OBLICON CASE DIGEST

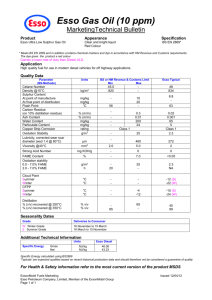

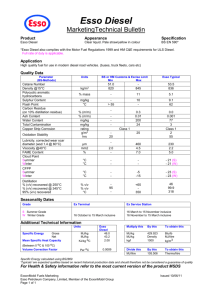

advertisement

HEIRS OF FLORES RESTAR v. HEIRS OF DOLORES R. CICHON 475 SCRA 73 (2005) Ordinary acquisitive prescription requires possession of things in good faith and with just title for a period of ten years while extraordinary acquisitive prescription only requires uninterrupted adverse possession for thirty years. Emilio Restar died intestate, leaving eight children-compulsory heirs. Restar’s eldest child, Flores, on the basis of a Joint Affidavit he executed with Helen Restar, caused the cancellation of Tax Declaration in Restar’s name. The same covers a 5,918 square meter parcel of land in Aklan which was among the properties left by Restar. Flores thereafter sought the issuance of another Tax Declaration in his name. Flores later on died. Ten years later, the heirs of Flores’ sisters, Dolores R. Cichon, et. al. (Heirs of Cichon) filed a Complaint against Flores’ heirs for “partition of the lot, declaration of nullity of documents, ownership with damages and preliminary injunction” before the Regional Trial Court (RTC) of Aklan alleging that the widow Esmenia appealed to them to allow her to hold on to the lot to finance the education of her children, to which they agreed on the condition that after the children had finished their education, it would be divided into eight equal parts; and upon their demand for partition of the lot, the defendants Flores‘ heirs refused, they claiming that they were the lawful owners thereof as they had inherited it from Flores. Flores‘ heirs claimed that they had been in possession of the lot in the concept of owner for more than thirty (30) years and have been realty taxes since time immemorial. And they denied having shared with the plaintiffs the produce of the lot or that upon Flores’ death in 1989, Esmenia requested the plaintiffs to allow her to hold on to it to finance her education, they contending that by 1977, the children had already finished their respective courses. The RTC of Kalibo, Aklan held that Flores and his heirs performed acts sufficient to constitute repudiation of the co-ownership, concluded that they had acquired the lot by prescription. The Court of Appeals reversed the decision finding that there was no adequate notice by Flores to his co-heirs of the repudiation of the and neither was there a categorical assertion by the defendants of their exclusive right to the entire lot that barred the plaintiffs’ claim of ownership. ISSUE: Whether or not Heirs of Flores acquired ownership over lot by extraordinaryprescription HELD: Acquisitive prescription of dominion and other real rights may be ordinary or extraordinary. Ordinary acquisitive prescription requires possession of things in good faith with just title for a period of ten years. Without good faith and just title, acquisitive prescription can only be extraordinary in character which requires uninterrupted adverse possession for thirty years. When Restar died in 1935, his eight children became pro indiviso co-owners of the lot by intestate succession. Heirs of Chichon never possessed the lot, however, much less asserted their claim thereto until January 21, 1999 when they filed the complaint for partition subject of the present petition. In contrast, Flores took possession of the lot after Restar’s death and exercised acts of dominion thereon — tilling and cultivating the land, introducing improvements, and enjoying the produce thereof. Flores’ possession thus ripened into ownership through acquisitive prescription after the lapse of thirty years in accordance with the earlier quoted Article 1137 of the New Civil Code. Heirs of Cichon did not deny that aside from the verbal partition of one parcel of land in Carugdog, Lezo, Aklan way back in 1945, they also had an amicable partition of the lands of Emilio Restar in Cerrudo and Palale, Banga Aklan on September 28, 1973 (exhibit “20”). If they were able to demand the partition, why then did they not the inclusion of the land in question in order to settle once and for all the inheritance from their father Emilio Restar, considering that at that time all of the brothers and sisters, the eight heirs of Emilio Restar, were still alive and participated in the signing of the extra-judicial partition? Indeed, the following acts of Flores show possession adverse to his co-heirs: the cancellation of the tax declaration certificate in the name of Restar and securing another in his name; the execution of a Joint Affidavit stating that he is the owner and possessor thereof to the exclusion of respondents; payment of real estate tax and irrigation fees without respondents having ever contributed any share therein; and continued enjoyment of the property and its produce to the exclusion of respondents. And Flores’ adverse possession was continued by his heirs. The trial court’s finding and conclusion that Flores and his heirs had for more than 38 years possessed the land in open, adverse and continuous possession in the concept of owner — which length of possession had never been questioned, rebutted or disputed by any of the heirs of Cichon, being thus duly supported by substantial evidence, he and his heirs have become owner of the lot by extraordinaryprescription. It is unfortunate that respondents slept on their rights. Dura lex sed lex. Arzadon-Crisolog v. Ranon (ART. 543) FACTS: According toRañon, her family had enjoyed continuous, peaceful and uninterrupted possession and ownership over the subject property since 1962, and had religiously paid the taxes thereon. They had built a house on the subject property where she and her family had resided. Unfortunately, in 1986, when her family was already residing in Metro Manila, fire razed and destroyed the said house. Nonetheless, they continued to visit the subject property, as well as pay the real estate taxes thereon. However, in August of 1986, her daughter, Zosie Rañon, discovered that the subject property was already in the name of the spouses Montemayor under Tax Declaration No. 0010563 which was purportedly issued in their favor by virtue of an Affidavit of Ownership and Possession which the spouses Montemayor executed themselves. The Affidavit was alleged to have created a cloud of doubt over Rañon’s title and ownership over the subject property. The spouses Montemayor, for their part, alleged that they acquired the subject lot by purchase from Leticia del Rosario and Bernardo Arzadon who are the heirs of its previous owners for a consideration of P100,000.00. The Heirs of Marcelina Arzadon-Crisologo, (represented by Leticia A. Crisologo del Rosario), Mauricia Arzadon, and Bernardo Arzadon (petitioners) filed an Answer in Intervention claiming, inter alia, that they are the rightful owners of the subject property, having acquired the same from their predecessors-in-interest. They averred that there existed no liens or encumbrances on the subject property in favor of Agrifina Rañon; and that no person, other than they and the spouses Montemayor, has an interest in the property as owner or otherwise. concept of owner for no one in his right mind would be paying taxes for a property that is not in his actual or at least constructive possession.They constitute at least proof that the holder has a claim of title over the property.As is well known, the payment of taxes coupled with actual possession of the land covered by the tax declaration strongly supports a claim of ownership. Possession in the eyes of the law does not mean that a man has to have his feet on every square meter of the ground before it can be said that he is in possession. (Ramos v. Dir. Of Lands) Nothing was done by petitioners to claim possession over the subject property from the time their predecessors-in-interest had lost possession of the property due to their deaths. Plainly, petitioners slept on their rights. Vigilantibus sed non dormientibus jura subveniunt. The law comes to the succor only to aid the vigilant, not those who slumber on their rights. Respondents occupied without interruption the subject property in the concept of an owner, thereby acquiring ownership via extraordinary acquisitive prescription. AGUIRRE, ET AL. vs. COURT OF APPEALS, ET AL. G.R. No. 122249 January 29, 2004 FACTS: ISSUES: (1) W/N the Notice of Adverse Claim filed by the petitioners constitute an effective interruption since 1962 of respondents possession of the subject property; and (2)W/N the respondents had acquired ownership over the subject property through uninterrupted and adverse possession for 30 years, without need of title or of good faith RULING: Article 1123 and Article 1124 of the Civil Code underscore the judicial character of civil interruption. For civil interruption to take place, the possessor must have received judicial summons. None appears in the case at bar. The Notice of Adverse Claim which was filed by petitioners in 1977 is nothing more than a notice of claim which did not effectively interrupt respondents’ possession. The open, continuous, exclusive and notorious possession by respondents of the subject property for a period of more than 30 years in repudiation of petitioners’ ownership had been established. During such length of time, respondents had exercised acts of dominion over the subject property, and paid taxes in their name. Jurisprudence is clear that although tax declarations or realty tax payments of property are not conclusive evidence of ownership, nevertheless, they are good indicia of possession in the Leocadio Medrano and his first wife Emilia owned a piece of land. After the death of Emilia, Leocadio married his second wife Miguela. When Leocadio died, all his heirs agreed that Sixto Medrano, a child of the first marriage, should manage and administer the said property. After Sixto died, his heirs learned that he had executed an Affidavit of Transfer of Real Property in which he falsely stated that he was the only heir of Leocadio. It turned out that while Sixto were still alive, he sold a portion of the subject land tp Tiburcio Balitaan and another portion to Maria Bacong, Maria Bacong later sold the said portion to Rosendo Bacong. Petitioners, all heirs of Leocadio who were affected by the sale demanded reconveyance of the portions sold by Sixto but the 3 vendees refused. Resultantly, petitioners filed a suit against them seeking the nullity of the documents and partition thereof. The vendees contended that they acquired the property under the valid deed of sale and petitioners’ cause of action was barred by laches and prescription. Tiburcio also contended that he is an innocent purchaser for value. ISSUE: Whether or not there was a valid sale between Sixto Medrano and the three purchases considering the fact that it was made without the consent of the co-owners. HELD: Under Article 493 of the New Civil Code, a sale by a co-owner of the whole property as his will affect only his own share but not those of the other co-owners who did not consent to the sale). The provision clearly provides that the sale or other disposition affects only the seller’s share, and the transferee gets only what corresponds to his grantor’s share in the partition of the property owned in common. Since a co-owner is entitled to sell his undivided share, a sale of the entire property by one co-owner without the consent of the other co-owner is not null and void; only the rights of the co-owner-seller are transferred, thereby making the buyer a co-owner of the property. It is clear therefore that the deed of sale executed by Sixto in favor of Tiburcio Balitaan is a valid conveyance only insofar as the share of Sixto in the co-ownership is concerned. Acts which may be considered adverse to strangers may not be considered adverse in so far as co-owners are concerned. A mere silent possession by a co-owner, his receipts of rentals, fruits or profits from the property, the erection of buildings and fences and planting of trees thereon, and the payment of land taxes, cannot serve as proof of exclusive ownership, if it is not borne out by clear and convincing evidence that he exercised such acts of possession which unequivocally constituted an ouster or deprivation of the rights of the other co-owners. Thus, in order that a co-owner’s possession may be deemed adverse to the cestui que trust or the other co-owners, the following elements must concur: (1) that he has performed unequivocal acts of repudiation amounting to an ouster of the cestui que trust or the other co-owners; (2) that such positive acts of repudiation have been known to the cestui que trust or the other co-owners; and (3) that the evidence thereon must be clear and convincing. Tested against these guidelines, the respondents failed to present competent evidence that the acts of Sixto adversely and clearly repudiate the existing co-ownership among the heirs of Leocadio Medrano. Respondent’s reliance on the tax declaration in the name of Sixto Medrano is unworthy of credit since we have held on several occasions that tax declarations by themselves do not conclusively prove title to land. Further, respondents failed to show that the Affidavit executed by Sixto to the effect that he is the sole owner of the subject property was known or made known to the other co-heirs of Leocadio Medrano. VDA DE GUALBERTO VS GO FACTS: Petitioners are the heirs of the late Generoso Gualberto, former registered owner of a parcel of land situated at Redor Street, Barangay Redor, Siniloan, Laguna under Transfer Certificate of Title (TCT) No. 9203, containing an area of 169.59 square meters, more or less, and declared for taxation purposes under Tax Declaration No. 4869. Sometime in 1965, the subject parcel of land was sold by Generoso Gualberto and his wife, herein petitioner Consuelo, to respondents father Go S. Kiang for P9,000.00, as evidenced by a deed entitled Kasulatan dated January 15, 1965 which deed appears to have been duly notarized by then Municipal Judge Pascual L. Serrano of the Municipal Court of Siniloan, On April 1, 1973, petitioner Consuelo executed an Affidavit attesting to the fact that the aforementioned parcel of land had truly been sold by her and her husband Generoso to the spouses Go S. Kiang and Rosa Javier Go, as borne by the said Kasulatan. Evidently, the affidavit was executed for purposes of securing a new tax declaration in the name of the spouses Go. In December, 1973, in a case for Unlawful Detainer filed by a certain Demetria Garcia against herein petitioners, the latter alleged that therein plaintiff Garcia is not a real party in interest and therefore has no legal capacity and cause of action to sue the defendants; that the real parties in interest of the parcel of commercial land and the residential apartment in question are Generoso Gualberto and Go S. Kiang respectively as shown by TCT No. 9203 issued by the Register of Deeds of Laguna. In a Forcible Entry case filed by respondents against petitioners before the Municipal Circuit Trial Court of Siniloan-Famy, Siniloan, Laguna docketed as Civil Case No. 336, a decision was rendered in favor of respondents, which decision was affirmed in toto by the RTC of Siniloan, Laguna. When elevated to the Court of Appeals, that same decision was affirmed by the latter court, saying that the Court finds that the judgment of the court a quo affirming the previous judgment of the municipal court is supported by sufficient and satisfactory evidence and there is no reason for the Court to hold otherwise. In the meantime, on June 14, 1978, Original Certificate of Title (OCT) No. 1388 was issued in the name of respondent Rosa Javier Go, wife of Go S. Kiang. August 10, 1995, in the Regional Trial Court at Siniloan, Laguna petitioners filed against respondents their complaint in this case for Conveyance, Accion Publiciana, and Quieting of Title with Damages, the trial court, dismissed petitioners complaint and ordered them to pay attorneys fees. On appeal, the appellate court, a affirmed that of the trial court, minus the award of attorneys fees. ISSUES: I. WHETHER OR NOT A TITLED PROPERTY CAN BE THE SUBJECT OF A FREE PATENT TITLE. II. WHETHER AN ACTION FOR RECONVEYANCE OF PROPERTY BASED ON A NULLITY OF TITLE PRESCRIBES. property ever since. The action for reconveyance in the instant case is, therefore, not in the nature of an action for quieting of title, and is not imprescriptible. Possible BAR QUESTION: Question: Held: I. No. The first issue raised by petitioners attacks the validity of respondent Rosa Javier Gos free patent title. This cannot be done in the present recourse for two (2) basic reasons: first, the validity of a torrens title cannot be assailed collaterally; and second, the issue is being raised for the first time before the Supreme Court. II. No. An action for reconveyance of real property based on implied or constructive trust is not barred by the aforementioned 10-year prescriptive period only if the plaintiff is in actual, continuous and peaceful possession of the property involved. In DBP vs. CA,[16] the Court explained: . . . [A]n action for reconveyance of a parcel of land based on implied or constructive prescribes in ten years, the point of reference being the date of registration of deed or the date of the issuance of the certificate of title over the property, but this rule applies only when the plaintiff or the person enforcing the trust is not in possession of the property, since if a person claiming to be the owner thereof is in actual possession of the property, as the defendants are in the instant case, the right to seek reconveyance, which in effect seeks to quiet title to the property, does not prescribe. The reason for this is that one is in actual possession of a piece of land claiming to be the owner thereof may wait until his possession is disturbed or his title is attacked before taking steps to vindicate his right, the reason for the rule being, that his undisturbed possession gives him a continuing right to seek the aid of a court of equity to ascertain and determine the nature of the adverse claim of a third party and its effect on his own title, which right can be claimed only by one who is in possession. Here, it was never established that petitioners remained in actual possession of the property after their fathers sale thereof to Go S. Kiang in 1965 and up to the filing of their complaint in this case on August 10, 1995. On the contrary, the trial courts factual conclusion is that respondents had actual possession of the subject Can a petitioner file an action to recover based on implied trust; prescribes after 10 years? Answer: Yes. An action for reconveyance of real property based on implied or constructive trust is not barred by the 10-year period of prescription only if the plaintiff is in actual, continuous and peaceful possession of the property involved. In DBP vs. CA, (2000) it was said that generally an action for reconveyance based on an implied or constructive trust prescribes in 10-years from the date of issuance of the decree of registration. However, this rule does not apply when the plaintiff is in actual possession of the land. If property is acquired through mistake or fraud, the person obtaining it is, by force of law, considered a trustee of an implied trust for the benefit of the person from whom the property comes. (Art. 1456, NCC). Thus, the law thereby creates the obligation of the trustee to reconvey the property and the title thereto in favor of the true owner. The prescriptive period for the reconveyance for fraudulently registered real property is ten (10) years reckoned from the date of the issuance of the certificate of title. (Consuelo Vda. de Alberto, et al. vs. Francis Go, et al., G.R. No. 139843, July 21, 2005). Solid Homes Inc v Spouses Tan When the prescription should count Facts: 1. In 1980, Petitioner Solid Homes sold to Sps. Uy a 1069sqm lot in their QC subdivision project. Said lot was registered in the name of Uy’s and TCT was in their name 2. Afterwards, the Uys sold it to herein Respondent Sps. Tan in 1985, TCT transferred to them subsequently. 3. Afterwards, after several visits to their property, Respondents found out the sad state of the development of the property. There was no infrastructure or utility systems as announced in the approved plans and advertisement of the subdivision project, and squatters occupy the property and its surrounding areas. 4. Respondents then demanded Petitioners in a letter dated 1995, to provide the promised developments for the project and rid their property of the squatters conformably with PD 957 5. Petitioner did not reply, hence, in 1996, they complained before the HLURB Arbiter with the same prayers. a. HLURB Arbiter ruled IFO Respondents b. Petitioner appealed to HLURB Board, but the Arbiter was affirmed. c. Petitioner appealed to OP, but affirmed HLURB with modification that if they cannot deliver the prayers, they should pay back the Respondents with the purchase price plus interests 6. Both parties appealed to CA. Respondents appeal because the payment should at least be based on fair market value and not purchase price. Petitioners appeal is for obvious reasons, kasi natalo parin sila. a. CA modified OP decision, payment should be based on fair market value. 7. Hence, this petition Issue: W/N Respondent’s action has prescribed Held: No. Ratio: Petitioners claim that the action has prescribed because more than 10 years has lapsed since the sale in 1980 or the subsequent sale in 1985 up to the filing of the case in 1996. SC disagrees. While it is true that Art 1144 of NCC provides that 10 years is the prescriptive period to which an action should be brought upon, it must be counted when the cause of action has arisen. Art 1144 says that an action must be brought within ten years upon a written contract, upon an obligation created by law, or upon a judgment. If not on a written contract, it must be upon an obligation created by law. According to PD 957, the developer has the obligation to provide adequate utilities. Citing Banco Filipino Savings v CA, a cause of action arises when that which should not have been done is done; or that which should have been done is not done. The elements of cause of action are (1) right of the applicant, (2) obligation of defendant to respect such right, (3) act or omission of defendant that violates the applicant’s right. It is only upon the happening of the last element that a cause of action arises. In this case, it was only when the Respondents demanded in 1995 did the cause of action arise. Also in SSS v Moonwalk, an obligor violates his obligation from the time the obligee demands. Absent any demand thereto, the obligor does not incur delay. As long as he is not in delay, he cannot be guilty of some violation of the obligee’s rights. As a result, the prescriptive period does not run until demand is made. Mariano v. Petron, G.R. No. 169438, 21 January 2010, 610 SCRA 487 Summary: The Aure Group, owners of a parcel of land in Tagaytay (“Property”), entered into a lease contract over the Property with ESSO Standard Eastern, Inc., (“ESSO Eastern”), a foreign corporation doing business in the country through its subsidiary ESSO Standard Philippines, Inc. (“ESSO Philippines”). The lease contract contained an assignment veto clause barring the parties from assigning the lease without prior consent of the other. Later, without notice to the Aure group, ESSO Eastern sold ESSO Philippines to the Philippine National Oil Corporation (“PNOC”). ESSO Philippines, whose corporate name was successively changed to Petrophil Corporation then to Petron Corporation (“Petron”), took possession of the Property. It appears from the stipulation of the parties during trial that the acquisition of ESSO Philippines by PNOC included the acquisition of the leasehold right over the Property. Petitioner Mariano (“Petitioner”), who later bought the Property from the Aure Group and obtained title thereto under his name, sued Petron to rescind the lease contract and recover possession of the Property. Among his arguments was that the assignment veto clause in the lease contract was violated when ESSO Eastern sold ESSO Philippines to PNOC, thus assigning to PNOC its lease on the Property, without seeking the Aure Group’s prior consent. Petron countered that the lease contract was not breached because PNOC merely acquired ESSO Eastern’s shares in ESSO Philippines, a separate corporate entity. The underlying assumption of Petron’s assertion was that ESSO Philippines (not ESSO Eastern) initially held the leasehold right over the Property. The Ruling of the Trial Court In its Decision dated 30 May 2000, the trial court ruled for petitioner, rescinded the Contract, ordered Petron to vacate the Property, and cancelled the annotation on petitioner’s title of Petron’s lease.[16] The trial court ruled that ESSO Eastern’s sale to PNOC of its interest in ESSO Philippines included the assignment to PNOC of ESSO Eastern’s lease over the Property, which, for lack of the Aure Group’s consent, breached the Contract, resulting in its termination. However, because the Aure Group (and later petitioner) tolerated ESSO Philippines’ continued use of the Property by receiving rental payments, the law on implied new lease governs the relationship of the Aure Group (and later petitioner) and Petron, creating for them an implied new lease terminating on 21 December 1998 upon Petron’s receipt of petitioner’s notice to vacate.[17] Petron appealed to the Court of Appeals, distancing itself from its admission in the Joint Motion that in buying ESSO Philippines from ESSO Eastern, PNOC also acquired ESSO Eastern’s leasehold right over the Property. Petron again invoked its separate corporate personality to distinguish itself from PNOC. The Ruling of the Court of Appeals In its Decision dated 29 October 2004, the Court of Appeals found merit in Petron’s appeal, set aside the trial court’s ruling, declared the Contract subsisting until 13 November 2058[18] and ordered petitioner to pay Petron P300,000 as attorney’s fees. The Court of Appeals found no reason to pierce ESSO Philippines’ corporate veil, treating PNOC’s buy-out of ESSO Philippines as mere change in ESSO Philippines’ stockholding. Hence, the Court of Appeals rejected the trial court’s conclusion that PNOC acquired the leasehold right over the Property. Alternatively, the Court of Appeals found petitioner’s suit barred by the four-year prescriptive period under Article 1389 and Article 1146 (1) of the Civil Code, reckoned from PNOC’s buy-out of ESSO Philippines on 23 December 1977 (for Article 1389) or the execution of the Contract on 13 November 1968[19] (for Article 1146 [1]).[20] Petitioner sought reconsideration but the Court of Appeals denied his motion in its Resolution of 26 August 2005. Hence, this petition. The Issue The question is whether the Contract subsists between petitioner and Petron. The Ruling of the Court We hold in the affirmative and thus sustain the ruling of the Court of Appeals. ESSO Eastern Assigned to PNOC its Leasehold Right over the Property, Breaching the Contract PNOC’s buy-out of ESSO Philippines was total and unconditional, leaving no residual rights to ESSO Eastern. Logically, this change of ownership carried with it the transfer to PNOC of any proprietary interest ESSO Eastern may hold through ESSO Philippines, including ESSO Eastern’s lease over the Property. This is the import of Petron’s admission in the Joint Motion that by PNOC’s buy-out of ESSO Philippines “[PNOC], x x x acquired ownership of ESSO Standard Philippines, Inc., including its leasehold right over the land in question, through the acquisition of its shares of stocks.” As the Aure Group gave no prior consent to the transaction between ESSO Eastern and PNOC, ESSO Eastern violated the Contract’s assignment veto clause. Petron’s objection to this conclusion, sustained by the Court of Appeals, is rooted on its reliance on its separate corporate personality and on the unstated assumption that ESSO Philippines (not ESSO Eastern) initially held the leasehold right over the Property. Petron is wrong on both counts. Courts are loathe to pierce the fictive veil of corporate personality, cognizant of the core doctrine in corporation law vesting on corporations legal personality distinct from their shareholders (individual or corporate) thus facilitating the conduct of corporate business. However, fiction gives way to reality when the corporate personality is foisted to justify wrong, protect fraud, or defend crime, thwarting the ends of justice.[21] The fiction even holds lesser sway for subsidiary corporations whose shares are wholly if not almost wholly owned by its parent company. The structural and systems overlap inherent in parent and subsidiary relations often render the subsidiary as mere local branch, agency or adjunct of the foreign parent corporation.[22] Here, the facts compel the conclusion that ESSO Philippines was a mere branch of ESSO Eastern in the execution and breach of the Contract. First, by ESSO Eastern’s admission in the Contract, it is “a foreign corporation organized under the laws of the State of Delaware, U.S.A., duly licensed to transact business in the Philippines, and doing business therein under the business name and style of ‘Esso Standard Philippines’ x x x”. In effect, ESSO Eastern was ESSO Philippines for all of ESSO Eastern’s Philippine business. Second, the Contract was executed by ESSO Eastern, not ESSO Philippines, as lessee, with the Aure Group as lessor. ESSO Eastern leased the Property for the use of ESSO Philippines, acting as ESSO Eastern’s Philippine branch. Consistent with such status, ESSO Philippines took possession of the Property after the execution of the Contract. Thus, for purposes of the Contract, ESSO Philippines was a mere alter ego of ESSO Eastern. The Lessor’s Continued Acceptance of Lease Payments Despite Breach of Contract Amounted to Waiver The breach of contract notwithstanding, we hold that the Contract subsists. Contrary to the trial court’s conclusion that ESSO Eastern’s violation of the assignment veto clause extinguished the Contract, replaced by a new implied lease with a monthly term,[23] we hold that the breach merely gave rise to a cause of action for the Aure Group to seek the lessee’s ejectment as provided under Article 1673, paragraph 3 of the Civil Code.[24] Although the records do not show that the Aure Group was formally notified of ESSO Philippines’ sale to PNOC, the successive changes in the lessee’s name (from ESSO Philippines to Petrophil Corporation then to Petron) suffice to alert the Aure Group of a likely change in the personality of the lessee, which, for lack of the Aure Group’s prior consent, was in obvious breach of the Contract. Thus, the continued receipt of lease payments by the Aure Group (and later by petitioner) despite the contractual breach amounted to a waiver of their option to eject the lessee. Petitioner’s Suit Barred by Prescription Petitioner’s waiver of Petron’s contractual breach was compounded by his long inaction to seek judicial redress. Petitioner filed his complaint nearly 22 years after PNOC acquired the leasehold rights to the Property and almost six years after petitioner bought the Property from the Aure Group. The more than two decades lapse puts this case well within the territory of the 10 year prescriptive bar to suits based upon a written contract under Article 1144 (1) of the Civil Code.[25] WHEREFORE, we DENY the petition. The Decision dated 29 October 2004 and the Resolution dated 26 August 2005 of the Court of Appeals areAFFIRMED. SO ORDERED.