid-November to late December.

73

. For the selling firm, which of the following is not an expected advantage of initiating seasonal

dating?

CIA 1194 IV-29

A. Reduced storage costs.

C. Attractive credit terms for customers.

B. Reduced credit costs.

D. Reduced uncertainty about sales volume.

74

. For sales after the initiation of the seasonal dating policy on September 1, total collections on

or before January 11 will be

A. $0

C. $6,860

B. $6,370

D. $7,000

CIA 1194 IV-30

Change in Credit Terms

Prime Rate

75

. The high cost of short-term financing has recently caused a company to reevaluate the terms

of credit it extends to its customers. The current policy is 1/10, net 60. If customers can borrow

at the prime rate, at what prime rate must the company change its terms of credit in order to

avoid an undesirable extension in its collection of receivables? (E)

A. 2%

C. 7%

B. 5%

D. 8%

Gleim

Effect on Accounts Receivable Balance

76

. A firm sells on terms of 2/10 net 60. It sells 1,000 units per day at a unit price of $10. On 60%

of sales, customers take the cash discount. On the remaining 40% of sales, customers pay, on

average, in 70 days. What would be the impact on the balance of accounts receivable if the

firm initiates a more aggressive collection policy and is able to reduce the average payment

period to 60 days for those customers not taking the cash discount? (Assume sales levels are

unaffected by the change in policy.) (E)

A. Decrease by $4,000.

C. Decrease by $240,000.

B. Decrease by $40,000.

D. Decrease by $280,000. CIA 1196 IV-44

77

. A company plans to tighten its credit policy. The new policy will decrease the average number

of days for collection from 75 to 50 days and will reduce the ratio of credit sales to total

revenue from 70% to 60%. The company estimates that projected sales will be 5% less if the

proposed new credit policy is implemented. If projected sales for the coming year are $50

million, calculate the dollar amount of accounts receivable of this proposed change in credit

policy. Assume a 360-day year. (M)

Page 15 of 60

MANAGEMENT ADVISORY SERVICES

a. $3,817,445 decrease.

b. $6,500,000 decrease.

*.

WORKING CAPITAL FINANCE

c. $3,333,334 decrease.

d. $18,749,778 increase.

CMA 1294 1-24

Prest Corp. plans to tighten its credit policy. Below is the summary of changes:

OLD

NEW

Average number of days collection

75

50

Ratio of credit sales to total sales

70%

60%

Projected sales for the coming year is P100 million and it is estimated that the new policy will

result in a 5% loss if the new policy is implemented. Assuming a 360-day year, what is the

effect of the new policy on accounts receivable? (M)

a. Decrease of P13 million.

c. Decrease of P5 million.

b. No change.

d. Decrease of P 6.67 million. RPCPA 0596

. Dartmoor Company’s budgeted sales for the coming year are $40,500,000, of which 80% are

expected to be credit sales at terms of n/30. Dartmoor estimates that a proposed relaxation of

credit standards will increase credit sales by 20% and increase the average collection period

from 30 days to 40 days. Based on a 360 day year, the proposed relaxation of credit

standards will result in an expected increase in the average accounts receivable balance of

(M)

a. $540,000

c. $900,000

b. $2,700,000

d. $1,620,000

CMA 1292 1-21

78

48. Real Company’s budgeted sales for the coming year are P50,000,000 of which 75% are

expected to be credit sales at terms of n/30. Real estimates that a proposed relaxation of

credit standards will increase credit sales by 20% and increase the average collection period

from 30 days to 40 days. Based on a 360-day year, the proposed relaxation of credit

standards will increase average accounts receivable balance by: (E)

a. P1,200,000

c. P1,875,000

b. P3,125,000

d. P5,000,000

Pol Bobadilla

. Flyn Company's budgeted sales for the coming year are expected to be $50,000,000, of which

75% are expected to be credit sales at terms of n/30. Flyn estimates that a proposed

relaxation of credit standards will increase credit sales by 25% and increase the average

collection period from 20 days to 30 days. Based on a 360-day year, the proposed relaxation

of credit standards will result in an expected increase in the average accounts receivable

balance of (M)

A. $520,840

C. $2,083,340

B. $1,822,930

D. $3,906,270

Gleim

79

CMA EXAMINATION QUESTIONS

*.

Numero 1 Co.’s budgeted sales for the coming year are P96 million, of which 80% are

expected to be credit sales at terms of n/30. The company estimates that a proposed

relaxation of credit standards would increase credit sales by 30% and increase the average

collection period form 30 days to 45 days. Based on a 360-day year, the proposed relaxation

of credit standards would result to an increase in accounts receivable balance of (M)

a. P6,880,000

c. P2,880,000

b. P1,920,000

d. P6,080,000

RPCPA 0595

80

. Cannon Company has enjoyed a rapid increase in sales in recent years, following a decision to sell on

credit. However, the firm has noticed a recent increase in its collection period. Last year, total sales

were $1 million, and $250,000 of these sales were on credit. During the year, the accounts receivable

account averaged $41,096. It is expected that sales will increase in the forthcoming year by 50

percent, and, while credit sales should continue to be the same proportion of total sales, it is expected

that the days sales outstanding will also increase by 50 percent. If the resulting increase in accounts

receivable must be financed externally, how much external funding will Cannon need? Assume a

365-day year.

a. $ 41,096

d. $106,471

b. $ 51,370

e. $ 92,466

c. $ 47,359

Brigham

New Accounts Receivable Balance

81

. Ruth Company currently has $1,000,000 in accounts receivable. Its days sales outstanding (DSO)

is 50 days. The company wants to reduce its DSO to the industry average of 32 days by

pressuring more of its customers to pay their bills on time. The company’s CFO estimates that if

this policy is adopted the company’s average sales will fall by 10 percent. Assuming that the

company adopts this change and succeeds in reducing its DSO to 32 days and does lose 10

percent of its sales, what will be the level of accounts receivable following the change? Assume a

365-day year.

a. $576,000

d. $900,000

b. $633,333

e. $966,667

c. $750,000

Brigham

Incremental Investment in Accounts Receivable

*. Slippers Mart has sales of P3 million. Its credit period and average collection period are both

30 days and 1% of its sales end as bad debts. The general manager intends to extend the

credit period to 45 days which will increase sales by P300,000. However, bad debts losses on

the incremental sales would be 3%. Costs of products and related expenses amount to 40%

Page 16 of 60

MANAGEMENT ADVISORY SERVICES

exclusive of the cost of carrying receivables of 15% and bad debts expenses. Assuming 360

days a year, the change in policy would result to incremental investment in receivables of (M)

a. P24,704.

c. P701,573.

b. P65,000.

d. P9,750.

RPCPA 1095

144.A firm is considering relaxing credit standards, which will result in annual sales increasing from

$1.5 million to $1.75 million, the cost of annual sales increasing from $1,000,000 to

$1,125,000, and the average collection period increasing from 40 to 55 days. The bad debt

loss is expected to increase from 1 percent of sales to 1.5 percent of sales. The firm's

required return on investments is 20 percent. The firm's cost of marginal investment in

accounts receivable is (D)

A. $5,556.

C. $12,153.

B. $9,943.

D. $152,778.

Gitman

Expected Discounts Taken

*. The Liberal Sales Co. budgeted sales for the coming year are P30 million of which 80% are

expected to be on credit. The company wants to change its credit terms from n/30 to 2/10,

n/30. If the new credit terms are adopted, the company estimates that cash discounts would

be taken on 40% of the credit sales and the new uncollectible amount would be unchanged.

The adoption of the new credit terms would result in expected discount availed of in the

coming year of (E)

a. P600,000

c. P480,000

b. P288,000

d. P192,000

RPCPA 0596

82

. Price Publishing is considering a change in its credit terms from n/30 to 2/10, n/30. The

company’s budgeted sales for the coming year are $24,000,000, of which 90% are expected to

be made on credit. If the new credit terms are adopted, Price estimates that discounts will be

taken on 50% of the credit sales; however, uncollectible accounts will be unchanged. The new

credit terms will result in expected discounts taken in the coming year of (M)

a. $216,000

c. $240,000

b. $432,000

d. $480,000

CMA 1292 1-19

83

. Catfur Publishing is considering a change in its credit terms from n/20 to 3/10, n/20. The

company's budgeted sales for the coming year are $20,000,000, of which 80% are expected to

be made on credit. If the new credit terms are adopted, Catfur management estimates that

discounts will be taken on 60% of the credit sales; however, uncollectible accounts will be

unchanged. The new credit terms will result in expected discounts taken in the coming year of

(M)

CMA EXAMINATION QUESTIONS

WORKING CAPITAL FINANCE

A. $288,000

B. $480,000

C. $360,000

D. $600,000

Gleim

Pretax Cost of Carrying Additional Investment in Receivables

*. Mr. S. Mart assumed the presidency of Riches Corp. He instituted new policies and with

respect to credit policy, below is a summary of relevant information:

Old Credit Policy

New Credit Policy

Sales

P1,800,000

P1,980,000

Average collection period

30 days

36 days

The company requires a rate of return of 10% and a variable cost ratio of 60%. Using a 360day year, the pre-tax cost of carrying the additional investment in receivables under the new

policy would be (M)

a. P4,800

c. P3,000

b. P2,880

d. P4,080

RPCPA 1096

. The following information regarding a change in credit policy was assembled by the Wilson

Wax Company. The company has a required rate of return of 11% and a variable cost ratio of

50%. The opportunity cost of a longer collection period is assumed to be negligible.

Old Credit Policy

New Credit Policy

Sales

$4,600,000

$4,960,000

Average collection period

30 days

35 days

The pretax cost of carrying the additional investment in receivables, assuming a 360-day year,

is (M)

A. $5,439

C. $13,778

B. $10,878

D. $98,890

Gleim

84

85

. The following information regarding a change in credit policy was assembled by the Wilson

Wax Company. The company has a required rate of return of 10% and a variable cost ratio of

60%.

Old Credit Policy

New Credit Policy

Sales

$3,600,000

$3,960,000

Average collection period

30 days

36 days

The pretax cost of carrying the additional investment in receivables, using a 360-day year,

would be (M)

A. $5,760.

C. $8,160.

B. $9,600.

D. $960.

CMA 1289 1-16

Effect on Before Tax Profit (Loss)

Page 17 of 60

MANAGEMENT ADVISORY SERVICES

138.A firm is analyzing a relaxation of credit standards that is expected to increase sales 10

percent. The firm is currently selling 400 units at an average sale price per unit of $575, and

the variable cost per unit is $400 at the current sales volume. The average cost per unit is

$425. What is the additional profit contribution from sales if credit standards are relaxed? (E)

A. $23,000

C. $6,000

B. $16,000

D. $7,000

Gitman

WORKING CAPITAL FINANCE

*.

31. Terry's Place is currently experiencing a bad debt ratio of 4%. Terry is convinced that, with

looser credit controls, this ratio will increase to 8%; however, she expects sales to increase by

10% as a result. The cost of goods sold is 80% of the selling price. Per $100 of current sales,

what is Terry's expected profit under the proposed credit standards?

A. $26.0

C. $13.2

B. $15.4

D. $25.6

B&M

32. Tom's Toys is currently experiencing a bad debt ratio of 6%. Tom is convinced that, with

tighter credit controls, he can reduce this ratio to 2%; however, he expects sales to drop by 8%

as a result. The cost of goods sold is 75% of the selling price. Per $100 of current sales, what

is Tom's expected profit under the proposed credit standards?

A. $15.2

D. $27.0

B. $23.0

E. $21.2

C. $19.0

B&M