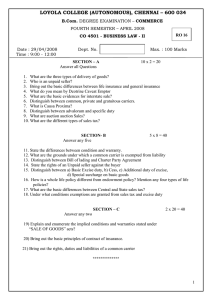

Indirect Tax - Excise - May 17 - Book 4

advertisement