1 MMAITI Tutorial 1-конвертирован

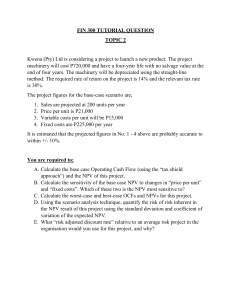

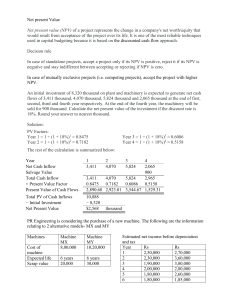

advertisement

Introduction Corporate Finance Moinak Maiti, PhD Associate Professor Department of Finance National Research University-Higher School of Economics Saint Petersburg, Russia, 194100 Question • Read the following passage: “Companies usually buy ( a ) assets. These include both tangible assets such as ( b ) and intangible assets such as ( c ). To pay for these assets, they sell ( d ) assets such as ( e ). The decision about which assets to buy is usually termed the ( f ) or ( g ) decision. The decision about how to raise the money is usually termed the ( h )decision.” • Now fit each of the following terms into the most appropriate space: financing, real, bonds, investment, executive airplanes, financial, capital budgeting, brand names. Which of the following are real assets, and which are financial? a. A share of stock. b. A corporate bond c. Atrademark. d. Afactory. e. Undeveloped land. f. The balance in the firm’s checkingaccount. g. An experienced and hardworking sales force h. Brand Value Question • Who owns a corporation? • Describe the process whereby the owners control the firm ’ s management ? • What is the main reason that an agency relationship exists in the corporate form of organization? Question • Would the goal of maximizing the value of the stock differ for financial management in a foreign country? • Why or why not? Question • Suppose you own stock in a company. The current price per share is $25. Another company has just announced that it wants to buy your company and will pay $35 per share to acquire all the outstanding stock. Your company ’ s management immediately begins fighting off this hostile bid. Is management acting in the shareholders ’ best interests? • Why or why not? Question • Why is the goal of financial management to maximize the current share price of the company ’ s stock? In other words, why isn ’ t the goal to maximize the future shareprice? What is Net Present ValueRule • The net present value rule is the idea thatcompany managers and investors should only invest in projects, or engage in transactions that have a positive net present value (NPV). • They should avoid investing in projects that have a negative net presentvalue. It is a logical outgrowth of net present valuetheory. • Net present value, commonly seen in capital budgeting projects, accountsfor the time value of money(TVM). • Time value of money is the idea that future money has less value than presently available capital, due to the earnings potential of the present money. • A business will use a discounted cash flow (DCF)calculation, which will reflect the potential change in wealth from a particular project. The computation will factor in the time value of money by discounting the projected cash flows back to the present, using a company's weighted average cost of capital (WACC). • A project or investment's NPV equals the present value of net cash inflows,which the project is expected to generate, minus the initial capital required for the project. • During the company's decision-making process, it will use the net present value rule to decide whether to pursue a project, suchas an acquisition. • If the calculated NPV of a project is negative (< 0), the project is expected to result in a net loss for the company. As a result, and according to the rule, the company should not pursue the project. • If a project's NPV is positive (> 0), the company can expect a profit and should consider moving forward with the investment. • If a project's NPV is neutral (= 0), the project is not expected to result in any significant gain or loss for the company. With a neutral NPV, management uses non-monetary factors, such as goodwill, to decide on the investment. Thank You Contact me: mmaiti@hse.ru